Intro

Key Stats

Company Background

The Business

Nintendo are Unique

The Future

Risks

Financials

What to Consider

Conclusion

Intro

The past year has forced most of the human population to stay indoors due to the ongoing global pandemic, so even the most optimistic of Nintendo bulls couldn't have predicted as good a year as Nintendo had.

With the majority of the population hunkered indoors, Nintendo offered a route out of boredom - a way of connecting with your friends whilst basking in some top-tier nostalgia. Animal Crossing was a perfectly timed release, with the company selling over 31.8 million copies so far. In addition to this, over 80 million Switch units had been sold as of December 2020, making it the second best-selling console of all-time, only trailing the Wii. TTM revenue is up 29.2% y/y and operating profits are up 54.2% y/y, while the stock is currently trading 43% above where it was a year ago.

One of the fairly straightforward conclusions to draw is that more people will be spending their time gaming as there isn’t much else to do. We definitely saw this at the beginning of the lockdown with a huge spike in demand for consoles and their respective games (most notably the Nintendo Switch and it’s perfectly-timed introduction of Animal Crossing).

However, Nintendo isn’t just a gaming company - they are (or are aiming to be) an entertainment company. The strength in depth of IP lends the company nicely to a model more akin to Disney, where the whole is greater than the sum of the parts.

In this piece I will be taking a look at Nintendo’s history, why I think they are unique, and a brief exploration of some of the key financial metrics. This is by no means a thorough look at the underlying stock - but more of an overview as to whether $NTDOY is still a viable stock in 2021.

Key Stats

Number 2 gaming brand in the world (behind EPIC)

Some of the most valuable IP on the planet

Digital sales grew by 106% y/y

Ambitions to become entertainment company - not just gaming

In a list of the top 15 best selling video game consoles of all time, Nintendo holds 8 spots on the list

Super Nintendo world opened in Japan earlier this year with a date of late 2021/early 2022 for the US.

Partnership and undisclosed stake in Niantic - AR company

Company background

Founded in 1889 by Fusajiro Yamauchi, Nintendo is a popular and well loved Japanese gaming company. They started out only producing handheld playing cards (still sold to this day), however the company ventured into all kinds of different businesses before becoming a toy production company in the 1960s.

The real story starts in the 1970s, specifically in 1974, when Nintendo secured the rights for the Magnavox Odyssey video game console. This led it to becoming a full-fledged video game company that pioneered the video game craze of the 1980s. In1977, after the crucial hiring of Shigeru Miyamoto - Mario, Zelda, and Donkey Kong franchises were born. Over the last few decades, Nintendo has released multiple consoles and handheld devices, the most recent example being the Switch. As of August 2020, 63 million copies of the Switch have been sold, putting it on pace to be the most popular console ever.

And the rest is history. Nintendo has become one of the most well known and loved gaming/software/development company in the world - with a number of originally produced and developed consoles.

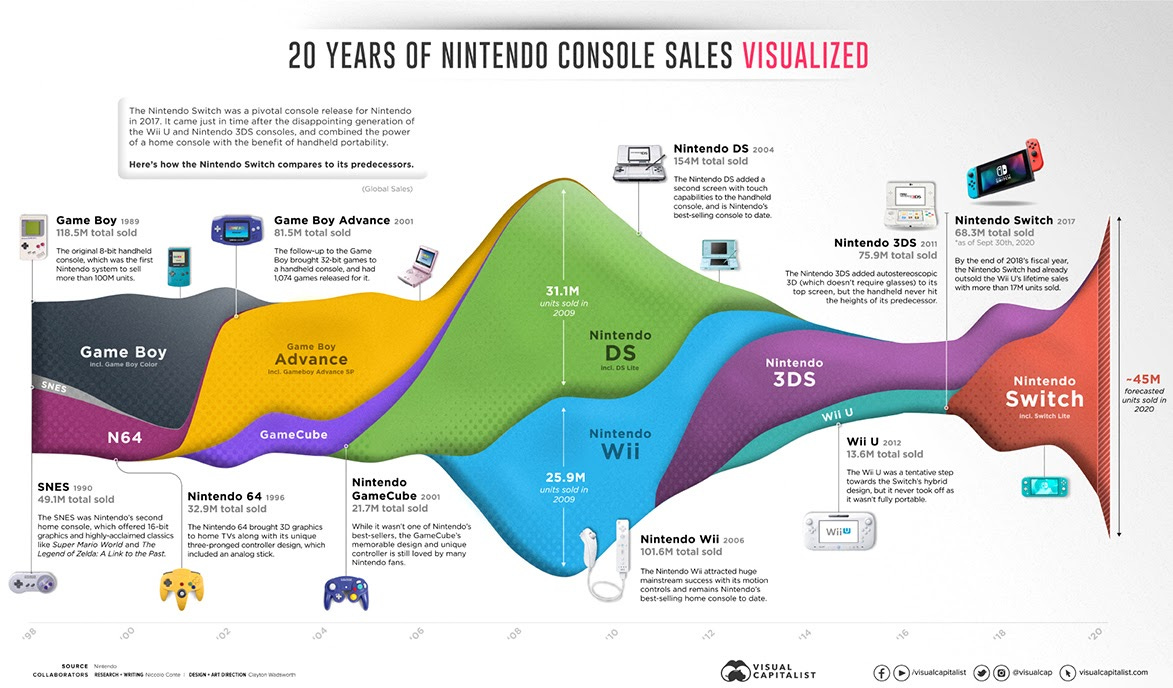

Above is an interesting graph depicting some of the interesting peaks and troughs for the company over the years. As expected, some consoles flopped (Wii U), whilst others represented the life-blood of the company for a period of time (Switch/Nintendo DS).

Below is a brief timeline of the different home consoles and portable consoles…

Nintendo’s Home Consoles

1977 – Color TV-Game

1985 – Nintendo Entertainment System (NES)

1990 – Super Nintendo Entertainment System (SNES)

1996 – Nintendo 64

2001 – Nintendo Game Cube

2006 – Nintendo Wii

2012 – Nintendo Wii U

2017 – Nintendo Switch

Nintendo Handheld Consoles

1980 – Game & Watch

1989 – Game Boy

2001 – Game Boy Advance

2004 – Nintendo DS

2011 – Nintendo 3DS

2019 – Nintendo Switch Lite

*A note on the recent history of the hardware:*

The Nintendo Wii software sales peaked in 2009. Fast forward to 2013 and we saw twice the amount of Wii consoles sold, however sales down 75% (all whilst PS3 and Xbox 360 sales were growing).

The main problem was the lack of take-up of the Wii from gamers. The learning was that the Wii console was essentially more of a novelty that didn’t have enough high-quality gameplay to keep consumers interested compared to the other consoles. Third party games were being bypassed from the Wii, meaning the content offering was relatively poor compared to the higher powered consoles.

First party software was good, and selling well due to being optimised for the console, however this was not enough to whether the storm of the next couple of years.

The willingness to innovate slightly backfired on Nintendo during this period, as the console ended up being under-powered (compared to the Xbox and Playstation) and had a relatively small selection of games.

Nintendo were fast losing ground to Xbox/Playstation, who were gaining millions of monthly subscribers for their live platform.

This whole period was actually destructive to profits and resulted in the company’s first ever operating loss in 2012.

After this, and the Wii U flop, the company launched the Switch. By the end of 2018 the Switch had already outsold the Wii U with 17 million units sold.

“While the Nintendo Switch sales success story came largely from how it unified home and handheld gaming, the console brought to fruition many of Nintendo’s strategies and technical decisions over the generations.

Many of the Wii Remote’s abilities are still present in the Switch’s Joy-Cons, with built-in accelerometers and gyroscopes for motion controls, along with the ability to rotate them sideways for a more classic controller configuration. The Nintendo DS’s touch screen permeated many Nintendo consoles and is still present in the Switch, and looking back at the Wii U’s tablet controller, it now seems like an early prototype for the Switch’s free-form portability.”

The business

Nintendo is a unique business in many ways. Just one factor is the business model. If we talk about the gaming industry we tend to have a bunch of different companies operating within distinct areas of competencies.

The brand:

The Nintendo brand (and IP) is notorious and well established in the gaming community. The infographic below - provided to me by @AlexanderHold (twitter) - nicely demonstrates the power of the brand and just how deeply ingrained the company is all over the world.

*note* EPIC games have an unrivaled popularity. “Epic is number one in 141 countries with a total of 4,716,375 global searches; Nintendo comes in second, and is top in 24 countries with 3,120,010 searches.”

1. Hardware:

In this category we have Companies like Microsoft and Sony who dominate the majority of the market. They produce hardware (Xbox & Playstation) alongside operating digital stores. Essentially they are platforms for game developers to be able to monetize their creations. These platform company’s goals are much broader than other typical gaming companies, in that they aim to maximise revenue across the entire gaming ecosystem.

2. Game publishers:

Examples of these include EA, Sony, Tencent and Activision-Blizzard just to name a few. These companies (or their respective divisions) focus mainly on financing the creation of games, alongside managing the marketing and distribution channels.

3. Production studios:

Game production studios are the people who actually make the game. Some examples of game development studios include Valve, Rockstar, EA, Ubisoft, Activision-Blizzard, Sega and Naughty-Dog amongst many, MANY others.

4. Game engines:

The game engines are the building blocks of most games. The majority of game production studios use either Unreal Engine (Epic Games) or Unity software to make their game. The standard monetisation model is to take a licencing fee based on how well the game performs.

Nintendo are special in that they operate in each of the first 3 categories - and are highly established. Fils-Aime, president and chief operating officer of Nintendo of America from 2006 to 2019, has alluded to the ambition of being an ‘entertainment company’ rather than a gaming company. Nintendo are competing for every spare minute in the day - this more closely resembles companies such as Twitter or Facebook who have entire departments dedicated to getting you to spend as much time on their platform as possible.

Matthew Ball nicely points out the individuality of the company with this quote: “Although Nintendo operates a hardware platform like Microsoft’s Xbox or Sony’s PlayStation, 85% of Nintendo’s software revenue comes from Nintendo’s own titles. This is the reverse of industry averages. This makes Nintendo a sort of fifth type of company. They make hardware so that its development arm can make the games it wants to make, which also happens to be hardware that other developers can distribute their games through, but mostly don’t.”

Nintendo's main segments of operations

Hardware video game business

This is the way most customers interact with the business. Nintendo have had a rocky history with the success of their hardware. However, the company keep innovating to come up with vastly differing ‘best-selling’ consoles.

Their dedicated video game platform makes up 96% of the revenues. 52% is from hardware, such as Nintendo Switch and Switch Lite, and 32% is from first-party software.

Digital sales makes up 18%. Digital sales are downloadable versions of packaged software, download-only software, add-on content and Nintendo Switch Online. Digital sales grew by 106% y/y.

Mobile gaming business

This is an area Nintendo have been dabbling with over the past few years but with limited success. You may be familiar with the recent Pokemon Go game, however this was mainly the work of AR company ‘Niantic’. Nintendo will be looking to increase exposure in this market over the coming decade as mobile gaming booms.

Nintendo’s IP outside of core gaming applications

Nintendo has some of the most well known IP in the world, with titles such as Mario, Zelda and Pokemon - just to name a few. The company’s ability to be able to monetize this valuable resource will be key to the continued success of the business and will allow the company some breathing space as they won’t need to wholly rely on the success of each new console.

Mobile and intellectual property income make up only 3%. Plenty room for growth.

Nintendo are unique

Nintendo aspires to be an entertainment company, not a gaming company.

“That time you spend surfing the Web, watching a movie, watching a telecast of a conference: that's all entertainment time we’re competing for. Nintendo’s competitive set is much bigger than its direct competitors in Sony and Microsoft. Nintendo competes for time.” - Matthew Ball

This is substantially different than Microsoft or Sony, who mainly focus on the gaming aspect, and not much outside of that.

The cross-cutting nature of IP.

Nintendo’s IP is some of the most valuable in the world - up there with Disney.

Nintendo’s Fils-Aime - “How Nintendo leverages these differing IP’s across a variety of entertainment platforms is how we're looking to grow the company… a belief that consumers will come back, maybe buy a Mario T-shirt, eat that Mario cereal, or buy a Switch, because of affiliation and affection they have with that IP.”

Contrary to Disney, Nintendo take a much more measured approach when it comes to IP deployment. Disney are constantly utilising their IP, oftentimes doubling down on the successful ones several times within a year. whereas Nintendo only tends to release one of their biggest IP for each console - no sequel games within console generations. That’s six major releases of top IP over the past 30 years.

That being said, Disney and Nintendo should not really be compared apples to apples as they are very different companies fundamentally.

Top selling hardware.

In a list of the top 15 best selling video game consoles of all time, Nintendo holds 8 spots on the list. This goes a long way to show how ingrained in our gaming culture Nintendo actually is.

Innovation.

Nintendo has focused heavily on hardware over the years where it may have made more sense to focus on high profit margin areas such as the software side (lower inventory costs etc.). Below is a list of notable Nintendo innovations:

Hardware

D-Pad

Analog stick

Rumble packs

Shoulder buttons

In-game avatars

First mass distribution of VR consoles

First mass distribution of motion-based consoles

Fully portable consoles

Content

Wii Sport, Wii Fit (motion-based)

Personalized avatars

The future

So where does all of this leave Nintendo?

Hardware to software?

Sales in the past have mainly been driven by incremental hardware releases and big game hits. As a method of sustained growth, it’s probably not the best strategy. What if one of these major releases completely flops( like the WiiU in 2012)?

The natural progression from observing other gaming companies and the market in general is that mobile is a much more effective (and growing) market. However Nintendo have been slow to get into the mobile gaming market, having only seriously started to invest in 2015.

Adapting to new business models is key, and Nintendo are not one to shy away from change. In order to compete with the major gaming companies, they launched Nintendo switch online subscription service. This allowed for a new, recurring-revenue stream which allowed them to add more frequent content. The result of this was an increase in digital sales from 12% of revenues in the first 9 months of 2019 compared to 18% for the same period in 2020.

These first signs of a shift from hardware to software should be noted by shareholders and seen as a step in the right direction.

Theme parks

Another striking similarity to Disney and their overall ‘ecosystem’ ethos is the want to deploy their IP in physical locations. The company is underway with its first-ever theme park in Japan, and has one on the way in the US.

While Nintendo’s development team can prepare for their next console with a bit more financial breathing room thanks to the Switch’s superb sales, the company has been working hard to broaden its audience. The physical toys for younger audiences help capture a new generation of Nintendo fans, while older generations of fans will be excited to visit Super Nintendo World and indulge in nostalgia while introducing Nintendo to their children.

“Super Nintendo World, as the new land is known, was no small undertaking. It first arrived in Universal Studios Japan on Thursday, March 18, 2021, costing some $578 million – about $120 million more than what Universal is said to have spent on The Wizarding World of Harry Potter – Diagon Alley. It’ll next open at Universal Studios Hollywood, presumably in either ’22 or ’23, before landing in Epic Universe, the upcoming fourth park at Universal Orlando Resort, in early ’25.

In order to realize the theme-park version, Universal employs a whole swath of technologies: physical sets, projection-mapping, video projections, and a pair of augmented-reality goggles, which is how riders are able to collect – and use – the turtle shells during the race. Each ride vehicle sports four seats, and each of those seats comes equipped with a pair of the AR glasses and a steering wheel – meaning that every passenger gets a turn at driving.”

Augmented Reality:

Interestingly, one of Nintendo’s largest IP successes over the past decade (in Pokemon Go) was not directly a result of Nintendo itself - rather Niantic, an augmented reality development company. It is rumored Nintendo own roughly 20% of a stake in Niantic, therefore Nintendo have been somewhat exposed to the recent boom in the popular AR game.

The rise of augmented reality is something I have mentioned in previous articles. To keep it simple, augmented reality represents an immense opportunity over the coming years in almost all industries. In my Vuzix article, I outline the potential the industry has…

Grand View Research estimate AR market size to be $17.67 billion in 2020, expanding at a CAGR of 43.8% to 2028 to reach a value of $323 billion.

Mordor Intelligence estimate AR market size in 2020 of $1.98 billion, with a CAGR between 2021 and 2026 of 151.93% to achieve $506 billion by 2026

Fortune business insights estimate AR market size in 2019 of $2.82 billion with a projected CAGR of 48.3%, taking the 2027 value to $65.22 billion

Getting into Augmented Reality seems like a smart decision when looking at Nintendo’s recent partnership with Niantic to create new mobile apps combining Nintendo’s characters like Mario and Donkey Kong with Niantic’s augmented-reality technology. This new game, named ‘Pimkin’, is set to hit the app store sometime in 2021 and will be ‘walking-based’ (similar to Pokemon Go).

Niantic were reportedly valued at $4B in 2019. So with the fact that Nintendo own a material stake in the company, and the industry is predicted to grow exponentially over the coming years, then I wouldn’t be surprised to see Nintendo benefiting from this underlying trend.

Risks

Mobile gaming

Mobile gaming makes up a staggering 50% of the $160B gaming industry. Despite this, only 3% of Nintendo’s revenue came from mobile.

“Fire Emblem Heroes, the closest Nintendo has to a mobile hit, grossed $154 million in 2019, while Super Mario Run pulled in a genuinely pathetic $7.5 million. Compare this to Tencent's Honor of Kings, which brought in $1.7 billion over the same period, while Fornite grossed $407.1 million on its app alone. Given Nintendo's demonstrable excellence in creating games for the Switch, the lack of attention paid to mobile gaming cannot be read as incompetence, but disinterest.”

In the nine months ended Dec. 31, the company's revenue in its "mobile, IP, and other" category was just 42 billion yen (less than $400 million), or 3% of Nintendo's overall sales for the period.

Halfhearted attempt at streaming

“While Google and Amazon have moved aggressively into gaming with cloud-based offerings, Nintendo only began dabbling with the format in 2018. It has remained undefined and small since then, with the service only opening up in the US this October. The company had yet to enunciate its ambitions with the technology.”

Cautious expansion of IP

“Nintendo's reluctance to leverage its formidable IP base has left it playing a game of catch up. That the company has not attempted another Mario Bros. film since the live-action debacle of 1993 reads less like judiciousness than fear.”

Focusing on hardware

The focus on hardware innovation over the decades has my full respect - however this can also be seen as somewhat of a weakness in terms of the ever-changing landscape of gaming. I believe in the coming years, Nintendo will need to focus less on hardware if wanting to keep up with the pack. I could be wrong.

Financials

These financials will be fairly light touch - as I am anticipating the full year results in early May, so I will wait for those and provide an update.

$69.28B market cap

Revenue grew from $5B in 2015 to $12B in 2020 (CAGR of +19%)

Revenue for the first 3 quarters of FY 2021 amounts to $13.28B (already beating 2020 numbers)

Operating margin of 26%

Dividend yield of 2.64%

Net income increased from $382M in 2015 to $2.38B in 2020

The past 5 years has been positive for Nintendo finance-wise. The company has seen revenue grow from $5B in 2015 to $12B in 2020 - representing a CARG of over 19%. This is impressive considering the fact that Nintendo are a firmly established company. Most of this growth is mainly down to the popularity of the switch console (2017).

March 2020 to Dec 2020 has seen revenues of $13.28B, which is encouraging seeing as these figures already have eclipsed the prior full financial year.

Operating margins are seriously impressive, increasing from 4.5% of revenues in 2015 to 27% in 2020. The question remains around whether Nintendo can maintain these levels in the coming years. 2020 was a particularly good year, so I wouldn’t be surprised to see this number reduce slightly.

Balance sheet

Nintendo’s balance sheet looks healthy as it stands - with $22.57B in total assets, $18.64B of which are current assets. Liability-wise, the total stands at $5.74B with current liabilities at $5.30B

This indicates a strong cash position, mainly driven from the sales of the Switch over the past decade. It also shows that Nintendo has ample cash if needing to liquidate, as the current assets can pay the total liabilities 3.25X times before total liquidation.

Valuation

Comparing Nintendo to other gaming companies

Below I have attempted to compare Nintendo’s Enterprise Value/EBITDA between some of the main public gaming companies with the most comparability. Sony, for example, has many operations outside of gaming so is not completely comparable.

Comparing Nintendo to Disney

Secondly, I think it’s interesting to be able to compare Nintendo to the other major IP player with a similar mission ‘to be an entertainment company’ - Disney. Again, I am using the EV/EBITDA ratio.

From both of these examples it looks like Nintendo’s valuation is significantly below the industry average. To me, it doesn’t seem like the market has factored in the potential upside over the next decade, so this could be a very attractive price if you are confident the company has the ability to use their strong brand & IP to move into new markets.

What to consider…?

I always try to ask myself some questions to ponder before I make a full decision as to whether I should invest.

Can Nintendo continue to launch new and innovative games for the traditional console business?

Can Nintendo move fast enough into mobile, digital gaming, and other forms of entertainment using its beloved IP?

Are Nintendo likely to see success with the theme parks over the coming years as the pandemic’s grip on the world loosens?

Can Nintendo use their (so-far successful) relationship with Niantic to make a splash in the Augmented Reality market?

Most of these questions don’t have a definite answer, however serve as a useful tool in order to critically examine your thesis on the stock.

Conclusion

Nintendo are a company we all know and love. The staple games were part of most of our childhoods. And as for the stock, the company has a tonne going for it…

Top Selling consoles

Most popular games/IP ever

Popular brand

Greater aspirations than just gaming

History of innovation

Theme parks on the horizon

Dipping toes into new markets (AR)

On the other hand, there are some inherent risks with the company, which you should be aware of before deciding to invest…

Poor mobile gaming performance to date

Possibly outdated business model relating to hardware

Slow to utilize their IP

Overall, I think the valuation of the stock is reasonable given the significant growth opportunities over the coming decade combined with the historical success.

One key lesson from the past several decades is that high-quality IP is more valuable and extensible than ever believed before. My opinion is that Nintendo have been waiting on the sidelines, carefully observing Disney’s movements and are more-or-less ready to follow suit now that the potential upside is evident - this can be seen with the move into theme parks.

On the other hand, Nintendo seemed to be glued to their old ways of operating - avoiding the obvious move to mobile gaming, halfheartedly getting into streaming and cautiously extending their IP.

I am aware that part of this gingerness is somewhat the innate character of the company. It is not in their nature to jump into anything without being fully invested. However, in order to keep up their pace of growth, the company will need to seriously consider how they utilize the valuable IP lying at their fingertips.

Nintendo are much more than just a gaming company. If there is one sentence to describe Nintendo - “they are typically late, but usually right”.

Cheers,

Innovestor.