Summary

Market Cap of $43 billion.

37% growth in Monthly Average Users (to 442million).

Strong growth in users under 25 representing high purchasing power down the line.

Great platform for advertising.

Scale-able automatic bidding process implemented in July which has already contributed to over half of the company’s conversion revenue.

Thesis

Pinterest is a mixture between a unique e-commerce experience and a social network where users go in a unique frame of mind which is to purchase an item – i.e. Pinterest users look at images for inspiration for something to buy. Content and adverts are one and the same on the site, which is an advertisers dream. The company are early in their monetisation efforts with a current average revenue per user of $1.03 compared to Snap’s $2.73 and Facebook’s $7.89. Lots of room to grow with plans for a whole host of new tools such as video content and an automatic bidding feature for advertisers.

Fairly young in the development cycle, but already have a slick core product with a large under 25 user base (who’s purchasing power will only increase over time) along with an incredible service for advertisers and promising growth.

We’re not likely to see Pinterest match the scale of a company like Facebook anytime soon (or ever), but it’s not hard to imagine their ARPU reaching or surpassing Facebook’s over the next 5 or so years. With a current gulf in market capitalization between the two companies of $673 billion, I can absolutely see room for significant growth.

Business model

Pinterest is a fairly simple social media site to understand. They describe themselves as a ‘visual discovery engine for finding ideas like recipes, home and style inspiration, and more’.

A user will search for something like ‘home work setup’, see a page with potential ideas like this…

The user will then find something they want to emulate. For example, I want a nice swivel leather chair so I would click on the image below. Which then allows me to individually pick out items in the photo to investigate further and buy on their original sites. Alternatively, you can just save or ‘Pin’ the image for later.

This setup benefits the user as it allows you to easily look at high quality inspiration with an easy ‘call to action’ to buy or investigate further on the seller’s site. Also, the advertiser benefits in the sense that the users of Pinterest are visiting the site in a frame of mind where they are ready to buy. This makes allocating advertising budget that much simpler - making Pinterest an easy choice.

Another benefit of the Pinterest site is their relatively cleaner record in terms of negative press compared to platforms like Facebook (privacy issues, addiction), Instagram (addiction, mental health), Twitter (conflict, addiction) or Snapchat (safety concerns for younger users). The Pinterest platform in its current form will be relatively hard-pressed to encounter similar criticisms, making it a far cleaner choice for advertisers and generally a nicer site to visit.

Developing a platform

Pinterest has evolved as a platform quite considerably over the past couple of years. They have added a host of new features and tools for both the everyday user, content creators and advertisers. Some of the new additions include an updated storefront profile, new user UI, testing for product tags, visual search, integration with Shopify and a new suite of merchant tools.

Shopping:

The impact these additions have had on the shopping aspect of Pinterest is huge. They have resulted in a platform where advertising does not compete with native content – advertising is native content. The buying process is simple and seamless, which is leaps and bounds ahead of other social media sites attempting to monetize their platform (think obnoxious Facebook Ads).

Advertising:

Advertising, an aspect of the platform Pinterest have been laser-focused on over recent years - and is an area we are starting to see a tangible benefit from. Part of the reason for this is to do with the type of intent users have whilst browsing the site which is more ‘commercially driven’ than other sites such as twitter where users aren’t necessarily in the mind-set to buy something. This makes the task for advertisers of identifying potential customers an easy one.

Alongside all the other added features, they have recently added an automatic bidding system for advertisers which allows advertisers to scale their advertising spend. The success of this bidding system is demonstrated by the fact that since the very short period of time since launch (July 2020), the bidding system has accounted for more than half of the company’s conversion revenue. Also, most of the early adopters of this automatic bidding system have increased their advertising budget since.

In addition to all of this, the focus on automation shows the long-term intent of Pinterest as it allows for effective scaling capabilities.

Quickly growing audience:

Growth in monthly active users is impressive, with y/y MAU growth at +37% bringing the total number of users to 422 million. This is taking into account that the bulk of growth is happening in the international markets.

Also noted in the Q3 documentation was particularly strong growth in the users under age 25. This may not seem like a big deal at the moment, but as this demographic ages over the next 5 – 10 years, their purchasing power will grow with them – bringing in more advertisers and generating greater revenues.

Finances

Income statement

Revenue for 9 months ended September 2020 increased by 32.87% to $987 million.

Q3 revenue grew 58% y/y driven by recovery in advertiser demand.

Gross margin over this same time period improved from 65% to 68% which came from a sharp reduction in R&D, Sales + Marketing and G&A expenses.

Most of the high expenses in2019 are largely to do with share-based compensation during the year of their IPO

Still operating at net loss.

Adjusted EBITDA grew to $93 million (21% of revenue) y/y from $4 million in Q3 2019.

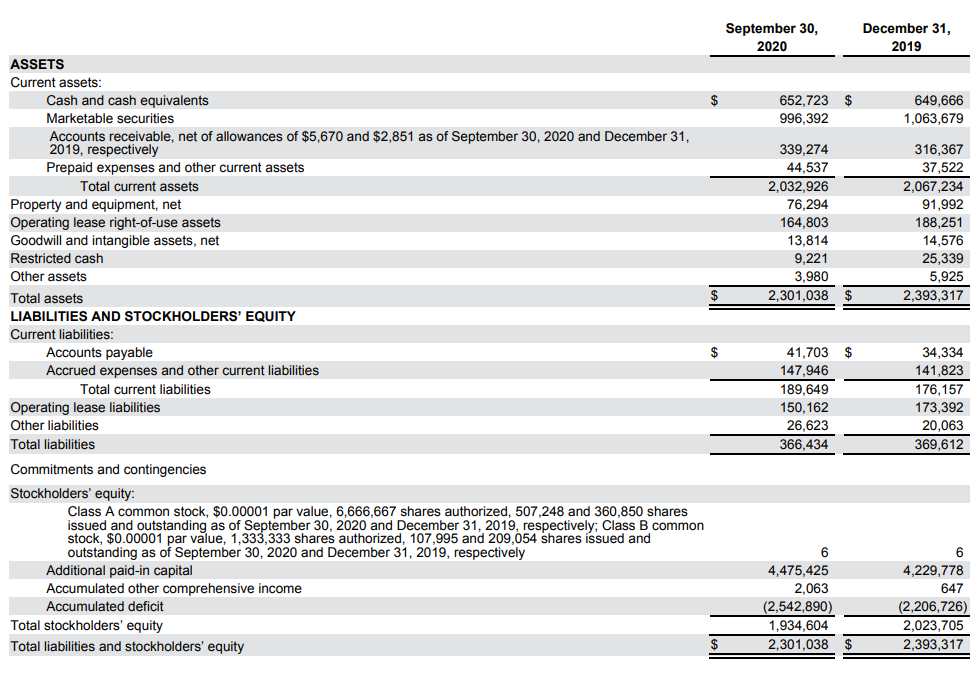

Balance sheet

Total Current assets of $2.3 billion

Total liabilities of $336 million

Able to pay off their current total liabilities by almost 2X with just their current cash and cash equivalents, and by almost 7X with their total current assets. Very healthy position.

Valuation

It’s hard to ignore the high valuation here at roughly 30X sales, but in my opinion not completely ridiculous given the strong top-line figures along with the prospect of growth over the next 5-10 years. Taking these factors into account, the valuation doesn’t seem too outrageous.

Let’s take a look at Pinterest in comparison to the other social media companies: Twitter, Facebook and Snapchat, where we can see that compared to the larger more established players, the stock is looking pricey at 30X sales compared to about 10X for Facebook and Twitter. But more or less in line with Snap who are similar in scope.

A $40 billion dollar market cap really isn’t that big for a digitally scale-able business compared to other social media giants such as Facebook ($715 billion). Pinterest are never going to be on the same scale as Facebook realistically, but there is absolutely room to grow somewhere in between the two valuations.

Overall, I’m relatively happy after looking at the financials. Strong top-line growth is promising alongside a growing user base and a rock solid balance sheet. However, margins have been held back recently due to a tonne of stock based compensation which should improve moving forwards. I’m happy to see Pinterest crossing over to profitability on an adjusted basis, however I would like to see this more consistently before I get too excited.

Risks

It’s important to look at the risks Pinterest face in their quest for growth.

Firstly, it is stated in the Q3 filings that a decent chunk of this current growth in users is in some part down to the COVID-19 pandemic, forcing people to stay indoors and use their platform for ideas such as home work setups or house plant ideas/tips and tricks. One big question mark is whether we will see some sort of slowdown coming out of the pandemic.

Other risks include:

Ability to attract and retain users

Copy-cat competitors

Over-doing the advertising making the site unplesant

Disruptive new tech/social media platforms (rapidly evolving industry)

Ability to keep developing desirable new product offerings and improve existing ones

Maintaining strong brand reputation

Ability to compete for advertisers

Only in early stages of monetization

Most revenue is from advertising

Some of these risks are within the control of the Pinterest team, so I will be keeping an eye on whether they are addressing these risks over the next couple of quarters.

Conclusion

All in all, I’m impressed with the performance of Pinterest over the past year. They are rolling out a bunch of value adding tools for both every-day users and advertisers whilst making promising early efforts on monetisation.

This, combined with the fact they are improving at attracting advertisers to the platform sets them up well for significant growth over the next 5 years.

The stock, like many out there, has achieved all-time highs only recently which is a fair enough reason to be put off. However when I’m deciding to allocate funds towards an asset – about 30% of the decision is based on how the company is doing now, whilst the other 70% is related to their future potential. So, based on that, I firmly believe there is space and plenty of room to grow in an ever evolving market.

In order for this growth to take place I want to see sustained profitability, continued MAU growth and an increase in the average revenue per user over the next few quarters. It will also be interesting to see how the company does coming out of the pandemic as COVID somewhat accelerated growth.

I think this is a big stock for the next decade.

Cheers,

Innovestor.

Great break down, keep up the good work!