Preamble

Okay so here’s an interesting company operating in an evolving industry – Fiverr.

The past 10 months have been weird to say the least. I strongly believe this type of seismic event brings with it as many opportunities as it does challenges, both for us as individuals and for the companies operating in the market.

Part of the fun of investing for me is being able to take a snapshot of the current market, put it in the context of the last year, 5 years, 10 years – and make educated prediction of the direction of travel for the future.

I will be saying this a lot in the coming newsletters, but my investing thesis is long-term. I’m investing in companies I think have the potential to grow and evolve into beasts. This, in my opinion, requires a little luck and imagination.

Summary

So, Fiverr. A company we are all probably very familiar with…

A quick look at the share price since IPO and you would be forgiven in thinking this stock is now over-priced. Though, in the context of a workforce that has completely shifted in mind-set and physicality, Fiverr is one of the few companies in a unique position to be able to capitalise on this underlying trend.

The trend I am talking about is freelancing, or the so called ‘gig-economy’. For many years the majority of us considered ‘work’ to be a word meaning getting up early, commuting, putting in the hours and receiving a pay-check. However, with all the advancements in technology over the last several decades, we haven’t really moved all that far away from this ‘old’ idea of what work should be.

Then along comes 2020 – throwing a massive wrench in our perception of what work can and should mean. Individuals are finding more time and energy to monetise their skills and knowledge which would otherwise have been wasted on the hour commute to and from our ‘city desks’.

An annual report from Upwork (a direct competitor to Fiverr) entitled Freelance Forward 2020 gives us a useful insight into the state of the freelance industry. Some top level figures:

36% of America’s total workforce are freelance: 59million (+2mill since 2019)

22% increase in total freelance earnings since 2019 $1.2Trillion compared to $1Trillion

Percentage of full-time freelancers increased 8% to 36%

Over half (58%) of traditional workers now working from home are considering freelance since Covid-19

As a picture of the gig-economy, I believe this data shows the beginning of a huge tailwind towards a (more) widespread embrace of this industry.

The company + the business model

Fiver have solved a problem here whilst also plugging a much needed gap in the market.

They have improved the way in which freelancers (or as they call - entrepreneurs) find clients – presented in a way resembling an e-commerce store. There are buyers and there are sellers (with no bidding taking place, unlike their competitor Upwork).

This puts Fiverr in a special position as they are operating more of a SaaP (Software-as-a-Product) model. With the focus on making Fiverr a shop where you can buy a product quickly and easily without having to spend time bidding. Essentially making the experience akin to the buying experience you get from an online store like Amazon.

This type of open market between freelancers and buyers has never been available in this way before now.

For the buyers (or ‘businesses’) it offers:

Transparent view of the talent available for a service

Quick, easy and reliable way of outsourcing

Trust and confidence the end product will be up to the desired quality. This is enabled through the way Fiverr shows every seller’s transaction history, reviews and past portfolio.

For the sellers (or ‘freelancers’) it offers:

Direct access to a platform providing global demand from buyers

Less time and effort spend in the bidding process and finding clients

Simple and effective tools available to deliver the product to the client

This creates a so-called ‘fly-wheel-effect’ where the ease of use and variety of products/services available to the buyer, increases the spend per buyer… leading to an attractive level of demand for sellers – which, in turn, results in more opportunities for sellers due to higher earnings potential… which, in turn, attracts more high quality sellers to the platform, resulting in even more high quality options for the buyers where the cycle then starts over.

Market Opportunity

Market opportunity is a tricky one. Fiverr are predicting a TAM (total addressable market) in the UK of about $100 billion - which is more than 10x the current market cap. Lots of potential here.

Another thing to note is the planned expansion into international markets isn’t factored into the $100 billion figure, which would add significantly more of an addressable market.

“We expect adoption of freelance work by businesses to increase as online solutions, such as our platform, alleviate these traditional challenges. We estimate our total market opportunity within the United States alone to be approximately $100 billion. We derived our estimate based on the latest U.S. Census Bureau Nonemployer Statistics ("NES") data, which includes income data of all U.S. businesses that have no paid employees and are subject to federal income tax, which we believe provides a good proxy for total freelancer income in the United States, filtered by categories most relevant to our marketplace. We believe that our opportunity outside the United States is even larger than our opportunity within the United States given the overall size of global markets outside the United States.”

Financials

The top-line summary of Fiverr’s key metrics looks strong after a great year…

Core:

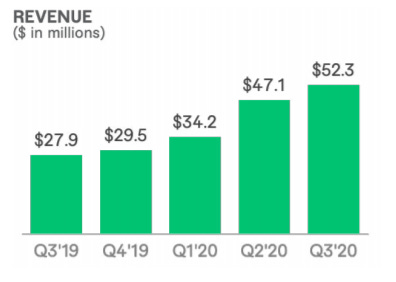

Revenue growth +88% y/y ($27.9m to $52.3m)

Active buyers +37% y/y (2.26m to 3.1m)

Spend per buyer +20% y/y ($163 to $195)

Industry-leading ‘take rate’ of 27% (+0.4% y/y)

Gross Profit GAAP +98% ($22m to $43.6m)

Gross Margin GAAP + 4.4% (79.0% to 83.4%)

Other:

R&D down to 19.5% compared to 29.2% in 2019

Sales + Marketing down to 46.4% from 52.1%

General and administrative expenses down to 10.4% from 15.3%

Profitability

Profitability-wise, Fiverr’s recent results look incredibly strong. Gross profit is up $21.6m, ($22m to $43.6m). This is a 98% increase in gross profit, which although impressive, isn’t uncommon for a growth company at this stage in its life-cycle. The impressive thing here is the continued increase in gross margin (as a % of revenue), which is up 3.6%.

All of this should be viewed in the context of extreme revenue growth over the past year (since the beginning of 2020). 88% Y/y growth over the most recent quarter is exceptional, though not entirely unexpected with the shift to remote working and more people becoming aware of the Fiverr service.

Liquidity

Now, for Liquidity. Let’s take a look at the balance sheet (as of Q3 2020).

As a rule of thumb, companies focused on growth tend to be fairly liquid. In layman’s terms, liquidity refers to the company’s ability to pay debt obligations (mainly short-term). From a quick glance at the balance sheet, Fiverr are in good shape liquidity-wise, as their total current assets (things like cash in the bank, and other assets they can make liquid easily) can pay off all their current (and non-current) debt obligations more than 2x over.

All this being said, it is important to note the fact Fiverr are yet to report a positive operating income -$0.5m for Q3 2020 y/y compared to -$8.4 the previous year. There are likely a multitude of reasons for this – however, the most likely reason at this time is that Fiverr are a company focused on growth. And with this focus comes the short-term reality of a ‘visually’ poor bottom line. I, however, am not overly concerned about this right now. Negative operating income is usual for this type of company as most of the growth comes from re-investment into the business.

Risks

There are many risks associated with operating a large publicly traded company. Many of these risks are relatively standard to a company in this position, and are mainly ‘business as usual’ operational risks which all companies need to worry about, such as:

Ability to achieve profitability;

Ability to maintain user engagement on our website and to maintain and improve the quality of our platform;

Ability to successfully implement our business plan during a global economic downturn caused by COVID-19 pandemic that may impact the demand for our services or have a material adverse impact on our and our business partners’ financial condition and results of operations;

Our ability and the ability of third parties to protect our users’ personal or other data from a security breach and to comply with laws and regulations relating to consumer data privacy and data protection;

Ability to detect errors, defects or disruptions in our platform;

Ability to comply with the terms of underlying licenses of open source software components on our platform;

Etc. Etc. Etc. These are standard.

The risks we need to focus on here are the ones specific to Fiverr currently, and the anticipated risks deriving from planned growth. These include:

Ability to maintain and enhance our brand within a competitive landscape;

o Extremely important with the highly competitive industry Fiverr operates in.

o Doing a good job at addressing this risk with the introduction of a new brand campaign, ensuring the company is ready to compete on a global scale.

Dependence on the continued growth and expansion of the market for freelancers and the services they offer;

o This one is (for the most part) outside of the company’s control. However, with developments over the last 9 months, it’s looking like this ‘gig-economy’ trend in Fiverr’s favour is here to stay for the long-haul.

Ability to expand into markets outside the United States;

o This one is crucial to the continued growth of Fiverr – with a predicted TAM (total addressable market) of over $100 billion in the US alone, the global market serves as a top priority moving forwards, and therefore the future success (and continued growth) largely depends on the company’s ability to capitalise on this opportunity.

o As of Q3 2020 Fiverr are making positive steps towards global expansion, with their 6th non-english website (in portugese). They are adapting core content for promotion in new markets. Planning to expand TV campaigns to Germany, the UK and Australia, as well as expanding to an international network of influencers.

The risk factors here are definitely challenging – especially considering the backdrop of a global pandemic. However the Fiverr management team are making promising statements backed up with action, which is a good indicator.

Valuation

Who knows…

I’ll have a stab with the valuation aspect of Fiverr. Though there are a tonne of caveats making this part VERY hard to give a definitive answer to. The main reason being there are almost no other publicly traded companies doing a similar thing to Fiverr (the closest we have is Upwork), and the fact that almost every share price at the moment is ‘expensive’ (23rd Dec 2020).

Put simply, in comparison to Upwork, Fiverr seems expensive. Although, I would argue most of this premium price tag is justifiable considering the relative performance of both companies over the last 12 months. For example, the average revenue growth for Fiverr per quarter over the past 2 years sits at 12.7% whereas Upwork sits at 4.97%.

The two graphs below somewhat illustrate the expensive nature of Fiverr at the current time. The first graph shows market cap, which demonstrates the steep rise in share price since March (considering revenue is about 45% the value of Upwork – though catching up steadily over the past 2 years).

The second graph showing the PS (Price to sales) ratio between the two companies which further demonstrates the steep increase in relative price.

However, as mentioned before, these are actually two quite different companies operating within similar (not the same) markets so the comparison here needs to be taken with a pinch of salt.

My final thoughts on this are that, yes, Fiverr is arguably expensive compared to its main competitor in the space – however these valuations are (for the most part) justified.

Innovation

This company might not seem particularly innovative – offering a platform for both freelancers and buyers to exchange digital goods and services. However I strongly believe they have something here which is (in and of itself) innovative. No-one else is offering this type of low friction ‘e-commerce-like’ experience for the users which is a huge step forward for both the buyer and seller side.

It will be interesting to see if other companies enter the direct market for which Fiverr is currently dominating.

I think the most likely outcome, especially with their ‘first mover’ advantage, is that Fiverr will continue to be the dominant force in the US, UK and some of Europe (possibly Germany). However, I can absolutely see similar competitors popping up in Asian markets which will somewhat eat into Fiverr’s Total Addressable Market.

Very much looking forward to keeping an eye on this potential mulit-bagger over the next year. Putting in a small position (~5% weighting with an initial 3-5 year timescale).

Cheers,

Innovestor.

excellent write-up