Key Stats

$11.08 billion market cap

Currently trading at $312.5

Q4 revenue +89.3% y/y and +77% full year growth ($55.9m for 2020)

Q4 active buyers growth of +45% y/y to 3.4 million

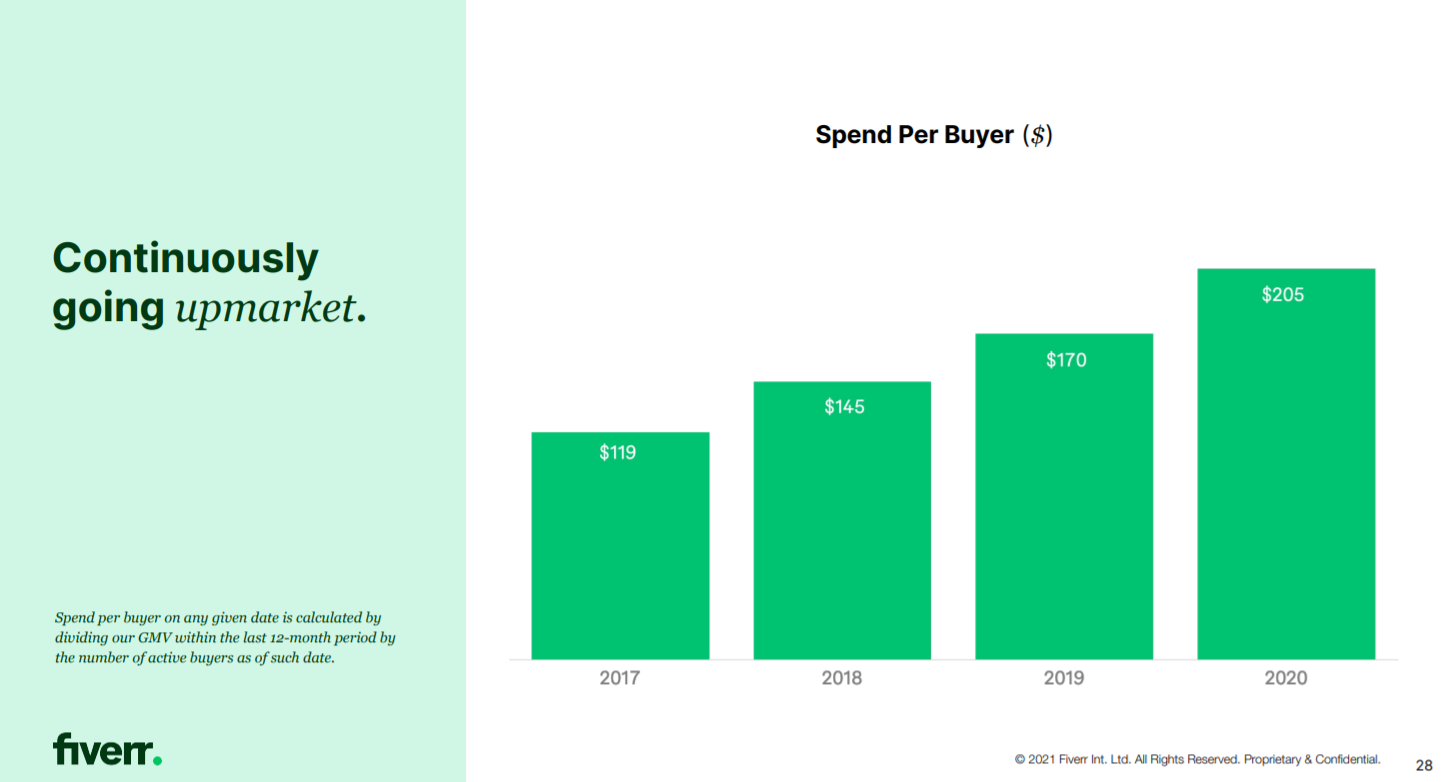

Spend per buyer of $205: +20% y/y

Strong outlook to 2021 with 40 to 50% revenue growth

Reached 500+ categories: added 30 new categories in Q4 and now offers digital services in more than 500 categories

Introduction

One of the first articles on my Substack was Fiverr, back when they were trading at around $216. Over the past 2 months we’ve see a gain of roughly 45%, which is insane.

I may cover some of the same material in this write-up, but I’ll do my best not to duplicate.

Thesis

Fiverr are benefiting from the secular shift towards a changing workforce with a greater emphasis on ‘working from home’ and ‘freelancing’. This shift has been accelerated mainly due to the global pandemic, forcing people to stay at home and forcing the workforce to re-think what ‘work’ looks like in the 21st Century. Alongside this, management are bullish on the retention levels stating “We expect the elevated engagement levels shown in 2020 to last well beyond the pandemic”

Fiverr stands out in 3 main ways… Their buyer and seller friendly marketplace enables transactions to take place with little-to-no friction, the powerful fly-wheel effect accelerates the pace at which growth occurs, and the company have a track-record of strong growth and scale over short period of time whilst maintaining a quality service.

All of this is happening with the background of two massive secular trends in their favour – the shift from offline to online, and the rise of the gig-economy.

Company overview

Fiverr are plugging a much-needed gap in the market. They are improving the way in which freelancers find clients – achieving this is the result of creating an easy-to-use e-commerce-type marketplace. There are buyers and there are sellers. The main difference between Fivver and their main competitor UPWK is the absence of a bidding system. I personally prefer Fiverr’s system as it’s more straightforward and lowers the barrier-to-entry.

We could go so far as to say Fiverr are operating a SaaP (Software-as-a-Product) model. With the focus on making Fiverr a shop where you can buy a product quickly and easily without having to spend time bidding. Essentially making the experience akin to the buying experience you get from an online store like Amazon.

This type of open market between freelancers and buyers has never been available in the current form before now.

Fiverr generate revenue in a very straightforward way. Primarily through transaction-based fees. When an order is placed, buyers pay Fiverr the ‘Gig price’ plus a 5% service fee with a minimum service fee of $2; upon successful completion of an order, Fiverr makes 80% of the Gig price available to the seller of the Gig.

Benefits for the buyer-side include:

Transparent view of the talent available for a service

Quick, easy and reliable way of outsourcing

Trust and confidence the end product will be up to the desired quality. This is enabled through the way Fiverr shows every seller’s transaction history, reviews and past portfolio.

Benefits for the sellers (or ‘freelancers’) include:

Direct access to a platform providing global demand from buyers

Less time and effort spend in the bidding process and finding clients

Simple and effective tools available to deliver the product to the client

This creates a so-called ‘fly-wheel-effect’ where the ease of use and variety of products/services available to the buyer increases the spend per buyer… this leads to an attractive level of demand for the sellers – which, in turn, results in more opportunities for sellers due to higher earnings potential… which, in turn, attracts more high quality sellers to the platform, resulting in even more high quality options for the buyers where the cycle then starts over.

Products

1. Catalogue infrastructure: “over 250 categories are available, from logo design and voice-overs, to our latest categories of 3D product animation and desktop and mobile game creation in Q2 2019. Recently, we have also rolled out a few cross-category Fiverr Stores to address specific industry use cases.”

2. Liquidity management system: using 9 years of transactional and behavioural data, this system allows Fiverr to match buyers and sellers at the Gig level in a personalized fashion. This takes into account many data points such as budget style, design taste, and purchase patterns.

3. Rating and reputation, scoring, and leveling systems: Continuing to iterate and enhance the machine learning algorithm to improve the quality of Gigs and sellers on our platform.

4. Payments, communication, collaboration, and automation: Some recent developments include the rollout of foreign currency capabilities, a partnership with Zoom for video conferencing, and the most recent - Fiverr Studios.

Market Overview

An annual report from Upwork (a direct competitor to Fiverr) entitled Freelance Forward 2020 gives us a useful insight into the state of the freelance industry. Some top level figures:

36% of America’s total workforce are freelance: 59million (+2mill since 2019)

22% increase in total freelance earnings since 2019 $1.2Trillion compared to $1Trillion

Percentage of full-time freelancers increased 8% to 36%

Over half (58%) of traditional workers now working from home are considering freelance since Covid-19

86% of all freelancers say the best days are ahead for freelancing. 90% among new freelancers.

I’m awaiting the 2021 version of this report (hopefully released in Q2 of 2021) in order to be able to update these figures.

Market opportunity

Fiverr estimates the US freelancer market to be in excess of $815 billion annually (up from $750 billion the previous year), with the current addressable market being $115 which will increase as new categories are added to the platform. It’s important to note is the planned expansion into international markets isn’t factored into this estimate – which would add significantly to the current figure.

With current revenues of $189.5 million and the majority of the freelance community still offline, there is considerable room for growth. You could even compare the current shift from offline to online freelance to the shift from bricks + mortar to e-commerce in 1994. It’s a gradual shift, but one that is certainly taking place.

The key here is to focus on the long-term global trend at play – which is the shift to an on-demand, online, and flexible workforce. Expanding internationally represents a huge potential opportunity for Fiverr.

Competition

There are a bunch of companies operating within the freelancing/gig-economy sector. These include freelancer.com, Guru.com, peopleperhour.com amongst a host of other smaller players. However the main public competitor to-date is Upwork who offer a similar service with the differentiation being the business-model of bidding compared to Fiverr offering ‘Gigs’.

Taking a quick look at revenue growth between the two companies – growth at Upwork is relatively slower with 24% y/y growth compared to Fiverr’s 89% y/y growth. We’re paying a premium here for the future potential.

Microsoft News

At the time of writing this, Microsoft have just announced their intentions to enter the freelancing space. My initial reaction? This move makes a lot of sense for Microsoft – especially since they are able to leverage their huge Linkedin platform which is already rich in data and connections.

Rumours have it this service will likely launch in the autumn, so I can’t say for certain how I feel about this just yet. However, if executed correctly – it could be a game changer in the freelance game. Linkedin is possibly the perfect base platform to build a skills-based marketplace for freelancers.

Will be keeping a close eye on this one.

Financials

Revenue

Q4 revenue +89.3% y/y and +77% full year growth ($55.9m for 2020)

Q4 active buyers growth of +45% y/y to 3.4 million

Spend per buyer of $205: +20% y/y

Strong outlook to 2021 with 40 to 50% revenue growth

Revenue for Q4’20 was $55.9 million, up 89% from $29.5 million in Q4’19, driven by continued growth in active buyers, spend per buyer and take rate.

In the twelve months ended December 31, 2020, the active buyers reached 3.4 million, representing 45% y/y growth. This was mainly driven by strong cohort behavior and efficient marketing investments. Fiverr also continue to focus on higher lifetime value by targeting buyers with larger budgets.

This spend per buyer graph (below) is more significant than it looks at first glance – we can see Fiverr have been continuously increasing the average value a buyer is spending on the platform. This indicates a steady shift towards a higher-quality marketplace with ‘higher-ticket’ items. Part of the concern from the commenters on twitter in the previous write-up was whether Fiverr would be able to compete with Upwork’s higher-value market segment. From this data, it seems Fiverr are beginning to penetrate that market.

Profitability

Profitability-wise, Fiverr have delivered again with incredibly strong 2020 results.

Gross profit increased 84.24% y/y from $84m in 2019 to $156m in 2020

Gross margin was 82.6% for 2020, an increase from 79.3% in Q4’19. Non-GAAP gross margin was 83.9% in Q4’20, increasing 310 bps from 80.8% in Q4’19. This increase was mainly driven by increasing revenue scale, complemented by the modest mix shift between core marketplace revenue and other revenues.

Adjusted EBITDA was $4.6 million, or 8.3% of revenue in Q4 2020, compared to ($3.3) million or (11.3%) in the fourth quarter of 2019.

This continued profitability improvement was mainly driven by strong revenue combined with improved cost efficiencies.

All of this should be viewed in the context of extreme revenue growth over the past year (since the beginning of 2020). Although impressive, its not entirely unexpected with the shift to remote working and more people becoming aware of the Fiverr service. Hopefully the company can continue this trend over 2021 and soon enough report a net income (I don’t think this is far away).

Balance sheet

Now, taking a look at the liquidity situation. Liquidity refers to the company’s ability to pay debt obligations (mainly in the short-term). Glancing at the balance sheet, we can see Fiverr are in a fairly strong position.

Their current assets (the assets which can be easily liquidated at short notice) amount to $591m, whilst their total liabilities (current and non-current) totals $515,799. This means Fiverr have the ability to pay off all of their longer-term debt 1 X over if something terrible were to happen. I’m generally happy with this, although it’s important to state the cash position has somewhat worsened since Q3 2020 resulting from a sharp increase in convertible notes.

Valuation

Very expensive. But we are paying for potential future growth here, so this doesn’t surprise me.

Valuation is always hard and mostly down to a combination of several very subjective factors. In this case it’s also made harder by the fact there is only 1 other publicly traded company with a similar product to Fiverr – Upwork.

Looking at the graph below, the PS ratio shows the comparative ‘price-tag’ difference between the two companies – and it’s clear to see Fiverr are the more expensive company relative to sales. That being said, I would argue Fiverr have a good level of growth factored into this valuation, so there is definitely potential room to keep expanding moving forwards.

Taking everything into account, yes, Fiverr is possibly overextended at this point – but we have to put this price in the context of the overall market which is also arguably significantly overextended.

Key Risks to consider

Microsoft announcing plans to move into the space

High Valuation

Question around trend towards freelancing/wfh

High growth during covid, need to be able to scale appropriately if wanting to continue rate of growth. Bandwidth Do they have the bandwith for this?

Post-covid does Fiverr continue to grow?

Inappropriate or low-quality sellers can lessen the brand/reputation.

Conclusion

Overall, I’m extremely confident about the future success of Fiverr. Over the past year they have proven their ability to adapt to the changing circumstances and capitalize on the secular shift to digital and freelance.

It can’t be underestimated how difficult a task it is to process this high level of growth in such a short period of time, which I think speaks volumes about the management team.

However, questions do linger regarding several aspects of the business.

Can they improve their branding/outside perception as ‘cheap’ in order to gain higher-ticket clients and grow their revenue further?

Will Microsoft’s offering turn out to be a direct competitor and can they hold their position in the market?

Post-covid, will the freelancer market continue it’s current path or contract?

All things considered, I’m very encouraged by the direction of travel and can’t wait to see how this develops.

Cheers,

Innovestor