Introduction

Before we get into the main part, I think it’s worth summarising my thoughts on the company and disclose that this is currently my largest position - so there may be some bias. However I will try to give both perspectives where possible.

I see Facebook as a sorely undervalued behemoth. Most of us use the extensive suite of products multiple times throughout a given day. Many of these products influence not only our purchasing decisions, but influence some of our life choices (whether this is good or bad is a discussion for another time).

Facebook are constantly using their large cash reserves to innovate and create new products fitting into new and emerging niches. An example of this is VR/AR where over the past couple of years they have been quietly working away to get to a point where they have a successful product, appealing to a wide audience at a low price point.

Overall, the optionality present here is huge, and is a big factor in why I see Facebook succeeding over the next decade.

Key stats

User growth:

Daily active users up 11% y/y to 1.84 billion

“Registered and logged-in Facebook user who visited Facebook through our website /mobile/messenger on given day”)

Monthly active users up 12% y/y to 2.8 billion

“Registered and logged-in Facebook user who visited Facebook through website/mobile/messenger within last 30 days”)

Family Daily Active people up 15% y/y to 2.6 billion (anyone who visits one of the ‘family’ of products on a given day)

“Logged-in user of Facebook, Instagram, Messenger, and/or WhatsApp on a given day”

Family Monthly Active people up 14% y/y to 3.3 billion

“logged-in user of one or more family products (Fb, Insta, messenger, WhatsApp) within the last 30 days”

Financial stats:

Q4 Rev up 37.9% to $28 billion

2020 total revenue up $16.2 billion (+23%) to $86.97 billion

‘Other Revenue’ for Q4, defined as “rev from the delivery of consumer hardware devices and net fees we receive from developers using our payments infrastructure” has increased 155.8% to $885 million from Q4 2019. FY numbers increased 72.5% to $1.79 billion.

Operating margin 46%

Share repurchases of up to an additional $25 billion of class A common stock. This is in addition to the previously authorised $34 billion with $8.6 billion remaining.

Revenue streams

Facebook’s strategy focuses on several main aspects:

Advertising

Being the go-to platform for advertisers is a key part of their business model – accounting for over 95% of revenues.

Technology development

Continuing to utilise Facebook Labs to develop technology at a faster rate than competitors.

Strategic acquisitions

Using the power of their immense balance sheet to acquire companies such as WhatsApp, Instagram and Oculus who align with the future strategic model.

Facebook really starts to look good when you take into account the various streams of income and potential streams of income over the next decade. Though as it stands, their main source of revenue is advertising – and substantially so.

Advertising

Advertising currently takes up 96.74% of the company’s gross revenue, which is undeniably huge. This works in practice by Facebook selling advertising space on the various platforms they own (Facebook, Instagram, WhatsApp and Messenger).

Facebook have been grinding away at this model for a good part of the last decade, where they are now at the point of essentially perfecting it. If you have ever used Facebook Business Suite, you will be aware of the relative ease of use combined with powerful analytics and tools to target certain demographics. Alongside this, it very easily integrates between the handful of platforms Facebook owns – Instagram, Facebook.com and Messenger. It may be that we will see the addition of ads to WhatsApp and Oculus over the coming years, though as far as I’m aware we’re not there yet.

Other Revenue

Defined as “revenue from the delivery of consumer hardware devices and net fees we receive from developers using our payments infrastructure, as well as from various other sources”.

We can probably assume a good portion of this (possibly 50% this quarter) is attributable to sales of the Oculus Quest 2, which is encouraging.

As you can see from the below bar graph, ‘other revenue’ in the 4th quarter of 2020 has increased by 155.8% to $885 million – largely driven by the sales of the Quest 2.

Products

Facebook

Facebook.com is the OG product here for Facebook Inc. (hence the name), and this is where a large sum of the advertising revenue is based. We don’t have a breakdown of the revenues by partner, however it’s safe to assume this is a big one.

2.7 billion MAUs

Instagram

Facebook Inc. acquired Instagram for $1 billion in 2012 which was probably one of their best investments in terms of being able to enhance the overall advertising model. For example, Instagram is estimated to have pulled in about $18 billion in ad revenue for 2020.

Instagram is one of the world’s biggest and most influential social platform where people can upload images to be liked, shared and commented on. Some stats:

4th most users of any mobile app

1 billion MAUs

88% of users outside US

Users spend an average of 30 mins per day on the platform

81% of people use Instagram to help research products and services

130 million Instagram users tap on shopping posts every month

55% of fashion shoppers have made a purchase based on an Instagram creator’s post

Projected ad revenue of $18.16 billion for 2020

WhatsApp

Created in 2009 and acquired by Facebook inc. for $19 billion in 2014 (as one of the largest tech acquisitions in history), WhatsApp allows users to send free instant messages by using their phone number to sign up.

The platform has added many features over the years such as voice calling, video calling, group calls, and in 2018 launched WhatsApp Business. Recently it has also moved into the payments market in both Brazil and India. The addition of these payment features could be another potentially huge revenue stream once expanded globally. As of Oct 2020;

MAU (Monthly average users) of 2 billion

Most downloaded app of 2019

69% of global internet users (excluding china) are WhatsApp members

Messenger

Created in 2008, Facebook Messenger allows users to send messages to each other on the platform. Apparently it is no longer necessary to have a Facebook account to use messenger.

1.3 billion MAUs

Expected to grow to 2.4 billion users by end of 2021

More than 20 billion messages exchanged monthly

Messenger marketing/advertising leads to 70% better open rate than e-mail marketing

VR/AR

Included somewhere in this section should be Facebook Labs who are the brains behind the VR and AR products being produced. Facebook Labs are “developing all the technologies needed to enable breakthrough AR glasses and VR headsets, including optics and displays, computer vision, audio, graphics, brain computer interface, haptic interaction, full body tracking, perception science and true telepresence.”

Focusing more on the main aspect of this sector of Facebook, is Oculus. Facebook acquired Oculus for $2.3 billion in cash and stock in March 2014. Since then, Facebook have been aggressively developing the technology via their Facebook Labs to the point where it is on the verge of mass adoption with their Oculus Quest line.

The original Oculus Quest comes in at somewhere between $400 and $500 depending on where you live. The idea is that you no longer need to plug a VR headset into an expensive PC in order to be able to play, you can play anywhere you want, with little-to-no setup time/cost.

The Quest 2 continues on this model and comes in at $299 (which is in-itself a big deal as it allows far more people to access VR). And with this much cheaper price-tag, you get the benefit of a better processor, higher-fidelity display and a lighter overall form-factor. The Quest 2 is now on its way to becoming the first mainstream virtual reality headset.

I truly believe VR will play an incredibly important role in the digital space moving forwards as it will revolutionise the way in which we interact remotely and digitally. Zuck talks to this point in the earnings webcast.

Another encouraging point to add to this is the eco-system being created for developers. “Right now, more than 60 Oculus developers are generating revenue in the millions – that’s nearly twice as many as a few months ago”.

VR is here ladies and gents, and it’s here to stay.

As for the AR aspect – this is still in more of a developmental phase in the process, though Facebook did announce potential RayBan x Facebook AR glasses in late 2020, which is a possible peek into the future form factor once the technology is sufficiently developed.

Financials

Revenues

I have already discussed the revenue situation earlier on in the article. Though to summarise, revenues for the 4th quarter of 2020 are extremely strong, with Q4 revenues up 33% y/y. This is mainly due to increased demand for advertising. It’s also important to note the huge increase in other revenues which was mainly driven by Oculus 2 sales.

FY 2020 total revenue up $16.2 billion (+23%) to $86.97 billion.

Profitability

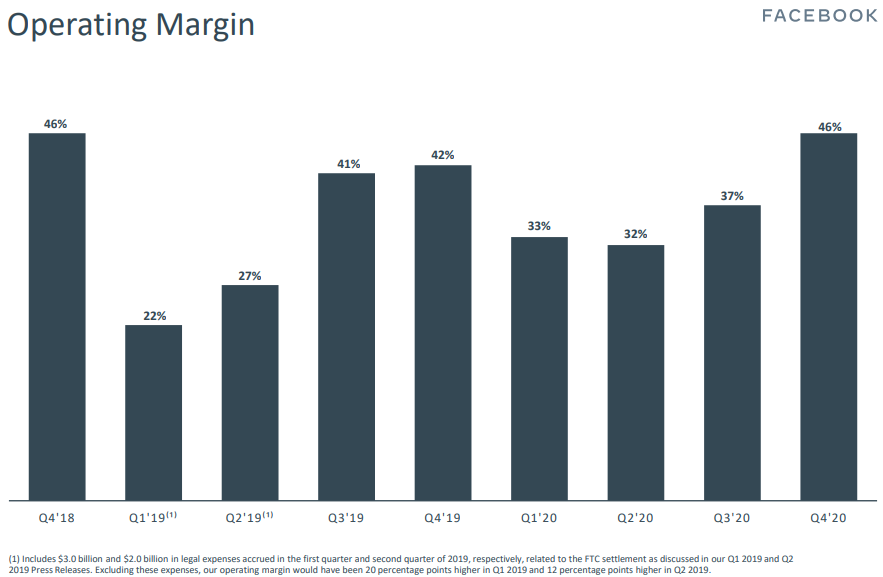

Margins are another area Facebook have beat expectations in this quarter. The Q4 operating income was $12.8 billion, representing 46% operating margin. Taking tax into account, the net income sits at $11.2 billion.

Comparing the revenue per quarter to the costs per quarter, we can see an inverse relationship between the two over the past year or so. This indicates an encouraging trend of revenues outpacing costs, and is something I love to see.

Over the coming years, as the insane amount of optionality within the business starts to reveal itself in the form of monetisation, I would expect the ‘other revenues’ portion of the overall revenue figure to grow relatively quickly. This will put Facebook in a safer position, as it will mean they wont need to rely on one main source of income.

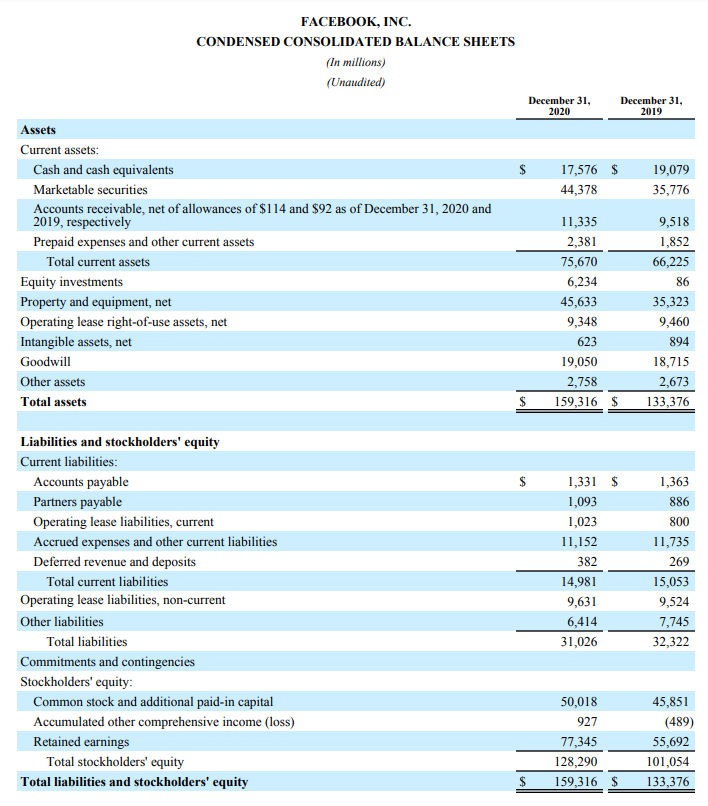

Balance sheet

Facebook probably have one of the healthiest balance sheets you will come across. To keep it relatively straight-forward, if we take the cash and cash equivalents + Marketable securities (easily liquid assets) totalling $61.9 billion, this easily (over 3x) pays off the current liabilities. In addition, the total assets of $146 billion completely dwarf the total liabilities of $29 billion.

This gives Facebook the flexibility to be able to try new things and fail at these new things without any long-term consequences.

Risks

Facebook are a global business, and with that comes a long list of risks. So here’s a top 10 (there’s plenty more).

Covid 19

This is the case for any business, but short-term uncertainty from the effects of Covid will likely have an impact on business operations.

Retention of users

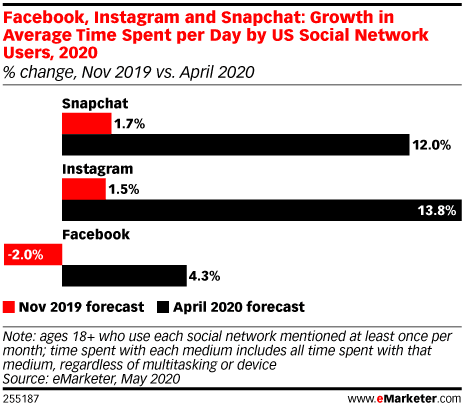

Part of the challenge of operating within the social media space is that the landscape is constantly evolving. New players enter the market relatively easily and if successful with their app, can gain a large market share relatively easily. Alternatively it can be a slow steady decline of users, which is possibly what we’re seeing with Facebook as the younger generation favors apps like TikTok and Snapchat

Demographic purchasing power decrease over time

As mentioned above, the younger audience will have a growing purchasing power over time. If Facebook can retain the younger segment (Instagram) along with the older segment (Facebook), then the company should be in a good position.

Most rev from advertising

As stated in the revenue section, over 95% of Facebook’s revenue comes from advertising. If external forces cause restrictions to be put in place, then it could cause serious problems for Facebook moving forwards.

Regulations/governments

An ongoing issue for facebook are the potential new regulations being put in place by many governments all over the world regarding the ethics surrounding social media sites. It’s entirely possible regulations have a negative impact.

Public perception

The public opinion on Facebook could be argued to be wholly negative over the past couple of years. Especially with recent election results seemingly reliant on Facebook as a means to target people.

Competition

As mentioned before, there are many high-quality players in the social media space.

Long-term mind-set

Facebook’s mind-set on long-term growth (good) may have negative impacts on the quarterly results.

Privacy concerns

There are still big question marks about how closely facebook are able to monitor your digital footprint. There will no doubt be questions asked about this issue from governments over the next decade.

Lawsuits

Facebook are expecting lawsuits. If these lawsuits don’t go in their favour it could significantly negatively affect the stock price.

Conclusion

Facebook have a tonne of things going for them now, and potentially even more going for them in the future. Their financials are rock solid, with incredible y/y growth in revenues alongside growing margins and a very healthy looking balance sheet.

The main takeaway for me, though, is the optionality - and just how much there is in the pipeline for the next decade. VR is just getting started. Facebook have cemented themselves as a leader VR hardware, they are integrating E-commerce onto the available platforms which is something that makes sense and will see huge growth if done correctly, and payments over whatsapp could be a game changer. Combine all this with the potential launch of Facebook’s new Cryptocurrency in 2021. I think we’re looking at some good value here that isn’t fully factored into the price of the stock.

Overall, I’m very optimistic about Facebook’s long-term outlook. The fundamentals are strong, they’re constantly innovating and they have Zuck at the helm – in my opinion one of the most innovative and forward thinking CEOs out there.

I will be keeping a close eye on how the company deals with regulations and privacy issues over the next couple of years, but this is a strong buy in my opinion.

Not financial advice.

Cheers,

Innovestor