Key Stats

History

The business

The market

Founder Led

Recent Acquisitions

Growth opportunities

Notes from investor day

Financials

Valuation

Risks

Key considerations

Conclusion

1. Key Stats

80% of dGPU market

data-center revenue has increased by 124%

data center segment will reach over $60 billion by 2023

since 2016 the company’s data center revenues have multiplied nearly 9x

the AV market will be a about $60 billion TAM by 2035

Founder led

Growth opportunities within growing industries (AI, 5G, AV, Gaming)

Omniverse introduced

2. History

I think it’s always important to gain some perspective on how a company got to their current position in the market. To do this with Nvidia, lets take a short look at their history as a company.

Founded in 1993 and based in California, Nvidia design GPU’s (Graphical Processing Units) for various markets. The creators had the foresight to believe the personal computer would one day be in everybody’s homes and be used all over the world for a wide variety of use-cases.

When Nvidia began operations, the market was severely crowded. There were already 24+ GPU firms operating in 1993, and by 1996 there were 70+ companies making GPU’s. Over the next 10 years a sort-of ‘natural selection’ occurred - leaving Nvidia as the last man standing. This is one of the main reasons the company are in such a strong position today.

Since that early period, Nvidia have remained No.1 in their field by constantly innovating, keeping up with the latest trends in computing and constantly looking towards the future. A good point in hand is the partnership in 2000 with Microsoft’s Xbox console. This enabled the company to essentially dominate the video game market by being an integral part of the majority of gaming consoles in that generation.

Even until recently, it may be easy to think of Nvidia as just a gaming company - however, as far back as 2010, Nvidia were already looking to get into other industries by powering some of the world’s fastest supercomputers. Their current breadth and depth of operations is equally as impressive as it is intimidating. The company are now looking to capitalize on the next wave of technological trends.

3. The business

As mentioned above, Nvidia is a company that designs semiconductors - specifically GPU’s (graphics processing units). These GPU’s are used by the majority of powerful computers out there today. They are important for high-quality graphics and video rendering - amongst many other use-cases.

For example, when we are gaming we are usually looking at 3D shapes made up of millions of 3D triangles. When moving a character about in a video-game or when rendering 3D models, each individual triangle has to be re-calculated for size, lighting and shading. This has to be done for each individual frame. which has to happen extremely quickly in order for the user to have a smooth experience.

The below video (at 9:00) does a good job of highlighting the amount of triangles present in a game, and is a good way to think about just how powerful these processing units need to be in order to dynamically power our games.

All of these calculations are done at the same time by the GPU’s - using something called ‘parallel processing’.

When most people think of processors within a computer, they are thinking of CPU’s (Central Processing Unit). CPU’s usually have around 4-8 cores, and in comparison to a GPU’s core, are extremely powerful.

GPU’s have hundreds of smaller cores that are much less powerful, but they can all run simultaneously - therefore allowing them to compute the triangle calculations mentioned above. This diagram below tries to simplify these key differences between CPU’s and GPU’s.

To summarise - a GPU can process large amounts of simple calculations simultaneously, whereas a CPU can handle more complicated computations but can do less at any one time.

4. The Market

Due to the nature of Nvidia’s business, the company operates within several distinct segments - the 4 main distinct segments being Gaming, Data-Centers, Professional Visualization and Automotive.

Currently, Nvidia are leaders in the GPU market, and have been dominant in the gaming space for some years now. As an example, PCMag has Nvidia as 4 of the top 10 GPU’s, with AMD as 3/10. Along with this, they boast an 80% share of dGPU market (GPU’s not already built into motherboard).

Current drivers of growth are Data-Centers & Gaming. Future drivers of growth will likely be Artificial Intelligence and self-driving cars.

Lets dig deeper into each of these areas in order to see how Nvidia is planning on tackling these different segments.

Gaming

NVIDIA’s dominance in gaming is evidenced by the company’s nearly 80% market share in dGPU’s worldwide, With AMD trailing at roughly 20%. Changes in the gaming industry are leading to an increase in the demand for more powerful hardware. Stemming from this, the gaming industry is predicted to be at the beginning of a very steep growth-curve, with E-sports being a prime driver.

“The global eSports viewership currently stands at 496 million people worldwide. In 2020 alone, there was a 70% increase in the number of eSports viewers in the US, most likely because of the pandemic.

Consulting firm Activate predicts that in the US, eSports will have more viewers than any other professional sports league except for the NFL by 2021.”

Some predictions have the expected number at 769M by 2024.

Other key points for gaming:

Rapidly growing market.

Money spent on the gaming market is set to grow at around 9% per year (not including the E-Sports market which is set to explode over the next several years).

As graphics increase in complexity and more power is required - it will only increase the demand for more powerful GPU’s

Professional Visualization

Professional Visualization uses GPU’s designed specifically for 3D modelling software and image analysis. There are a wide variety of use-cases, however one common use-case is the modelling used in architecture. The video below does a good job at explaining the benefits of improvements in these GPU’s.

As you can see, details have got to a point where you are able to simulate photorealistic images and simulate light throughout the day for a more accurate design analysis. This leads to improved workflow efficiencies and therefore saves time and money.

Data center

The data center market in particular has been, and will continue to be, a great source of growth for Nvidia. Over the past year data-center revenue has increased by 124%, and since 2016 the company’s data center revenues have multiplied nearly 9x. “Revenue growth was driven by our Mellanox acquisition and the ramp of the NVIDIA Ampere GPU architecture. In fiscal year 2021, Mellanox revenue contributed 10% of total company revenue.”

Nvidia acquired Mellanox Technologies in 2019 who are a networking company based in Israel. They estimate the overall addressable market for the data center segment will reach over $60 billion by 2023.

The continued growth in data centers will also help to pull the overall gross margin up as, compared to the other segments, the gross margin levels for data centers are several percentage points higher. The effect of this can be seen from the expanding margins over the past 5 years - from 49% in 2012 to 62.3% in 2021.

To add to this, the Data-center aspect of the business has grown as a percentage of total revenue over the past several years, as shown below - with a large jump in 2021, mainly due to the acquisition.

Key data center points:

Data Centers are one of the largest opportunities for Nvidia.

Areas for which data centers have viable use-cases include Artificial Intelligence and high-powered computing.

Nvidia’s GPUs help to accelerate deep learning and machine-learning workloads.

‘Deep learning’, put simply, is using computer analysis in order to identify patterns from massive amounts of data. This data can be in all kinds of formats (text, images + sound etc.).

It is believed Deep learning could create more economic value than the internet over the next 10-15 years.

AI (Artificial intelligence) tends to be used in task automation. One example of this is the ability computers have to be able to actually write and correct their own code. Other examples include reading medical images, financial fraud detection and accurate voice detection. Oftentimes these are jobs where human error is costly.

The below video is a fun little example of using an A.I. to learn and play flappy bird (about the 4 minute mark is where the A.I. starts learning).

Other Key stats:

AI is also being used to assist autonomous vehicles. Considering all the data EV’s have to process at once - it makes sense that GPU’s, Machine Learning and accelerated computing have use-cases here.

AI has a tonne of ethical issues surrounding the debate as to whether we should implement it or not. Questions around whether AGI (artificial general intelligence) is a good idea for humanity and whether we should contain AI to it’s more ‘narrow’ task-orientated roles remains a big debate.

“The paperclip maximizer is a thought experiment described by Swedish philosopher Nick Bostrom in 2003. It illustrates the existential risk that an artificial general intelligence may pose to human beings when programmed to pursue even seemingly harmless goals, and the necessity of incorporating machine ethics into artificial intelligence design. The scenario describes an advanced artificial intelligence tasked with manufacturing paperclips. If such a machine were not programmed to value human life, or to use only designated resources in bounded time, then given enough power its optimized goal would be to turn all matter in the universe, including human beings, into either paperclips or machines which manufacture paperclips.”

Automotive

NVIDIA has created a suite of products helping with the development of Autonomous Vehicles. Examples include products designed to collect large amounts of data used in deep learning simulations, as well as solutions to help vehicles process data and make better, faster decisions.

The company has partnered with a number of auto companies In order to develop Autonomous Vehicle programmes. It is predicted the AV market will be a about $60 billion TAM by 2035. We are only seeing the very beginnings of the EV growth curve, which has a long way to go.

Nvidia partnership with BMW in first steps towards omniverse idea.

5. Founder-led

“NVIDIA was co-founded by Jensen Huang, who remains as the CEO to this day. Jensen Huang co-founded graphics-chip maker Nvidia in 1993, and has served as its CEO and president since inception. Huang owns 3.6% of Nvidia, which went public in 1999.

Jensen was born in Taiwan but moved to the US at the age of 10. He did his Bachelor of Science in Electrical Engineering from Oregon State University and Master of Science in Electrical Engineering from Stanford University. Prior to founding NVIDIA, Mr. Huang worked at LSI Logic and NVIDIA’s competitor, AMD.

Under Huang, Nvidia became a dominant force in computer gaming chips and has expanded to design chips for data centers and autonomous cars.

Since the mid-90’s, several companies in the GPU market have gone extinct, however NVDIA has not only managed to survive but become the dominant player in the GPU market. Jensen has shown a repeated ability to overcome challenges successfully navigate issues within a constantly evolving landscape.

Overall, management has been effective over the years and the exec team has plenty of strength in depth.

6. Recent Acquisitions

Nvidia Acquire Mellanox for $6.9B: Mellanox make ultra high-speed internet and infinity-band products. Allowing data-centres to link incredible amounts of GPU computing power at even higher speeds.

They recently came out with 7th generation of Nvidia melanox infiniband which is capable of 400GB per second.

Nvidia Acquire ARM for $40B. ARM tend to make chips for mobile phones & tablets. The thin shell of a typical phone doesn’t allow for cooling spaces or big batteries so these chips are usually less powerful. Capabilities are catching up to the standard - with better heat efficiencies and better power consumption. This type of expertise can therefore help reduce costs and increase efficiencies in running data centers.

Jenson Huang describes this as ‘one more step in the direction of fully AI computing’, where computers write more of their own code. He says that computers are capable of writing code much faster than humans. Some of the code they are writing, humans wont ever be able to write. This combination will lead to the greater expansion of computing power, help autonomous systems all over the world and enable society to do all kinds of ‘previously impossible’ tasks.

7. Growth Opportunities

AI

As mentioned in one of the sections above, AI will be an incredibly important aspect of Nvidia’s operational arms moving forwards. AI/deep learning are one of the fastest-growing technologies, and Nvidia is well-positioned to capitalize. Their GPU-based approach is considered the gold standard for deep learning training, and should remain the gold standard for many years to come. Thanks heavily to the rapid adoption of AI across companies large and small, NVIDIA's data center's revenue has also exploded.

Ark estimates AI/deep-learning will add $30T to the global equity market over the next 15-20 years.

“Extending our technology and platform leadership in AI. We provide a complete, end-to-end accelerated computing platform for deep learning and machine learning, addressing both training and inferencing. This includes GPUs, interconnects, systems, our CUDA programming language, algorithms, libraries, and other software. GPUs are uniquely suited to AI, and we will continue to add AI-specific features to our GPU architecture to further extend our leadership position. ”

5G

NVIDIA is an interesting way to play the upcoming 5G boom. The company is exposed to several sectors that are likely to be major beneficiaries of the shift from 4G to 5G. This includes mobile gaming, VR/AR and IoT (just to name a few). This increase in powerful devices with high data-output will drive the demand for Nvidia’s GPU’s even higher.

Other important catalysts include global digitization trend and the recent Arm acquisition.

Global digitization: Many of the events that have taken place over the past year (global pandemic) has encouraged the world to become more ‘digital’. This has forced digital technology to catapult at a rate much faster than the original road-map. All of this has boosted demand for GPUs used in data centers as well as gaming consoles.

The company’s high-performance computing technology is used by every major cloud provider including Amazon Web Services, Microsoft Azure and Google Cloud.

Nvidia CEO Jensen Huang (Q3 earnings call):

“I think starting this quarter, we’re now in every, every major cloud provider in the world, including Alibaba, Oracle and of course the giants, the Amazons, the Azure, and Google Clouds. And we’re going to continue to ramp into that. And then of course, we’re starting to ramp into enterprise which in my estimation, long-term, will still be the largest growth opportunity for us, turning every industry into an AI, turning every company into AI and augment it with AI and bring the iPhone moment to all of the world’s largest industries.”

Acquisitions: Nvidia recently announced the acquisition of Arm Ltd. for $40 billion. Arm’s chip designs are currently used in more than 50% of the smart devices in the world.

This acquisition will allow Nvidia to benefit from Arm’s leading position in larger CPU-based end markets which will expand its AI computing platform, while Arm can benefit from Nvidia’s dominant position in the data center business. Overall, this is a win-win that dramatically increases Nvidia’s TAM over the coming years.

Robotics/Autonomous driving

As mentioned before, the use of AI, Machine Learning and Deep Learning will enable robots/autonomous vehicle systems to learn in an accurate simulated world.

“Autonomous vehicles will transform the way we live, work, and play, creating safer and more efficient roads. To realise these revolutionary benefits, the car of the future will require a massive amount of computational horsepower. Tapping into decades-long experience in AI, NVIDIA DRIVE™ hardware and software solutions to deliver industry-leading performance to help automakers, truck makers, tier 1 suppliers, and startups make autonomous driving a reality.”

Gaming

For most of their past, Nvidia were mainly known for their exposure to the gaming market. This will likely remain over the coming years as E-sports is set to grow exponentially alongside the relative computing power advancements needed.

As mentioned earlier in the article, Nvidia dominate the gaming market - demonstrated by an 80% share in the dGPU sector. The demand for their line of products will only grow over the coming decade, as e-sports will bring more people to gaming than ever before.

8. Notes from the Investor day

New technology

Omniverse (big one): A platform to create and simulate shared virtual 3D worlds. One way in which this ‘omniverse’ platform can benefit is by allowing robots (cars etc) to simulate accurately within virtual worlds in order for deep learning to take place.

It connects to other worlds using USD (the HTML of 3D worlds).

Simulates in a potorealistic way.

Can connect designers using different tools into one world - a shared world to create a scene or a game.

Can also connect robots/AI characters performing various tasks into one world. A shared world like the BMW simulator factory. Foundation platform of AR and VR strategies, design and remote collab strategies, metaverse and virtual world strategies, and robotics and autonomous machines strategies.

Nvidia entering the server CPU market. Heating up rivalry with Intel. ‘Grace’ is the first datacenter CPU. Its first processor for data centers will operate 10x faster than existing chips.

2X bandwidth.

10X energy efficiency of today’s fastest servers. Designed especially for its giant scale.

It is now theworld’s first cloud-native supercomputer.

This is Nvidia’s largest move to vertically integrate their hardware stack - offering a CPU alongside GPU and DPU products.

AI industrial edge: Could be where AI makes the biggest impact in various sectors...

Healthcare

Warehouse Logistics

Manufacturing

Retail

Agriculture

Transportation

Other notes:

Tracking above previous outlook across all markets, although gaming will be a significant driver. Expects strong year for datacenter demand.

$8B auto pipeline through FY27 with new DRIVE partnerships (volvo, cruise, zoox, SIAC) and next gen drive atlan expected in 2025..

Next-gen Bulefield-3 DPU: 100x performance increase over 3 years. Expected to sample in Q1 2023.

9. Financials

Revenue, operating income and net income all increase dramatically from the year 2016. This is mainly due to the beginning of the shift away from just a traditional PC graphics chip vendor, to starting to focus on these other high-growth areas such as AI, AV and data centers etc.

The business looks well managed with consistent and growing operating margins.

Looking at the revenue to the gross operating expenses, we can see that the gross margin has been steadily increasing over the past decade - from 51% in 2012 to 62% in 2021.

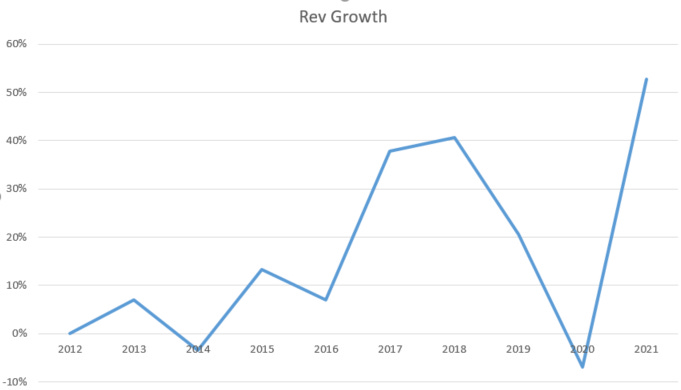

Revenue growth has been steadily increasing over the past decade, and has been maintaining over 20% growth y/y since 2016 (barring 2020 - where we see a small decrease in revenue growth levels). Nvidia makes up for this revenue decrease in 2020 with a steep increase between 2020 and 2021, growing at over 50%

Costs of revenues + R&D + G&A = the majority of the companies expenses (total of 73% of revenues). Other costs such as interest and tax only make up a small percentage (2% overall).

Overall, Nvidia look incredibly strong from a financial standpoint and we can safely expect this trend of increasing gross margin to continue into the future as the data center aspect becomes a much larger part of the business.

Balance Sheet

Total assets = £28,791

Current assets = £16,055

Total liabilities = £11,898

Current liabilities = £3,925

Equity = £16,893

Some important things to note here…

Current assets cover total liabilities by 1.5X. This is healthy.

Total assets have continued to increase y/y for the past decade. From $5.5B in 2012.

Note that long term debt has increased by almost 3x since 2020. Need to keep an eye on this.

Overall, Nvidia is an extremely financially sound company with tonnes of operational experience and future optionality in order to be able to maintain these high levels of profitability over the coming years.

10. Valuation

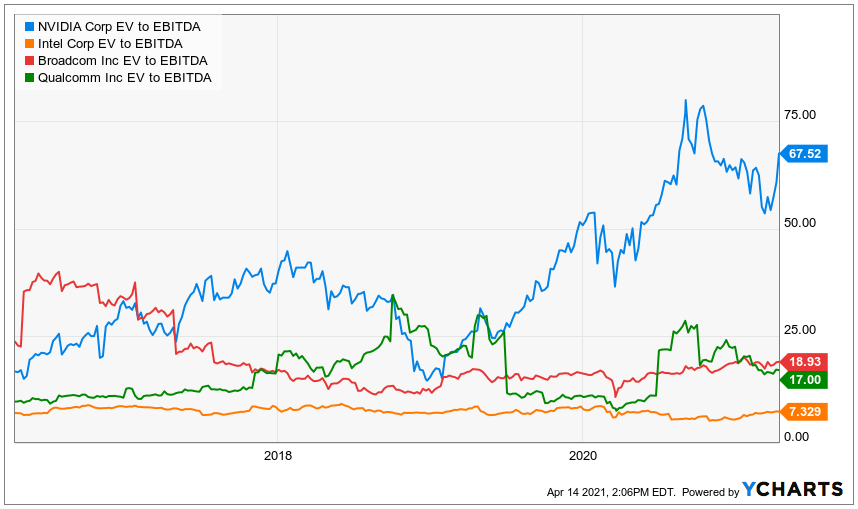

Valuation multiples of almost all major 5G/semiconductor technology players have expanded over the past year as investors become more confident about gains that the companies can derive from the shift to upgraded networks/upgraded technology.

Relative valuation here is tricky as there is no company doing quite what Nvidia are setting out to achieve - along with the fact they have their hands in so many different pots.

Given the bredth and depth of Nvidia’s operations within such a variety of growing and evolving industries, it’s hard not to be optimistic about the future and conclude that there is still plenty of room for growth.

Short-term, this ‘looks’ expensive. Long-term, I think this could be an attractive price. Lets come back in a couple of years time to see if these statements holds true.

Valuation is more of an art than a science. Oftentimes, at the time of purchase, a stock can look expensive. For example, Netflix a year ago, Amazon 5 years ago, Shopify now - the list goes on. The similarity between these companies is that they are high-quality companies with solid financials and a vision for the future. Nvidia has this - which is why valuation can be so misleading sometimes. In order to mitigate risk, I will be Dollar Cost Averaging into this stock over a long period.

11. Risks

Concentration of revenues: For fiscal year 2020, “Dell represented approximately 11% of our total revenue” which was attributable primarily to the Graphics segment. This number has improved for FY21, as “No customer represented 10% or more of total revenue”.

Ideally, we would want to see Nvidia’s clients account for relatively small proportions of revenue in order to shield themselves from risk - however I’m not too concerned about this.

Strong competition: Competition from the likes of Intel and AMD. Target market remains competitive, with an expectation of increased competitiveness as the companies continue to expanse product offering.

Nvidia are doing well in this regards - putting pressure on their competition by the announcement of entry into the server CPU market.

Reliance on third parties to manufacture, assemble, test and/or package products: this reduces control over product quantity and quality, manufacturing yields, development, enhancement and product delivery schedule and could harm the business. Dependent on

industry-leading foundries, such as Taiwan Semiconductor Manufacturing Company Limited and Samsung Electronics Co. Ltd., to manufacture our semiconductor wafers.

Ability to predict demand: Manufacturing lead times are very long. Most products are manufactured based on estimates of customers’ future demand. This could lead to a significant mismatch between supply and demand, giving rise to product shortages or excess inventory, and make demand forecast uncertain.

Data-protection: With the highly technical, and often highly sensitive data being stored within the company (due to the inherent nature of the suite of products), there is scope to argue any breach of data will have disastrous consequences - not only to the individuals whose data is breached, but also the reputation of the company.

The ability or inability to successfully integrate recent acquisitions: “We may not be able to realize the potential financial or strategic benefits of business acquisitions or investments, including the Mellanox acquisition and the planned Arm acquisition, and we may not be able to successfully integrate acquisition targets, which could hurt our ability to grow our business, develop new products or sell our products.”

12. Key considerations

Is the company well enough positioned within the upcoming growth markets (AI, deep learning, Machine learning, Autonomous vehicles, gaming) in order to continue to grow above their (already) steep price?

Is there a possibility of spreading themselves too thin over various markets - enabling competition to gain a solid footing?

Does the company have the expertise and ability to deliver within ‘new’ markets?

*If you made it this far and would like to leave a donation, you should be able to do so by the link below - thanks!*

13. Conclusion

Overall, I think Nvidia are in a prime position to be able to capitalize on growing markets such as AI, Gaming, Autonomous Vehicles, Virtual worlds and 5G (amongst others).

The current price is expensive, and one could argue overvalued. I would remain cautious when getting into Nvidia, however the business itself is just about as solid as they come.

The combination of a founder-led visionary, constant innovation, optionality coming out of their ears and a track history of coming through adversity - I am willing to bet on Nvidia continuing to push boundaries (and expectations) over the coming decade.

Cheers,

Innovestor

Why did you stop writing? this is a very good deep dive. You should post deep dives like that on Jika.io you'll get much more exposure.