Key Stats

$800 million market cap

Revenues up 83% y/y to $8.7 million

Total paying subscribers up over 108% y/y to 13 million

Possible TAM of ~$150 million by 2026

Currently produce 3000 shows (6x more factual programs than Netflix) with the goal of 12,000 within 3-5 years

Thesis

Looking to capitalize on the current revolution in television consumption behaviour - from ‘channel-driven linear television’ to ‘menu-driven on-demand television’, Curiosity Stream’s flexible business model along with the multiple avenues of content monetization and differentiated niche content offerings provides the company with several long-term competitive advantages. Their low cost operating model allows them to produce high-quality content whilst charging low prices. And their varied revenue streams allows the company to be agile and adapt to the market as it evolves.

One thing becomming apparent over the past couple of years with the rise of these SVOD services is that it is important to define a category and deliver the broad spectrum of sub-niches within that category. For example, Netflix embraces all Film/scripted drama content, HULU encompasses all amusement & General Entertainment content whilst Curiosity Stream focuses on Factual content. This content is proven to have longevity and is engaging across multiple demographics.

I believe there is plenty of room to grow into the leading provider of factual-driven content. With an already impressive library of content (6X larger than Netflix’s factual content) and impressive plans for future growth along with strong y/y growth, Curiosity Stream are in a good place to capitalize.

Business Model

CuriosityStream inc, are one of many emerging ‘subscription-video-on-demand’ (SVOD) services capitalizing on the growing trend towards on-demand content. The main difference being the niche focus on ‘non-fiction’ content which is thought to appeal to about 60% of the total viewership (compared to sports which is 25%).

Curiosity currently have over 3,100 titles with about 1/3 being original content. This content reaches about 13,000,000 users worldwide and generates revenues through several different methods:

Individual direct subscribers

Paying a monthly/yearly fee for access on their device

About 1,000,000

Bundle subscribers

Bulk licence fee from other outlets such as Roku

Sales of programmes

Large deal in Q2 worth about $5million

Advertisement

Only recently launched this initiative but starting to see promising revenues with the estimate of a large advertising market.

Partnerships

Essentially partnering with other large companies who want to be associated with high-quality content.

For example, at the beginning of the doc, it would say “Brought to you by Ford”

This can be lucrative and can be useful to use their platform when promoting.

In addition to this, a nice economic advantage of Curiosity Stream’s factual content niche is the relative cost of production compared to scripted drama. For example, the most expensive documentary content would cost around $500k to produce, compared to a standard drama like law and order which would cost about $5-6 million per episode. This lower production budget allows for two main things; the ability to scale with a limited budget, and the ability to keep prices low.

“As other streaming providers find it challenging to build an audience and grow their business, we are experiencing the opposite. We have the unique competitive advantage of having a library that scales across multiple revenue streams, multi-generational and multi-national audiences and is difficult to replicate.”

Here is a good slide from a recent operational presentation which nicely outlines the business model (it’s more simple than it looks).

On the left are all the sources the company acquires shows from (which actually include over 130 sources worldwide) including Curiosity Studio originals

The second column is the operational activities to do with marketing, legal etc.

This allows the company to upload to the internet including all the major interface platforms in order to reach a global customer base regardless of device.

Additional points:

Launching in India with ‘Tata Sky Binge’ platform which should reach over 19 million viewers.

John Hendricks (Founder) states that due to the low price point, customers are willing to pay $19.99 per year instead of the $2.99 per month which results in one of the lowest churn rates in the industry.

This is mainly due to the fact that there are 11 less opportunities throughout the year to cancel your subscription.

In turn, this allows the company to analyse more data and feed into algorithms/models throughout the year to be able to make better decisions for consumers.

Market Opportunity

The market opportunity here is potentially huge. Cable television reaches roughly 500 million worldwide whilst satellite TV reaches another 450 million households. However a better proxy for the Total Addressable Market here would be the Youtube viewership who currently have about 2 billion active users. So, if we take into account that 60% figure (which is the number of people interested in factual content) we come up with a total addressable market of (450 mill + 500 mill + 2 bill) x 0.6 = 1.74 billion over the next decade.

Now if we look at research papers published about video streaming we have some similar estimates:

Grand View Research estimates a current value of $42.6 billion with a CAGR of 20.4% to 2027

TAM by 2026 of $156 billion

Allied Market Research estimates a 2018 value of $38.56 billion growing at a CAGR of 18.3% to 2026

TAM by 2026 of $148 billion

Management

The Curiosity board is stacked with relevant experience in the industry. And from the few calls I have listened to, seem very capable. But lets look at some of their history:

Founder and Chairman, John Hendricks

Three decades in the television business

Until May 2014 was Chairman of Discovery Communications, the global media parent company of Discovery Channel, Animal Planet, TLC and Science among many others

President and CEO, Clint Stinchcomb

Over 25 years of traditional and digital media experience. Leveraging a broad range of global roles in television and digital programming, production, content development, strategic planning, consumer marketing, operations, advertising sales, network distribution, and communications.

Played a critical role in the launches and successful growth of several television networks, content franchises and enthusiast brands.

Former Chairman and CEO at Showtime Networks, Inc., Matthew Blank

Blank served as an advisor to Showtime Networks Inc., having spent over 20 years as Chairman and CEO. He assumed the position of Chairman and CEO in 1995, after serving as President and Chief Operating Officer since 1991.

CFO, Jason Eustace

20 years of leadership experience and a record of achievement in financial planning and analysis in the media, e-commerce and retail industries.

Prior to this role, he served as the Head of Finance for Bluemercury, Pet360 and Discovery Communications-US Networks, where he was responsible for accounting, financial planning and analysis, budgeting, and strategic planning.

Finances

Latest quarter income statement

Revenues up 83% y/y to $8.7 million

Led by direct-to-customer and distribution subscription revenue.

All revenue lines increasing y/y with majority increasing triple digits.

Paid subscribers increased over 100% y/y

Decreasing ‘Customer Acquisition Cost’ by 18% driving estimated 53% increase in LTV y/y

Gross Margin up to 61% from 59% y/y

Operating expenses decreased 7% to $12.0

EBITDA improvement from -$10mill to -$6.7mill y/y

The company are on track to achieve their $39.5 million target for 2020 which is a 119% increase y/y. In addition to this, they aim to achieve $71 million for 2021, which is 80% growth y/y.

Balance Sheet

$800 million market cap

$60 million total assets

$29 million current assets

$18 million total liabilities

Fairly good balance sheet, with the ability to pay for the total liabilities 1.6 times over using the liquid assets.

Valuation

(Assuming estimated yearly rev of $39.5 million)

P/S Ratio of 20.25

P/B Value of 1.05

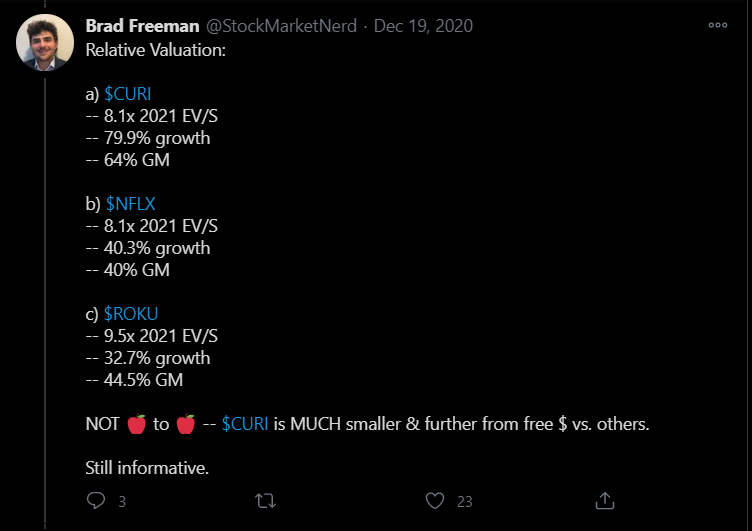

Here’s a good tweet from @StockMarketNerd who was able to dig into this section better than I can.

Risks:

It has to be said, the company didn’t do a great job at outlining the potential risk factors for the near future in their SEC filings – however I have come up with a few potential risks.

Competition is a big factor here.

All the big streaming services will continue to offer original factual content while focusing on their main ‘category’ (e.g. Netflix’s main category is scripted drama, but continue to produce factual content)

This allows Curiosity Stream to fully focus on developing excellent quality factual content that is ‘best-in-class’.

For context, Netflix’s current documentary content sits at around 400-500, whilst Curiosity Stream’s is about 3000 with the plan to increase to about 12,000 over the next 5 years. If achieved, this could cement them as an industry leader in factual content, where bigger providers would come to CuriosityStream for factual content.

A large part of their business model relies on the distribution of their services through third party applications/platforms. This is good in the sense that there are no upkeep costs of having a stand-alone platform along with being able to reach multiple platforms. However, there is nothing stopping one of these providers (Roku, Comcast, Netflix) from dropping Curiosity Stream as a service if they do not fit in with their overall strategy.

Are consumers going to be willing to pay the small amount extra per month with all the other services already out there?

Will the company be able to compete with other factual based streaming services, or even the native factual/documentary services on sites like Netflix?

It seems like with the volume of titles (currently 3000 compared to Netflix’s 500ish) Curiosity Stream can remain competitive here.

Relatively young business

Scale

It’s important to note that Curiosity Stream don’t have a platform to scale like Netflix/Disney/Roku – they mainly operate through deals with distributors such as Comcast who reach a large audience with their platforms. It could be argued that this is inherently risky as they don’t have 100% control over what to show, however it also means they reach the widest possible net of people.

Conclusion

Curiosity’s flexible business model along with multiple avenues of content monetization and differentiated content offerings allows CuriosityStream to succeed where other similar ventures have failed. Other providers have had more limited business models, expensive content and narrower go-to market strategies.

I would be cautious with this one as it’s a very competitive market, but also a market that has a tonne of upside if executed correctly. And with the significant experience in the management team along with the very impressive to-date results, I can see CuriosityStream becoming a force to be reckoned with in the industry.

Their success, however, does rely on their ability to continue to grow at rapid rates whilst also creating those ‘hit’ pieces of content which really stick with the consumer. For example, Game of Thrones (HBO) or The Crown (Netflix). I would also like to see profitability at some point over the next couple of years, though due to early stages in their growth cycle, I’m not expecting too much.

Definitely one to keep an eye on when their next earnings report lands.

Cheers,

Innovestor