Intro

Key Stats

The company

Products

Bull Case

Risks

Management

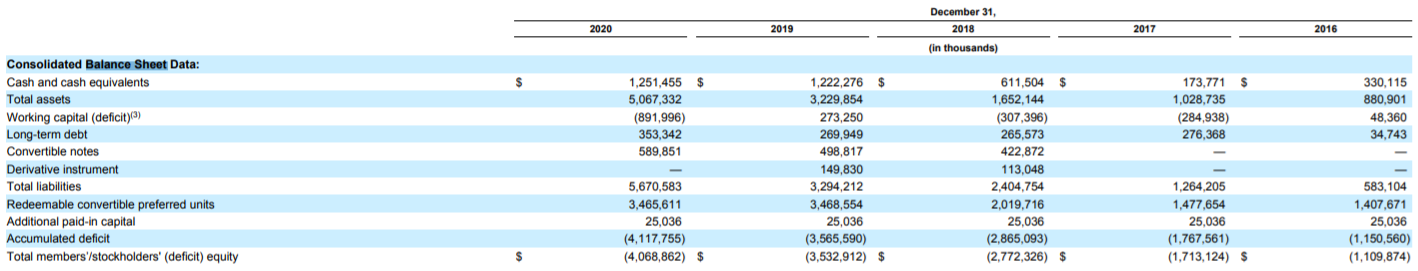

Financial Performance

Valuation

Metrics

Conclusion

Intro

Optionality is the word of the day for this one. Coupang are a behemoth in the South Korean market, and I don’t think I’ve seen a company with quite so much ambition and a clear path to vision mixed with impressive growth to date.

The similarities to Amazon are startling with their e-commerce arm offering near instant delivery times with a seemingly unlimited selection of SKU’s. So the question here, really, is how far can they go? Can Coupang dominate Korea?

Key Stats

Market Cap: $79.4B

90% y/y Rev growth

5 year CAGR of over 60% from $1.67B in 2016 to $11.98B in 2020

TAM of $470 billion in 2019 and is expected to grow to $534 billion by 2024

25 Million people live in the metropolitan area surrounding Seoul – that’s roughly half the population (70% of Koreans live within seven miles of a Coupang fulfillment center).

Newer cohorts increase spend at a faster rate than older cohorts (e.g. the 2016 cohort increased spend by 1.37x between y1 and y2 whereas the 2019 cohort increased spend by 2.19x between y1 and y2).

In less than three years, 2 out of 5 Koreans (population of 50 million) were a customer of the company.

The company

Coupang are a South Korean based company with focuses on e-commerce, fresh food delivery and takeaway delivery – fully owning each of the verticals.

Founded in 2010, the company initially based their business model on that of Groupon, however cleverly pivoted towards e-commerce after realizing the business model was inherently flawed. It was rapidly becoming obsolete - and it cost more to acquire customers than it was gaining per customer in revenues. It then transitioned to a model more reminiscent of e-bay, where the company operated a platform selling 3rd party items.

After moving away from this second business-model to focus more on an ‘amazon-like’ experience, the company quickly accelerated due to their virtuous cycle....

“As the company grew exponentially through aggressive marketing and customer acquisition, there was an indirect network effect between sellers and the company’s customer base. The more customers that joined, the more sellers with attractive products wanted to sell through Coupang, and that in turn brought more customers to site/app. In a matter of six months of starting the service, they acquired a million customers, then reaching five million customers another six months later. In less than three years, 2 out of 5 Koreans (population of 50 million) were a customer of the company.”

Nowadays the company pride themselves on a great experience for their customers, including fast delivery (within hours) on a wide range of products. They offer a multitude of services including standard e-commerce deliveries (similar to Amazon), fresh food deliveries (similar to Amazon), fast food deliveries (similar to UberEats), and a third-party merchant service (similar to Shopify). The closest company doing what Coupang are doing is Amazon - and that’s quite the comparison.

Let's take a deep-dive into Coupang’s business, the market it operates in and its financials - in order to get an idea of whether this company could match the growth trajectory of amazon over the past decade.

Products

Coupang really are a behemoth. Each of the individual businesses listed below represent a dominant force in the Korean market, however combining all into a 4/5/6 armed beast represents a much greater opportunity - to solidify the word ‘Coupang’ into almost every aspect of Korean life.

There is a vision here, which is mentioned in the company’s S-1 filing - to create a world where customers wonder “How did I ever live without Coupang?”. And this nice little scenario below helps to outline how it might work in reality.

The level of convenience demonstrated, along with the availability of products stands to highlight the scale and complexity of Coupang’s mission here.

Rocket Delivery

Initially, the lack of existing fulfillment capacity and the limitations of third-party logistics in the market forced the company to build out their own from scratch. This resulted in Coupang being able to guarantee one-day delivery on all rocket orders. All free delivery.

This part is broken down into the sale of third-party products and first-party products. Initially, the company started by selling third-party products on their site, however by manufacturing and distributing ‘in-house’ products they will be able to drive down the operating costs, therefore increasing margin. This is why the company is looking at getting into high-profit categories such as apparel.

Rocket WOW membership

This is a similar offering to that of amazon prime, and is part of the competitive advantage taking away valuable customers from direct competitors (such as Naver). For about $2.5/month, it provides free overnight delivery amongst other services.

Rocket Fresh

This initiative challenged the idea of ‘rocket’ delivery even more. What’s the point in getting a pair of headphones in a matter of hours if you still need to get in the car to grab milk?

Coupang offers the ability to do your grocery shopping at the same time as ordering a pair of headphones. Think Amazon Fresh.

Coupang Eats

Similar to uber eats. Just another way of utilizing the company’s extensive logistics network in order to offer that added extra optionality.

I’s important to note that food delivery is one of the only operational spaces in which Coupang is not the market leader. The competition (Baedal Minjok and Delivery Hero) have a market share of 99.2% combined. Baedal Minjok is funded by Naver, Coupang's closest competitor.

Coupang Pay

There isn’t much mentioned about Coupang Pay in the S-1 filing, however it seems the payment system will be yet another aspect to the company’s cluster of in-house products.

Having full control over the payment aspect within the overall Coupang eco-system will offer added leverage down the line. For example, integrated payments for merchants with a Coupang storefront.

Merchants on Coupang

Similar to Amazon or Shopify, sellers can list their products on Coupang’s app/website as third-party marketplace sellers. Coupang’s large customer base and user friendly app allows businesses to expand their global reach easily and bring their great products to Korean customers. The company offers:

A storefront: Similar to that of shopify.

Data analytics: In order to help to improve advertising, enable better insights/recommendations, improve targeting, broaden reach and enable better management of business strategies.

Access to logistics pipeline: Each of these offerings are incredibly valuable to individual sellers. 70% of merchants are small businesses with under $3Million revenue per year. These small businesses on Coupang saw their sales increase over 50%.

What’s interesting with all of these products is the possible synergistic nature that could potentially emerge when combining all three – ecomm, groceries & fast food. Typically you would need a different logistics system for all three. E.g. different drivers/employees/vehicles are used to transport a household item compared to a takeaway pizza. However, there may be potential to combine some of these logistic channels in order to reduce operational margins/efficiency. For example, could the vans delivering items also have a separate cooled compartment to deliver food. This is part of the benefit of completely owning the entire supply chain and logistics channels.

Bull case

Data focused company:

Data is a focus at Coupang, and because of this the company are making sure they have a robust process in place in order to extract as much value as possible. As we know, data will be the most valuable asset in the world at some point in the future.

Part of the benefit of collecting large amounts of data is to be able to optimize efficiency in the long run in order to offer better products.

Coupang are also not being stingy with their data. For example, they offer merchants detailed analytics in order to help increase their sales. It makes sense really. Improve the success of the vendors on your platform and a virtuous circle begins.

All of this creates long-term optionality. I’m not sure how this looks in reality, however the most likely outcome is a super app – Rocket Delivery, Rocket Fresh, Coupang Eats, payment processor… more?

Owns logistics

The supply chain system Coupang have built here is something special, and possibly the company’s most important competitive advantage. There has been nothing like it before Coupang.

Self owned fleet of trucks.

Employ drivers full time – pay benefits.

Further entrenches their grip on the market.

It might look like drawback on the income statement, however it makes it hard for competitors to enter the market.

Eco packaging

Control entire shipping and sorting process end-to-end which has allowed the team to minimize cardboard packaging. This has therefore lead to the elimination of cardboard packaging in over 75% of shipments.

Process return using just app. Leave outside door.

Eco-bags for fresh food. These are completely re-usable bags that replace virtually all additional disposable packaging. E.g. trucks once leaving full and coming back empty are now coming back with returns from customers and eco-bags for reuse.

Good employer:

Many companies focus on that initial ROI more than anything. Coupang are making sure the employee is at the heart of the company and are treated well.

Established 5 day work week, even though providing a service 7 days a week.

Employ driver directly and pay full salaries with benefits.

Stock options (first company in korea for front-line workers).

Third largest employer in korea. In 2020 Coupang were the no.1 private sector job creator – adding nearly 25,000 jobs. This is more than the rest of the 500 largest companies combined

Market opportunity is large

Korean market very different to many of the western markets in several aspects…

25 Million people live in the metropolitan area surrounding Seoul – that’s roughly half the population (70% of Koreans live within seven miles of a Coupang fulfilment center).

Tech-forward looking country.

Sophisticated consumer. Among the most sophisticated in the world.

96% use smartphone. 40% order groceries online.

12th largest economy

Discretionary income tripled to $1.7T since 2000. This is somewhat a realization of the benefits of investments in tech.

Locked in consumer.

Supply chain hard to replicate.

TAM

“While we are the leading e-commerce business in the market, our total net revenues remains a very small percentage of the total retail, grocery, consumer foodservice, and travel spend in the Korean market, which was $470 billion in 2019 and is expected to grow to $534 billion by 2024”

Limited market, but market is huge.

Korea is the fourth largest economy in Asia and the twelfth largest globally as of 2019

GDP of $1.6 trillion and GDP per capita of $31,847.

Total spend in retail, grocery, consumer foodservice, and travel in Korea was $470 billion in 2019 and is expected to increase to $534 billion in 2024

Compelling mission – clear path.

“Building our own integrated network of technology and logistics infrastructure.”

Want everyone who uses Coupang to wonder “how did we ever live without Coupang?”

Re-investment

Plans to invest $870M to build seven regional fulfilment centers, creating thousands of new jobs.

Goal is to create 50,000 new jobs in Korea by 2025.

Intend to invest billions to create new infrastructure and jobs in areas outside of Seoul. Committed to advancing long term economic development in all regions throughout the country.

Risks

Labor practices

Overworked/underpaid delivery people is an issue at the center of the country. 2 employees passed away after working long hours at Coupang. Over tsame time period – 17 other deaths amongst competitors.

Growth questions

Can the company grow into other markets outside Korea? Concern – how big is the market op? Already so highly penetrated. Focused on SK. Not rapidly expanding across asioa. Korea 4th largest in Asia and 12th largest in the world. $130B in ecom sales in 2019. Expected to grow at 10% CAGR. Legitimate and growing Op.

14m active customers. 4.2m subscribed. 48m active users in China, so 30% of internet users users of internet? High penetration in Korea - but can the company continue high levels of growth? Currently unclear.

You could argue the success of Amazon was to do with very successful services like AWS and Amazon Prime. Will Coupang be as successful with one of their products?

Unprofitable - what is the path to profitability? It’s unclear as it stands.

What happens after the lockup period?

Active customer growth is slowing

Management

Bom Kim is the superstar CEO here. He has somewhat of a reputation for building companies and raising capital. However, there may be some disagreement on the methods of his management style. Looking at the company’s glass door score, they receive a respectable 3.9/5 stars, 76% recommend to a friend, and 79% approve of the CEO.

These are by no means bad reviews, but it does raise some questions about the management style.

That being said, the quality of the management team certainly looks impressive on paper - with a depth of diversity and talent across industries.

Gaurav Anand, CFO. Previously worked at Amazon from 2007 to 2014, holding various positions across North America Retail, International Retail, AWS, and payments.

Hanseung Kang, Director, Business Management. From August 2011 to February 2013, Mr. Kang served as the Secretary to the President of the Republic of Korea for Legal Affairs. During the prior eighteen years, he served in the Korean judiciary, first as a judge at district courts and later as a presiding judge in the appellate court. Mr. Kang has also served as a Special Counselor to the Legislation and Judiciary Committee of the National Assembly of the Republic of Korea, and as the Counselor for the Judicial Affairs at the Embassy of the Republic of Korea in the U.S.

Daejun Park, Director of Business Development. DJ Park has served as our Representative Director of Business Development since January 2020. In this role, he explores, develops and leads Coupang’s new services including the food delivery service Coupang Eats to ensure they can be successfully introduced to customers. Prior to joining us, Mr. Park worked at LG Electronics, a multinational electronics company, and Naver, an engineering and development company.

Thuan Phan, CTO. Prior to joining Coupang, Mr. Pham served as Chief Technology Officer of Uber Technologies, Inc. from April 2013 to May 2020.

Minette Bellingan, Director of Coupang Private Label Business (CPLB). Minette Bellingan leads CPLB, which develops and sells private label products and provides compliance services to the Coupang family of companies. Prior to joining Coupang, she was the Director of Global Sourcing and Private Brands at Amazon.com. Ms. Bellingan has over 20 years of experience in private label and compliance in online and offline retail in Asia, Europe, and the United States.

InTae (“Kiro”) Kyung, Director of Coupang Pay. He leads the financial technology and payment services to provide payment options and other financial services to customers and merchants. Mr. Kyung is an experienced software development engineer and leader who founded two tech startups before joining Coupang.

Joe Nortman, Director of Coupang Fulfillment Services (CFS). CFS provides fulfillment services to the Coupang family of companies. Prior to joining us, Mr. Nortman held various roles in fulfillment, logistics, and operations at both online and offline retailers such as JC Penney from July 2013 to May 2017, and Amazon from June 2012 to July 2013, as well as at United Parcel Service, a multinational package delivery and supply chain management company, from August 1995 to June 2006.

Financial performance

Income Statement

I think there are a couple of key points here with the financials. Firstly,over the past 5 years, growth has been rapid - increasing from $1.67B in 2016 to $11.98B in 2020 (boasting a 63.66% CAGR). The fact that Coupang achieved this level of growth from a billion dollar base is impressive.

To demonstrate the insanity of these numbers, Coupang’s total revenue grew 90% from 2019 to 2020, to reach $12B. The company looks like it’s in the stage of hyper growth. The majority of this recent jump is likely to be covid-related – however it is still impressive.

The obvious caveat to this is that when you look at the margins, they seem slim. At only 16.5% Gross Margin, it’s difficult to see how the company can reach profitability in the short-term. This is where we need to understand how ingrained long-term thinking is to this business and how much resource is going into investing in the infrastructure and R&D now, in order to capitalise on the longer-term (potentially huge) growth opportunity that is the Korean TAM.

Coupang is still unprofitable. I expect Coupang to remain unprofitable for at least the next several years until the company are fully established as the No.1 e-commerce/food infrastructure in the country. Encouragingly, the company have narrowed their net loss from 29.5% of total revenues in 2016 to 4% of net revenues in 2020. Still, cash is being burned to the tune of $500M every year, but there is somewhat of a path to profitability.

Another important point to mention is the fact that management explicitly states in the S1 that “Our long-term goal is to maximize Free Cash Flow while minimizing shareholder dilution. Today, a significant portion of our current capital expenditures represents investment in capacity for future growth, and, due to our ambitious plans for growth, we expect to continue to make large capital expenditures in the near future. Because the purchase of property and equipment may not be directly correlated to the underlying performance of our business operations at the time of incurrence of such costs, we believe it is useful to look at operating cash flow as a barometer of the current health of our business and our ability to generate long-term Free Cash Flow per share.”

The above is relatively encouraging as it indicates a clear path to profitability and positive FCF. The management has a long-term view, which is something I like to see.

Additional points

Gross margins showing signs of growing (4.7% in 2018 to 16.6% in 2020)

$4B raised from IPO

Accounts payable doubled from $1.6B to $2.3B

Inventory doubled from $630M to $1.2B

Valuation

Due to Coupang’s various arms of operations which are not yet fully mature, it’s inevitably difficult to estimate what the finances will look like in 5/10/15 years from now. Will the company still be predominantly an e-commerce company, or will other aspects (like payments or CoupangEats) come into their own?

Each of these different business arms tend to have differing valuation multiples applied.

For now, as it is predominantly e-commerce(currently 92%), it is useful to be able to compare between international peers in e-commerce. @Mukund (on twitter) does a great job below at outlining the attractiveness of Coupang’s current valuation.

I’m optimistic. I believe Coupang has the capability to reach similar operating margins to that of the large western E-commerce players like Amazon. This relies on the continued improvement of operating margins and reaching the largest possible addressable market. Time will tell.

Metrics

In this section I will try to pick out several key metrics I believe to be of interest. I think the company could have done slightly better at breaking some of these down into more detail, but it’s a good start.

This first matrix shows the growth in spend from the respective cohorts. A couple of key takeaways:

Cohorts consistently increase spend over the years.

Newer cohorts increase spend at a faster rate than older cohorts (e.g. the 2016 cohort increased spend by 1.37x between y1 and y2 whereas the 2019 cohort increased spend by 2.19x between y1 and y2).

Customer loyalty is strong and measurable.

This second chart paints a similar picture. “It reflects the composition of annual spend from new customers and existing customers, irrespective of cancellations and returns. The percentage spend from existing customers has remained strong, increasing from approximately 87% in 2016 to approximately 90% in 2020.”

Additional points:

Active customer growth has slowed from 28.6% in 2018/19 to 25.9%

South Korea is a perfect geography for the product - Within 7 mines of 70% of Koreans so can beat competitors in terms of time

Great infrastructure in a country which has one of the fastest growing per capita discretionary income slices in the world (discretionary income tripled since 2000).

Personal incomes are set to rise at a rate of about 3% y/y, which is particularly impressive because that's more than the rate of inflation in the country.

Conclusion

Overall, I’m excited for the future of Coupang. I believe the company are onto something truly special here that would make the likes of Jeff Bezos somewhat envious. The goal of creating a suite of products and services so tightly ingrained within the Korean way of life is a compelling vision, and one that (if executed properly) is within the realm of achievability.

I will be keeping a close eye on this one - as a company boasting a 60%+ CAGR over 5 years at a base level of billions is an impressive feat.

The risks, however, cannot be understated. Can Coupang continue to grow revenues at such lofty rates considering the relative size of the korean market? Can the company fend off new market entrants with their already established moat?

If we’re looking over a 10 to 15 year period, I would argue that Coupang has the potential to become a $500B to $1T company. The size of the market, the growing consumer spend and the move towards digital effortless transactions will likely mean Coupang are in the best position to capitalize.

Time will tell on this one. However, I’m willing to bet Coupang has what it takes to be successful in the long-term.

Cheers,

Innovestor