Today we have the second edition of the Investor Interviews segment where we take a look at investing from another unique perspective.

Subscribe below to get this type of content, along with company deep-dives and growth-portfolio insights directly into your inbox 👇

This second guest is known on twitter as @InvestiAnlyst, also known as Francis. He’s been a long-time follow of mine and someone who I constantly learn from with his fantastic contributions on Twitter, Substack and Seeking Alpha.

In this interview we learn more about the man himself, his investing style and other great nuggets of wisdom.

Enjoy!

1. Background

Innovestor

Thank-you so much for agreeing to take part. To start, lets get to know Francis in some more depth.

Tell me a bit about your background.

“How did you initially become interested in investing? What are your main areas of focus? Also, talk a little about what you do for fun.”

Francis

Thank you for the opportunity.

I graduated with a business degree and a minor in Finance/Economics. I worked in the Data & Analytics field as a Product manager, building Artificial Intelligence solutions and machine learning models for improving business decision-making. I currently work as a form of Economist, focused on Investment Attraction and Economic Development Strategy in Western Canada.

I started my journey as a value investor and transitioned happily into tech Investing primarily because I had a good amount of knowledge.

I am a BIG TIME European Soccer fan - Very passionate about everything Liverpool FC.

Innovestor

Thanks for sharing. Great time to be a Liverpool supporter!

Do you have any personal link to the city? I’m a Norwich fan myself - which seems like not such a great decision lately...

Francis

I watched Steven Gerrard growing up as a teenage after the Miracle of Instabul in 2005. I immediately feel in love with Liverpool.

Innovestor

Can’t argue with that! I remember watching that game live when I was younger - what a night.

…

It’s interesting to me that your journey started from the lens of a value investor.

“What initially attracted you to that specific style? And other than your interest in (and proficiency for) tech, what was the catalyst for the switch towards growth investing (if that’s even how you would describe yourself)?”

Francis

I was attracted to value investing because in University I studied Business and Economics. I had a minor in Finance.

In business school, you are taught to use formulas and strict frameworks to measure and calculate a stock. I also got attracted to the comfort of owning low PE stocks, however, I observed that if you want to outperform and grow your portfolio, you have to be comfortable paying up for quality stocks that have great visibility into future growth.

Innovestor

I would agree with that.

…

So, it’s been a pleasure to interact and learn from you on Twitter over the past year or so. I’ve always been amazed at the consistency and quality of your content.

“As an ‘economist by day’ what drives you to contribute on your Substack, seeking Alpha and Twitter in your spare time? It seems like almost another full-time job!”

Francis

Throughout my life, I have always been someone who has been extremely curious about learning about what drives the world from a business perspective (sometimes curiosity got me in trouble!).

The inner drive for learning, teaching and writing is what motivates me to continue to develop all my platforms.

There is a magic to putting down a pen to paper.

As a result of my curiosity levels, I sometimes need to put my thoughts on paper to help me overcome overthinking. I enjoy researching businesses and writing helps bring clarity and structure to my thinking. This is primarily how all my platforms on Seeking Alpha, Substack and Thread writing became a passion outside of work.

Innovestor

This is similar to myself. Investing enables my curiosity.

Also, I agree that writing your thoughts down, even if not publishing them, is a brilliant way to synthesize the ideas in your head. Everyone should give it a go.

…

“Following on, do you have any plans with where you want to take your twitter/substack in the future?”

Francis

I really want to just focus on becoming a better investor and learn from the best.

I want to become better at understanding Enterprise SaaS, evolving my investment process and meeting great people in Investment business through my platforms. We will see how things evolve over time.

2. Investing Style

Innovestor

Moving on to your investing style. It seems we both have similar ideas when it comes to the type of companies we like to research (i.e. growth/technology).

“Firstly, how would you describe your investing style? And how would you say it has evolved over time?”

Francis

My Investing Style is honestly still a work-in-progress that is constantly evolving.

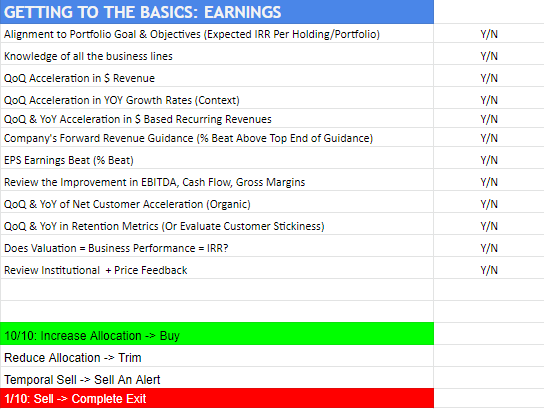

The image below is a simple breakdown of my current investing process and has helped me to be successful to-date.

The rubric below was developed based on my past decisions and what I expect of my future self. However, I am human. I don’t follow all my rules 100% of the time, but I always try my best to ensure I have a process in place that guides my decision-making rather than making my investing decisions on emotions or lack thereof.

Innovestor

This framework is great. I think there are a couple of really interesting points here and a tone of things new investors could utilize.

Firstly, it highlights the idea that, in many ways, big parts of investing decisions can be subjective in nature. E.g. your opinion on management’s skillset may differ from someone elses. Or you may have a passion towards an area that someone else does not.

Therefore, sometimes it’s just a case of trusting your gut.

Francis

Evaluating Management is a difficult skill and it is subjective.

I generally try to evaluate quantitative metrics such as if the Founder or CEO has been part of successful businesses in the past, or their biggest accomplishments/setbacks in the past. These provide some clues to evaluate Management’s ability to execute.

Innovestor

Also, I like the point about having the flexibility and experience to know when to bend your own rules. And that the underlying point in a good framework is to avoid the emotional decisions, which always turn out to be the worst.

Francis

Absolutely, It is constantly a balance. Balancing facts with intuition.

Innovestor

“Next, do you have any main influences in terms of investing style? Also are there any quotes that stand out to you?”

Francis

Cathie Wood and Brad Gertsner at Altimeter Growth Capital played a role in influencing my decision in the early days. Peter Lynch has played a role in different areas.

In recent years, I have been influenced by people I’ve met on Twitter such as Individuals like Dennis Hong, friends on Twitter such as @StockNovice on Twitter and @Investing City.

My favourite quotes come from Peter Lynch:

“Investing in stocks is an art, not a science, and people who've been trained to rigidly quantify everything have a big disadvantage.”

“Invest in what you know & see around”

“Everyone has the brainpower to make money in stocks. Not everyone has the stomach.”

Innovestor

Those are some great quotes.

“Another aspect of investment style which varies significantly person-to-person is strategy towards allocation and risk. Do you follow any specific rules around these aspects?”

Francis

Yes, I currently have a concentrated portfolio of about 10-names. I ensure I have a high-degree of confidence on my core names.

My Top 3-5 allocation are significantly allocated to the company where I have tremendous confidence in their future growth prospects relative to the current valuation. I want to always ensure I have more money towards my best risk-reward idea.

Innovestor

To me, this is really interesting. I feel like 10 would be considered a fairly concentrated portfolio by many people’s standards.

There has been somewhat of a debate recently on twitter as to what the sweet spot is for portfolio size. Mine currently sits at about 18 which I am looking to cut down by at least 5 in the short-term.

How do you weigh up this balance between portfolio growth and diversification? I always think about the below graph and this quote - “Diversification may preserve wealth, but concentration builds wealth” - Warren Buffett.

What are your thoughts?

Francis

My portfolio allocation is primarily based on the list of criterias outlined earlier as well as the best risk/reward I see available on the market. I used to have a bigger portfolio close to 20, but as I continued to adjust my process and set the quality bars higher, my stocks naturally decreased.

I also use an active watchlist where I track a list of about 10-companies closely and if 10/10 hit those criterias, I don’t have a problem bringing them in my criteria.

Earnings is an important aspect, so I follow the framework to guide how I evaluate my companies. It all goes back to the framework I shared earlier.

I generally look at Forward Revenue Growth 2-3 years away, Evaluate the net retention rate, the stickiness and confidence/credibility of the management team and the current tailwinds being experienced by the company. After allocating my best idea, I get ready to sit and strengthen my stomach (as Peter Lynch said) for the volatility, while recognizing that the best companies always recover from any crisis.

In summary, I try to set a very high-quality bar and let that determine what goes in or out of my portfolio.

Innovestor

Brilliant answer.

3. Research

…

Regarding the research process - a question I get asked fairly often is how I pick the companies I end up analysing in the deep-dives. For me it’s all about mixing my passions/interests with my investing process.

E.g. My interests revolve around immersive tech, entertainment and gaming - which is why some of my most enjoyable work-to-date has been linked to these areas.

“Does this hold true for yourself? Do you have any particular areas of interest you particularly like to focus on?”

Francis

Yes, I agree. If you plan to invest in a company for a decade. You will have to be a part of the story and the product. Hence, if you don’t have any interest or passion for the topic, you’ll find it hard to keep up, study a company in depth and develop a necessary edge.

I combine my past work experience and my passion for technology to study these areas. I feel that due to my experience, interest and network, I have my own personal edge in analyzing these sectors.

Innovestor

“Similar to the previous question, are there any industries or technologies you would keep an eye on in the next 5-10 years?”

I know you focus a good amount on the creator/gig economy along with big-data – so I’d be keen to hear what you think some important trends will be over the next decade.

Francis

The world has drastically changed both during the pandemic as well as the fact we are gradually exiting/learning to live with Covid. As a result, I believe there will be a significant spending/tailwind within the Enterprise SaaS Technology market compared to the consumer B2C.

One of the biggest habits that changed the world was employees and companies learning to work remotely. As a result, many changes have had to occur at the Enterprise level.

I personally believe Enterprise SaaS platforms areas such as Cybersecurity, Data Analytics Platforms/ML Tools for insights, Collaboration tools, On-Prem to Cloud Transitions will see major growth.

Some other key sectors include the rise of the Gig-economy/Freelancing and Fintech (Buy-Now-Pay-Later),

Innovestor

Thanks Francis. More into the nitty gritty – I think it’s interesting how there is almost never one ‘correct’ opinion when it comes to analyzing a company (especially on twitter). We all think we’re right, until we’re not.

“Do you have any particular attributes or heuristics you look for in a good investment?”

For me, good management, underlying revenue growth and a clear path to profitability are core aspects.

Francis

Accelerating Revenue Growth (Year-over-Year) and (Quarter-over-Quarter) with a decline in operating expenses, Steady Dollar-Based Net Retention and customer stickiness are strong signals.

If you combine these metrics with a company that has a leading market share together with a management team that has shown they can execute - you can find a big winner.

4. Quickfire

Innovestor

Linking to the above question, an influx of new investors has seen other asset classes, such as crypto, take off recently.

“As a tech-focused investor with a main focus on equities, do you have any plans to learn about these new asset classes? Does this area of technology interest you at all?"

Francis

I have a decent amount of investments into both major Cryptocurrencies - Ethereum and Bitcoin. A slight more allocation towards Ethereum because this platform has a lot more use-cases for the next era of decentralized finance.

My overall thesis is that finance is going to be more digital over the next decade and secondly, the next disruption in finance will create decentralized parties.

The major cryptocurrencies will all play a major role.

Innovestor

Looking at the creator economy from the perspective of a creator – you have covered the Upwork vs Fiverr debate in considerable detail.

“I’m curious, do you see the creator economy continuing to grow over the coming years? Or do you think we will revert back to pre-pandemic ways of working?”

Francis

Holistically, two major themes have occurred during Covid. Employers are facing a massive labour shortage especially in North America. And secondly, the content creator economy has exploded as a result of more people working from home and internalizing their future goals. Platforms like Substack have been successful in Covid.

Upwork has a robust business model that matches both aspects of the market. Upwork has a more experienced, award-winning Enterprise-focused business that has been ranked as one of the best in the industry that is helping companies manage the labour shortage issue (thread below).

They also have a big platform for entrepreneurs and freelancers who are going solo. Their entire business model is anti-fragile and resilient because they have multiple revenue streams. They are one of the leading staffing platforms in the US.

On the financial aspect, their revenue has been accelerating. On Upwork’s growth, new management team and the current tailwinds, they are a business that can generate significant returns as their multiple re-rates. Upwork has a much better business economics to capitalize on this structural shift.

Innovestor

Since the pandemic, many new investors have entered the market.

“If you had to give one piece of advice to someone who has just started investing, what would it be?”

Francis

Constantly learn. Streamline your information process. Importantly, be open to new information/data. It is very easy to become attached to a company, but it is particularly essential to detach yourself from a company’s stock and the underlying business.

My biggest advice is to know what you own. Don’t be in a hurry to make money. Be obsessed about playing the long-game. Focus on improving your investment process rather than always focusing on results, but importantly back-test this process to ensure that you are getting the results long-term. If not, course correct. Don’t be afraid to think outside the box.

Innovestor

I love this answer. Every new investor should be taking notes.

Being objective and long-term oriented is key.

“Could you explain what you mean by ‘streamline your information process’? How does this look in reality?”

Francis

I believe the quality of information and evidence that an investor uses to analyze and guide their portfolio decision-making process is essential.

In reality, I study the most successful Investors that have consistently outperformed the market then I curate my social media feed using Twitter Lists to specifically track their moves/what they say.

Secondly, if its a hedge-fund, read their posts/blogs eg. Altimeter Growth Corp Hedge Fund.

Lastly, trying to identify the #1-3 top metrics that moves the needle for a company and focus solely on tracking those metrics and ignore short-term noise. The goal is to constantly filter your information sources.

Innovestor

I often find I learn far more from my mistakes than I do my wins.

“What is your biggest investing mistake? And what did you learn from it?”

Francis

My biggest investing mistake was holding on too long to a company that was underperforming.

I can share the company, it is called “TWOU.”

I kept placing my ‘hope’ that the company would turn things around because it was undervalued. I was stubborn, refused to be open to new information and I only wanted to listen to information that was confirmed by my world-view and personal thesis. I held on to the losing stock for a long-time and my opportunity cost was particularly high because I missed out on the returns on other better stocks in 2020.

It was a good lesson that taught me to be open to new information. I also learned that sometimes cheap valuations generally mean there is something wrong. Companies are cheap for a reason and the market is somewhat efficient in its pricing, so be cautious because opportunity cost can be high in the wrong stock.

Finally, It also made me realize that in some cases, I have to be willing to pay up for high-quality companies with great visibility into their future growth and business prospects.

Innovestor

“If you had $100K which you were forced to invest now between 3 stocks (weighted equally) over the next 10 years, which 3 stocks would you choose? And a short sentence on why.”

Francis

Upstart: Founder-Led, flawless GTM sales motion that is leading to triple-digit revenue growth while highly-profitable with over 30% EBITDA margin and they are disrupting a niche category in a large lending market.

Affirm: They have key partnerships with the Top 4 eCommerce companies in the US (Amazon, Walmart, Target and Shopify) in a Buy-Now-Pay-Later market that is only less than 5% penetrated in North America. They have a massive competitive advantage in their brand and underwriting risk. They are led by a seasoned entrepreneur, the ex CTO/Founder of Paypal.

Palantir: They are the leading company in the world positioning to capture a large market opportunity in the race for Artificial Intelligence across 10-industry sectors. Primarily because they have built the most sophisticated vertically-integrated AI tech stack that covers every area of AI. They are led by incredibly talented Founders.

Innovestor

Finally, do you have any books or podcasts you would recommend to new-ish investors?

Francis

I listen to many non-fiction books. However, for Investing, my best advice has been listening to great podcasts, shows and interviews with investors who are well-respected.

My favourites are Invest Like The Best and Colossus Podcast by Patrick O'Shaughnessy are some of my best podcasts.

I would suggest that people focus on listening to great Podcast from successful investors such as Pat Dorsey that analyze real-world companies and get practical hands-on experience trying out things in the market.

Investing is not black and white, it has a mix of the arts and sciences.

Innovestor

Brilliant - and that’s it for the questions.

Thank-you, Francis, for your time today. And no doubt we will speak again soon.

Francis

Thank you so much for the opportunity to do this interview. I want to wish everyone the best. Happy Investing!