Introduction

Thesis

Key Terms

GoodRx explained

Other venutres

Market context

Management & Culture

Bull Case

Bear Case

Financials

Conclusion

1. Introduction

Many successful businesses are the result of solving important yet accepted problems. Oftentimes the solution is simple, however more complex problems tend to require more sophisticated solutions. GoodRx has chosen to tackle a key problem in one of the most convoluted, political and complicated industries out there - the US healthcare system.

I have spent a good part of this last month learning about the intricacies of the US healthcare system in order to write this deep-dive. From the point of view of a UK citizen, the US healthcare system comes across, for the most part, as overly complex and generally inefficient. And inefficiency creates opportunity.

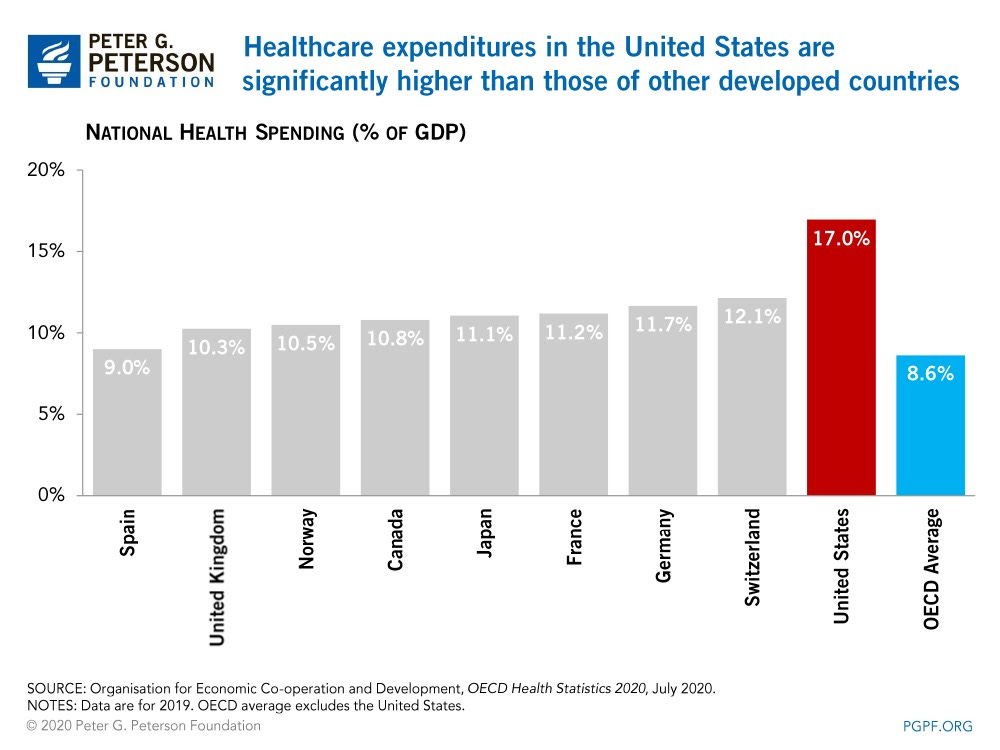

The US is the only OECD country without some form of universal health coverage, resulting in the US spending twice as much (per capita) than other OECD countries.

Despite this higher spending, most data shows health outcomes in the U.S. to be worse than other OECD countries, even after adjusting for nuances like above-average obesity.

A 2020 study by the Commonwealth Fund notes the U.S. has the highest rate of avoidable deaths in the world.

The vast majority of americans (64%) will need to make the decision to risk their health by delaying/avoiding medical care because of the costs.

These serious systemic issues prompted lifelong friends, Doug Hirsch and Trevor Bezdek, to start GoodRx - a service offering affordable access to healthcare for all citizens. Since starting the company in 2011, they have gone on to help over 6 Million monthly users get access to affordable healthcare - saving a cumulative $25 billion on prescription costs (as of March 2021).

Lastly, taking into account the low penetration of GDRX (10%) and the fact that 70% of patients still don’t know that drug prices can vary by pharmacy - I believe GoodRx are still in their infancy as a company.

2. Thesis

Addresses a huge inefficiency in the current medical market - drug affordability. The product helps regular people save an average of 70% off retail pharmacy cash prices. In turn, this helps people get access to medication that would otherwise be out of reach.

Market leader in the space and is primed to take share in their primary markets.

Addressable market penetration is currently low at about 3-5% but has the potential to increase dramatically over the coming decades.

Re-investing heavily into growth - specifically advertising.

Strong history of past growth, positive Free Cash Flow and an attractive balance sheet. These are all important to future growth as it enables the company to be able to conduct investments and M&A activity at will.

Management have significant ‘skin in the game’ have have a proven track record of execution along with showing a real desire to give the consumer the best product possible.

There are some risks such as Amazon entering the scene, along with the potential for substantial healthcare reform which, if it happens, could significantly reduce GoodRx’s value proposition.

3. Key terms

If you’re reading this from outside the US, some of the terminology throughout the article may be difficult to understand, so I’ve highlighted a few key terms.

Deductible: The amount you pay for covered health care services before your insurance plan starts to kick in. E.g. With a $2,000 deductible you pay the first $2,000 of covered services yourself.

Copayment: Defined as a fixed amount you pay for a covered healthcare service after you have paid your deductible. E.g. For a doctors office visit costing $100, you pay a fixed price of $20.

Coinsurance: Similar to copayment, but calculated as a percentage after your deductible has been paid.

EHR: Electronic health records - essentially a digital version of a patients medical history.

U&C prices: Usual and customary (U&C) prices reflect the costs of the drugs to the consumer at the retail level without the use of insurance.

PBM: Pharmacy Benefit Managers negotiate discounts and rebates with drug manufacturers with the goal of lowering the overall cost of prescription drugs for the general public. There are currently 66, with the top 3 controlling over 80% of the pharmacies.

Rx: Abbreviation for a prescription.

4. GDRX explained

4.1. The problem

As explained in the introduction, healthcare costs in the United States are the most expensive globally by almost 2x the OECD average. In reality, the current state of healthcare in the US means that people who don’t have access to affordable healthcare plans either delay treatment, or simply go untreated.

The state of the current system ultimately leads to the US having the highest rate of avoidable deaths - defined as “premature deaths from conditions that are considered preventable with timely access to effective and quality health care”.

These issues aren’t new. But 10 years ago, GoodRx was formed with the intention of reducing the scope of this problem by making healthcare more affordable through heavy discounts.

4.2. How do GoodRx solve the problem?

GoodRx solves this problem by essentially offering a coupon service where users can access cheaper medication.

The company started out as a price comparison tool, enabling users to compare the price of prescription drugs between various locations. This still makes up the majority of their revenue.

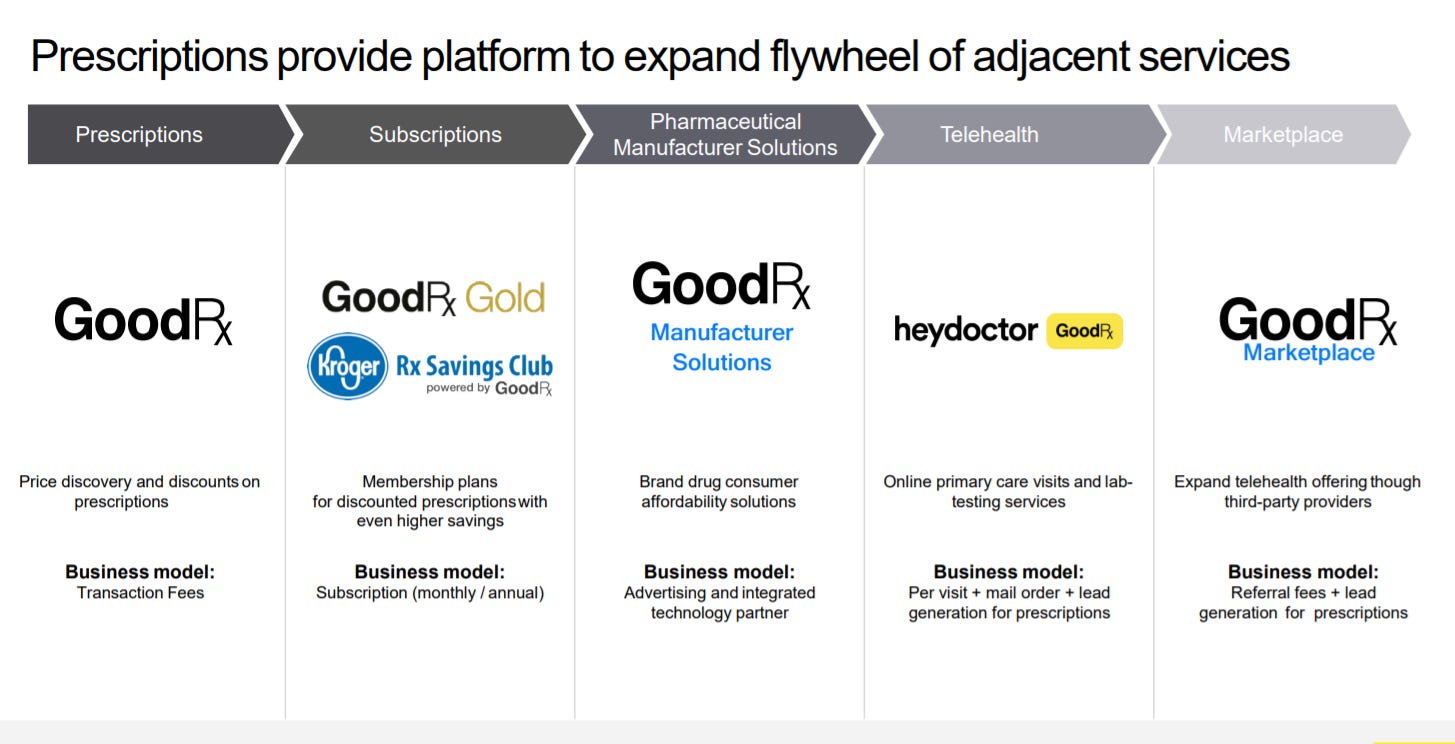

The core business serves as the main on-boarding mechanism in order to make customers aware of the various other businesses GoodRx runs, such as Subscriptions, Telehealth, Marketplace and Pharmaceutical Manufacturer Solutions.

The basic GoodRx service gives consumers the ability to compare Rx (prescription) prices between a range of pharmacies. Using the app or online, GoodRx provides the user with a discount card to present at the pharmacy counter in order to receive significant discounts on regular prices.

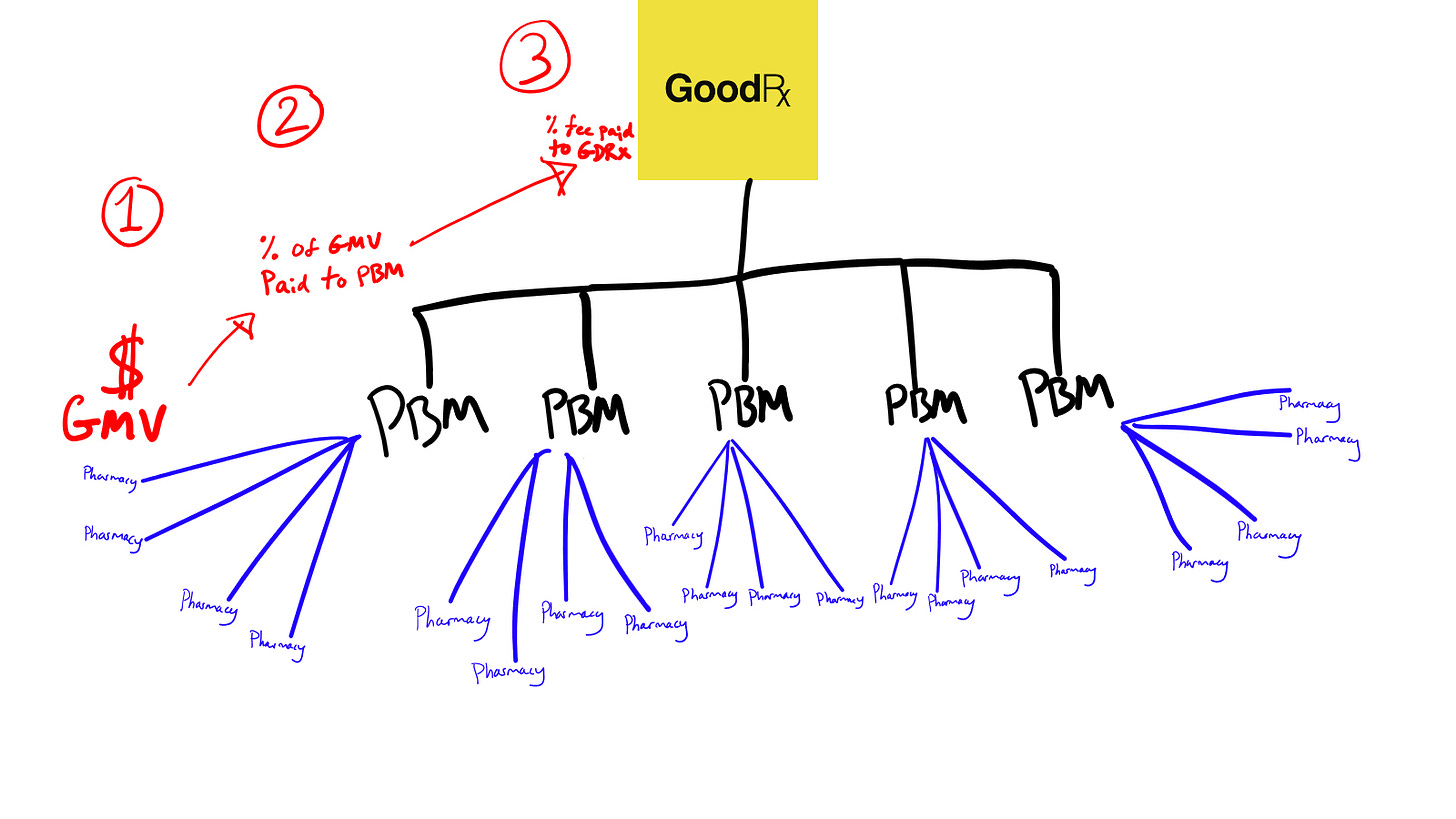

4.3. So, how do they achieve these discounts?

Firstly, we need to understand one of the key features of the US healthcare system - a PBM (Pharmacy Benefit Manager).

Pharmacy Benefit Managers negotiate discounts and rebates with drug manufacturers with the goal of lowering the overall cost of prescription drugs for the general public.

Each PBM has a network of pharmacies with which they sign contracts to allow consumers with insurance to easily fill cheaper prescriptions at those locations. Most pharmacies are part of one or multiple PBM networks.

But why would Pharmacies want to lower their profit margin by selling drugs at a lower price?

Well, In exchange for the discount, these pharmacies are hoping to build awareness, drive more foot-traffic to their store, and therefore make up the margin on in-store purchases. This model works well for bigger pharmacies selling other items such as food, however it’s not so great for the smaller independent pharmacies.

If an uninsured consumer chooses to purchase a drug using the GoodRx discount code, the pharmacy pays a fee to the PBM who provided that discount. Then, a portion of that fee is shared with GDRX, which allows GDRX to offer the discount service for free.

On average, the GoodRx fee works out at 14.4% of the Gross Merchandise Volume (total price the consumer pays). The reason this business model works for GoodRx is because if the end user pays the original price instead of finding a discount code, then the PBM earns $0. Therefore, it’s in the PBM’s best interest to work with GoodRx - a win-win for everybody involved.

Consumers get cheaper drugs.

Pharmacies recoup margin on footfall traffic.

PBM’s increase their revenues.

GoodRx, as the facilitator, gets a fee from very little operational overhead (high gross margin).

Because of the attractive economics of this business model, it’s no surprise that a large proportion of the PBM’s in the country have signed contracts with GoodRx.

And, just for context, there are currently 66 PBMs, with the three largest – Express Scripts, CVS Caremark, and OptumRx – controlling approximately 89% of the market and serving more than 270 million Americans. GoodRx has contracts with Express Scripts, OptumRx and over 10 more PBM’s.

Over the company’s lifetime, the average discount offered to consumers has risen from 58% to 79% (as of Q2 2021).

GDRX is accepted in over 70,000 pharmacies country-wide (over 85%).

4.4. Who is the consumer?

My logic going into this deep-dive was that the majority of GoodRx’s revenue mix would come from uninsured consumers rather than their insured counterparts. This turns out to be somewhat incorrect.

In actual fact, ~75% of the company’s monthly active users (MAUs) are insured.

So how can we break the customer base down?

The uninsured: Currently, 27.5 million americans go without health insurance (roughly 8% of the population). This category would be the main beneficiary of GoodRx.

High deductible plans: Roughly 50% of americans are enrolled in ‘High Deductible Health Plans’, for which GoodRx will come in very useful as long as

Expensive Copayment or Coinsurance plans: Once the deductible limit is met and patients start having to pay copay/coinsurance, it seems like GDRX prices are cheaper than copay/coinsurance roughly 40% of the time.

4.5. What is the value proposition?

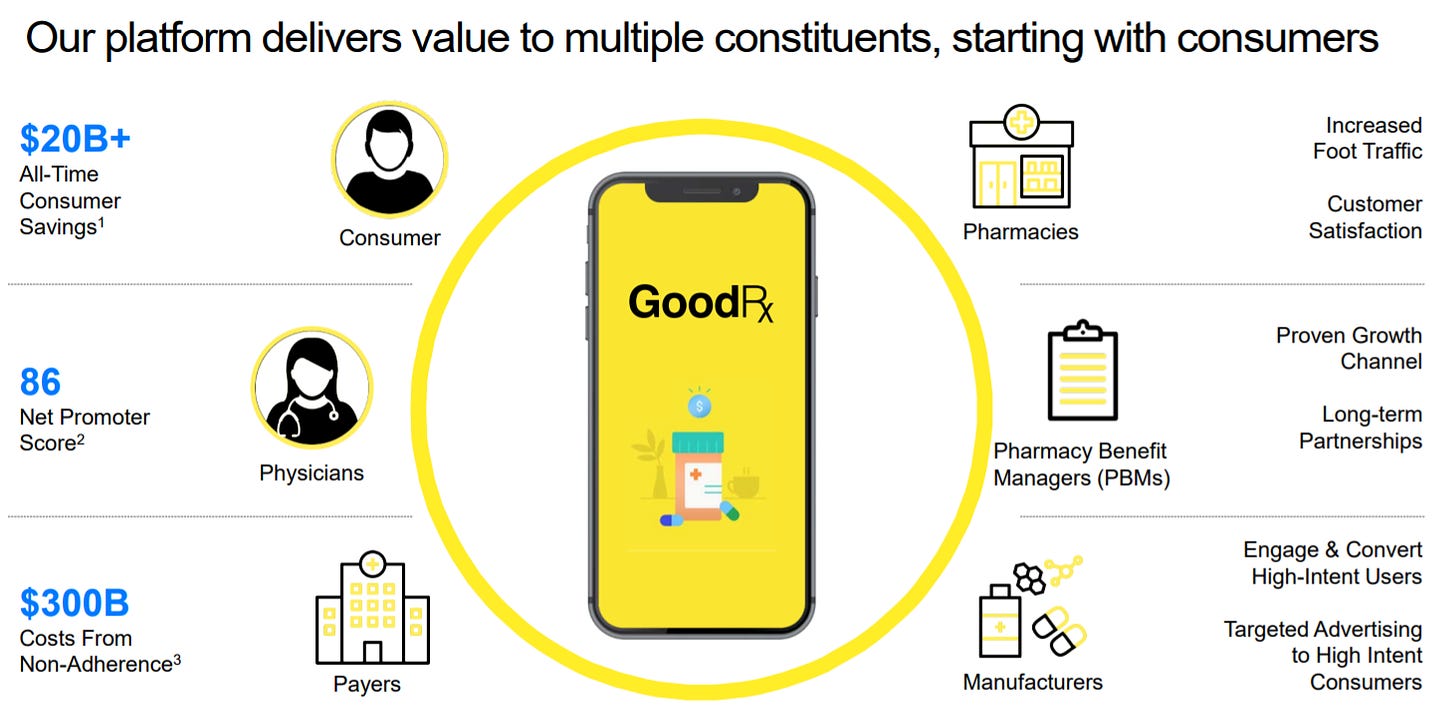

There are two main value propositions for the GoodRx platform - giving consumers the ability to quickly and easily compare prices between pharmacies, and ultimately to help consumers save money on prescription costs.

Over and above these two value propositions, GDRX provides value in various other ways…

Consumers:

Simple access to affordable healthcare

Improves quality of care due to accessibility

#1 downloaded medical app

Over $25 billion in customer savings

Physicians:

Increases medical adherence, improving health outcomes

Happier customers

PBMs:

Adds to profits

Offers easy to use platform

Pharmacies:

Increased footfall

Better customer perception of pharmacies, as offering lowest price

Manufacturers:

Encourages more patients to start, and stay, on their therapy

Provides high-intent audience, enabling effective targeting to deliver higher ROI

5. GDRX other avenues

In addition to the core ‘coupon’ business, GoodRx operates other complimentary businesses with the aim to improve the overall healthcare experience. These include:

Subscription services

Telehealth

Marketplace

Pharmaceutical Manufacturer solutions

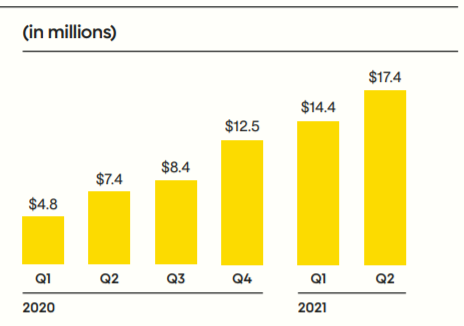

As you can see from the below graphs, the ‘other revenue’ segment of the business has been growing rapidly over recent years. As of FY2020 it makes up roughly 11% of total revenues, and has more than doubled since 2019.

5.1. Subscriptions

GoodRx charge $5.99 per month for individuals or $9.99 for groups as a subscription in addition to the core ‘coupon’ service. This gives added benefits - namely getting access to cheaper prices on over 1,000+ prescription drugs.

“Some pharmacies offered us even lower prices if we could create a membership program for people filling 2 or more prescriptions at a smaller group of pharmacies“

These prescription services are split into three main baskets:

Free prescription service

GoodRx Gold (2017)

Kroger Savings Plan (2018)

I’m not fully clear on how GoodRx Gold differentiates from the core service. However, from some digging, it seems that instead of GoodRx getting paid a fee by PBMs through the regular route, they instead negotiate prices with the Pharmacies directly and keep 100% of the subscription fees.

The company mainly enrolls people to the gold service organically, but also attempts to upsell users of the core discount service. Generally speaking, the more often you use GoodRx for your prescriptions the more likely it is you will get sufficient benefit from the subscription service. It seems prescription penetration currently sits at about 20% of the overall customer base (which is good), and has potential to increase over the coming years - probably growing at a quicker rate than the core business.

5.2. Telehealth

Telehealth, which is essentially a vertical integration on the existing GoodRx infrastructure, is an interesting area and one which seems to be expanding rapidly (somewhat boosted by the pandemic). It is also a ‘no-brainer’ extension to the core GoodRx product.

GoodRx purchased Heydoctor in 2019 and has since re-branded to ‘GoodRx Care, subsequently launching GoodRx Marketplace in 2020. You can think of this division as a similar model to Teladoc, probably the most popular Telehealth service.

The Telehealth division (GoodRx Care) in this instance acts as a sort-of marketing tool - seamlessly driving traffic to their core business and subscriptions via referrals from physicians. This strategy is extremely beneficial for GoodRx as it significantly lowers the Customer Acquisition Cost. Additionally the company can cross-advertise on both platforms, squeezing the most value out of their customer base as possible.

Apparently >10% of GoodRx Care consults lead to a consumer using a GoodRx discount code at a pharmacy.

Already competitive area

Medical consultants keep the majority of fees under the GDRX telehealth model (lower margin business). Requires scale for profitability.

Scale of their operation has improved dramatically since the takeover, however it seems unlikely that profitability of the operation will happen anytime soon.

If we look at Teladoc as a comparison within this sub-sector of the medical market, there are some big differences in scale between Teladoc’s offering and GoodRx’s offering.

Teladoc currently has over 50% market share and generate roughly $100 in revenue per visit, this is compared to the GoodRx telehealth solution generating about $40 in revenue per visit. In for GoodRx Care to get to Teladoc’s level of scale and profitability will be incredibly costly and time-consuming.

This doesn’t seem like a long-term profitable business-model on the surface, however building out the Telehealth business is a great on-ramp towards GoodRx marketplace, which is where the bulk of the profitability lies.

5.3. GoodRx Marketplace

Essentially, GoodRx Marketplace is an aggregator of over 30 Telehealth providers (including Teladoc), covering over 150 conditions across the entire country.

GDRX generates referral fees for directing traffic to marketplace partners and by integrating electronic health record systems of partners (such as TDOC) to allow customers to utilize the prescription service if a prescription is written with the consultant.

I see this as more of a strategic play as it allows GDRX to move up the customer acquisition funnel to the point of prescription and simultaneously lower the CAC whilst driving higher penetration for the core prescription business.

By the time the S1 was issued, they saw more than 1M consumer visits and over 200,000 consults. Scaling quickly.

Telehealth is a small part of the business today, but has plenty of potential to scale over time.

5.4. Pharmaceutical Manufacturer Solutions

As well as offering discounts on generic drugs, they also aim to target manufacturers who spend a great deal on marketing branded medications directly to consumers. Consumer focused advertisements are growing fast - accounting for roughly 30% of overall ad spending (about $10B).

GoodRx are hoping to capture some of this market by partnering with drug manufacturers in order to advertise on the GoodRx Marketplace.

6. Market context

6.1. Total addressable Market

I think it’s safe to assume GoodRx’s serviceable addressable market is much smaller than their estimated TAM of $800B.

Richard Chu does a great job of breaking this down, but essentially the breakdown is

$18 Billion for prescription and subscription services

$10 billion for the Pharma Manufacturer solutions segment

$7.5 billion for the Telehealth segment

To reach a total Serviceable Addressable Market (SAM) of $35.5 Billion.

Market penetration is currently low at about 3%-5% of the overall addressable market. However, there is good scope to increase this important figure over the coming years.

One fairly obvious reason I can think of for the low penetration at this stage is the age-mix of GoodRx users and the differing habits between age groups. Basically, the older you get the more likely you will be to need to use GoodRx’s services. And GoodRx’s modern e-commerce-like solution is less likely to be utilised by the current older generation. As the older generations move on and the current, more tech-savvy, generations find the need to use GoodRx’s services more - the company will continue to grow.

For example, research shows smartphone penetration to be around 61% for the 65+ demographic. Therefore in several decades time, the GoodRx penetration figure is likely to rise substantially.

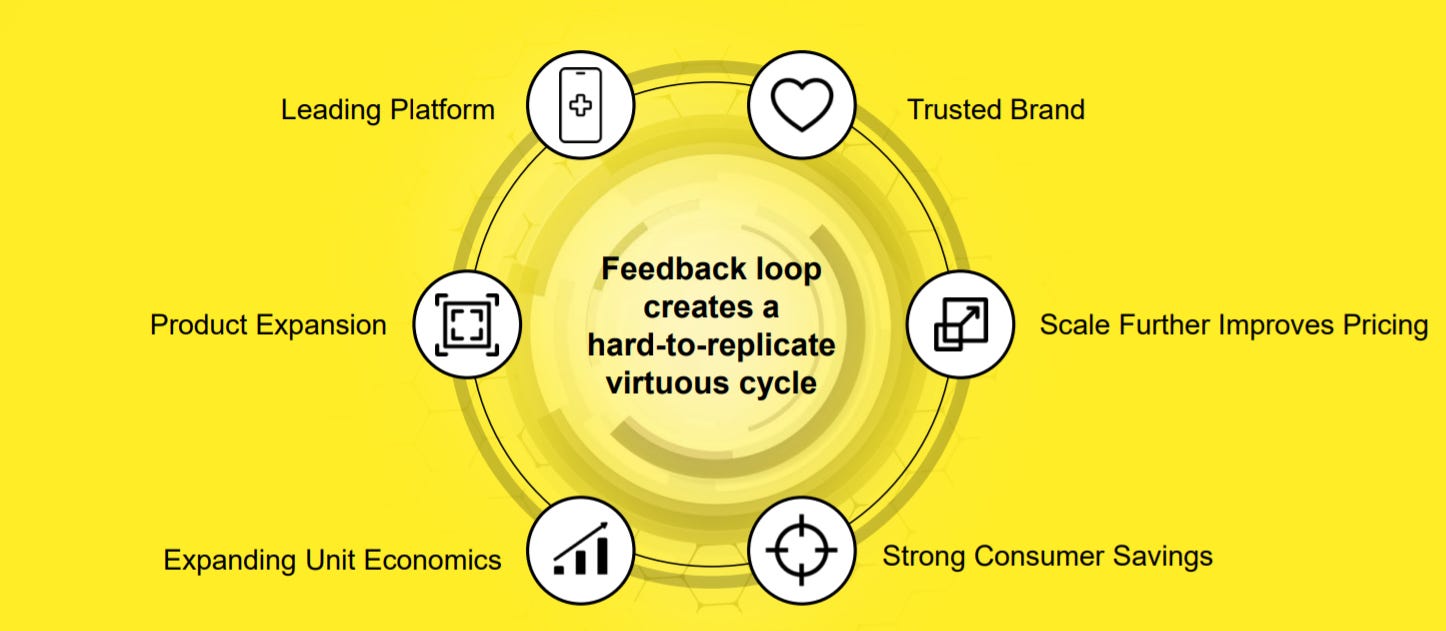

6.2. Competitive advantage

But where is the competitive advantage for GoodRx? What makes them unique?

High quality recurring revenue: In terms of the nature of the prescription business, a high proportion of ailments are chronic - therefore requiring regular medication in order to operate. This creates solid recurring revenue with low churn for GoodRx unless the patient happens to move to a different pharmacy where they don’t need GoodRx.

Lowest prices due to PBM relationships: GoodRx are head-and-shoulders above the competition when it comes to the relationship with the PBM’s. As mentioned earlier, GoodRx have contractual relationships with at least 12 of the top PBMs across the United states, with over 85% pharmacy penetration.

What makes this even better is the fact that the company have a patent (expiring in 2034) which essentially enables GoodRx to be the only competitor allowed to sign contracts with multiple PBM’s. Therefore it’s almost impossible for other competitors to offer a consistently better service than GoodRx.

Watertight contracts: Similar to the above point, the contracts written up by the GoodRx team seem to be very forward-thinking and don’t allow for much flexibility on the PBM side.

For example, the contracts stipulate that the PBM’s can’t terminate the contracts out of conveniency, they must auto-renew, and the PBM can’t go outside the GoodRx platform. Additionally, if the contract were to expire, GoodRx would continue to receive payments for several years after the termination.

Purchasing power: Essentially, GoodRx is the aggregator of demand for the PBMs. If a PBM is able to negotiate more competitive discounts then they will most likely receive more of the GoodRx volume.

As more and more PBMs onboard to the service, there is a battle to capture as much of the GoodRx volume as possible. This means the incentive to reduce prices perpetuates to every PBM, therefore GoodRx’s discount prices will continue to improve over time.

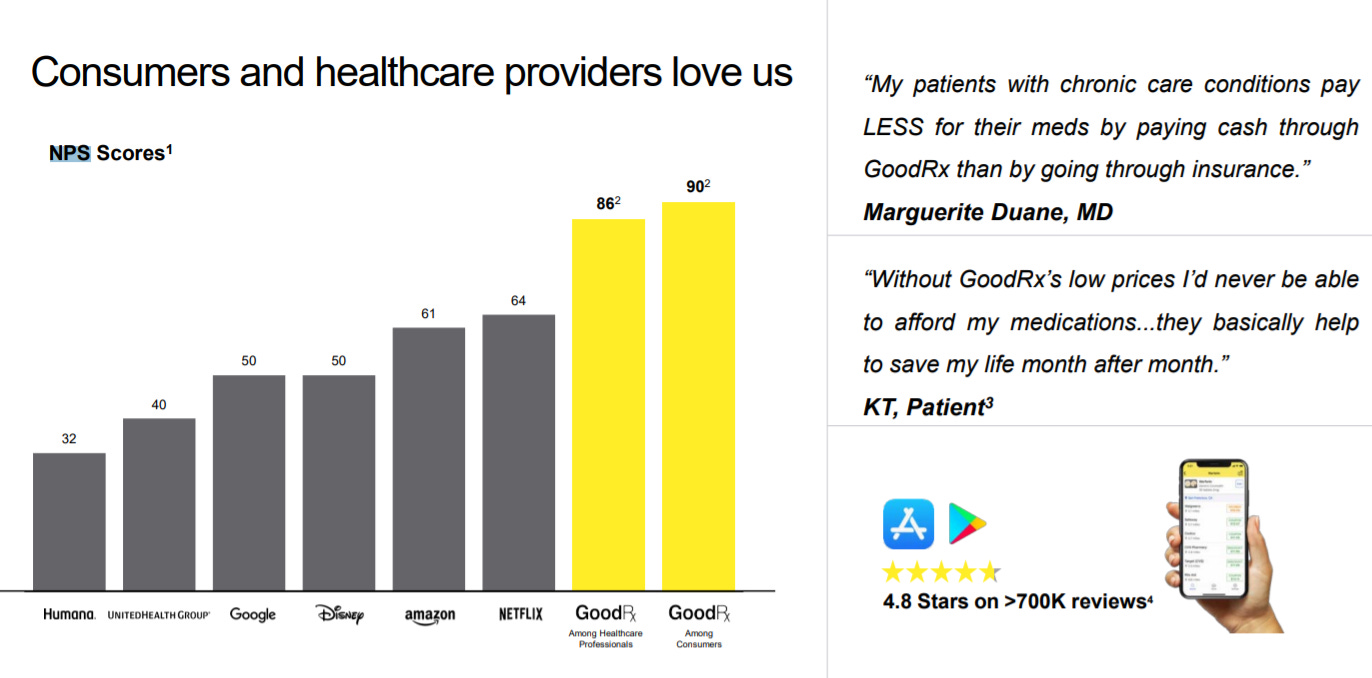

High NPS score: It seems to be the case that everywhere I look online I see glowing reviews of the service. It’s hard not to like something that can cut the cost of your essential medication by 70% on average!

They also report NPS scores of 86 among healthcare professionals and 90 among customers. These are great numbers, but it’s useful to remember these are ‘self reported’.

Strong Marketing/customer acquisition: One aspect GoodRx (and all other competitors) need to be cognizant of is marketing. It’s probably the most important aspect of acquiring customers. And seeing as roughly 50% of total costs are focused towards sales and marketing, this bodes well.

6.3. Competition

There are a multitude of competitors GoodRx will need to contend with over the coming years, and they fit into three main buckets - Direct competitors (basically doing the same thing), large pharmacy chains (e.g. CVS) and Amazon.

Direct competitors include Blink Health, WellRx, Rx Saver, Inside Rx and many more. With Blink Health being probably the closest competitor with roughly half the reach at 35,000.

Other than that, GoodRx tend to remain either the No.1 or No.2 best price on the market. And, of course, the patent not allowing any competitor to be able to contract with more than 1 PBM means GoodRx will likely continue to pull away from the competition.

Pharmacy discount programs include companies like CVS and Walmart where they tend to offer fairly good drug prices for popular drugs. The reason being is because they operate at a big enough scale to afford to take a small hit on a ‘loss leader’. This gets people physically into their store where they will probably make strong markups on other purchases.

Lastly, Amazon have been in the news over the past year due to their new foray into the mail-order drug market. For me, this should be considered one of the larger risks. After buying PillPack in 2018, Amazon launched Amazon Pharmacy. It acts as a mail-order pharmacy, but prime members also get access to their discount programme (similar to GoodRx).

I believe Amazon are hoping to leverage their existing delivery infrastructure to eventually offer same-day delivery. However it’s not quite there yet, and probably won't be for quite some time. However, when we look at the likelihood of using the amazon discount card over the GoodRx discount card, it seems like GoodRx still wins in terms of price. Their multiple PBM relationships are simply too strong compared to Amazon’s one.

I can see Amazon successfully growing this business model - and there is a real chance customers will value the frictionless integrated experience over the GoodRx model and will therefore forgo a small price difference. However, the mail-order business is only young, and time will tell if they are successful.

You would think mail-order would take off during the pandemic, however the percentage of people using mail-order prescription services is roughly at pre-pandemic levels. This is mainly due to slow delivery times, the added value of a knowledgeable pharmacist, and patient wellbeing.

7. Managament & Culture

GoodRx is a story of three good friends - Doug Hirsch, Trevor Bezdek and Scott Marlette - who put their heads together in order to solve a core problem in the healthcare industry.

The idea famously stemmed in 2011 from a breakfast the three friends would attend once every year where they would spend hours discussing various business ideas. After throwing out a tone of ideas, they landed on the GoodRx business-model.

Both Doug and Scott worked as early employees at Facebook.

7.1. Culture

Culture is an aspect of a company that is hard to accurately quantify. Though it’s as important to the success of a business as other aspects such as finances. At the end of the day, if company culture is strong and people want to wake up and work there, it’s a big plus in my books.

From reading interviews, the culture at GoodRx feels like one of entrepreneurship - i.e. not to be afraid to fail and ‘break things’ as long as the intention is there to fix the problem just as quickly. Being able to foster and maintain this entrepreneurial spirit inside an organisation with over 200 employees enables them to stay somewhat agile, which enables the company to react more quickly than their competitors.

Overall, from looking at the very positive Glassdoor reviews (98% approve of the CEO) and CEO interviews, it seem like the company have a fantastic culture which is conducive to a positive future.

7.2. Building a mission

From every interview and transcript I’ve digested, it’s clear that the founders are really passionate about solving the transparency and affordability problems in healthcare. As a result, they’re very customer and product focused, which explains why they didn’t just stop at Rx drugs; they find new problems and build products to address them, or find better ways to address the same problem and tweak the product.

7.3. Skin in the game

Skin in the game is absolutely present at GoodRx.

For one, the company is founder-led which has a multitude of effects.

Passion - the ability to get excited about the work you’re doing.

Obsession - manifests in pure dedication in solving some of the hardest problems.

Owners mindset - This permeates throughout the business, encouraging employees to take risks and make hard decisions.

Secondly, the ownership within the business indicates a strong level of ‘personal stake’ in the success of the business. The share structure is semi-confusing with shares split into class A and class B - class A being worth 1 vote per share and class B being worth two. The below image really goes to show that most of the decisions will be made by 4 main groups of investors - one of which being the founders (‘Idea Men’).

7.4. Valuable board members

Lastly, it’s useful to take a look at the composition of the board members to see if there is anyone particularly influential working alongside GoodRx.

The majority of the board is made up of investors from the various investor groups above, but there are several board members who stick out.

Agnes Rey-Giraud joined the board in 2016 and previously spent 12 years as an executive at Express Scripts, which is one of the GDRX’s most important PBM partners.

Jacqueline Kosecoff also joined in 2016, and was previously the CEO of OptumRx, which is another important PBM partner. Express Scripts and OptumRx have a combined PBM market share of nearly 50%, which makes these two directors invaluable, in my view.

Gregory Mondre is on the board of Expedia

Julie Bradley was previously the CFO of Tripadvisor and currently on the board of Wayfair (Expedia, Tripadvisor, and Wayfair all lean heavily on digital advertising, much like GDRX, and these directors likely provide valuable insight there).

8. Bull Case

A real problem with a real solution.

Ability to scale massively over time as demographics evolve.

Great optionality makes for a sticky product for patients and physicians.

Good track record with consistent growth.

Zero marginal cost of supply, so scaling is key. Only limited by demand.

Smart marketing.

Monopoly on PBM contracts.

9. Bear Case

Healthcare reform - GoodRx shouldn’t have to exist.

PBM reliance - if one of the big PBM’s leave, it could have major negative effects on GDRX’s bottom-line.

Data privacy - Need to be very careful when handling patient data.

Amazon entering the picture.

Pharmacies hate GDRX because it hurts their margins.

Highly shorted: almost 28% of the float is short as of early 2021.

10. Financials

10.1. Income Statement

Revenue growth has been strong over the past several years, with a Compound Annual Growth Rate (CAGR) of 50% since 2016. In addition to this, y/y revenue for Q2 has increased 43%. These numbers are primarily driven by the strong growth seen in the Monthly Active Consumers and Subscription plans - which have grown 36% and 86% respectively.

Gross margin sits at roughly 95% which is a symptom of the capital-light business model they operate. Net margins hover around the mid-teens, with the most recent quarter coming in at 17%. And adjusted EBITDA margins sit at 30%, a decline from 40% the year prior. This is mainly due to an increase in R&D and G&A spending.

As discussed earlier, Sales and Marketing expenses make up 50% of the company's total costs, which is crucial in order to continue to grow and maintain their leading position. Compared to other competitors, GoodRx has a significant advantage in the amount of cash available to spend on these expenses.

Subscription transactions revenue grew 32% y/y/ to $144.9M driven mainly by an increase in users, but partially offset by the acquisition of Scriptcycle. Then if we take a look at ‘other revenues’ (including telehealth, subscription and pharmaceutical manufacturer) we can see much more accelerated growth. With Q2 revenues growing 136% y/y and 21% since Q1 2021.

10.2. Balance sheet

Before the company IPOd in late 2020, they had approximately $700 million of first lien debt on the balance sheet. “A first lien is the first to be paid when a borrower defaults and the property or asset was used as collateral for the debt. A first lien is paid before all other liens.” This is obviously not a great situation to be in as it diminishes the companies ability to incur additional debt, make other payments, make investments, do M&A type activity etc.

However, the IPO raised approximately $900 million - offsetting the total debt load. They finished 2020 with negative debt of $300 million, which is a combination of $667M in debt and $968M in cash and cash equivalents.

The first lien debt is to be deployed slowly over the coming years, so it is likely GoodRx will utilise this excess cash balance to invest in the business.

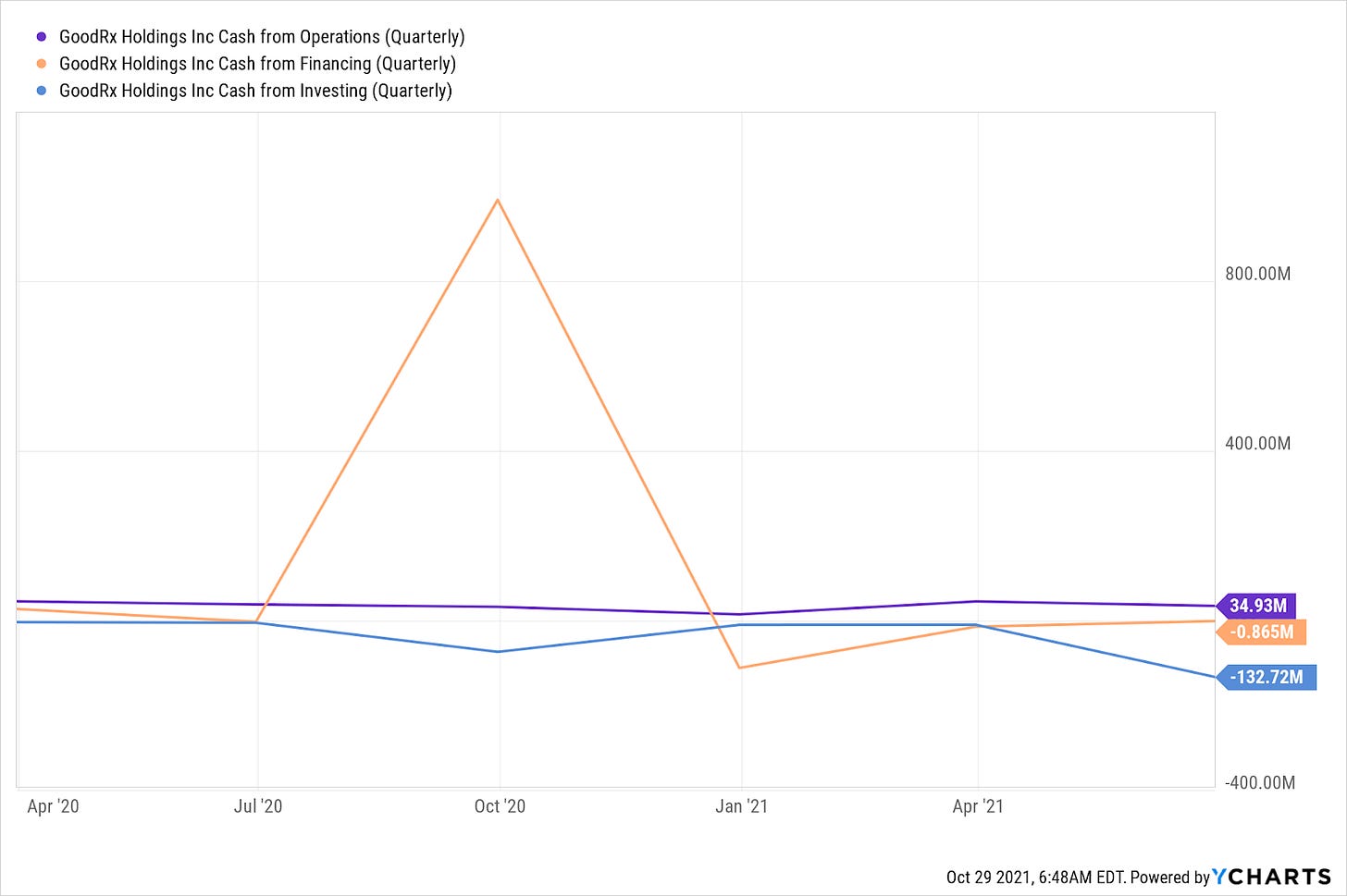

10.3. Cash Flow

GoodRx are unique in the sense that the business-model requires relatively low levels of capital expenditure in order to grow. Therefore the company has consistently generated positive free cash flow from operations.

The fact that they operate ad a 95% gross margin goes a long way to help with their cash position. In addition, they have negotiated an 8 month payback period on marketing which further contributes to the companies high margins.

10.4. Valuation

On the whole, it’s tricky to pinpoint GoodRx down in terms of relative valuation due to the fact that most of their competitors are private businesses.

That being said, trading at a multiple of ~28 EV/Rev seems to match up with the premium deserved from being a high-quality company with strong recurring revenues whilst growing rapidly and being a clear market leader. The business model semi-resembles a SaaS business model where margins tend to be high and revenue is reliable due to the subscription nature. Again, factoring in the quality of the contracts signed offers the company fairly predictable longevity.

All of the above combined with the optionality in its ‘other’ areas which are growing much faster than the core business, i would argue, justify the valuation.

11. Conclusion

Overall, GoodRx is a unique business run by unique leaders operating in an industry begging for disruption.

Healthcare is an issue at the core of the American system, and GoodRx are on a mission to help improve the system for those who would otherwise not be able to afford it. I think the overall industry needs a big change, however the likelihood of that happening anytime soon is next to nil, as the current way of doing things is tightly woven into the fabric of the American economy. Therefore GoodRx are nicely poised to continue to find a way to make this system work for the benefit of the consumers.

GoodRx might even be a solid hedge against inflation. As inflation continues over the coming years, we will all be worse off - meaning the GoodRx service will be in higher demand.

The mixture of a strong moat, optionality, driven leadership, reliable revenue and high margins is rare to find outside of the SaaS world. Coupled with their proven track record in delivering shareholder value, and the fact that the healthcare system is in the process of modernising - GoodRx could be one of the best bets in this segment over the next decade.

Cheers,

Innovestor