Key stats

TTM Revenue of $429.79 million (+84% Y/Y growth)

Operating income continues to be negative (TTM -$28 million)

Market Cap $7.3 billion

Products available at approx 122,000 retail outlets in over 80 countries

The Beyond Meat model

Founded in 2009, and currently one of the fastest growing food companies in the United States – Beyond Meat produces plant-based meat products such as the classic ‘Beyond Burger’ along with ‘Beyond Sausage’, ‘Beyond Meatballs’ and ‘Beyond Beef’. This is to meet the increased recent demand in healthy and environmentally friendly alternatives to traditional meat sources.

Beyond Meat’s products are “made from simple ingredients without GMOs, bioengineered ingredients, hormones, antibiotics, or cholesterol” whilst maintaining the same tastes and textures as animal-based meats and being better for people and the planet.

Along with meeting this new demand, part of Beyond Meat’s goal is to improve the health of the individual and the planet by empowering people to make good choices.

They are a major disruptor to the global meat market industry worth an estimated $1.4 Trillion.

Is growth slowing?

Revenue growth over the past several years hasn’t been an issue for Beyond at all – with $16 million in 2016, $32 million in 2017, $88 million in 2018 and $297 million in 2019. That’s a Y/Y growth rate of 101%, 170% and 239% respectively. Insane numbers.

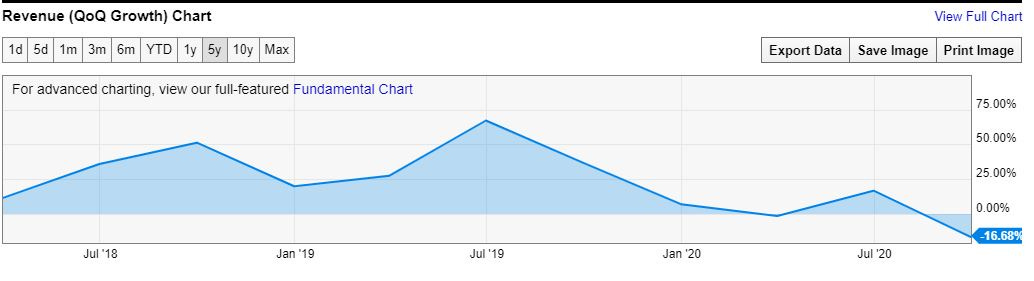

The problem is, keeping up this kind of growth is near enough impossible. And we have started to see the result of this over the past couple of quarters, with the final quarter of 2020 expected to be below targets, too. The below chart shows the slowing and even shrinking Quarter-on-Quarter revenue growth since the start of the pandemic.

That being said, the current year revenue for the 3 months ended September 2020 stands at $305 million compared to $199 million for the same period in 2019 (53% Y/Y) growth. Not bad at all, all things considered.

This market is potentially huge

As stated in the 2019 annual report, the global meat industry is worth approximately $1.4 trillion. The plant based alternative to meat isn’t just targeting vegetarians and vegans, it’s also looking to appeal to a broader range of people including those who typically eat meat.

Let’s say Beyond Meat successfully penetrates into this market and is able to eat up just 1% of market share over the next 5 years – they would be looking at a TAM (total addressable market) of around $14 Billion, which leaves an incredible amount of room for growth.

According to Grand View Research, a 19.4% CAGR through the year to 2027 is set to power the industry to $13.8 billion in sales.

Innovative to the core

Creating something that looks and tastes like meat purely from plant proteins is a huge engineering feat only possible through a good deal of investment in R&D along with having some of the smartest people on the field working on the problem.

In order to achieve this, they have implemented the ‘Beyond Meat Rapid and Relentless Innovation Program’ which consists of a ‘state of the art’ Manhattan Beach Project Innovation Center in El Segundo, California – bringing together leading scientists from Chemistry, Biology, Material Science, Food Science and Biophysics disciplines.

In addition to all of this, their business development efforts have seen the recent launch of a new e-commerce website called “Shop Beyond”, which allows U.S. customers to order and receive the company’s products delivered to their doors.

I would expect to continue to see a net loss on the income statement moving forwards as Beyond Meat continue to invest heavily in innovation – something I’m very happy to see.

Adapting to COVID

COVID has had a major impact on the business of Beyond over the past year. The closure of the majority of food outlets all over the globe forced the company to pivot their sales strategy towards retail rather than eating-out establishments. And having to spend around $6 million to re-package and re-route their product.

Demand in products for Q3 has also been negatively affected by COVID due a surge in demand in Q2 from people stocking up on freezer food, therefore diminishing the subsequent Q3 demand.

COVID looks like something that is here to stay at least for the next 3-6 months, so I would imagine we will likely see stifled growth for this period. COVID is also making it near-enough impossible to predict the consumer demand patterns beyond a limited time frame.

It’s all long-term

As stated in the 2019 annual report and backed-up throughout SEC filings, Beyond Meat take the long-term view. This perspective runs throughout the overall strategy, even if they risk disappointing those who focus on short-term metrics.

This is something I love to see from management – as is confirms the desire to maximise long-term profits over short-term gains.

This kind of decision-making permeates in various choices throughout the business – across innovation, infrastructure, marketing and business development.

An example of this is a paragraph in the Q3 financial results which states “The decrease in income from operations was primarily driven by the decline in gross profit, combined with higher operating expenses primarily due to the Company’s increased headcount to support long-term growth, increases in the Company’s marketing initiatives, higher share-based compensation expense, investments in international expansion initiatives, and continued investments in innovation.”

All good news in my eyes.

Competition

There’s a good deal of competition in the overall ‘food’ market, however we don’t currently see any other public players in the plant-based market. The closest we have is probably Tattooed Chef. And outside of the public market we have Impossible Foods who are potentially looking to be a strong competitor.

In terms of the big players, however, we are starting to see these massive companies getting involved in the meat substitute industry. For example, Nestle have launched a rival burger to Beyond Meat’s patty using similar pea protein technology. This is amongst many others in the industry such as Tyson Foods and Unilever.

If I had to state the bear case for Beyond, this would be it. They are potentially going to be operating as a small player within a market filled with giants. These larger competitors can plough 10x money into r+d, marketing etc. to push out smaller players like Beyond. I wonder if Beyond will be able to compete.

Financials

9 months to September Revenue $305 million (+55% Y/Y)

Adjusted gross margin $27.3 million (28.9% of revenue compared to 35.6% y/y)

Slowing growth due mainly to Covid market conditions

Trading at 18.82 x sales

EBITDA of -4.5%

Healthy balance sheet, with a book value of $379 million

Profitability wise, Beyond Meat are yet to produce a net-positive operating income, with the current TTM loss at $28 million. The main reason for the sustained losses here comes back to the overall strategy and what the company are hoping to achieve within this industry over the next decade rather than over the next year to 2 years.

The company continues to invest in innovation within all areas of their business whilst also aggressively expanding which is where the majority of this operating loss comes from.

Q3’s results are worse than expected, however as mentioned before, Covid has been the main contributor here as it has led to increased costs due to a significant shift of business models.

Taking a step back and simply focusing on revenues, we can see Beyond Meat are on track to report ‘okay’ growth (in comparison to previous years), with y/y revenues increasing 55% all within the context of the global pandemic and many food outlets closing down.

It is absolutely worth questioning whether the overall growth here is slowing or even coming to a plateau seeing as Q3-2020 saw a decrease in revenue from the previous quarter. However I believe we will get an indication of this over the coming quarters.

Turning to valuation. It’s hard to deny the stock looks expensive. It’s trading at around 19x sales. It especially looks expensive if we compare it to another company operating in the food space such as Tyson Foods, who are currently trading at about 0.5x sales. All that being said, it’s hard to compare seeing as there isn’t any other public company’s we can benchmark against.

Conclusion

Overall, I’m confident Beyond have a solid strategy in place to make this work over the long-term combined with a determined and passionate management team. However, if investing, I would absolutely tread carefully due to the level of intense competition potentially evolving over the coming 5 years. And just to add to that point, I wouldn’t expect this stock to ‘pop’ anytime in the next 9 months or so, it’s likely to be a slow burner over a 10 year period. But that’s fine with me, as that’s my style anyway.

In addition to all this I think it’s important to point out the huge potential tailwinds this industry could encounter over the next 10-50 years. The global population is just starting to wake up to the fact that we are polluting our planet every single day due to the decisions we make with our food.

According to the United Nations Food and Agriculture Organisation, 14.5% of Greenhouse Global emissions are directly down to animal agriculture. Along with this, they warn of a global food crisis unless us humans change the way we produce meat and use land.

Beyond Meat are looking to change the planet. And that’s a hard thing to do.

Cheers,

Innovestor