Key Stats

*As of Q3 2020*

TTM (trailing-twelve-month) Deliveries up 70% from 20,321 in 2019 to 34,599 in 2020

Total of 68,634 deliveries as of Nov 30th 2020

Market Cap of $85 billion

TTM Revenue $1.78 billion (+46% y/y)

Vehicle sales in Q3 up 146% y/y compared to Q3 2019

7,194 full time employees

Possible expansion to Europe (Norway)

Customer referral rate of 64% (+12% since 2019)

Business model

NIO are a Chinese smart electric vehicle company operating at the premium end of the market. The name translated in Chinese (Weilai) means ‘Blue Sky Coming’, reflecting their commitment to environmental change.

The company design, manufacture and sell electric smart vehicles. They have 3 main models produced on a large-scale – the ES8, ES6 and EC6.

*note – all software feature included in ES8 also included in ES6 and EC6*

ES8

7 seater high-performance vehicle (also 6 seater)

Launched 2017 with upgrade in Dec 2019 with more than 180 improvements.

0-100 kph in 4.9 seconds

100 kWh battery can reach a range of 580 km

5* Chinese safety standards – 21 active safety features

NIO pilot system – Level 2 autonomous driving system

Over the air updates

NOMI – speech-based interactive AI.

$65,000

ES6

5 seater high-performance electric SUV

Launched Dec 2018

0-100 in 4.7 seconds

Breaking distance from 100kmph is 33.9 meters

Equipped with 70 kWh or 100 kWh liquid cooled battery with driving range of 510km and 610km respectively

Structure made from high-strength carbon fibre, making the ES6 stronger and lighter.

$52,000

EC6

Smart premium electric coupe SUV

Launched Dec 2019

0-100 in 4.5 seconds

100kWh battery boasts 615km range

Full digital cabin

$52,000

Some of the main goals over the next 5 years are to successfully launch more products to a broader customer base, expand infrastructure and service coverage nationwide, continue to focus on technological innovations and create more monetization opportunities during the lifetime ownership.

Aggressive Innovation

NIO are doing a hell of a lot in terms of innovation - definitely offering something different to the model Tesla offers.

Suite of charging solutions (‘NIO power solutions’):

Power Home and Power Home Plus for ‘home changing solutions’ - standard and ultra-speed home chargers where practical for users.

Power Swap – Innovative battery swapping stations offering battery swapping service within minutes. As of October 31, 2020, NIO had 158 Power Swap stations covering urban areas and expressways across 70 cities.

Power mobile – charging trucks offering rapid charging for 100km range within 10 minutes. As of October 31, 2020, NIO had 318 Power Mobile charging trucks.

Power Charger – reliable fast charging piles located in parking lots and other locations easily accessed by users for them to locate, use and pay for through the NIO app. As of October 31,2020, NIO had approximately 701 Power Charger piles in operation, covering 52 cities, and provided over 440,000 one-click power services.

Power express – 24 hour on-dmand pick-up and drop-off charging service

Access to the nationwide charging network consisting of over 390,000 publicly accessible charging piles.

Battery as a Service Model (BaaS) – allows users to purchase electric vehicles and subscribe to usage of battery packs separately. Essentially you can purchase the car without the battery pack and subscribe to a battery, even upgrading later down the line. Lower initial cost for consumers.

Autonomous Driving - NIO are pioneers in automotive smart connectivity and enhanced Level 2 autonomous driving. NOMI, which is believed to be one of the most advanced in-car AI assistants developed by a Chinese company, and is a voice activated AI digital companion that personalizes the user’s driving experience.

Unfortunately I don’t know enough about the core battery technology to have any real opinion on that aspect.

Strategic partnerships

Current positioning in the market has attracted global leaders across the supply chain, autonomous vehicles and various value added services creating an extensive “industry alliance network”.

Partners include Tencent, Baidu, Mobileye and CATL.

E.g. partnering with Mobileye to develop next gen autonomous driving technology.

Partnership with JAC to manufacture ES8, ES6 and EC6 models provides flexibility, scalability and speed to market, cementing the first-mover advantage in the China market.

Looking to Expand

Worldwide R+D - Strategic location of teams with access to best talent, with the global engineering office located in Shanghai. The vehicle design headquarters is in Munich, Germany and the software and autonomous driving technology is designed and developed at the North American headquarters in San Jose in the United States.

Expanding to Europe? - Basically just rumors at this point, although maybe some evidence suggesting expanding into Europe starting with Norway. I’ve had a little dig on LinkedIn and this seems real.

Is the market about to explode?

I strongly believe we’re pretty much at the beginning of a long-term upward trend in adoption of electric and autonomous vehicles over the next 5 – 10 years.

There are various estimates floating about. With one estimate of $335.3 billion by 2023 with CAGR of 38%, and another estimating $802 billion by 2027 with a CAGR of 20.1%.

Another interesting point being that the Asia and Europe markets account for 74.8% of the total addressable market in 2019. This puts NIO in a good position to be able to solidify their position as a market leader in the Asian markets whilst also expanding out to Europe.

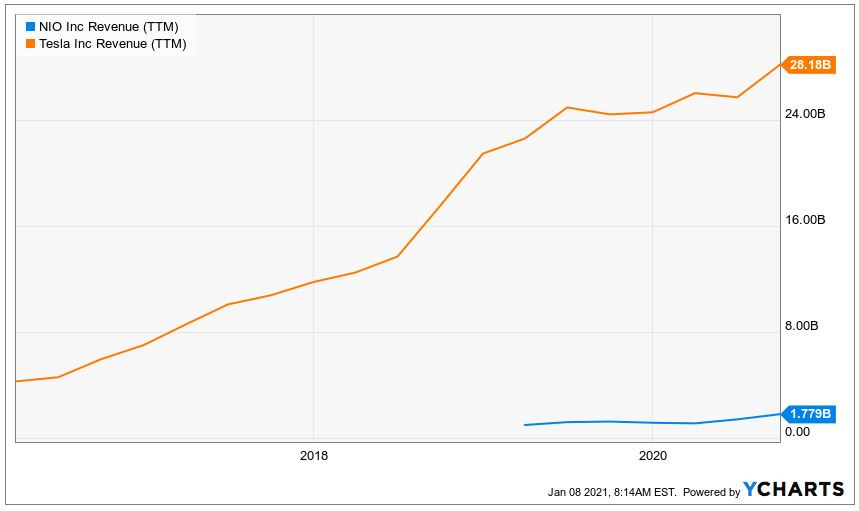

In addition to these points, with their current TTM revenues of $1.8 billion compared to Tesla’s $28.2 billion, there is plenty of room to grow and capitalize on the potentially huge TAM.

However this relies on their ability to aggressively expand whilst also continually investing and innovating, which will undoubtedly result in a continued operating loss for the foreseeable future.

What’s the competitive advantage?

NIO are pretty much doing all they can to create a competitive advantage within a market that will potentially be filled with competitors with deep pockets in the next 10 years.

Pioneering China’s smart EV market

Strategically positioned in China’s EV market with very limited competition.

Innovative new charging solutions

Battery as a service (BaaS) model – consumer can choose to upgrade.

High quality control

Ranked the highest in quality among all electric vehicle brands in JD Power’s New Energy Vehicle Experience Index Study.

High referral rate (64%)

High volume produced vehicles (ES8, ES6 and EC6) are positioned at the intersection of China’s fastest growing SUV and premium segments.

Best in class performance across speed, acceleration, battery range and autonomous driving features. Big head start on competitors.

ES8, ES6 and EC6 are more affordable than the EV’s of other imported brands as a result of the absence of import and purchasing taxes, lower manufacturing costs amongst other tax benefits.

The Brand

Nio Day

Great marketing strategy with the goal of releasing new models each year.

“We held our first “NIO Day” in December 2017 at the Beijing Wukesong Arena, where we introduced the seven-seater ES8. We launched our second volume manufactured electric vehicle, the ES6, to the public on our second “NIO Day” in December 2018. Our first two NIO Days consisted of presentations by our Chief Executive Officer, Bin Li, who introduced our ES8 and ES6, respectively.

The second NIO Day had 150 million views and produced a significant increase in our social media followers, as well as over 5,500 Chinese media reports. The third NIO Day was held in December 2019 in Shenzhen, where we launched our third volume manufactured electric vehicle, the EC6, and the new ES8 to the public. Our users played main roles during the event and we believe the user enterprise concept was well perceived.

We plan to hold NIO Day each year on which we introduce our new vehicles and products to users. We expect to hold the fourth NIO Day in January 2021 in Chengdu. We believe that NIO Day gives us an opportunity to interact with our current and prospective users while providing us with more publicity and brand awareness.”

Formula E

“We had in the past operated the Formula E team, which is a racing team that competes in the Fédération Internationale de l’Automobile, or FIA, Formula E championship electric racing series. In 2019, we sold the business related to Formula E team to Brilliant In Excellence Co., Ltd., a Hong Kong based buyer, and became a sponsor of the team.

In September 2019, 333 Racing, a British Motorsport racing team, partnered with Formula E team. The Formula E team was renamed as NIO 333 Formula E team thereafter. NIO 333 Formula E team is currently managed and operated by professional Motorsport management personnel in China, and will compete in the 2019/2020 racing season with our company as its primary sponsor.”

Risks

There are a tonne more risks than mentioned here. I have just included what I believe to be the most important.

Main business risks

Covid-19 pandemic

The Chinese government has been putting in place relatively strict measures if an outbreak of COVID occurs in a certain city. If this happens in an area where Nio have Service centres or Vehicle delivery centres, it could adversely affect their operations. All of this is largely out of their control.

Rapidly evolving industry, subject to unforeseen changes.

Reliant on some single-source-suppliers.

Ability to build Nio brand.

Future success dependant on future demand for electric vehicles.

Concers about EV safety/design/performance/cost etc.

Limited range of mileage and declining range over time

Electric grid capacity and reliability

Access to charging stations

Accidents associated with Autonomous Vehicles.

Sustained losses continue

COVID-19 may negatively affect the business financials

Limited operating history and face significant challenges as a new entrant into the industry

Customer reputation at this stage is key

Governance risks

Need to ensure relationships with business entities comply with PRC (People’s Republic of China) regulations, otherwise could be subject to severe penalties.

Contractual arrangements may not be as robust as direct ownership in providing operational control.

Business in China risks

Changes in China’s political or social conditions or government policies could have a material and adverse effect on NIO’s business

Financials

Let’s start with revenues. Over the last 8 quarters we have seen an average quarterly revenue growth of 35.4% with the latest quarter producing $653.66 million in revenues, resulting in the TTM revenues of $1.779 billion. This $1.79 billion is up 46% y/y from 2019.

All this indicates healthy growth and the continued ability of NIO to expand operations within a rapidly growing market.

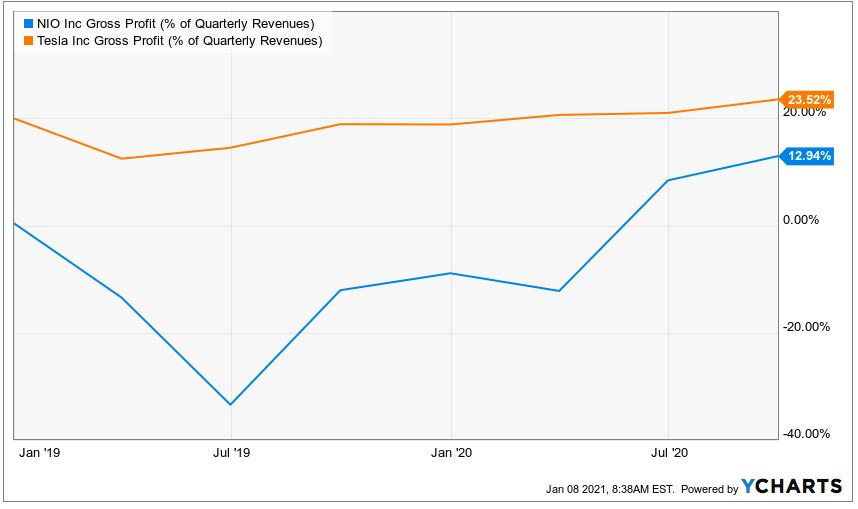

Looking at margins, the cost of goods sold is relatively high (at 87.06%) compared to their main competitor Tesla (76.48%), which leaves the gross margins at 12.94% and 23.52% respectively.

I can’t say I’m over-the-moon with these numbers, though I could argue due to NIO’s current stage in their business growth cycle, this relatively lower level of margin is understandable and should pick up over time.

In terms of cash-flow, the company achieved positive cash flow from operating activities for the second sequential quarter. “The order growth momentum continued positively, driven by expanded brand awareness, growing user base, extended sales network and most importantly, the compelling products and technologies. Meanwhile, our continuous improvement of operational efficiency, cash flow and balance sheet has laid a solid foundation for our future sustainable growth and decisive investments in technologies.”

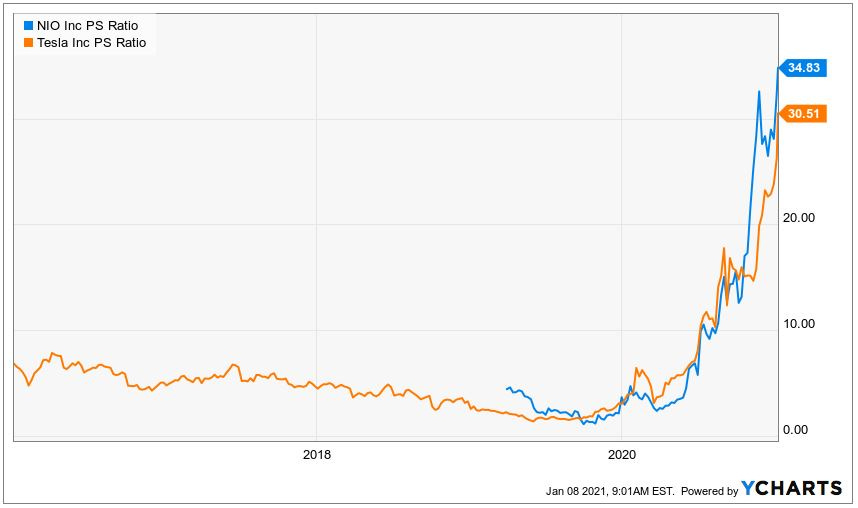

Valuation-wise, it’s hard to argue make the argument of NIO shares looking cheap at the moment - currently trading at almost 35x sales. This is in comparison to TESLA’s equally high 30.51 P/S ratio. Not sure how to rationalize this really.

Conclusion

To conclude, the electric vehicle and autonomous driving market is set to be huge over the next 5-20 years. NIO are in a great position to capitalize on this growth with a great suite of products, stellar referral rates and a vast array of planned innovation.

Although in order to solidify themselves as a serious player in the space, I would like to see improved margins along with sustained increases in revenue growth and serious plans for expansion over the next year or so.

Big fan of this company, will be creating a small position. I don’t want to be missing out on the Electric Vehicle revolution.

Cheers,

Innovestor