Welcome to the 306 new readers who have joined us since the last article! If you aren’t already subscribed, join the community of 1,701 investors by subscribing below.

My aim with these deep-dives is to make the research process of investing in individual stocks more accessible. Enjoy!

Thesis

Key takeaways

The business

Market Opportunity

Competition

Bull Case

Bear Case

Financials

Conclusion

1. Thesis

E-commerce is slowly but steadily becoming the norm. The past decade has seen Amazon rise to be one of the worlds most influential companies, and is one of the few that if it were to disappear tomorrow, we would most likely see a dramatic impact on the global economy. The company has slowly but surely weaved its tenticles into almost every core activity we do - entertainment, food shopping, clothes, general shopping, business operations, AWS (the list goes on).

Technology is dragging traditional retail kicking and screaming into the 21st Century. 15 years ago smart phones were only just emerging and the majority of shopping was completed in traditional bricks and mortar stores. Just 15 years and 1 global pandemic later, we can see e-commerce becoming a more ingrained part of our everyday lives.

With that being said, MercardoLibre are looking to use the blueprints of the first movers in order to apply a similar model to Latin-America - a rapidly evolving demographic in terms of digitisation and technology adoption.

The company have been quietly executing over the past decade in order to be in with a shout of total continental domination. Management recoginse the longer-term opportunity present within the Latin American market, and are therefore sacrificing short-term profits by investing heavily in the platform. All this with the intention to grow market share for long-term continued success.

Whilst macroeconomic risks may challenge the company’s prospects (such as currency fluctuations as well as political turmoil), the powerful tailwinds are more than likely to fuel the company’s future growth.

2. Key takeaways

Meli are heavily concentrated on both e-commerce and fintech, so could be considered the love-child of Amazon, Square and Paypal.

Latin America are roughly 10 years behind the U.S. in terms of e-commerce purchase rates (currently 4% - roughly where the U.S. was about 10 years ago).

MercadoLibre intends to drive forward environmental objectives such as: clean transportation, land conservation and preservation, energy efficiency, renewable energy, green buildings and pollution prevention and control.

“Present in 18 countries including: Argentina, Brazil, Mexico, Colombia, Chile, Venezuela and Peru. Based on unique visitors and page views we are market leaders in each of the major countries where we are present.”

Latin America’s middle-class composition jumped from 20-30 percent to 60-70 percent over the past 10 years. However, half of that middle class is in a vulnerable position.

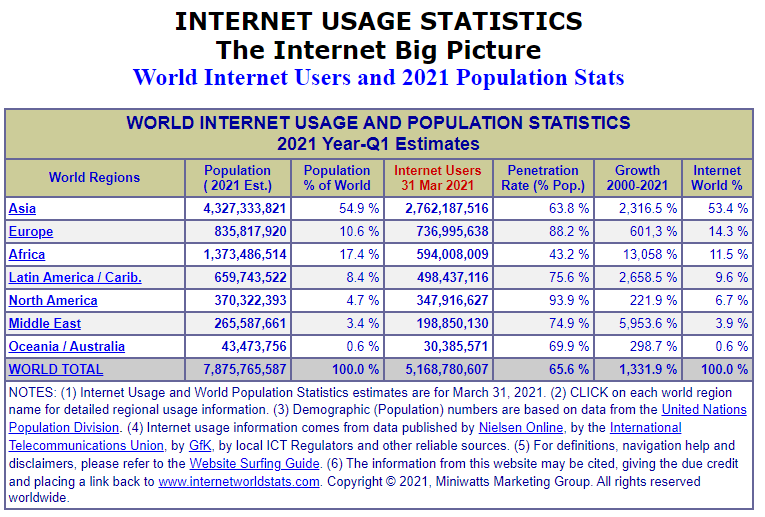

59% of Latin America have internet access

70% of adults are unbanked.

3. The business

3.1. History

The current CEO, Marcos Galperin, attended Stanford Graduate School of Business at age 26 where he came up with the idea for MercadoLibre in 1999. Soon after he had the idea, he was able to convince Stello Tolda (current COO) and Hernan Kazah to join him on the journey to create one of Latin America’s most successful e-commerce companies.

Hernan Kazah - “At the time there were like 80 other companies throughout Latin America following the same business model. We may have had a great team and long-term vision. But the idea was not unique. Even our friends sometimes got confused about which business was ours.”

After years of building up MercadoLibre, expanding into new markets and raising funds - the company became the first Latin American company to be listed on the NASDAQ and to this day is Latin America’s most popular e-commerce site.

Coincidentally, on the same day, (august 9th 2007) BNP Paribis froze $2.2B in assets - signifying the start of the global financial crisis.

Compared to their major international competitors (Amazon, E-Bay, Alibaba) MercadoLibre was a relatively late-mover - 5 years later than Amazon, 4 years later than Ebay and 4 months after Alibaba. Although not first to the scene, Meli have used their lagging position in the market as an advantage, learning from the mistakes of their competitors.

3.2. Company overview

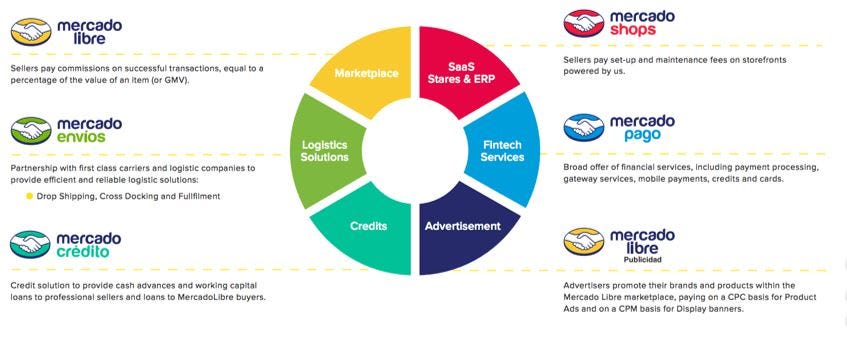

‘What does MercadoLibre do?’ is not such a simple question to answer. The company have their fingers in many different pies.

Meli aims to enable e-commerce and digital payments throughout Latin America by delivering a suite of technology solutions across the complete value chain of commerce. The company have established themselves as the largest e-commerce player in Latin America, and operates across 18 countries, with a market leading position in each of the major countries.

Latin America, which comprises of over 650M people, is also one of the fastest growing regions in terms of digital/technological adoption. These factors will serve as a huge tailwind over the next decade, however the region also entails significant risks, such as currency fluctuations and civil unrest.

3.3. How they make money

Mercadolibre currently operate in 18 countries, some of which include Argentina, Brazil, Mexico, Colombia, Chile, Venezuela and Peru. The company are market leaders based on unique visitors and page views in each of the major countries in which the they have a presence.

At the core, Meli’s business model is predicated on the innate belief that entrepreneurs are the driving force of the economy - and that the empowerment of entrepreneurship can drive economic growth.

The company started out by simply taking a cut of the sales from the original online marketplace (e-bay type model). Nowadays, Meli delivers e-commerce and digital & mobile payment solutions to both buyers and sellers via different technology verticals.

“Our company was born with a purpose: to democratize commerce and money, equalizing the opportunities between large companies and small entrepreneurs, by reducing geographical and economic gaps.

This virtuous ecosystem is guided by a conviction and is that entrepreneurs are the true agents of change. That is why, through what we call Entrepreneurial Effect, we promote those who lead the strategies in which we work and generate a triple impact; for your business, for your communities and for the planet.”

Lets dive deeper into the various aspects making up the entirety of MercadoLibre’s model. There is a lot to unpack…

As outlined by the above graphic, there are 6 main segments to the business; Libre (marketplace), Envios (logistics), Credito (credit), Shops, Mercado pago (payments) and Libre Publicidad (advertising). This combination of products and services amalgamates in a well oiled ecosystem - elevating the average person’s ability to buy, sell, create a business, and access credit… all within one system.

These elements have been the result of a slow but steady building process over the past several decades.

Libre Marketplace:

The marketplace is (and always was) the core of Meli’s business. Starting off as an eBay replica, the company operated an automated e-commerce platform allowing anyone to buy/sell goods online.

As arguably the most well established of the business segments, you would maybe expect growth to somewhat plateau. However, as technology/internet penetration continues to grow within Latin America, there is still plenty of room for growth. Advertising alone has the potential to substantially increase returns. Amazon, for example, operate mainly in the US which has an almost fully penetrated internet market, and are predicted to generate over $26B in 2021 alone.

Envios (Logistics):

Envios operates a very similar model to Amazon logistics, with a mixture of solutions - including drop-shipping, fulfillment, cross-docking & flex. But at it’s core, the Enios service is a powerful tool to connect otherwise disparate locations. This is achieved through a mixture of first and third-party logistics providers.

Part of the recent strategy from management was to double-down on investments in Meli’s logistics. As a result of these investments, Meli is currently positioned as the leading logistics service within the region - this is taking into account that Envios is only available in 6 of 18 current locations.

Over 208M items shipped

Grew over 130% y/y

Network penetration of 80%, up from 46% y/y

74% of all volume delivered in less than 48 hours

Free shipping threshold reduced

Libre Credito: Relatively straight-forward - Libre Credito provides users of the platform access to credit (loans) at favourable rates.

The Credito service solves the regional problem of the majority of people needing access to credit in order to build and scale small businesses, however lacking access to credit. Via Credito, Meli are able to underwrite customers who would otherwise not be eligible for credit.

The direct effect of this is an increase in small businesses selling on the platform, which leads to an increase in products… therefore fueling the fly-wheel.

The company are also starting to offer credit for buyers, given the low penetration of credit card holders in LatinAmerica. This has allowed normal people to buy higher-ticket items - thereby increasing the attractiveness of becoming a seller on the platform.

Mercado Shops:

A similar idea to that of Shopify - the ‘Shops’ division enables a user to set up an online store, with the benefit of having access to other valuable ecosystem assets such as traffic from marketplaces and easy integration with payment solutions.

Libre Publicidad (Advertising): Enables businesses to promote their products and services on the Internet through MercadoLibre. As mentioned earlier - the potential to grow the online advertising business as more and more people use the platform is a huge revenue opportunity.

Mercado Pago (Payment solution):

Akin to Paypal or Square. Over the past several years Meli has introduced an integrated payment system, allowing Latin America to move away from cash. The payment business is getting really big, really fast.

Originally, Mercado Pago started out as a service where you could deposit cash, transfer to credit, then use it in a card form. The popularity of this service, combined with the introduction to third parties/bricks & mortar retailers saw an explosion in usage and uptake. Meli had stumbled onto a potentially huge growth lever.

Total Payment Volume reached almost $15B, growing 129% y/y

Reached a total of 630M transactions for Q1, growth of 117% y/y

Under this business segment, Meli operate several different financial service products - credit, Point of Sale systems (similar to Square readers), pre-paid cards, digital wallets, merchant services, and investment accounts (Mercado Fondo).

Mirroring the company’s overall strategy/ethos, the sheer variety of payment services shows their intention - to create an ecosystem where the added value of the combination of services is unmatched. This desire to create a comprehensive financial system stems from the inherent lack of banking infrastructure in the region.

4% of the US and 1% of the UK are unbanked - compared to 63% of Mexio and 54% of Argentina.

3.4. Management

One of the standout aspects in the story of MercadoLibre is the competence of the management team, spearheaded by the CEO - Marcos Galperin. Beneath Galperin we have Dan Rabinovich (COO), followed by a handful of ‘Presidents’ and Vice-Presidents’ who are essentially CEO’s of the various departments within their own right.

From various interviews over the years, a picture emerges of a passionate and highly competent CEO in Galperin - who has managed to slowly curate a team of highly effective executives across a range of different domains.

Pedro Arnt - CFO

Osvaldo Giminez - President of Fintech

Martin de los Santos - Vice President of Finance

Stelleo Pasos Tolda - President of Commerce

Ariel Szarfsztejn - COO of Mercado Envios

2 examples of management’s effectiveness…

Overcoming obstacles

Over the past decade, Galperin had a vision of improving the logistics infrastructure within Latin America - and to achieve this he started Mercado Envios in 2013. Over the following years the company invested large sums of money into the venture. By the latter half of the decade, MercadoLibre’s infrastructure system spanned to Brazil, opening up completely new (very large) markets.

However, in 2018, Brazil’s national postal service raised it’s prices - resulting a huge blow for the company.

Instead of backing off when finances were under severe pressure, Galperin decided to invest more and more money into MercadoLibre’s infrastructure system - expanding fulfillment and free-shipping capacity within the reigon.

This risk paid off. By 2019, Mercado Envios (the logistical arm of MercadoLibre) were handling over 80M packages per quarter across six countries. MercadoLibre were fully established as the core logistics within the region.

This upfront investment into the business will likely prove to be a deciding factor in the future success of the company.

Knowing the market

A question you may be asking yourself is “why can’t another global e-commerce player get involved within the Latin American market? The opportunity it offers is so great - why would someone like Amazon ignore it?”

One of the answers is the fact that management have a good understanding of the intricacies of operating within the Latin American Market. Galperin and his team decided early on to adopt the structure of different teams for different geographies. This allowed the company to be more agile in responding to differences within the regions - adapting product-market fit to the local circumstances. Other companies, like Amazon, adopted more of a ‘top-down’ approach. Which has seemingly been less effective.

4. Market opportunity

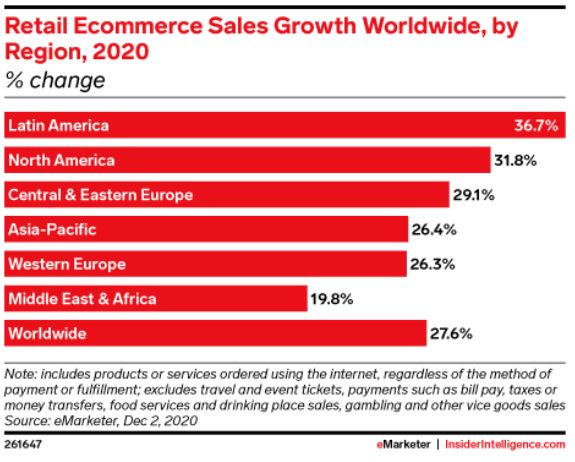

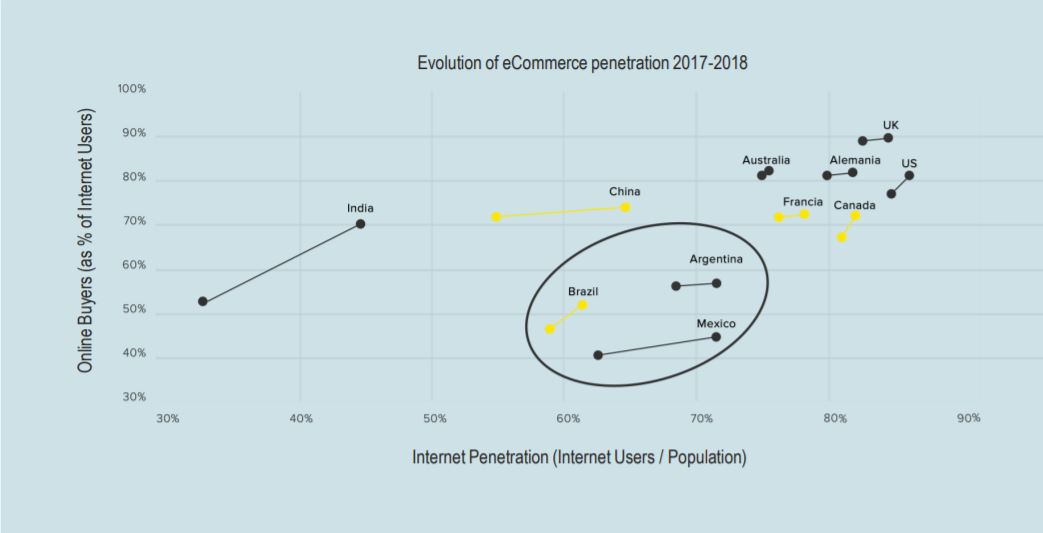

This graph, from the company’s 2018 business overview slides, is a great way to visualize the potential for Latin America to grow into their position within the overall market. There is evidently still a long runway ahead.

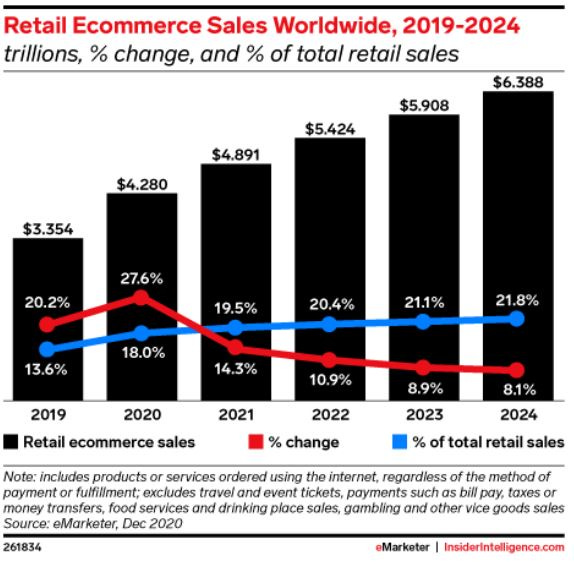

Covid was a large factor in the uptick in online e-commerce sales. From Statista: “In the week starting April 6, 2020, e-commerce revenue in Peru increased ten times (that is 900 percent) compared to the week starting March 9th In Latin America. Altogether, the growth rate in the period amounted to 230 percent. The changes were linked to the outbreak of COVID-19.”

If the pandemic had only lasted 2 or 3 months, I believe we would have been back to our old ways of traditional retail. However, the fact the pandemic is still ongoing (over 1 year later) has resulted in the formation of new habits. Habits are a powerful thing, and not easy to change.

In my opinion, Online commerce is here to stay. From Statista: “Of digital buyers surveyed in Latin America, 78 percent said they were willing to continue shopping online after the sanitary emergency.”

4.1. Total Addressable Market

“In 2018, the percentage of consumers who made at least one purchase online in the previous 12 months grew to 93% of internet users in the U.S., 97% in the UK, and 92% in China. The market of developed countries is in its maturity phase”

The TAM (Total Addressable Market) is one of MercadoLibre’s greatest opportunities, yet potentially the most daunting challenge.

Latin America’s current population sits at roughly 660M and boasts one of the fastest internet penetration growth rates over other nations - and there is still a long way to go in comparison to other continents. For comparison, Europe’s internet penetration sits at 88% and North America’s sits at 94%.

When trying to figure out the potential market opportunity available for MercadoLibre, it is worth separating out the two distinct areas of operation - eCommerce and Digital Payments.

E-comm

According to statista, revenue in the e-commerce market is projected to reach $49B in 2021 with an expected CAGR (compound annual growth rate) of 8.34% - Resulting in a projected market volume of $68B by 2025.

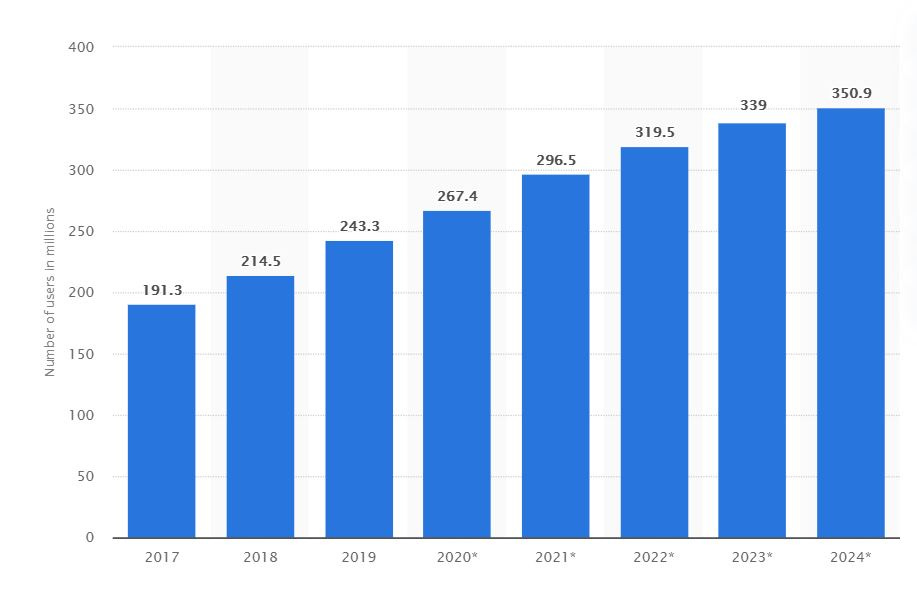

In 2020, more than one third (roughly 220M) of internet users in Latin America will have purchased products online. By 2022, this figure is expected to grow to nearly 35 percent, reaching over 277 million digital buyers.

In 2019, retail e-commerce sales in Latin America surpassed 70 billion U.S. dollars. According to forecasts taking into account the impact of the COVID-19 pandemic, this figure is expected to reach almost $116 billion by 2023.

In 2020, e-commerce sales were estimated to account for 5.6 percent of all retail sales in Latin America. This figure was forecast to continue growing in the following years, surpassing seven percent by 2023. Comparatively, U.S. e-commerce penetration levels are much much higher at around 33%. The U.S. experienced similar levels of e-commerce penetration as Latin America in 2009.

Meli leads in most countries they operate including: Brazil, Mexico, Argentina, Colombia, and Chile. These five countries comprise roughly 86% of the e-commerce market in Latin America combined.

Digital payments

Business opportunities represented by the unbanked sector in Latin America is projected to be $34 billion (however this is a fairly old statistic).

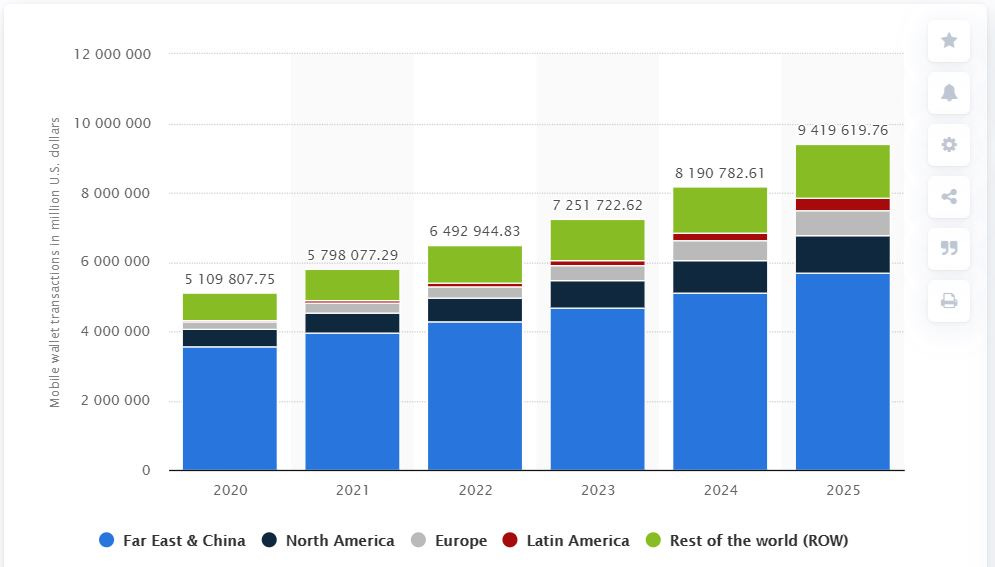

Market size of mobile wallet transactions is lowest in Latin America at roughly 1% of total global transaction size. This is predicted to increase to about 4% by 2025. Still plenty of runway ahead.

In Latin America, cash is still popular for a number of reasons – lack of banking infrastructure, lack of access to credit, and a mistrust in financial institutions. 71% of Brazilians report using cash as the main means for paying for their daily lives.

Similarly to the e-commerce market, the statistics demonstrate a large opportunity for MercadoLibre within the Latin American market - both with e-commerce and digital payments. Both opportunities are young in terms of runway, with so much of the market left to penetrate.

For me, the really exciting area of development for MercadoLibre is Mercado Pago, as it represents possibly the greatest opportunity in getting the majority of Latin America involved in the financial system as well as the Meli flywheel.

5. Competition

As the reigon has developed, more and more foreign players are looking to get a slice of the action.

Amazon initially entered into the region in 2012, Alibaba in 2015 and Shopee (SEA) look to be the most recent entrants. Competition is hotting up - and it’s a real question of whether Meli can survive against substantially deeper pockets.

Taking a brief look at Shopee (one of the 5 main arms of Sea Ltd) - it is “Sea’s e-commerce platform and is the leading e-commerce platform in Southeast Asia and Taiwan by gross merchandise volume. Unlike the developed markets, the internet economies in Southeast Asia are still expanding rapidly and Shopee is on track to acquire a significant share of this expansion. Shopee also has footprints in Latin America including Brazil and Mexico. Shopee provides consumers an easy, secure, fast, and enjoyable online shopping experience that is enjoyed by tens of millions of consumers daily.” - Wolf of Harcourt Sea investment Thesis

The Asian company have a slightly different overall strategy than Meli. They aim to get customers onto the platform via the popular games divition - Garena.

For example, their most popular mobile Battle Royal game, Free Fire, is a great way to get users involved within the ecosystem. Not only is gaming an important aspect of getting users on-board, the addictive social features surrounding the games encourage users to open and play the apps multiple times per day. There are plenty more strategic routes in order to get people involved and using the platform that Meli simply don’t possess.

Worringly for MercadoLibre, Shopee’s strategy seems to be working. The Shopee app is the 6th most downloaded app on the google play store in Brazil.

Amazon, Alibaba, Americanas and OLX are all also serious players in the e-commerce industry. For example, Alibaba have made a deal with Atlas Air in order to improve their logistical infrastructure within Latin America.

“The move comes as Cainiao (Alibaba’s logistics company) has seen its parcel volumes to South America take off this year; in the third quarter of 2020 it transported more than 8m packages, double the number transported during the second quarter of this year.”

As for Amazon, late last year the company announced plans to open its biggest distribution center yet in Brazil. Whilst at the same time opening 2,000 jobs in Colombia - mainly in customer service. And in Mexico, the company have kicked-off another payment option that makes it even easier for users to complete purchases using cash.

Overall, even though competition within the reigon is heating up, I think Meli will welcome it. Part of the company’s strategy over the past decade has been to learn from the mistakes and successes of the first movers. Keeping a low profile whilst executing on targets will be key to the company’s future success.

Are Meli safe from Amazon?

No one company is really safe from Amazon (with the one exception of Alibaba). Any business in almost any market has a risk of Amazon finding a way to price-match and therefore drive down margins.

That being said, Meli acts as more of a Paypal/Amazon hybrid. With a large amount of Meli merchants running bank accounts within the platform - the ecosystem is sticky. It would take a extraordinarily large push from Amazon to somehow untangle the existing network effects.

6. Bull case

Competent management

MercadoLibre are founder-led.

Galperin, one of the co-founders over 20 years ago, is still at the helm and has been one of the main driving factors of growth at Meli. So much of what we see today - the logistics network, the payment network - is mainly a vision from Galperin. He is someone who saw e-commerce and digital payments early and capitalized (and more importantly executed) on the opportunity.

“Galperin trust disclosed ownership of 3,900,000 shares of Mercadolibre Inc (US:MELI). This represents 7.8 percent ownership of the company.”

Evolving e-comm and Digi Payments industries

As discussed in one of the sections above, MercadoLibre are capitalizing on the underlying opportunity of the adoption of both e-commerce and digital payments within Latin America.

With a region double the size of North America and with a much reduced level of internet and digital wallet penetration, MercadoLibre are in the perfect position to capitalize on the rapidly growing e-commerce industry. There is still plenty of runway here.

Large TAM

Similar to the point above, Latin America represents a population nearly double the size of the US (660M compared to 370M), which indicates a potentially larger market size than Amazon if executed correctly. As stated on the investor relations page, the company is the leader within many of the countries it operaties in, including Brazil and Mexico - which represent roughly 60% of the e-commerce market in LatinAmerica.

“Based on estimates from the Statista Digital Market Outlook, Mexico and Brazil would together account for more than 60 percent of the e-commerce market in Latin America in 2020.”

E-commerce sales only accounted for 3.1% of total retail sales in Latin America last year, according to Statista. But Meli estimates the market will still grow at a compound annual growth rate (CAGR) of 8.3% between 2021 and 2025 as internet penetration rates rise.

Strong history of innovation

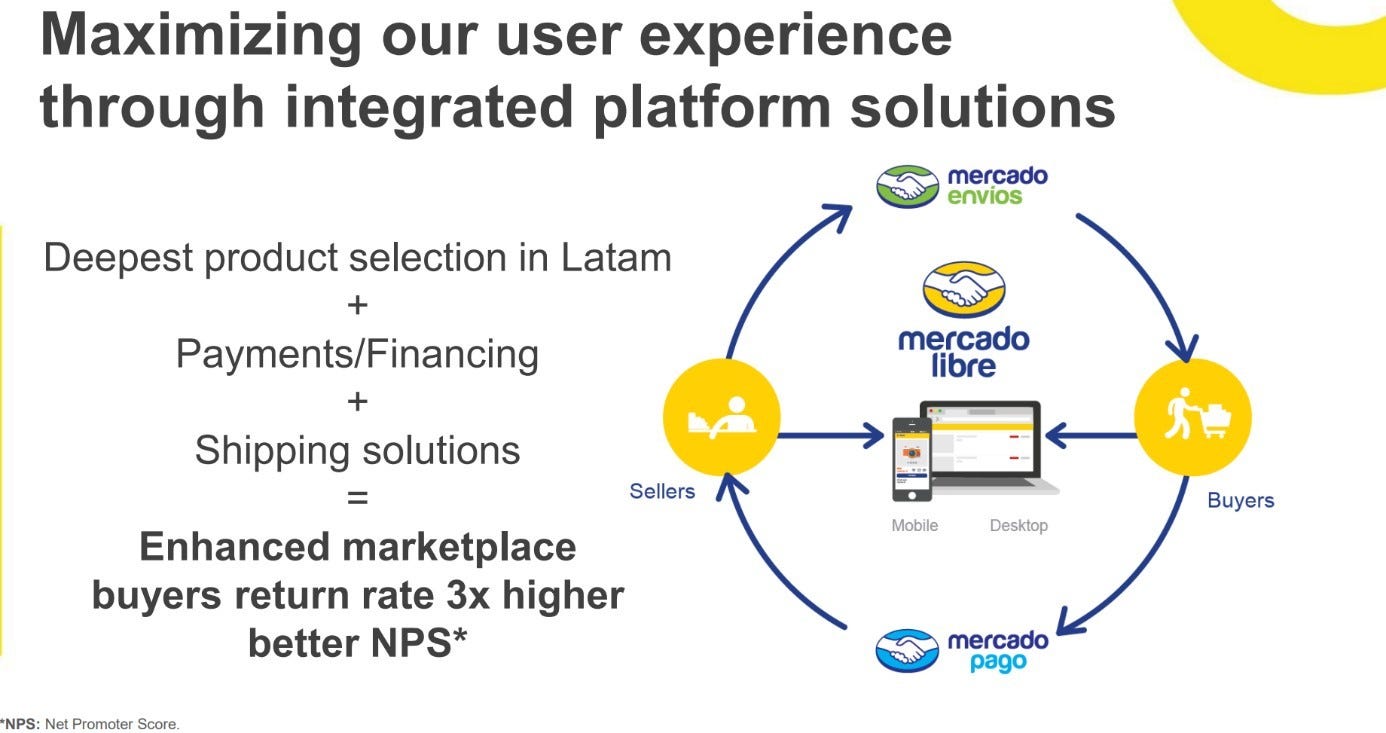

Meli has a rich history of innovation. The company started as an e-Bay replica but quickly added many different strings to their bow in the form of Mercado Envios, Pago, Fondo, Credito, Shops and Publicidad among others - creating a sticky ecosystem of banking, logistics and commerce.

Focus on growth

Again, this is a testament to the management team and their willingness to take risks at a time when the company is under financial pressure. The executive team are aware this is a long game, and therefore need to focus on building a robust infrastructure - thereby forgoing short term profits for the long term domination of the Latin American market.

Strong Network effects

Part of the beauty of the MercadoLibre ecosystem is the intertwined nature of each of the different components. At first glance it looks complex, however the model makes logical sense. And once you are within the flywheel, the benefits are obvious. Put simply, the more merchants Meli can get to sell on the platform increases the level of buyers, which then increases the desire to be a merchant - and the flywheel continues.

Robust growth & emerging profits

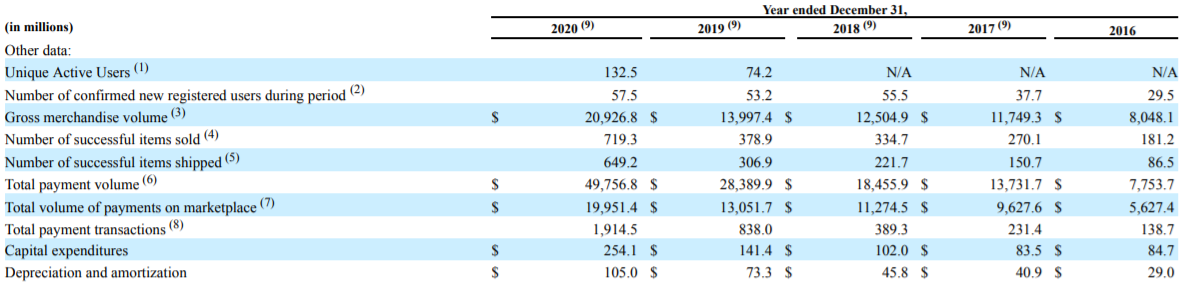

Unique active users grew by 78% in 2020 to reach a total of 132.5M, up from 74.2M in 2019. The first quarter of 2021 has already seen unique active users increase by 69.8M in the three months ending March (representing 52% of the total unique active users).

The company’s annual revenue expanded by over 6 times from $651.8 million in 2015 to $3.97B in 2020. However, due to large investments in infrastructure and S&M costs, MercadoLibre hasn't been profitable over recent years. Net loss in 2020 was 0.7M, down from a net loss of 172M in 2019.

2021 earnings are expected to more than double, even as revenue growth slows.

7. Bear Case

Economic and political risks

One important thing to remember here is that we are dealing with Latin America as a whole, which brings with it a myriad of issues. Just looking at the past several years we have seen political scandals, hyperinflation and corruption, just to name a few. These are generally considered the associated set of risks when operating within emerging markets.

Currency fluctuations

Foreign exchange rates can have a huge impact on MercadoLibre’s operations. Due to the Securities and Exchange Commission rules, Meli have to use the foreign currency rates and translate those to dollars for the financial reports.

Two examples:

Over the past 5 years the Argentine Peso has devalued rapidly against the USD.

In 2017, Meli had to exit Venezuela due to the country defaulting on its government bonds.

Currency fluctuations alone are why some big investors have sold their MELI positions.

Overvalued compared to competition

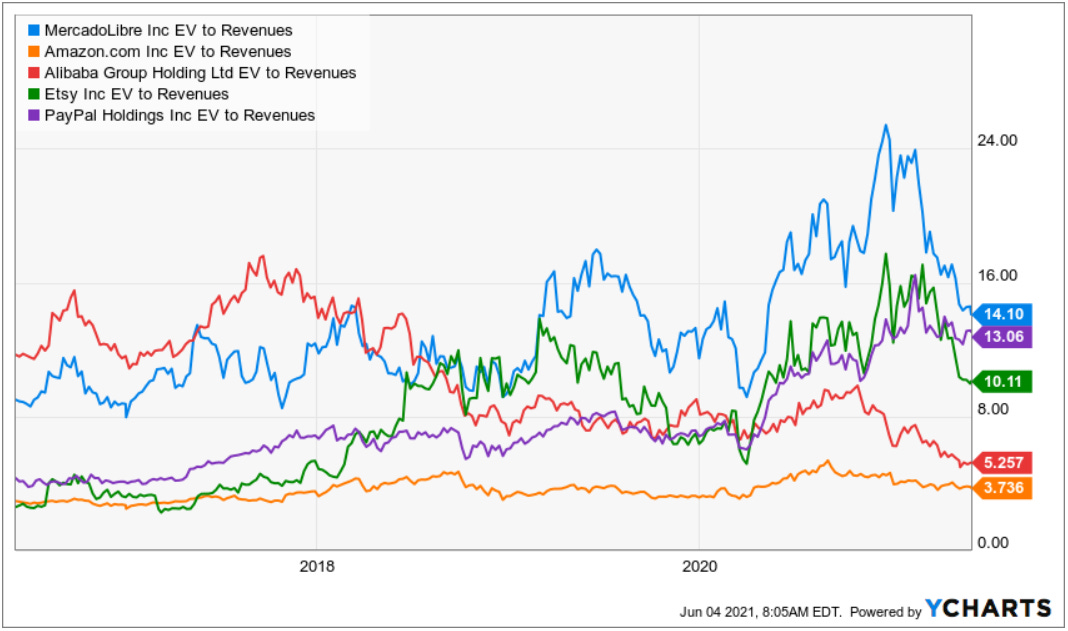

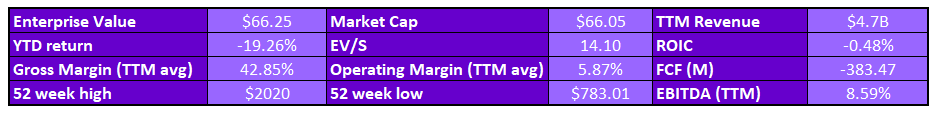

We will take a look at the valuation in more depth later on in the article, however just from an initial glance you can see the relative valuation between competitors is high, although has contracted significantly over the past several months.

This, combined with the steep increase in share price over the past 3 years (from roughly $300 in 2018 to the current price of $1324) has contributed to the relative overvaluation.

Slowdown in growth

The past year has been nothing short of a once in a life-time boom for e-commerce - the result of which being a boost in revenue of 70% y/y. It is unlikely this growth trend will continue at the rapid pace at which Meli shareholders are accustomed to, however with the large total addressable market available - there is still plenty of growth runway ahead.

High expectations, heavy investments, loss making.

Similar to the above point - expectations are high and the stock has appreciated considerably over the past year. Meli will have to continually demonstrate growth to rationalize their current valuation. They have invested heavily into building out their infrastructure and technology, and are at a pivotal point where they will have to start proving the justification behind these investments. Eventually they'll have to show their business model is sustainable and can turn a profit. There are a number of ways for the company to falter.

Competition

As mentioned in one of the earlier sections, competition within the region is heating up. And with entrants like Amazon, Alibaba and SEA ltd looking to get in on the action, the coming years could be tough for Meli - especially if the competitors decide to invest heavily within the region.

Over-reliance

94.2% of the 2020 consolidated net revenue figures came from a mixture of Brazil, Argentina and Mexico. Having a revenue concentration of too few geographical locations could prove to be a hindrance - especially if each of those countries operate at a high risk of political or economic turmoil.

8. Financials

Lets start by zooming out to look at the performance of Meli (as a stock) over the past 5 years. As we can see, when bench-marking against the S&P 500, Nasdaq, Amazon and Alibaba - MercadoLibre have outperformed each.

8.1. Revenues

Taking a snapshot of MercadoLibre isn’t an easy feat. Especially considering the breadth of operations over the differing countries and business divisions. Therefore, I think it will be useful to try to separate these out as much as possible.

But to start, lets look at overall revenue. On a TTM (Trailing Twelve Months) basis revenue has increased by 90% in one year, from $2.475B to $4.7B. And looking that on a quarterly basis, net revenues for Q1 were $1.4 B, a year-over-year increase of 111.4% in USD and 158.4% on an FX neutral basis. This looks healthy.

Covid has absolutely been a major contributing factor in the past year’s positive operating results, as more and more people have become accustomed to making purchases from the comfort of their own home.

e-commerce:

If we firstly look at the e-commerce aspect of Meli (Mercado Libre, Envios & Shops), we can see strong growth in overall volume of goods sold on the platform - indicating the investment in infrastructure starting to pay off as demand for Meli’s services increases.

GMV (gross merchandise value) grew to $6.1 Billion in Q1 2021, representing an increase of 77.4% growth on a USD basis, and 114.3% on an FX neutral basis.

MercadoLibre currently have about 25.4% of total Gross Merchandise Volume as a percentage of total retail e-commerce sales in Latin America.

In Brazil, the largest market, Meli doubled the number of items sold and nearly doubled GMV versus 2019.

This is somewhat expected, however it’s useful to note that 2020 was MercadoLibre’s strongest year (by far) for Gross Merchandise Volume, surpassing the $20B figure. An overall growth rate of 51% compared to 2019.

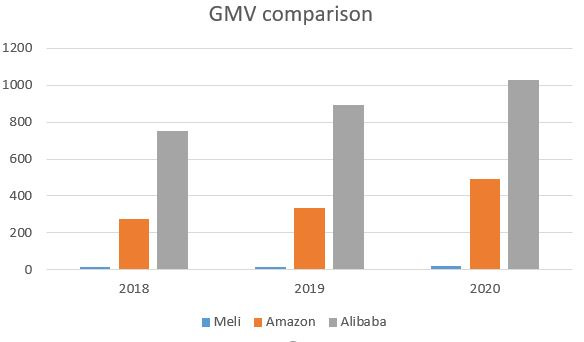

Interestingly, if we compare the GMV value to that of Alibaba and Amazon (although not really a fair comparison), we can see Meli still has a long runway ahead - considering the U.S. has half the population.

An additional way of looking at the e-commerce growth is to take a peak at Total Payment Transactions, which have grown by 115% in 2018/19 and 128% between 2019/20. This is a testament to the heavy investment into the Envios aspect of the business, which was a result of investment from paypal in 2019 (just before the pandemic - good timing!). For example, Mercado Envios shipped 208.1 million items during the first quarter, representing a 130.7% year-over-year increase.

All of these factors are lowering the delivery times, increasing the number of goods/services available on the platform, and thereby fueling the flywheel.

Fintech:

Secondly, if we take a look at the Fintech aspect of the business - Mercado Pago. We can see a business division doing very, very well.

Total payment volume (“TPV”) reached $14.7 billion, a year-over-year increase of 81.8% in USD and 129.2% on an FX neutral basis.

Total payment transactions increased 116.7% year-over-year, totaling 630.1 million transactions for the quarter - almost double the amount of transactions for the entirety of 2018.

Off-platform TPV grew 82.5% year-over-year in USD and 136.4% year-over-year on a FX neutral basis, reaching $8.5 billion.

As of Q3 2019, more transactions were made outside of the MercadoLibre marketplace than were taking place inside it.

8.2. Profitability

The profitability of MercadoLibre is a mixed-bag. On the one hand, the company needs to keep investing in S&M and logistics in order to grow and compete effectively, however at some point the company needs to start making consistent profit. And you would hope that, as the company continues to grow and the unit economics get better, profitability should be right around the corner.

From the below graph it is clear that as MercadoLibre have started their growth trajectory, gross profit has started to rapidly decline. Not exactly what we want to see.

Having said that, when we benchmark Meli’s gross profit with similar competitors, we can see a similar trend - and actually, their gross margin is currently the highest.

Overall, it looks like the majority of the large infrastructure investments are in the past, including a $440M share re-purchasing. “The company incurred $91 million in financial expenses this quarter, turning a very strong EBIT quarter into the red. However, the main driver of this is nonrecurring. We recorded a $49 million charge related to our convertible debt repurchase transaction. We also increased year-over-year tax payments from increased earnings in multiple geographies.” Therefore we should start to see a significant growth in profits from here on out.

In addition to all of this (and as mentioned before), the Forex fluctuations will add some level of turbulancy to their results, over and above a company operating within only the US market.

8.3. Operating costs

MercadoLibre’s operating income has been a mixed bag over the past 5 years - hovering somewhere between -$100M and +$100M on a quarterly basis. The past 12 months have been good for Meli, with $248M in operating profit compared to the previous years TTM value of -$193M.

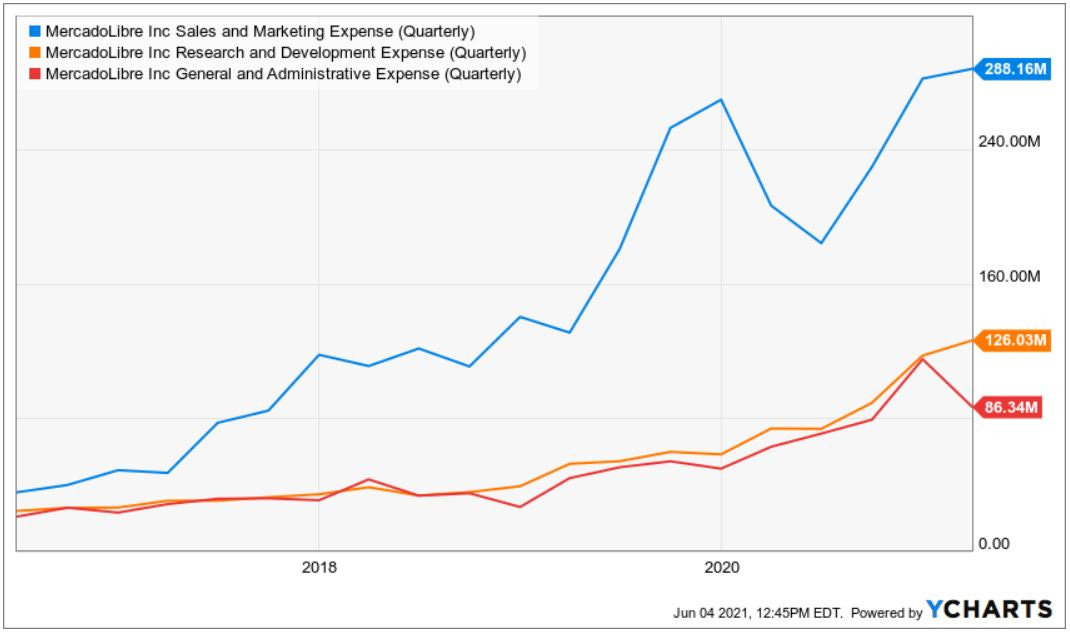

As we can see from the below chart, Meli have historically leaned on the sales and marketing as a lever for growth. Though we can see that this expense dropped rapidly as covid hit due to it not being a necessary expense.

“We decided to invest less aggressively on the marketing side to acquire new users. We decided to save those marketing dollars for later in the year where we hope these countries will be open.”

8.4. Balance sheet

Current assets = 3.9B

Total Asssets = 5.2B

Current liabilities = 3.2B

Total liabilities = 5.22B

Meli’s balance sheet at first glance looks generally fine - however the current assets don’t cover the total liabilities, which is always a cause for concern. If we look in slightly more detail we can see the increase in overall liability was mainly driven by an increase in loans payable (from $860M to $1.65B).

Unfortunately I cannot see the details of what exactly is included in the ‘loans payable and other financial liabilities’ section in the Q1 updates. I will be keeping an eye on the balance sheet for future quarters to see if this value keeps increasing.

8.5. Cash Flow

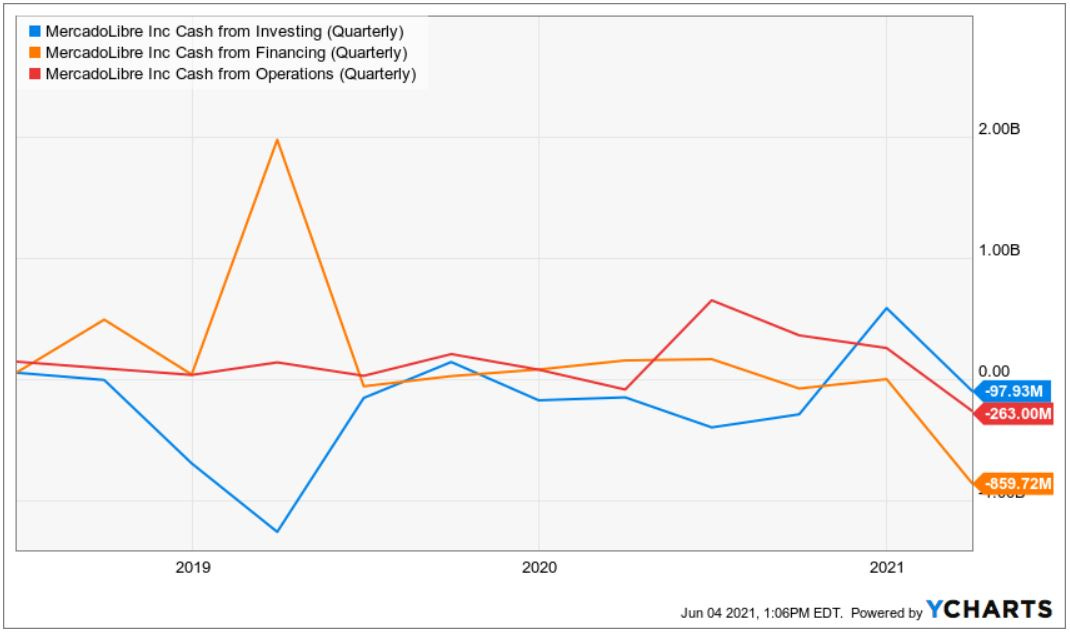

Meli have $1.18B in cash as of Q1 2021, an $80M decrease since the end of the previous quarter. This quarter has seen Meli burn through significant amounts of cash in all three areas - CF from operations, CF from investments and CF from financing.

The driver CF from operations were the ‘payables and accrued expenses’, and the ‘funds payable to customers and amounts due to merchants’.

The driver of the decrease in CF from investments was the ‘purchasing of property and equipment’ along with ‘changes in principal of loans receivable’.

The driver of the decrease in CF from financing was a $1.8B ‘Payments on repurchase of the 2028 Notes’.

Historically, Meli’s cash flow has been somewhat erratic, with no clear source of financing. Ideally, as Meli evolve from their hyper-growth stage into a more mature company I would like to see cash flow from operations be the primary source of income. I don’t see this happening on a consistent basis for quite some time as there is still plenty of growth ahead with significant investments to be made.

8.6. Valuation

As always, relative comparisons are hard and oftentimes misleading. No two companies are exactly the same. In this case I will use Amazon, Alibaba, SEA, and Shopify as benchmarks.

From the graph above we can see that MercadoLibre, although are not cheap, look to be a relatively good price in comparison to other players within the e-commerce industry. Also, their valuation has contracted significantly over the past 6 months - indicating now might be an attractive entry point.

The graph below also seem to indicate these next weeks/months as a good entry point, as the price has dropped below the 200day moving average.

*Firstly, Thanks for making it this far. If you would like to help support my writing, feel free to buy me a coffee via the link below.*

9. Conclusion

To conclude, as a company started by two guys at Stanford business school over 20 years ago, it would have been difficult to imagine the scale and complexity with which MercadoLibre operates today. In the process of building an e-bay replica for Latin America, the team at Meli have created an ecosystem that enables Latin America to take a leap forward with regards to economic empowerment.

MercadoLibre are set to be the primary beneficiary of the global trend towards internet adoption and therefore e-commerce. Latin America are currently about 10 years behind the U.S. with regards to these factors, so have plenty of runway to grow.

All of this is not without risk (and nor should it be). Political, economic and geographical issues, along with the introduction of powerful competition, raises significant question-marks over MercadoLibre’s ability to succeed - not just as a business, but as a stock. However, I believe Meli are best placed to dominate in the Latin American market and will be able to keep up their track-record of exceptional execution.

Cheers,

Innovestor

Alibaba, the biggest e-commerce company in China, generated about US$110bn revenue in 2020. Given that China is the biggest consumer market in many items and a unified market, it is unlikely that MELI can achieve US$100bn revenue? If that being the case, what do you think is the more achievable revenue target? What about valuation? Both Amazon and Alibaba are trading at 4-5x P/S now, SEA are Shopify are much higher but are they sustainable? Thanks!

Lots of good points - you are comparing Latin America to USA and while it is true that the population of the former is roughly double that of the latter, it is worth pointing out that the US economy is currently roughly 5 times larger; US gdp ~21 trillion vs Brazil+Mexico+Argentina+Columbia+Chile ~4.1 trillion.