Today is a different style of article than the usual Innovestor deep-dive. I’m hoping to produce more of these short-form ‘stock take’ articles which will cover various topics related to stocks and investing. Ideas of future articles include:

The importance of Skin in the game

Basics of valuation

The power of good Intellectual Property

Various industry segment overviews (Gaming, 5G, immersive technology etc…)

Feedback is always appreciated. Enjoy.

What is a moat?

To first understand what we mean by the word ‘Moat’, I think it’s worth taking a look at one of the earlier use-cases. As, over the years, it has come to mean different things to different people.

One of the more famous explanations of the term ‘moat’ came from Warren Buffet in his 1995 Berkshire Hathaway shareholder meeting. He said the following in response to a question on his opinion of the fundamental rules of economics…

"What we're trying to do, is we're trying to find a business with a wide and long-lasting moat around it, protecting a terrific economic castle, with an honest lord in charge of the castle."

What we're trying to find is a business that, for one reason or another -- it can be because it's the low-cost producer in some area, it can be because it has a natural franchise because of surface capabilities, it could be because of its position in the consumers' mind, it can be because of a technological advantage, or any kind of reason at all, that it has this moat around it."

"But we are trying to figure out what is keeping -- why is that castle still standing? And what's going to keep it standing or cause it not to be standing five, 10, 20 years from now. What are the key factors? And how permanent are they? How much do they depend on the genius of the lord in the castle?"

"And then if we feel good about the moat, then we try to figure out whether, you know, the lord is going to try to take it all for himself, whether he's likely to do something stupid with the proceeds, et cetera."

In essence, Buffet argues that In order for a company to be successful, they must have a definite competitive advantage allowing them to maintain pricing power and better than average profit margins.

How are Moat’s created?

The vast majority of companies don’t have a moat when they start off. It’s often something that develops over time as the business begins to scale and the brand/product develops.

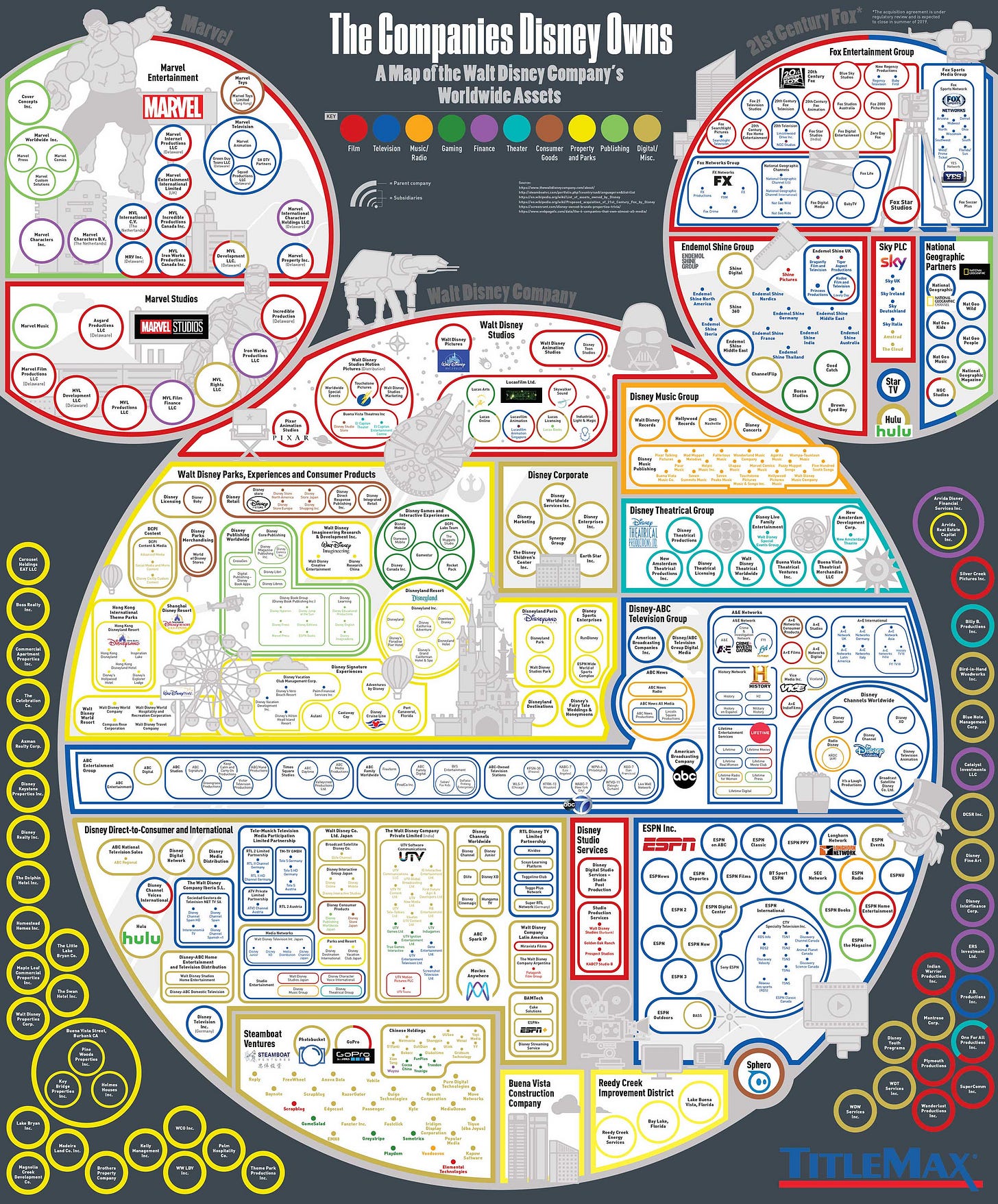

For example, when Disney first started, they had no moat. As the years went on and more intellectual property was added, the moat grew and grew. Similarly with Amazon, the moat didn’t really kick in until years down the line when they gained enough scale to dominate the e-commerce industry.

Some common examples of moats include…

Low-cost of production: Low cost of production is an advantage coming directly from scale. Amazon are the perfect example here - as the company scaled from a relatively small online retailer to one of the largest on the planet, the unit economics improved so much so that this factor alone gave them the ability to force out smaller competitors.

High switching costs: More of a trait of newer technology companies, the core idea is the more difficult it is for a consumer to change to a rivals product/service, the greater the moat.

I would also argue that switching costs are less common of a moat nowadays, as advances in technology and business culture make it much easier to switch services.

These costs don’t solely come in monetary form, occasionally it is in the form of data or behaviour which will need to change. For example, if we take a look at a Spotify customer contemplating a move to Apple Music. Physically, there is no switching cost as you can simply cancel one and open the other, but the customer would sacrifice years of personalized data that manifest in tailored recommendations from the machine learning outputs Spotify provides. Switching costs have almost become “data moats”.

Network effects: Relatively common. At its core ‘network effects’ take place when users of the product/service/platform gain more value as the number of users in the ecosystem increase. This is often a symptom of a business where the product/service creates significant value for itself and others.

A good example of a company with powerful network effects includes Airbnb or Fiverr. As more and more users join the platform, there are more properties/sellers available which will attract more customers, and this cycle continues.

The dynamics at play here are almost impossible for new competitors to replicate within a short period of time.

Intangible assets: Creating something differentiable that is impossible to replicate is a proven way to build an economic moat. This can take several different forms, including Intellectual Property, patents and trademarks.

Patents are fairly common within the medical industry, whereas intellectual property is often a feature of the entertainment industry. Both create extremely valuable competitive advantages.

Arguably, corporate culture is also some form of intangible competitive advantage, as it ensures high productivity and tends to attract the best talent within the industry.

Natural monopolies: This refers to when a situation exists allowing companies to serve consumers well due to sheer scale. Examples include airports, railways, utilities and infrastructure. Each of these industries should be more beneficial with scale.

Competitive moats take time. Unless you are geographically lucky, you will often have to spend years building value and executing at scale. Most companies will start out with no moat but will develop one of the above over time, therefore making it hard (but not impossible) for new entrants to gain market share.

Do moats exist within tech companies?

I would argue there are close to 0 actual moats in technology. The whole industry is created from disruption and is focused on how to disrupt the competitor. It’s a very agile industry and one that is hard to try to keep up with.

The closest thing to a moat would probably be the high switching costs present in lots of tech companies. Typically, switching your development team is expensive in time & money. Also the idea of network effects in marketplace companies like Airbnb would be examples of a moat.

“In this current wave of disruption, is it still possible to build sustainable moats? For founders, it may feel like every advantage you build can be replicated by another team down the street, or at the very least, it feels like moats can only be built at massive scale. Open source tools and cloud have pushed power to the “new incumbents,’ — the current generation of companies that are at massive scale, have strong distribution networks, high switching cost, and strong brands working for them. These are companies like Apple, Facebook, Google, Amazon, and Salesforce.”

Several other examples within technology:

Facebook advertising platform - previously no moat until this was in place.

Netflix’s moat is supposedly the brand/content-library/first mover advantage.

There is somewhat of a disconnect between traditional companies and software companies. Traditional investors would argue there is no moat in any of these SaaS businesses - they just have a really good product.

The above tweet outlines some of the more traditional ideas of what a moat looks like. However, it could be argued many of these industries simply look like monopolies.

Is a Moat just a monopoly?

I would say there are two main schools of thought when answering this question…

“Moats simply do not exist. If you are talking about moats, what you really mean is ‘monopoly’. In reality, monopolies do well. And searching for companies that have the best chance of becoming monopolies is a great investment strategy”

“Economic moats are not monopolies. There are many examples of moats aligned with consumer benefit.”

Elon musk - “I think moats are lame…If your only defense against invading armies is a moat, you will not last long. What matters is the pace of innovation–that is the fundamental determinant of competitiveness.”

What I think Elon is getting at with this quote is that a competitive advantage isn’t a static thing - an advantage (or moat) you have today may not be sufficient tomorrow.

George Stalk Jr. of BCG - “The best competitors, the most successful ones, know how to keep moving and always stay on the cutting edge. Competition is so dynamic that speed is a critical strategic weapon.”

Conclusion

My generally held opinion here is that the term ‘moat’ has been vastly overused over recent years. It seems almost every company is said to have some form of economic moat, whereas this simply isn’t true.

There are many examples of defensible business models, however with the advent of AI, Machine learning and cloud computing, traditional moats are less and less common - ushering in the next generation of software companies who operate on a completely different playing-field. Pace of innovation is likely to be a key factor in competitiveness moving forwards.

As investors, we should be careful (and less lazy) when deciding whether a company has a moat. Oftentimes the answer is no.

Cheers,

Innovestor

Thanks for reading this short article. If you enjoyed, please hit the subscribe button in order to get more articles like this straight into your inbox.

Thank nice concept and I agree in principle as a small investor