Intro

Key Stats

Revenue Streams

Bull case

Risks

Growth Opportunities

The move to streaming

Financials

Valuation

Key considerations

Conclusion

1. Intro

Disney are one of those companies that keep surprising us. There are many contributing factors to Disney’s success over the decades. One could argue these successes do not rely on any one aspect to keep the ship steady, rather it is a case of the the whole being greater than the sum of the parts.

Over the past several years we have seen Disney, a literal giant of a company, nimbly manoeuvre into an entirely new business model. One entirely fitting of the 21st century and almost completely going against the grain of their previous model.

This transformation has been happening during the looming threat of a global pandemic, forcing the company’s parks and experience arms to close down temporarily.

In this deep-dive I will be taking an in-depth look at what makes Disney special, and why I believe it has strong growth potential over the next decade.

2. Key Stats

94.9M Subscribers as of 12th Feb 2021 (in 1.5 years)

$340.6B Market Cap

$65.4B (6% decrease y/y)

Disney+ segment growing from 10% of total rev to 22% of total rev y/y

3. Revenue streams

Previously Disney segmented their revenues into four distinct segments: 1) Media Networks, 2) Parks, Experiences and Products, 3) Studio Entertainment and 4) Direct-to-Consumer & International. However, as of October 2020, the Company announced a strategic reorganization of the media and entertainment businesses to accelerate the growth of their direct-to-consumer (DTC) strategy (Disney +).

The operations of the Media Networks, Studio Entertainment and DTC&I segments were reorganized into four groups: three content groups (Studios, General Entertainment and Sports), focusing on producing content to be used across all DTC platforms… and a distribution group, which is focused on distribution and commercialization activities across these platforms.

In the quarterly reports, the revenue structure is laid out and broken down by the following.

Media and entertainment distribution: This aspect makes up 78% of the overall revenue stream and includes…

Linear Networks: (47% of total revenues) It mainly encompasses the cable and broadcasting networks and primarily drives revenue from affiliation fees, advertising and licensing fees.

Direct to Consumer: (22% of total revenues - growing from only 10% of total revenues 1 year ago) Disney+ is the flagship product, currently reaching 94M subscribers who pay an average of $4.03 per month (down 28% from $5.56 a year earlier).

Content Sales/Licensing and Other: (10% of total revenues) Disney's ‘Content Sales/Licensing and Other segment’ sells film and television content to third-party TV and subscription video-on-demand (SVOD) services. The segment also includes theatrical distribution, home entertainment distribution, music distribution, staging and licensing of live entertainment events on Broadway (and around the world), post-production services through Industrial Light & Magic and Skywalker Sound, and a 30% ownership interest in Tata Sky Ltd.

Parks, experiences and products: Accounting for roughly 22% of overall revenue, Disney's ‘Parks, Experiences and Products’ segment is comprised of theme parks and resorts in Florida, California, Hawaii, Paris, Hong Kong, and Shanghai. It also includes a cruise line and vacation club. Revenue comes mainly from selling theme park admissions, food, beverages, various merchandise, resort and vacation stays, and royalties from licensing intellectual properties. This segment has had an extremely tough year due to the restrictions in place from the global pandemic.

Domestic: Represents 9%I

International Represents 2%C

Consumerproducts: Represents 11%

Just from looking at the various revenue streams, it’s clear to see just how vast Disney’s business model expands. The company are truly one of a kind, in that they cover most of the globe. If one revenue stream fails to deliver one year, there are many other aspects to help pick up the pieces.

4. Bull Case

Unmatched IP popularity: Disney has achieved the highest grossing movie of 2015,16,17,18 & 19 (2020 was a strange year). In the past decade only 35 films have crossed $1B – 19 of which are Disney (half of those 19 happened within the past 3 years. 25% of annual box office is Disney IP. None of this factors in newly acquired IP in 21st Century Fox.

The brand: The Disney brand name is seriously valuable. Everyone has experienced a disney product at some point in their life.

“Everyone loves Disney; all the company needs to do is literally list out which films and series it’ll have and millions will understand Disney+ and want it. After all, a quarter of US spend on film already goes to Disney (soon to be close to 40% including Fox).”

Strength in depth: Part of the reason Disney+ has been able to gain so much traction in such a short period of time is due to the deep catalogue the company has at its disposal. For example, if they want to grow faster or increase subscribers from lagging forecasts, all they need to do is move exclusive IP to the platform. Compare this to Netflix, where the cost of acquiring new (top quality) IP is relatively high.

Consumer spending on Disney content already high: Reportedly consumers spend $2.6 - $3 billion every year on DVD/digital copies of Disney content. It makes sense for most of these people to buy a subscription rather than spending additional money on physical products. This indicates a large and easily target-able market.

Large market for kid and young adults: This links again to the strength of the IP. Because Disney IP has been around for so long and is so ingrained into the culture of many people under the age of 30 who still have nostalgia for old Disney movies – it’s hard to see how the company doesn’t significantly penetrate into a large portion of these markets.

Continuous improvement: We have been seeing evidence of this over the past 6 months, where Disney are continuously adding to IP gaps alongside bringing out new, high-quality content. ‘Soul’ is a great example of this, alongside the addition of Star+ which will see Disney’s catalogue expanding the audience demographic internationally.

Receptive to deals: Disney has the ability to upsell the Disney+ aspect through other mediums… “Disney can use its myriad of consumer touchpoints and high-dollar sales to drive SVOD adoption. Buy a cruise or theme park pass? Free year of Disney+. $300 tote bag? Disney+. Buy a DVD or video game? Here’s a three-month free trial. Many will argue this move will artificially inflate subscriptions – and it will. But that’s the point. This approach is common in SVOD, strategically necessary, and ultimately irrelevant to the company’s long-term success.” - Matthew Ball

Greater than the sum of it’s parts: Disney’s business model doesn’t rely solely on one aspect to generate profitability/revenue – it relies on the sum of the parts making up the diverse and intermingling eco-system that is Disney. At the heart of all of these different monetization streams (Theme parks, music, theatre, comics, books, merchandise, tv shows, movies etc.) is good storytelling and strong IP.

The advantages that are created when the individual business segments come together as one was summarized by former CEO Bob Iger in early 2019, when he was asked by Barron's about some of the acquisitions that had proved so critical to the company's success. This was his response:

"In the case of Pixar, Marvel, and Lucas, none of them were for sale. We were the only ones. Us identifying them as acquisition targets and my going out and meeting with Steve Jobs and Ike Perlmutter and George Lucas... Looking back, particularly with Marvel and Lucas - Pixar was different - we had an ability to monetize those assets better than anyone else. If someone came along, we would have had a competitive advantage. You can argue that in the Comcast (CMCSA) case with Fox (FOX), they're probably the only other company out there that can monetize. Whether they monetize as well as we do, I don't know. I don't think they're quite where we are."

5. Risks

There is no one company quite like Disney, with such a deeply ingrained IP and ecosystem of parks/products/experiences, it’s a difficult model to replicate.

Competition:

“Disney faces a number of competitors across its various markets, with ViacomCBS (VIAC), Charter Communications (CHTR), Sony (SNE), and Comcast (CMCSA) being its main competitors. These companies compete with Disney's products mainly through TV, cable, and other media markets such as DVD/Blue-ray, video games, and the Internet.

The growth of multichannel video programming network distributors and cable networks has increased the competitive pressure for Disney. Contracts are renegotiated at certain points in these markets, and the rise of competition puts increased difficulty on Disney to renew the contracts with such favorable conditions as it has had in the past.

Disney also competes in the strong and lucrative sports market. It has done extremely well with sports channel ESPN, which provides 24% of its total revenues.3 This is due in part to the popularity of sports channels, but also to program bundling packages.

In the theme-park market, major rivals to Disney include Six Flags Entertainment (SIX), Cedar Fair (FUN), Universal Studios, and Comcast. This competition has increased in recent times, particularly due to Universal's cashing in on the popularity of the Harry Potter books and movies. Universal Orlando has opened a Harry Potter-themed land in Orlando and Hollywood, which has boosted attendance numbers.”

SVOD services (Netflix):

Of course, with the addition of Disney+, Disney are throwing themselves straight into the deep-end among the established industry players such as Amazon Prime and Netflix. The main advantage for Disney (and part of the reason they have so quickly amassed so many followers in such a short period of time) is the fact that they own a large amount of their IP. This enables Disney to be far more agile than their competitors. In addition to this, the company own ESPN+ and HULU. The value proposition they are offering for the price is significant.

Legacy business model:

One could argue the ‘parks, experiences and products’ segment looks out of date compared to their newer offerings - and you would be partially correct.

I don’t think there’s much room for these offerings to grow substantially from where they are now. However, the physical experiences and products remain a vital Cog in the overall machine. Part of the real value of Disney as a whole is the ability to consume certain IP over various mediums. Someone who adores Iron Man can watch it on Disney+, visit the attraction at Disneyland (or one of the various other locations), purchase the merchandise, buy the iron man skin in fortnite, read the comics and much more. This ability to be able to offer a 'full' and personal experience sets Disney apart from most other IP owners.

This being said, covid hasn't treated the physical segment of the business kindly - having endured a 68% decrease in operating loss in 2020.

The hope (and expectation here) is the pent up demand, deriving from a years worth of new content and inability to experience in person, will see this segment pick back up from where it left off. Maybe not quite to the same level - but close.

New CEO:

It’s no secret that Bob Iger was a well respected CEO - and for good reasons. He has overseen the company's success for the best part of 15 years, which has steadily seen the company grow from $31B in revenues to almost $70B in revenues.

It will therefore be important to keep a close eye on how he integrates into the business and how the business changes under the new leadership. It is important to note, however, that these past 2 years and the next 2 years represent somewhat of a transition period for disney in that they are entering into a completely new business model which may take some time to fully settle into.

6. Growth Opportunities

As much as Disney are a 98 year old business, the company are still remarkably in-touch and agile when it comes to focusing on areas of growth. This can mainly be observed with the move in 2019 to a DTC offering (Disney+) which sees Disney joining the cable-cutting trend.

Some areas moving forward we can expect strong growth in include…

DTC (Disney+, HULU, ESPN+): Disney’s DTC offering has exploded since the announcement in Nov 2019. Disney+ alone reaches 94M subscribers, which is well on the way to catching up with Netflix if combining subscribers of HULU and ESPN+. Disney will likely reach a similar scale in a much shorter timeframe due to the tremendous backlog catalogue of IP at their fingertips.

As an add-on to the above point - Disney have released Star+ in some territories outside the US. This new offering will increase the price (as expected) and offer viewers a wider range of content from the backlog of other (more mature) IP sources, such as 21st Century Fox.

Potential pricing power: As of Jan 2 2021, the average monthly revenue per paid subscriber for Disney+ is $4.03. If you compare this to Netflix which comes in at $10.82 – we can assume the potential to push the price up is realistic. Netflix has a notoriously inelastic demand level, where an increase in price doesn’t lead to a major decrease in user uptake/increase in churn. To be speculative, I would imagine Disney have a similar level of price inelasticity due to the strong pull of the IP. I would also add that the price will likely continue to gradually increase as more content is added. The opportunity here for Disney is to add tiered levels of subscriptions.

Covid recovery stock: Disney isn’t your typical covid recovery stock, seeing as a large part of the business involves sitting indoors watching TV. However, with the Vaccine roll-out underway and the promise of a semi-open economy over the next couple of months, Disney’s ‘Parks, experiences and products’ segment will likely be able to open back up and almost certainly benefit from the pent up demand. For context, in 2019 this segment brought in $7.5B compared to 2020 where it brought in $3.5B.

Data: The new DTC offering further enables Disney to add to its goal of being able to maximise profits from the entire eco-system of products. The DTC offering (Disney+) will provide extremely useful user data which can help with targeted advertising, movies/franchises to focus on, and what overall strategic direction to go for with regards to the physical parks/experiences etc. This more detailed and arguably closer relationship between Disney and the consumer will almost certainly enable an increase in overall LTV (Life Time Value – average rev a customer generates through their lifespan as a customer).

Gaming: Disney haven’t been all that successful in gaming historically, however the current CEO is well aware of the potential opportunity here and is absolutely looking to exploit over the coming decade. We can see the beginnings of this in games like Fortnite, where in-game events are being used as a promotional element when releasing a movie (Avengers for example). I’m not entirely sure how Disney are planning on capitalizing on the opportunity here, however I would argue the company are very well placed to capture a large amount of upside. Gaming represents a completely new touchpoint where the company can increase the LTV/average spend of customers.

Intellectual property (IP) is no longer in just one medium since the audience is everywhere, so should the IP (books, movies, video games, etc.). “It’s clear that intellectual property has a disproportionate impact on customer attention” – Matthew Ball

7. The move to streaming

One of the major question-marks over the recent transition from linear broadcasting to streaming, is the company’s ability to execute. Upon Disney's arrival, the competition (Amazon and Netflix) were already well established and had a seemingly firm grip on consumer spending habits.

I think we can safely say that Disney's execution, resulting in high-levels of penetration, was near enough flawless. This shows that there is far more room within the streaming space than we initially thought. If the value proposition is large enough, people will be willing to subscribe to multiple services.

8. Financials

Revenues + profitability:

Most of the revenue stuff has been covered earlier on in the article regarding revenue streams, however it’s always useful to dive a bit deeper wherever possible.

Revenues have been fairly stable over the past decade, with an average y/y growth rate of exactly 7% if you exclude 2020 and 5.5% if you include it. Operating margin between 2011 and 2018 grew from roughly 19% to 25%, indicating strong fundamentals. However, as expected, the huge acquisition of 21st Century Fox for $70B represented a huge decline in the overall operating margin. This, combined with the pandemic over the past year has further seen margins (and overall revenue) plummet to ~6%.

These poor 2020 results are likely temporary, however we may not see operating margin pick up to the levels of 2017 for quite a while as the company continue to focus on Disney+ growth efforts.

EBITDA shows a similar story, however I imagine this will pick back up to pre-pandemic levels once the parks, cruiselines, theatres etc. fully re-open.

Balance sheet:

There are several interesting points to note here. Firstly, the debt to equity ratio has historically remained relatively low over the past decade (below 1). Which has meant the company were in a financially good position when faced with a major global disruptive event.

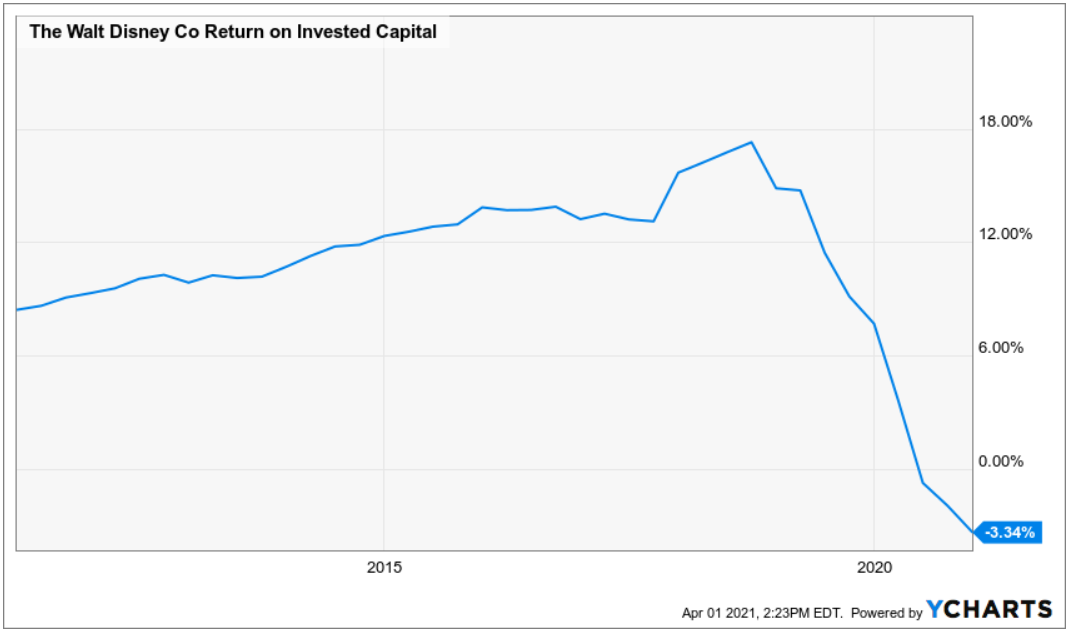

Secondly, the return on invested capital over the past decade (barring the past two years due to a large acquisition and a global pandemic) has been between 9% and 15% compared to the industry average of about 8%. This shows the effectiveness of the management involved.

Dividend:

Disney has decided to cut the dividend due to needing to recover from the pandemic and re-invest into their new growth opportunity (Disney+). In all honesty, I see this as a smart move.

9. Valuation

More established companies, such as disney, are easier to value due to the backlog of financial data, meaning less assumptions need to take place. Using revenues and therefore EBITDA over the past 10 years I have attempted to try to forecast the estimated share price out to the year 2030.

One big caveat to this section is the fact that 2020 was a rough year. If I choose to include the figures for 2020, it would completely distort the forecast outcome. I believe that with Disney’s DTC offering becoming a vital part of the business and the location-based aspects coming back to near enough full strength over the coming year, we will likely see the company continue on their historical growth path. Therefore, I have excluded the 2020 numbers in this forecast.

It’s relatively clear to see that 2020, which encountered somewhat of a ‘black swan’ event has significantly altered some of the averages used here.

In conclusion, the above forecasting model has generated a price target for 2030 of $221. This seems like a reasonable increase and represents a $32.81 upside.

All this being said, if we see the Disney+ aspect of the business continue to grow and dominate as it has done over the past year then my estimate of $220 by 2030 will likely be on the extreme side of conservative. What is stopping the Disney share price eventually competing with Netflix?

Like I have said earlier in the article, Disney is like no other company out there and therefore incredibly difficult to compare on a relative valuation basis.

10. What to consider?

Whilst I am extremely bullish on the overall proposition Disney has to offer over the long-term, it’s important to ask yourself some challenging questions that may poke holes in your thesis.

How do Disney recover from the year-long (probably 1.5 years) shutdown of the parks/experiences segment. Will they ever fully recover long-term?

Do Disney have the resources to compete with the current streaming giants? Is the current back-catalogue enough to see the company as a serious contender in the space?

Thank-you for making it this far. If you would like to buy me a coffee using the link below, feel free! Any donation is greatly appreciated.

11. Conclusion

A large amount of the core business has been negatively impacted by the pandemic. As an investor, you will need to make your own mind up regarding the impact this has on the business long term. I personally believe the long-term outlook for Disney over the next decade look bright. As the world returns to normal, people will once again flock to movie theaters and theme parks, with Disney being the primary beneficiary. In addition, I believe Disney will continue to justify and attain the meaningful pricing power that they've demonstrated in the past.

For a company with the bredth and depth of value that Disney demonstrates, it’s hard not to feel optimistic about the future. For a 98 year old company, the focus on high-growth areas is outstanding.

Disney have built such a strong business model, allowing the company to monetize it’s IP. As a result, Disney are able to make investments in brands that other companies cannot (E.g. Pixar or Lucasfilms - neither of which were on sale to any other company).

Bob Iger has built a behemoth. He has put the company in a position where they can capitalize on the massive secular growth trend that is cable-cutting. Disney+ is a well oiled, well executed product, with a clear plan to commercial success over the next decade.

Overall, I think the company’s focus on its DTC strategy is smart and timely. I think the Disney will face challenges over the short-term but should fully recover with a stronger and more resilient business in the longer term.

Full disclosure, I am invested in $DIS and plan to hold the company for the foreseeable future.

Cheers,

Innovestor