Key Stats

More than 49 million monthly average visitors to website as of sept 2020 (up almost 15 million y/y)

Total real-estate service transactions up 23.3% y/y to 24,160

US market share up to 1.04% y/y

Average number of leads generated up 15.26% to 1,820

Thesis

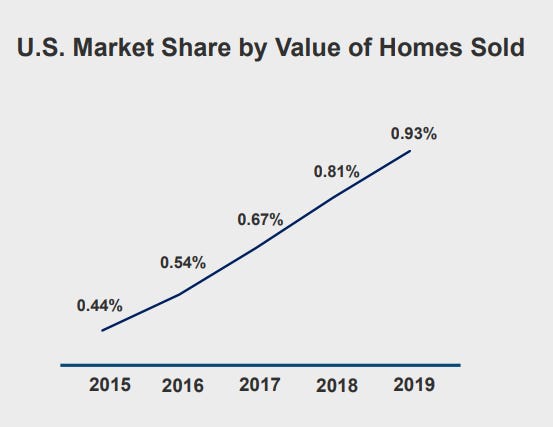

Driven by the low relative cost and frictionless experience alongside their competitive counter-positioning strategy, Redfin are steadily gaining market share within an industry estimated to have achieved $82 billion in real-estate commissions within 2019.

Using the tailwind of the pandemic as a firm base to push off from, I believe Redfin will continue to see tremendous growth in the coming years as the sentiment continues to shift towards digital. This, combined with consumers slowly realising the cost savings from using the Redfin service will further add to the coming growth.

Betting on Redfin is betting on a combination of the shift towards digital and the continued growth of the US Real-estate market.

Business Model

One of Redfin’s main goals is to re-define real-estate in the consumers favour. The company leverage technology to bring buyers and sellers together in order to be able to do business directly on their platform.

Redfin helped customers buy/sell more than 235,000 homes worth over $119 billion in 2019, saving the average customer approximately $1,850 per transaction.

The value Redfin offers is 5-fold:

Agents there to service your needs, not theirs. Better customer experience at lower cost.

Shown by higher retention rate.

Quicker sales.

Great exposure for your listing (#1 most visited brokerage site).

Easy to use tech at every step in the process.

Potentially save thousands over traditional brokerage methods.

One crucial element of Redfin’s business model is to counter-position themselves from the ‘traditional’ real-estate business model. This results in the majority of Redfin’s counter-positioning coming from two main aspects…

Using full-time employees rather than the standard industry model of essentially ‘independent contractors’ (not quite, but pretty much).

Lower fees. Usual fees on a property transaction are about 3% for buyers AND sellers agent (~6%). Whereas Redfin charge roughly 1%-1.5%.

Full time employees

For as long as I can remember, the real-estate sector has been operating under the model of employing agents who are basically employed as ‘independent contractors’. They partner with a broker in order to help gain the benefit of a brand and steady clients, and in return they pay a broker a portion of their commission. This is usually about 3% for the buyers agent and 3% for the sellers agent (overall 6%). E.g. for the sale of a $500,000 house, you could expect fees of about $30,000.

This model has essentially become the norm due to the good money that can be made. Redfin are looking to change this so the consumer benefits from the transaction.

However, the downside to this innovative business model is that it somewhat lacks flexibility. Paying staff fixed salaries regardless of how many listings are processed in any given month, leaves the company with the risk of posting a loss if the total commission revenue doesn’t exceed the cost of operations for the month, which will consist mainly of the fixed employee cost. These higher upfront overhead costs could come back to bite Redfin if there are any significant downturns in the Real-Estate market.

Cheaper commission

Arguably the more important aspect of the company’s counter-positioning strategy is the innovative commission model. As mentioned above, a traditional home sale ends up with about 6% or more in realtor fees.

Redfin fees are much lower. For Redfin to sell your house, you will pay a 1.5% fee, or a 1% fee is you use the service for both buying and selling. If your house is proving tricky to sell, they will fix it up for you and then list it for only a 2.5% fee, still less than the competition. Finally, if your house is one of those that sits on the market for months without a buyer, Redfin will buy it from you for a 7% fee.

All this means that for someone who normally would build months of years of maintenance or mortgage payments on a home they don’t even live in, they could get rid of it for only 1% more than it would have cost them to use a traditional broker in the first place.

This implies difficulty for traditional brokers to adopt Redfin’s model.

Counter-point

Q. Redfin's counter-positioning may be effective in limiting the response of legacy real estate agencies. However, how does it tackle new participants to the market who are able to relatively easily replicate the business model?

A. Redfin have the advantage of time over other competitors looking to gain market share. Redfin have spent over half a decade building up to a 1% market share which they can build on moving forwards. Any competitor looking to enter into the market will take significant time to reach this level, by which time Redfin should be miles ahead.

Core products

Redfin online brokerage – listing services.

Redfin Mortgage – Available in 54 markets. Allows the user to underwrite mortgage loans.

Title forward – Linked company that provides title and settlement services.

Redfin Now – service that buys homes directly from owners for a near-instant cash settlement in order to resell to buyers. Estimated profit coming in 2021/2022.

The overall goal here (as shown in the image below) is to eventually combine the Redfin Brokerage, RedfinNow, Redfin Mortgage and Title Forward into one elegant solution.

Market opportunity

Redfin operates within a large TAM (total addressable market) which consists of people buying, selling and financing homes within the US. Data shows annual home sales in the US were in the region of $1.9 trillion in 2019, with an estimate from Redfern indicating a total of $82 billion in US real-estate commissions.

The US retail real-estate is an industry where there is huge potential to implement digital transformation in an otherwise stagnant environment – similar to the health industry.

Massive fragmented market

Low digital penetration

Low interest rates and high propensity to move in 2021/2022, should drive record sale volumes

Competition

Residential real-estate is a competitive landscape. Redfin estimates over 86,000 brokerages within the US market. Some of the main competitors operating within the similar ‘disruptive technology’ segment of the overall market include Zillow, eXp, Purplebricks and Opendoor – with Zillow and eXp being the closest in terms of business models.

Management

Redfin’s management consist of highly skilled and passionate individuals who are seemingly committed to making Redfin a market leader over the next 5-10 years. To profile just a few…

Glenn Kelman - CEO

Prior to joining Redfin, he was a co-founder of Plumtree Software, a Sequoia-backed, publicly traded company that created the enterprise portal software market. In his seven years at Plumtree, Glenn at different times led engineering, marketing, product management and business development; he also was responsible for financing and general operations in Plumtree's early days.

Scott Nagel – President of Real Estate Operations

Scott runs the real estate operations at Redfin, with responsibility for revenues, customer service and legal compliance. Prior to Redfin, he was a managing director at LexisNexis, with profit-and-loss responsibility for an $80 million-business.

Chris Nielsen - CFO

Chris leads the finance team at Redfin. Before joining Redfin, Chris was the chief financial officer and chief operating officer of Zappos.com, a leading destination in online apparel and footwear sales, where he oversaw the company's financial and fulfillment operations.

Bridget Frey – Chief Technology Officer

As Redfin’s Chief Technology Officer, Bridget leads the software engineering team, which she has grown to more than 150 engineers in Seattle and San Francisco.

…here’s a brief detour…

Matterport SPAC (GHVI)

This section will be a slight tangent from the article – but one I think is absolutely worth the read, as it could potentially be a buying opportunity depending on your take.

Part of Redfin’s product offering is to create a compelling and immersive experience for the users of Redfin – encouraging the users to come back to the site vie their interactive map and virtual tours of the properties. This is where Matterport comes in.

Matterport is the leading 360 virtual tour platform provider. It’s hard to argue otherwise when taking a look at the quality of their virtual tours compared to other similar products. Below is a list of Matterport’s client list (which is impressive to say the least). It includes names like Redfin, AirBnb and H&M.

The reason I mention Matterport here is because it was recently announced they will be going public via SPAC with Gores Holdings VI. Therefore the shareprice of Redfin could be closely linked to the success of Matterport (or vis versa) over the next 5 years as long as Matterport are continuing to supply the majority of virtual tours.

If you’re bullish on Redfin and their ability to solidify themselves in the American real-estate market, then it’s likely Matterport will somewhat follow suit. Like with a lot of successful companies – as their customer base grows, they grow alongside.

That being said, Matterport have plenty more strings to their bow as they supply many differing services for differing industries.

Keep an eye on $GHVI.

…back to Redfin…

Finances

*To be updated on 24th Feb 2021 to reflect Q4 earnings*

Market Cap of $8.88 billion

YTD return 29.03%

Gross Margin (TTM)

EBITDA -$62,650,000

FCF $38.5 million

Revenue growth TTM 30.42%

Revenues

Redfin generate the majority of their revenues from the commissions and fees charged on each real-estate services transaction closed by lead agents/partner agents and from the sale of homes.

Q3 revenue declined 0.74% y/y to $236.92 million.

TTM Revenue growth (as of 30th sept 2020) stands at +60.15%, up from +31.59% growth in 2019 and +38.49% growth in 2018 to reach the current TTM revenue of $874.77 million.

This is some really encouraging growth over the Coronavirus period, however the company does mention it expects to see a decline in revenue growth for Q4.

Revenue growth since 2016

TTM net loss decreased by 52.67% to $40.34 million driven mainly from a sharp decrease in the cost of sales over the past several quarters.

Now lets take a look at the individual segments of Redfin’s operational devisions: the real-estate service (comprising of brokerage and partner business), properties (homes sold through Redfin’s RedfinNow service) and other (including mortgage, title and other services).

Real estate service:

The real-estate service revenue was up 36% y/y driven mainly by the increase in the partner business (+93%) followed by the brokerage aspect which gained 33%.

Properties segment:

The properties segment significantly under-performed this quarter, generating $19 million compared to the prior year’s $80 million (a 76% decrease).

Other:

Lastly, the ‘other’ segment generated $8.5 million compared to the previous year’s $5.1 million, netting a 65% increase.

Valuation

To quickly look at the valuation of the stock here, we will look at the PS ratio compared to other competitors within similar markets – Zillow $ZG and eXp world holdings $EXPI.

As you can see, the PS ratio of each of these is roughly within the 7x – 11x range, with Redfin sitting in the middle at 9.742. However it is important to note the large run-up in valuation since March for all three of these companies. This may initially look like each of these are at a point of being very expensive. However, you need to take into account the changing market dynamics – moving forwards these type of online marketplaces seem to be where the market trends are heading, which would imply these valuations are fair.

However, I would add that revenues are possibly not the best way to measure the value here as the quality of revenues (gross margin) between each of the three companies are significantly different (as seen below).

Conclusion

Redfin’s overall share of the US housing-sale market has broken past the 1% barrier, which still leaves plenty of room for growth over the coming decade. The company are rapidly increasing their share of the market through an undeniably attractive proposition of lower fees, better customer experience, seamless technology integration and working with agents who have your best interest at heart.

Overall, I’m confident there is plenty of room to grow here, however (as with most growth companies in the market at this current time) I’m concerned about the valuation. I’m also cognisant of the variety of risks involved. For example:

Covid 19 impact on the housing market

Novel business model may not work

Relies on stability of overall housing market

Operating in highly competitive market

So far, Redfin have been able to establish themselves within this competitive market whilst growing at a rapid rate.

Cheers,

Innovestor.

1.5% is the commission for redfin but as a seller you have need to pay buyer agent commission as well , which could be 3% .. ideally, its 4.5% from 6% .. also redfin will charge 1% if you buy and sell from them within 6 months