Welcome to the 90 new readers who have joined us since the last article! If you aren’t already subscribed, join the community of 1,324 investors by subscribing here:

Key highlights

Intro

Business

Tesla Vs Nio

Deliveries

Innovation

Bull case

Bare case

Financials

Conclusion

1. Q1 Key highlights

Global chip shortage dampening deliveries for first half of Q1.

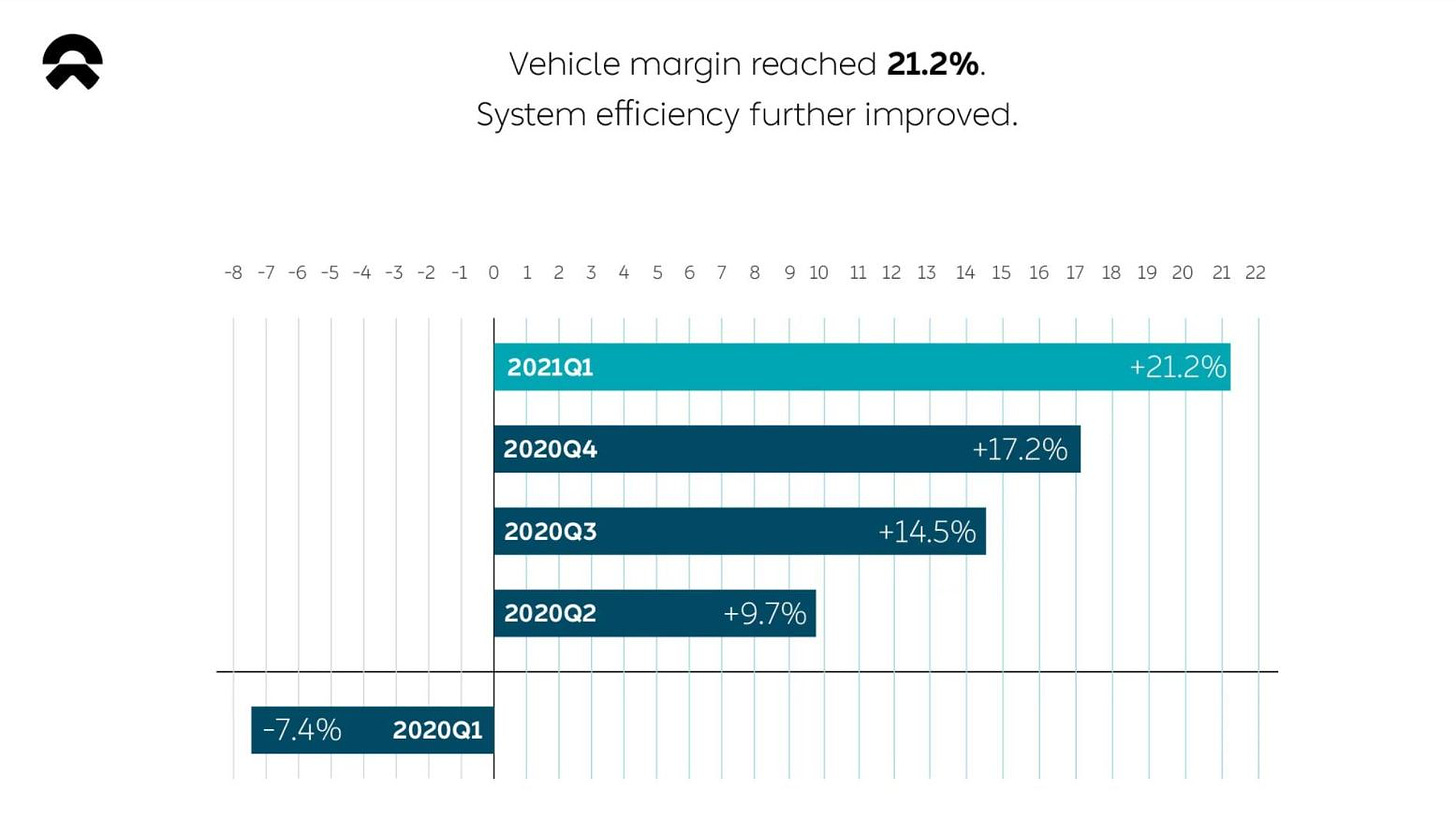

Q1/21 financials showed surprising strength in vehicle and gross margin, pointing to an ability to increase operating efficiency at scale amid headwinds (chip shortage).

Beating Q1 delivery guidance with 20,060 units

NIO customers used Nio Pilot for a total of 62,417 hours - up 278% y/y

Expansion into Norway in September

Expectations to enter 5 more European countries next year

2. Intro

Before we get into this one, it’s important to point out that with young Chinese growth companies like NIO, there are some inherent risks. Not simply because the company is Chinese-based and operates with a different set of inherent risks, but more the fact that they are competing within an industry near the beginning of it’s growth trajectory. The Electric Vehicles industry is a complex industry, and one that is filled with competition and conflicting interests. It’s entirely likely only several EV car manufacturers end up ‘winning’ in the long-term.

3. The business

NIO are a Chinese smart electric vehicle company operating at the premium end of the market. They are currently based in Shanghai, with expansion plans currently in-place in the US, UK Norway and Germany. The name translated in Chinese (Weilai) means ‘Blue Sky Coming’, which is said to outline the company’s commitment to environmental change.

Nio design, manufacture and sell electric smart vehicles, and have 4 main models produced on a large-scale – the ES8, ES6, EC6 & ET7.

Normal EV’s contain batteries which, when drained, will need re-charging. The problem is, this tends to be fairly time-consuming. For comparison, it takes less than 5 minutes to fill up a regular car vs the roughly half an hour it would take to fill up a Tesla at a normal charging station.

This is where NIO comes in. They are pioneering battery swapping technology which will allow users to reach full charge in about 1/3 of the time as it would take to charge at a charging station. This is achieved by operating various battery swapping stations throughout a city where the user would simply drive up, leave the swapping station to do it’s thing, then 10 minutes later have a completely new battery in their car at 100% charge.

And cost-wise, it’s fairly inexpensive. Firstly, you can buy the car with or without a battery. If you buy without, you have the ability to rent a battery from NIO at a low cost. And secondly, the battery swapping service is free for the initial owners of the car - then the subsequent users can purchase the energy they use when re-charging (just like with electric charging stations).

For this plan to be feasible, it seems necessary to have a high number of battery swapping stations in each city, however it’s not quite there yet.

Up until now, NIO has deployed 193 battery swapping stations, 134 supercharging stations and 327 destination stations across China. It has also given access to over 380,000 third-party charging piles.

Additionally, and to help with the number of battery swapping stations available, Nio offers a fleet of rescue vans with built-in chargers. These vans will meet you wherever you happen to be, in case you run out of battery whilst not being near a swapping station.

4. Tesla Vs Nio

I am aware Tesla aren’t directly comparable to Nio, however it’s interesting to compare & contrast the two companies - especially as they both operate within the same overarching market.

Batteries

As mentioned above, Nio buyers have the choice of whether to buy the car with a battery or without. Purchasing without makes the car more affordable. For context, roughly 1/3 of people buying Nio cars will choose the option to buy without the battery and rent the battery at a lower cost over a longer period of time.

Price

The result is is that Nio are therefore able to undercut the price of the comparable Tesla Model. For example, lets take Nio’s cheapest car (the ES6) and compare it to the equivalent Tesla model (Model Y). You can buy an ES6 in China for roughly the equivalent of $42,000, whereas you should be able to pick up a model Y for about $39,000.

Then, if you take into account the cost savings from choosing the ES6 without the battery, you would be paying roughly £7,700 less - resulting in a lower initial cost by roughly $4,700.

Range

Tesla claims the Model Y will do 314 miles on one charge according to the latest tests. While Nio says the ES6 can top 380 miles - however these figures are from an older type of test, so not quite as reliable. Realistically, the ES6 could probably do about 300 miles in normal driving conditions.

From carwow.co.uk…

“Tesla claims the Model S Long Range can do 412 miles on a charge according to the latest WLTP tests, and the Plaid + can do more than 520 miles. If you convert these numbers into NEDC figure (like Nio uses) that’s getting on for almost 600 miles of range. But, Nio claims the ET7 can go even further – it reckons that top-spec cars can do 620 miles between charges. That’s more than most petrol and diesel cars can do without a fill up.

Part of the reason the Nio ET7 can go so far is because its 150kWh batteries are some of the largest fitted to any electric car you can buy. And, when you chuck in a bigger battery you get more range – it’s as simple as that.

So, what’s stopping Tesla from putting an even larger battery in the Model S. You know, to show Nio who’s boss? Put simply, bigger batteries take longer to charge. It’s just like giving a car a bigger fuel tank – you can drive further, but it takes longer to fill up.

And this is where Nio has the edge. Because, no matter how big it makes its batteries, they still take pretty much the same amount of time to swap. So, when you run out of juice you’ll be ready for another 620 miles in as little as three minutes.”

Speed

The new ET7 is the Nio equivalent of the Model S - an upmarket saloon promising the longest range, fastest motors and the best tech. The quickest version of this car will do 0-60mph in 3.9 seconds. Just as quick as the new BMW M4 Competition, but still significantly slower than the latest Model S Plaid, which can do 0-60mph in 1.99 seconds.

The fastest ‘Performance’ version of the ES6 has 550hp and it can do 0-60mph in 4.7 seconds. There’s also a coupe version called the EC6, which is even faster. It does 0-60mph in about 4.5 seconds, which is only a second slower than the fastest Tesla Model Y Performance.

Summary

“Nio has has reach the 100,000 car deliveries number, and done more than 2,000,000 battery swaps. It’s just launched its fifth new car since 2014, meaning (on average) it releases a new car every 18 months. Tesla has been around for more than 13 years and it’s only launched 6 different cars in that time: the original Tesla Roadster, the Model S, the Model X, The Model 3, The Model Y and the Cybertruck…”

5. Deliveries

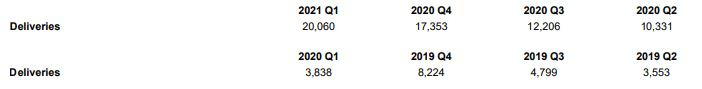

7,102 vehicle deliveries in April. 125% increase y/y. Considering the five day production shutdown and chip shortage - this is not bad at all.

20,060 deliveries in Q1 2021, a 422.7% increase y/y.

TTM (trailing twelve months) deliveries totals 59,950.

This beats the previous years TTM deliveries number of 20,414 - a 193% increase in vehicles delivered.

If we look at the predicted numbers for this year, they are on course to deliver about 80,000 cars if the growth remains flat. However, if the second half of the year sees a pick-up in the global supply of chips, we could see a NIO boost delivery numbers in Q3 & Q4 - pushing the 100k figure.

Q2 will still likely be impacted by the global chip shortage, but the company can still take orders. They are also backed-up with ET7 deliveries - which gives me even more reason to believe NIO can reach that 100k figure.

6. Innovation

NIO are innovating aggressively and, in doing so, are offering something distinct.

Suite of charging solutions (‘NIO power solutions’):

Power Home and Power Home Plus for ‘home changing solutions’ - standard and ultra-speed home chargers where practical for users.

Power Swap – Innovative battery swapping stations offering battery swapping service within minutes. As of October 31, 2020, NIO had 158 Power Swap stations covering urban areas and expressways across 70 cities.

Power mobile – charging trucks offering rapid charging for 100km range within 10 minutes. As of October 31, 2020, NIO had 318 Power Mobile charging trucks.

Power Charger – reliable fast charging piles located in parking lots and other locations easily accessed by users for them to locate, use and pay for through the NIO app. As of October 31,2020, NIO had approximately 701 Power Charger piles in operation, covering 52 cities, and provided over 440,000 one-click power services.

Power express – 24 hour on-dmand pick-up and drop-off charging service

Access to the nationwide charging network consisting of over 390,000 publicly accessible charging piles.

Battery as a Service Model (BaaS) – allows users to purchase electric vehicles and subscribe to usage of battery packs separately. Essentially you can purchase the car without the battery pack and subscribe to a battery, even upgrading later down the line. Lower initial cost for consumers.

Autonomous Driving - NIO are pioneers in automotive smart connectivity and enhanced Level 2 autonomous driving. NOMI, which is believed to be one of the most advanced in-car AI assistants developed by a Chinese company, and is a voice activated AI digital companion that personalizes the user’s driving experience.

In early January, Nvidia & NIO announced a partnership which will offer advanced automated driving capabilities.

“The cooperation of NIO and NVIDIA will accelerate the development of autonomous driving on smart vehicles. NIO’s in-house developed autonomous driving algorithms will be running on four industry-leading NVIDIA Orin processors, delivering an unprecedented 1000+ TOPS in production cars,”

7. The bull case

Strong brand

Constant innovations such as BaaS

Strong management

China is by far the world’s largest auto-market.

Their only real competition in the luxury EV market is Tesla. I’m not sure we could even count Tesla as a direct competitor.

Global expansion into Europe.

They seem to have major government support as well as what seems like unlimited funding from tech giant Tencent.

Speculation, but there is maybe potential for a robo-taxi fleet somewhere down the line.

NIO are pretty much doing all they can to create a competitive advantage within a market that will likely be filled with competitors with deep pockets over the next 10 years.

7.1. The Brand

7.1.1. Are Nio too important to fail?

“This is the first chance China has to establish an entry-level luxury brand. Can the company be allowed to fail? This is the marriage of militarized state manufacturing on one hand and big tech software/battery development on the other.”

7.1.2. Brand positioning

It could be argued that vehicles, just like smartphones and other pieces of technology, are statements about your status or personality. Essentially, these objects represent who you are and presents a signal towards others as to how you would like to be perceived.

As a luxury brand, Nio are positioning themselves next to the likes of BMW and Audi - at least, this is how the CEO (Li) sees the main competition. The company are building a brand people want to identify with.

An interesting statistic: “During the first nine months of 2020, luxury cars outperformed mainstream models in the US market. The market share of luxury models increased to 44.3% in 2020, from 40% in 2019”.

Tesla’s aim is to lower the price of their cars steadily over time, whereas Nio’s aim is seemingly to target the higher-end ‘luxury’ market - taking advantage of the increase in demand for this type of vehicle.

The brand has several similarities to Apple:

Sequential (simply named) models - EC6, ES6, ET7 & ES8

Convenience oriented - Battery as a Service (BaaS).

‘Nio Houses’ - Similar to Apple stores in appearance

Aiming for high-ticket ‘luxury’ customers

General focus on ‘community’

As a strategy within China, I think this will work well. Especially considering China has one of the fastest growing ‘upper-middle’ and ‘upper’ class groups.

7.1.3. Nio Day

Great marketing strategy with the goal of releasing new models each year.

“We held our first “NIO Day” in December 2017 at the Beijing Wukesong Arena, where we introduced the seven-seater ES8. We launched our second volume manufactured electric vehicle, the ES6, to the public on our second “NIO Day” in December 2018. Our first two NIO Days consisted of presentations by our Chief Executive Officer, Bin Li, who introduced our ES8 and ES6, respectively.

We plan to hold NIO Day each year on which we introduce our new vehicles and products to users.

We launched the ET7, a flagship premium smart electric sedan, at our fourth NIO Day on January 9, 2021. The ET7 features NIO’s latest NAD (NIO Autonomous Driving) technology including NIO Adam, a super computing platform, and NIO Aquila, a super sensing system. We will begin making deliveries of ET7 in the first quarter of 2022”

7.2. Battery as a service (BaaS)…

Battery as a service is a simple yet effective idea. As mentioned earlier in the article, Nio users can drive into a battery swap station with a low/dead battery and have it replaced by a fully charged one in a matter of minutes. The next version of these battery swapping stations will make it possible for the user to stay inside their car whilst the swap is taking place. It is estimated to perform up to 312 swaps per day.

BaaS is a key element to Nio’s overall strategy, so they need to get it right. A key element of the business model is the ability to be able to purchase a car at a reduced rate - because of this, the Battery as a Service element needs to work well and be accessible/convenient. Therefore increasing the number of these stations is key, and definitely something to keep an eye on with regards to meeting targets.

Nio recently partnered with Sinopec Shanghai Petrochemical Company Ltd (a state-owned oil and gas company). The intention is to build more battery swap stations. Sinopec stated that they aim to have 5,000 battery swap stations in their network by 2025, as they aim to transition to a higher presence in electricity and non-oil business. Nio is targeting 500 battery swap stations by the end of 2021.

Competition

Tesla tried battery swapping in 2013, however left the idea behind when they decided to focus on the superchargers/giga-factories.

It’s not wholly clear which method of charging will be the most efficient, as more and more people adopt Electric Vehicles the economics of charging will surely change. There are upsides & downsides to both, which this Quora thread is useful at highlighting.

In addition, a handful of companies around the globe are trying to deploy similar systems. For example, Blue Park Smart Energy, a competitor in China with government influence, is doing something similar. In addition, American start-up Ample, have started operations in California, catering for fleet vehicles.

Overall, there is still a long way to go in the race to see which method of EV charging works best. Maybe, eventually, it will be a mixture of both. Nio are doing a good job in innovating within this category. If they can establish themselves as the leader in BaaS technology/infrastructure, then it’s possible they could supply other EV’s (already seen somewhat here with Ford).

7.3. Strong Management

NIO's CEO went to one of the highest-regarded Universities in China - Pekin University, majoring in sociology. Li started his first business at 21, then not long after joined Bitauto Holdings Ltd - a portal providing consumers with in-depth information about cars. He was the CEO there for 8 years, during which time the company went public. In 2014, Li started NIO.

It’s a broad-brush assumption that American companies are the ones innovating with cutting-edge ideas, while the Chinese can only compete in lower production costs through cheaper labour. However, the Chinese culture rewards entrepreneurship maybe even more-so than the US - shown by the fact that Beijing now has the most billionaires in any city in the world.

Understanding the customer is key, and Li seems to get this. His history speaks for itself, and he has been busy meticulously growing Nio over the past 7 years from the ground up. This is something I love to see.

7.4. China is the world’s largest auto market

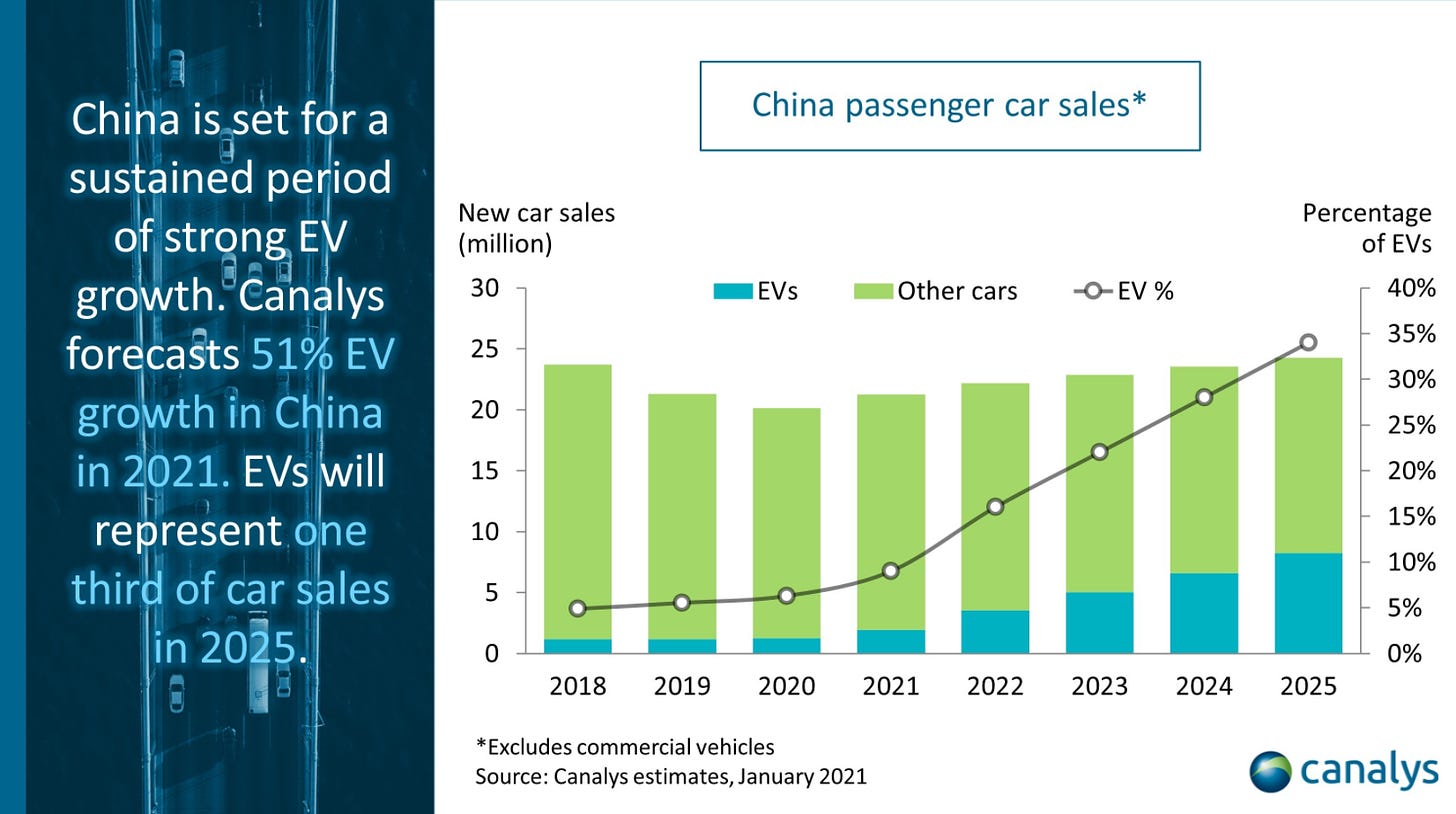

It’s no secret China is one of the biggest EV markets in the world, alongside being the largest overall automobile market globally.

Due to a want/need of government to reduce emissions - politicians and high-up government officials have expressed the need to increase the amount of EV’s on the road. China has one of the worst pollution outputs in the world, and this is one way of tackling the problem.

In addition, China’s middle class is (and has been) one of the fastest growing group over the past 10 years. These underlying factors will almost certainly result in large levels of demand for products like Nio’s.

The demand for the global electric vehicle market is projected to value at $1,212.1 billion by 2027, according to a new report published by Million Insights, with a CAGR of 41.5 % from 2020 to 2027.

The global electric vehicle market was valued at $162.34 billion in 2019, and is projected to reach $802.81 billion by 2027, registering a CAGR of 22.6%.

Pune, India estimate the global electric vehicle market to reach $985.72 Billion by 2027, exhibiting a CAGR of 17.4% during the forecast period.

We are at the beginning of an Electric Vehicle revolution over the coming decade, which will continue for much longer due to a variety of interconnected factors.

1.3M EV’s were sold in China in 2020 - representing roughly 40% of the global EV market. This figure is expected to increase by 50% in 20201…

As mentioned earlier, the chip shortage will likely have a dampening effect on the deliveries of EV’s in the short-term. However, demand is likely to continue to increase in the long-term, with low estimates of 60K deliveries, target estimates of 80K and bull-case estimates of 100k deliveries in 2021.

Another point to be aware of is that Asia and Europe markets account for 74.8% of the TAM in 2019. This puts NIO in a good position to be able to solidify their position as a market leader in the Asian markets whilst also expanding into Europe (specifically Norway).

Nio has a large runway for growth if the company can continue to expand and innovate over the coming years. It seems like there is plenty of opportunity within the Chinese market to reach a growing user-base.

To illustrate this, Nio’s TTM Revenue currently sits at $3.4 Billion, whilst Tesla’s TTM revenue sits at $35.94B - demonstrating the potential room for growth within this market.

7.5. Expansion into Norway

As briefly mentioned above, Nio are beginning to expand into Europe - beginning with Norway. I’m not sure there’s too much to be said at the moment, however this is something I will be keeping a close eye on, as it could be key to the company continuing to expand the brand.

Here is the recent Norway launch event, if you would like a flavour of what is to come.

8. Bear case

Even though there is much to be said about the positives surrounding Nio and their business-model, It’s also important to be able to recognize the potential shortcomings and risks… of which there are many.

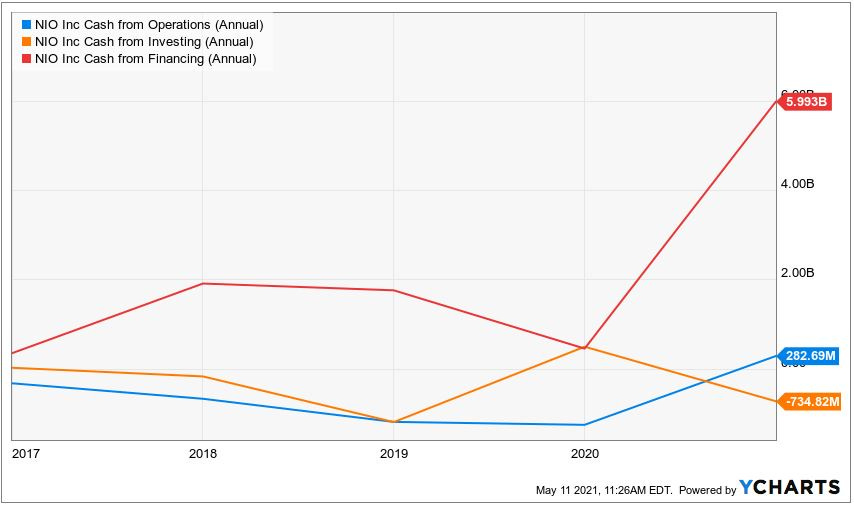

Nio are yet to be profitable and continue to burn through millions every quarter.

For a company still in the growth phase and looking to expand - this is normal. However they can’t keep this up forever, so will need to improve their cash flow from operations at some point soon, which they have been doing recently.

I will be following this quarter by quarter.

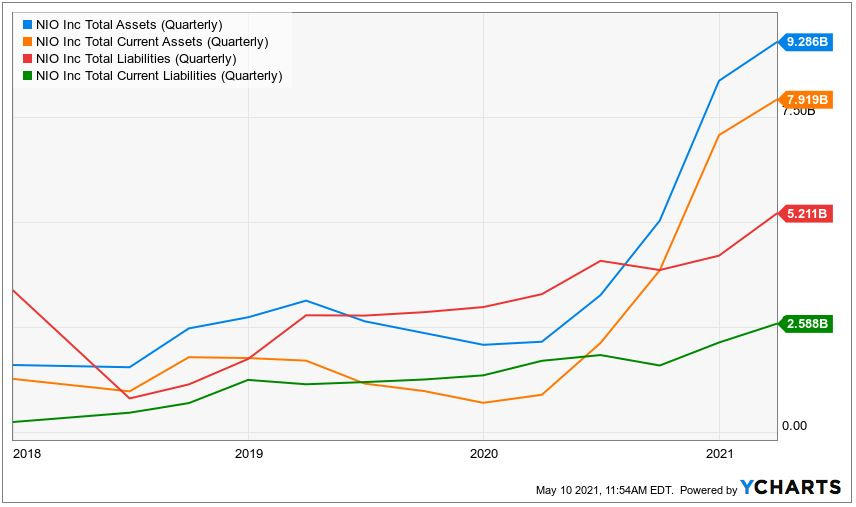

Their liabilities have been steadily expanding since mid 2018, from about $1B to about $5B. Long term debt also continues to grow at an alarming rate.

History of management using share dilution techniques to raise funds.

Very likely to continue to use this method in order to cover losses if they can’t reach positive operating profit within the next 2 years.

The global chip shortage is still ongoing

This could significantly impact Nio’s short-term targets, which is likely to impact the stock price over the short-to-mid term.

Question as to whether excessive spending on marketing assets like ‘Nio House’ is worth the investment at a time where the company is trying to grow

You could argue the introduction of elements such as Nio House are key to building a solid community of loyal customers.

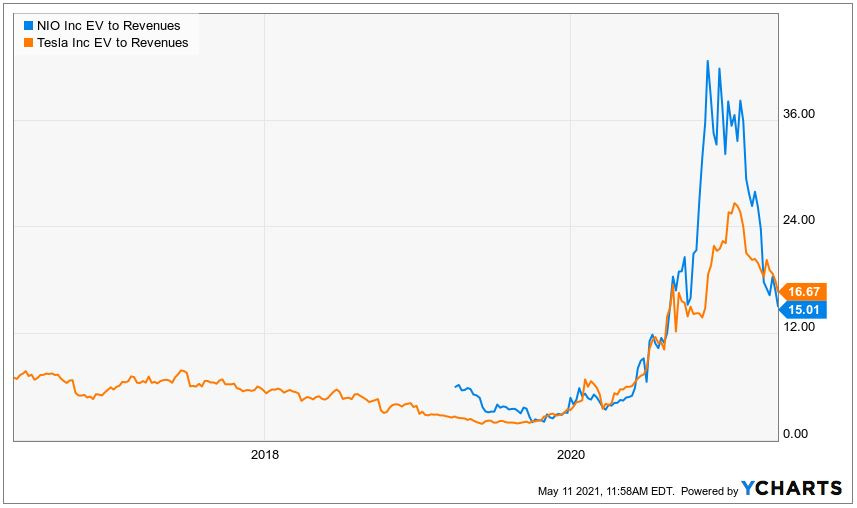

The stock is expensive.

However recent pullbacks have lead to a more attractive price.

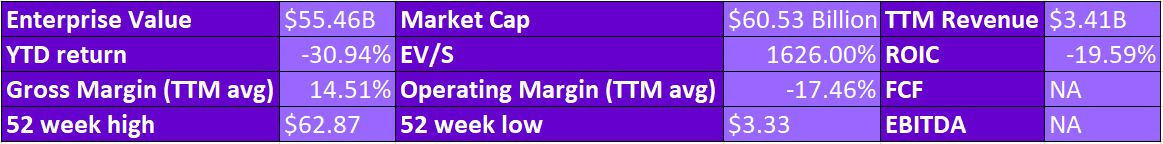

Nio are currently trading at an EV to Revenues of 15.01 compared to the end of 2020/beginning of 2021 where the company was trading at around 40X.

For reference, Tesla, has been trading at more conservative EV/Rev multiples, however Nio has only recently began to dip below.

9. Financials & valuation

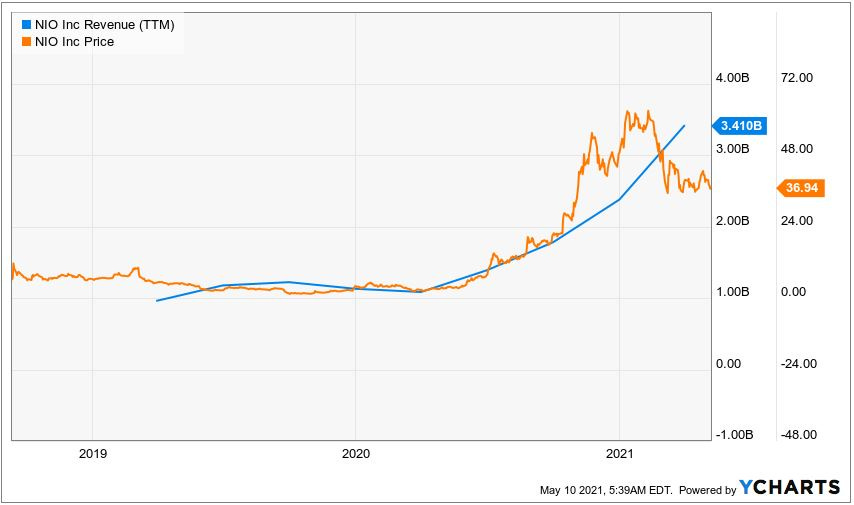

The past 2 to 3 years has been a wild ride for NIO.

As Electric Vehicles have been propelled front-and-center, the Chinese-based EV manufacturer has experienced a huge spike in demand for their product, leading to exponential growth. The simplest way to highlight the level of growth is by looking at the share-price alongside the TTM Revenue.

On Feb 10th 2019, the share price was sitting at $3.87 before shooting up to an all-time-high of around $62 (a 1502% increase).

Similarly, Q1 TTM revenue in 2019 was $961M, $1.084B in 2020 followed by $3.410B in 2021. Representing a 13% and 215% increase respectively.

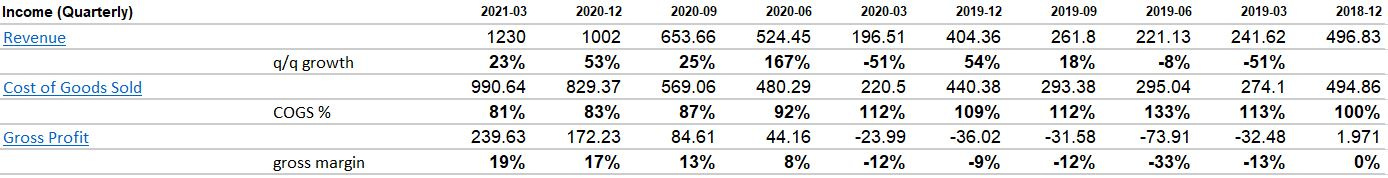

9.1. Revenues

As mentioned above, revenues are growing rapidly, mainly due to their current position within a rapidly expanding market. Over the past 8 quarters we have seen an average quarterly revenue growth of 35% with the latest quarter producing $1.2 Billion in revenues, resulting in the TTM revenues of $3.41 billion. This TTM $3.41 billion is up 215% y/y from $1.084 Billion for the same period last year.

All this indicates healthy growth and the continued ability of NIO to expand operations within a rapidly growing market.

Looking forward - NIO is forecasted to grow its revenues to $5.4 billion this year, with another 59% growth forecasted for 2022, and revenues for 2023 expected to be $12.5 billion (up 45% versus 2022's expected revenues).

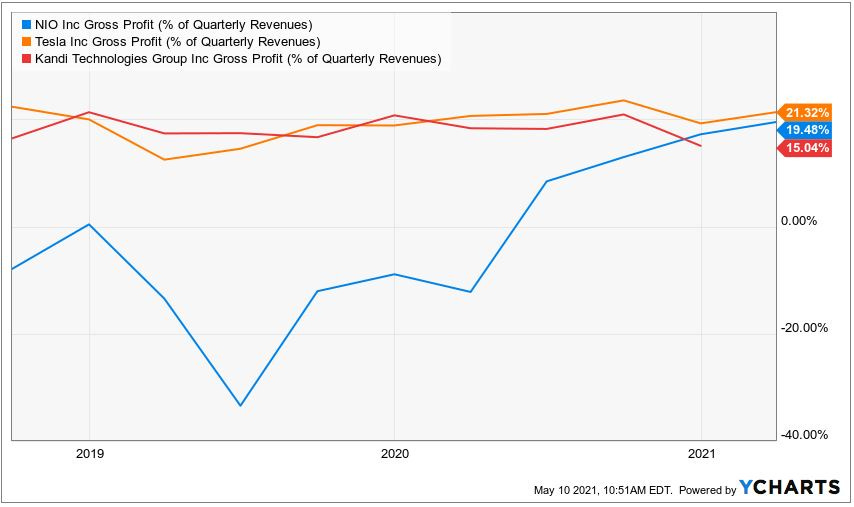

9.2. Profitability

Margin-wise, the gross margin is relatively low - currently at 19% for Q1/2021 -and has been rising steadily over the past several years. That being said, they started from a negative position only 1 year ago.

Objectively speaking, and from first glance, this isn’t a great outlook. A 20% gross margin doesn’t leave the company with much room to maneuver. However, two points. 1) If we look at the trend of NIO’s margin over the past two years on a q/q basis, we are looking at a positive uptrend with almost consistent growth - this is mainly driven by the increase of vehicle margin in the first quarter of 2021. And 2) it’s important to compare the industry standard margins, which happen to be fairly similar in this case…

And if we delve sligtly deeper, we can see the reason for this increase in overall gross margin is attributable to an increase in the vehicle margins. These vehicle margins are driven by “the increase of vehicle delivery volume, higher average selling price, as well as lower material cost. The increase of vehicle margin compared to the fourth quarter of 2020 was mainly attributed to higher take-rate of NIO Pilot and 100 kWh battery package. Which are mainly driven by the increased improvement on the overall vehicle margin.”

9.3. Balance Sheet

Lets take a look at the company’s ability to pay off their current liabilities (short-term) and non-current liabilities (long-term debt). Firstly, the below graph isn’t super clear, however it shows that from a point in mid-to-late 2020, the company’s total assets have eclipsed their total liabilities, which is always something we like to see from a liquidity standpoint.

If we look at the exact numbers, NIO’s current assets of $7.91B are able to pay off the long-term liabilities of $2.62B 3X over, and the total assets 1.5X over.

The above graph also shows that at a point in mid-2020, the company’s assets began to outweigh both the current and non-current liabilities. A good question to ask is why and how did this happen? From what I can gather, the company capitalized on the high level of interest in the market at the time by issuing 68M new shares.

“NIO's offering of 68 million new American depositary shares was completed on Wednesday at a price of $39 per share, raising about $2.65 billion before fees.

With this stock sale, NIO joined a growing list of publicly traded electric-vehicle companies that are taking advantage of high investor interest and lofty valuations to raise additional cash.”

Realistically, this isn’t the most encouraging sign. I would much rather the company not have to issue millions of shares in order to generate cash - however, the timing on this was good due to levels of demand.

Overall, I’m relatively pleased with the balance sheet, especially considering the company’s history of burning through cash. However, we need to ask ourselves whether the methods used here to raise cash is sustainable in the long-term.

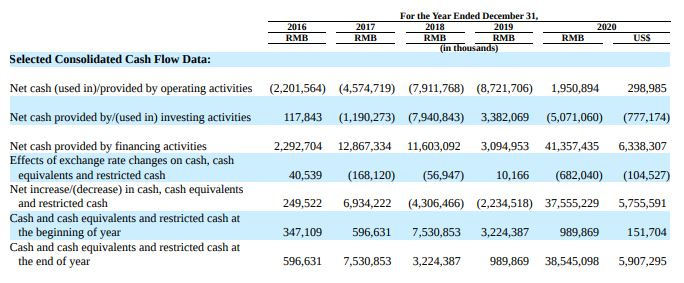

9.4. Cash Flow

As we can see from the below table and graph, Nio have been operating largely through external financing over the past 4/4 years. The only year with positive CFO (cash flows from operations) has been 2020. This is a good sign, as it shows that with scale, the business is beginning to move towards a more sustainable model.

9.5. Valuation

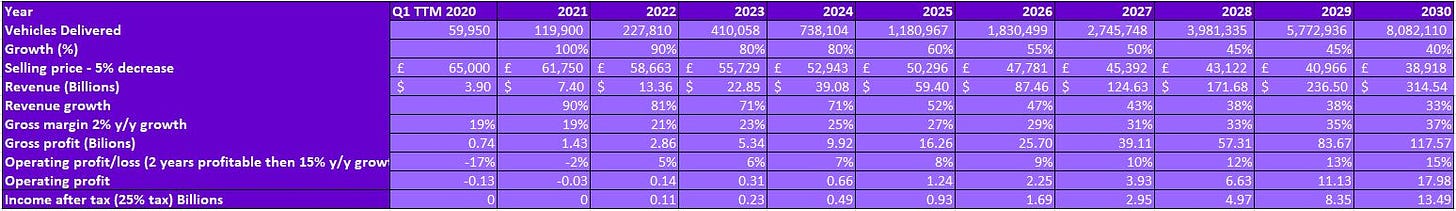

*Disclamer for this part* - due to the amount of assumptions I would need to make, I will keep the valuation fairly simple. I have used a model from Joshua Tai, who has recently completed a VERY deep dive on Tesla. I thought his valuation model was easy to understand and made sense for the EV market.

Vehicles delivered - This is a lot of guess-work. Feel free to try some different numbers if you would like. 8,000,000 deliveries by 2030 seems fairly optimistic, however, the Chinese EV market is by-far the largest in the world, and 8,000,000 is less than half of Tesla’s goal by 2030 (20 million).

Price of the cars - I have assumed the average price of the cars will continue to decrease as the technology evolves and the business begins to benefit from economies of scale. Therefore I have estimated a 5% y/y reduction.

Gross margins - Again, as economies of scale kicks in, I can see gross margin increasing. I have used 2% per year growth in this case as I think that’s a reasonable average over the long-term.

Operating profit - Seeing as the company are currently loss-making but moving swiftly towards profitability, I have given 1 more year of loss followed by 5% operating margins growing at 15% per year. Operating profit of 18% by 2030 seems reasonable, if slightly on the high side.

Tax rate - Not sure on this one, estimated 25%.

I have chosen a relatively high forward P/E value of 25X based on the average for the industry currently, this estimates NIO to be worth $337B by 2030. And with roughly 1.6B shares outstanding - we can estimate a 2030 share price of $210.

Again, there are so many different factors at play here - so do mess around with these numbers yourself to see if you come up with something a bit more robust.

10. Key takeaways & Conclusion

Before I conclude, I would like to point out 5 key takeaways…

The EV Market is only just getting started and has the potential to be gigantic within the next decade. The opportunity is huge. That being said, Nio are not the only EV company operating in the Chinese market. As the market continues to develop and the key technologies evolve, we could easily see new players enter the market. There is a tonne of money to be made here, and with that, many people wanting a slice of the pie.

Nio are pioneers with the BaaS model for charging batteries. However, just because they are innovating, it does not mean that their method will be the go-to method for charging. Time will tell.

Nio stock price is looking far more attractive over the past month as the price contracts. I would be looking to buy somewhere in the range of $15 - $25.

The company are yet to be profitable, however are heading in the right direction.

Stock dilution. Even though Nio are laser-focused on growth at the moment (which is fine), it’s worth keeping an eye on the issue of stock dilution and raising cash via debt as, generally, you would want to raise cash organically.

Overall, Nio are an interesting company with heaps of potential. Their mission is clear, the products are stunning and the macro-conditions are looking favourable for sustained growth.

However, in order to solidify themselves as a serious player in the space, I would like to see improved margins along with a sustained increases in revenue/delivery growth and signs of success with the expansion into Europe.

Patience is key here - if you can pick Nio up at a reasonable price, then there is plenty of upside to be had.

Cheers,

Innovestor.

Interesting that you think it could go down below $25 after the stock went down ~40%