Shopify represents a shift in consumer behaviour over the past decade (maybe more-so the past year) towards an entirely digital marketplace. The internet is the new frontier of commerce, and Shopify seem determined to capitalize on the opportunity.

Key Stats

Market Cap of $168.21 billion

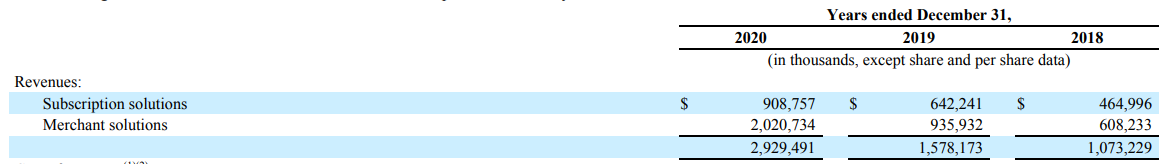

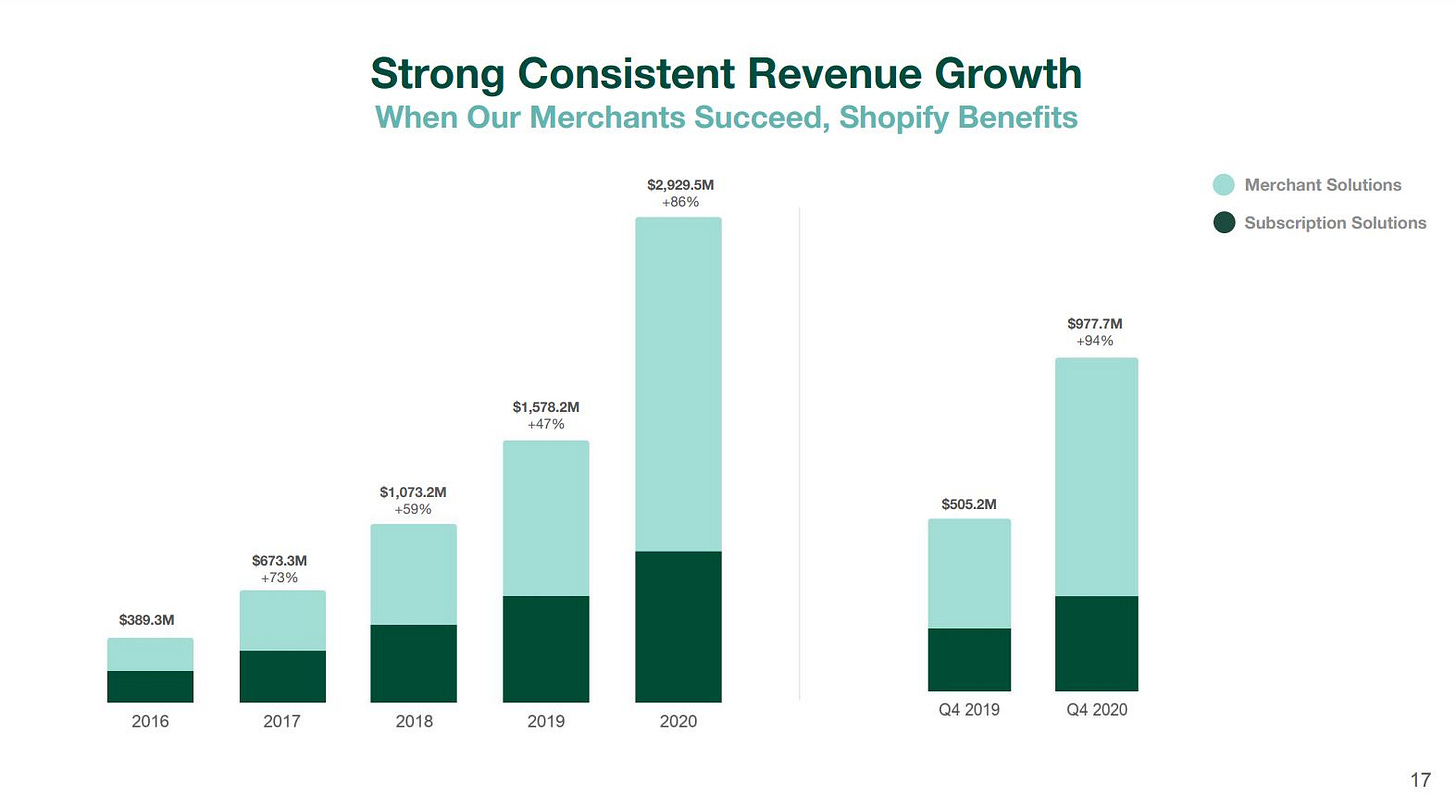

Total revenue for the full year 2020 was $2,929.5 million, (+86% increase y/y)

Gross profit grew 78% to $1,541.5 million in 2020, compared with $865.6 million for 2019.

Operating Income of $90.2 million for 2020 vs an operating loss of $141.1 million in 2019

Expected to continue growing revenue rapidly in 2021 though not at the rate of 2020

GMV exceeds $41 billion for the Fourth Quarter and Reaches $120 Billion for 2020

Background

Originally, in 2004 Tobias Lütke, Daniel Weinand and Scott Lake decided to begin their e-commerce journey by selling snowboarding equipment – creating a store called ‘Snowdevil’. However at the time the internet didn’t make setting up an online store easy.

A quote from Tobias Lütke describes it nicely: “I set up our online store based on a variety of different systems such as Miva, OsCommerce, and Yahoo stores. Truth be told, all those systems made my skin crawl because of how bad they were. The final straw was when I got a custom design made for my snowboard store and I couldn’t get it to work in Yahoo stores. We had this great CSS-based layout done with all these new fanged ‘web standards’ and the customizability of Yahoo Stores barely allowed me to change the background color of the top frame.”

Out of this frustration (like many good products) emerged the idea to build a tool giving users the ability to create easy customisable online storefronts. In its essence, Shopify is the exact same company with the exact same mission as back then – just much improved.

Strong ideas stand the test of time.

Company Overview

Shopify’s aim is to make the cost of failure for small businesses as close to 0 as possible.

The company competes under the broad umbrella of e-commerce, however they are relatively unique in that they are the backbone of online retail for small and medium sized businesses. Shopify ‘enables’ entrepreneurs by offering the tools to be able to get past the initial barrier-to-entry.

Shopify enable mainly small-to-medium sized businesses the ability to bring their store online in an easy, affordable way. The company allows you to set up both the front-end (design, layout, logo etc.) and the back-end (payment processing, inventory, order management, analytics and much more).

There are two main revenue streams:

Subscription solutions revenue is generated primarily through the sale of subscriptions to the platform, including variable platform fees, as well as through the sale of subscriptions to the Point-of-Sale ("POS") Pro offering, the sale of themes, the sale of apps, and the registration of domain names.

Merchant solutions revenue includes additional services to merchants not offered within the main subscription plan. This includes tools such as payment processing, shipping and fulfillment and financing of working capital. These solutions create value for merchants – saving time and money by making additional functionality available within a single centralized platform.

Pricing

Pricing-wise, Shopify is extremely competitive and arguably the best ‘value for money’ service out there. You can start out with a free account which lets you get used to the interface and set everything up for a 14 day period – after which you will have the option of one of the following…

There are a host of differences between the plans outlined above that aren’t included in this image. But for most SME’s the ‘Basic Shopify’, or ‘Shopify’ options will be more than adequate.

Market Opportunity

The secular change from offline to online is moving at a rapid pace, and has only been accelerating over the past year.

Grand View Research estimate the e-commerce market at $9.09 Trillion in 2019, expecting a CAGR of 14.7% to 2027 to reach a value of $27.23 Trillion.

Research and Markets estimate a current e-commerce value of $8.41 Trillion in 2019, expecting a CAGR of 32.4% between now and 2024 to reach a value of $34.2 Trillion.

Here I will make several assumptions. Firstly, lets assume the SME segment of e-commerce makes up about 25% of the overall market. Secondly, we will use the 2021 Grand-View-Research estimate of the e-commerce market size ($8.41 Trillion). Lastly, we will use a ‘take rate’ for Shopify at 2.6% (the average value of the take rates over the various plans). From these assumptions we can estimate the Total Addressable Market in 2021 for Shopify to be $77.74 Trillion, with Shopify successfully penetrating only 4% of the overall market. Plenty of room for growth.

Shopify estimate a Total Addressable Market (TAM) of $153 billion in their most recent investor presentation, so I might be slightly off with the SME market share segment. However, it’s a good exercise to visualise the level of growth still accessible to the company at this point in time.

Innovation

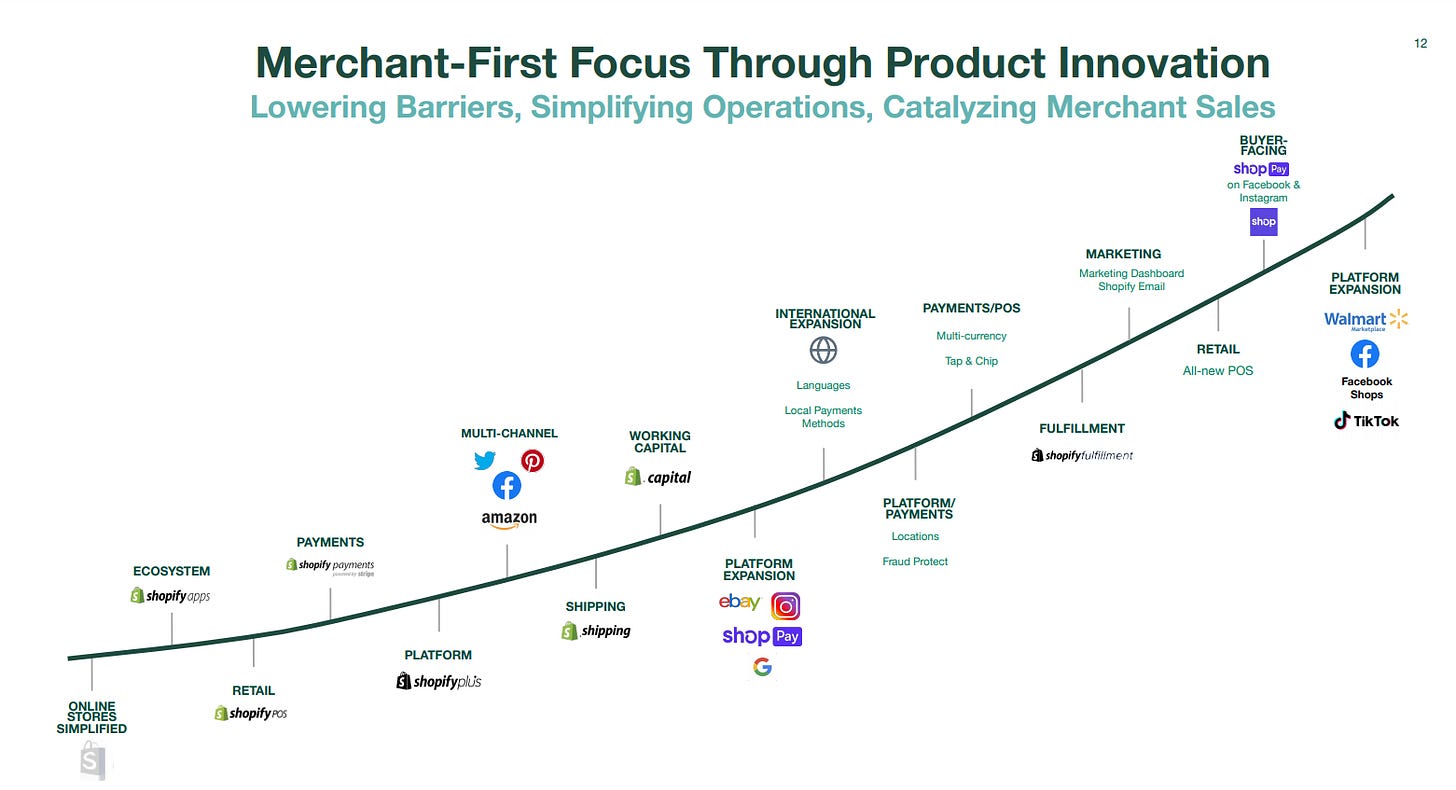

Part of the impressive growth present is down to the stellar strategy for investment in innovation and the frequency with which they come out with new innovative tools for the benefit of the merchants. With the increase in tools comes an increase in the Gross Merchandise Value (GMV), which has increased from $15.4 billion in 2016 to $119.6 billion in 2020. GMV represents the total dollar value of orders facilitated through the Shopify platform including certain apps and channels for which a revenue-sharing arrangement is in place.

This large increase in GMV shows the effectiveness of Shopify’s Strategy to increase the product offering within the eco-system – encouraging users to choose Shopify for a variety of solutions.

Several of the recent innovations include:

Instagram and Facebook to integrate Shopify, potentially increasing conversion rates by 1.72X

Shopify Fulfilment Network

Shopify POS

Additional language capabilities

Shopify Ping – chat with your customers utilising Facebook messenger.

Plans for future growth

In order to keep up the pace of growth to retain the current flywheel effect, Shopify have drawn out a short, mid and long-term plan with specific target areas.

In the short term- the goal is to ensure the functionality of the platform, payments system, shipping, capital and plus service is constantly updated and improved.

In the medium term, Shopify are looking to continue their efforts to expand globally, opening up the potential of penetration into other markets. Currently Alongside this, they are looking to expand and improve their Point of Sale system.

Lastly, the longer-term plan is to continue work on the recent acquisition of ‘6 River systems’ AI capabilities in order to improve the Shopify Fulfilment network. This is a part of the business with potential to grow the total addressable market. Alongside this, the company will keep working on Shopify Balance (accounting), Shop App and their wholesale B2B capabilities.

In addition, and underlying these key short, medium and long-term aspirations – Shopify are invested heavily in continuing to drive future growth. The aim of investing in growth is to improve the revenue base, retention of merchants and strengthen the ability to increase sales to Merchants (GMV). Key pillars of this include:

Grow Merchant Base

Focusing on product and brand marketing paired with global earned media efforts and ongoing content creation/distribution.

Increasing functionality to boost adoption include the translation of the platform which is now available in +20 languages.

incorporation of local payment methods into Shopify Payments

strategically invest in marketing programs that enhance the awareness of our brand and solutions among businesses at different stages of their lifecycle

opportunity from larger businesses looking for faster time-to-market and better value as they innovate to meet rapidly evolving buyer demands

inspiring entrepreneurship through marketing programs

investing in additional sales capacity focused on acquiring larger merchants and brick and mortar retail merchants

Grow Merchants’ Revenue

Goals tightly aligned to that of merchants – the more successful a merchant, the more revenue they produce for Shopify.

Continue to improve our platform to help our merchants sell more

Continue to use initiatives such as our Shopify blogs, Shopify Compass, Shopify community forums, and Shop Class programs to educate our merchant base on how they can be even more successful using the platform

Continuous Innovation/expansion

Consistently expand functionality of platform to meet evolving technology demands (e.g. mobile 2010, payments 2013, shipping 2015, Capital 2016, Fulfilment Network 2019, e-mail 2019, pay instalments 2020, integration with Facebook and Instagram 2021)

Grow and Develop Ecosystem

Thriving third-party ecosystem that includes app developers, theme designers, and other partners that bolster the functionality of the platform.

Shopify host an annual conference to demonstrate to partners the opportunities that exist to collaborate in building the future of commerce technology.

Currently approximately 6,000 apps available in the Shopify App Store

The vast ecosystem makes the Shopify platform more attractive and ‘stickier’, which further expands the merchant base, and in turn drives additional growth within the ecosystem.

Referral Partners

Strong relationships with thousands of design and marketing agencies throughout the world.

Approximately 42,200 active partners referred merchants to Shopify in the past 12 months, and this works in the opposite direction using the services marketplace.

Build for the long-term

Longer-term initiatives include localizing the platform for international expansion, promoting the brand, expanding the existing services, introducing new solutions, and entering into strategic partnerships and acquisitions.

In 2019 Shopify launched a sustainability fund committing at least $5 million annually to fund the most promising and impactful technologies and projects to combat climate change.

Not going anywhere

At this point, Shopify have fully solidified themselves as one of the leading brands within the e-commerce sector. Their SaaS software suite lowers the barrier-to-entry for many businesses with limited technical skills looking for an affordable option. Part of the beauty of this business model is the idea of a fly-wheel effect – where an increasing user base increases Shopify’s ability to implement innovative value-adding tools, which then leads to a further increase in users.

With that being said, many businesses now rely on the Shopify ecosystem - which is part of the reason for the large market share. Though it’s worth pointing out the rise of WooCommerce and other similar companies, who are currently gaining market share.

These are similar but ultimately different platforms as the target audience for WooCommerce focuses on the more technically proficient business owner.

Competition

This is not a market without competition. There are a host of similar competitors within the space, such as WooCommerce BigCommerce, Squarespace, Wix amongst many others. Many of these represent high-quality products offering a relatively similar service. Additionally, within the wider e-commerce sector Shopify indirectly compete with companies like Ebay, Etsy and Amazon.

So what needs to happen in order for Shopify to distinguish themselves from the pack?

Shopify need to continue to execute on…

Their long-term vision

Keeping the product simple, easy to use and cost effective

Integration of multiple sales channels

Creating a vast app eco-system

Maintaining the pace of innovation

Scale efficiently

Supporting the merchants

Looking at the core competition, no-one currently offers an integrated, multi-channel, cloud-based commerce platform with comparable functionality to Shopify.

Rapid growth of the industry is likely to attract new entrants to the market – though Shopify are in a strong ‘market leader’ position, which gives them a unique competitive advantage alongside an unrivaled depth of product offering.

Financials

The financial results for the year of 2020 are really encouraging here for Shopify.

EPS $1.58 compared to $1.21 in 2019

Market Cap of $168.21 billion

YTD return 26.31%

Gross Margin (TTM) 11% up from -8% in 2019

Revenues

Total revenue for the full year 2020 was $2,929.5 million, (+86% increase y/y).

Subscription Solutions revenue grew 41% to $908.8 million

Merchant Solutions revenue grew 116% to $2,020.7 million.

GMV (Gross Merchandise Value) for 2020 was $119.6 billion, an increase of 96% over 2019.

GPV (Gross Payments Volume) grew to $53.9 billion, which accounted for 45% of GMV processed versus $25.7 billion, or 42%, for 2019.

Profitability

Gross profit grew 78% to $1,541.5 million in 2020, compared with $865.6 million for 2019.

Operating income for 2020 was $90.2 million, or 3% of revenue, versus an operating loss of $141.1 million, or 9% of revenue, for 2019.

Net income for 2020 was $319.5 million, or $2.59 per diluted share, compared with net loss of $124.8 million, or $1.10 per basic and diluted share, for 2019.

A quote on short-term gross margins for merchant solutions: “We expect to see our gross margin percentage for merchant solutions decline in the short term as we develop Shopify Fulfillment Network and 6RS. The lower margins on merchant solutions compared to subscription solutions means that the continued growth of merchant solutions may cause a decline in our overall gross margin percentage.”

Valuation

One of the big risks here is the extremely high valuation, however Shopify are starting to show why they deserve this lofty valuation with the very strong 2020 full-year results. The current EV/Sales for 2020 stands at 70.95 according to Y-Charts, which is at the very high end of anyone’s estimates from the beginning of 2020.

It’s tricky to compare Shopify to other competitors within the same market due to the market mainly consisting of private companies, however when comparing Shopify to other large SaaS companies (like Zoom $ZM) the valuation seems on par with the market.

However when comparing Shopify to other e-commerce platforms such as Amazon, Walmart, Ebay and Etsy – The valuation is looking expensive.

Putting a value of cheap or expensive on any company in the current market is near impossible, so take of that what you will.

Management

Founder led.

This is the most important aspect in my opinion. Tobias Lutke is a visionary leader whos company is a reflection of his personality and values. I absolutely love to see this in a business.

Risks

Competitors and new entrants

While you would argue that Shopify has the most well-rounded solution in the e-commerce platform industry, there are some really high-quality companies looking to get a slice of the pie. For example, WooCommerce, Wix, GoDaddy, Squarespace amongst many others pose significant challenges to Shopify. Can the company be experts in many different specialities (payments, logistics, fulfilment etc…) over the long run?

User base relies on SME’s performing well

If faced with an economic downturn where business suffers as a result, we could easily see Shopify’s performance mirror that of the market.

Continuing to grow requires increased investment.

This shouldn’t be too much of an issue for Shopify in terms of finding the cash. However, the quality of innovation needs to be high in order to retain customers in this competitive environment.

Covid-19

It turns out that Covid 19, instead of hindering the day to day operations, propelled Shopify to another level. This mainly stems from the forced shift for many consumers towards digital. As high-streets re-open later this year, we might see a decrease in the need for online stores. However, in my opinion this trend is here to stay.

Conclusion

Shopify has a long runway to success. With Covid as the main catalyst, the secular shift from ‘bricks & mortar’ to ‘online’ has been significantly accelerated over the past year. They are in a prime position to be able to capitalize on this huge tailwind.

These points, combined with the stickiness of the business (irreplaceable service to most customers) and their proven track record of innovation indicates Shopify have considerable room to grow.

Take what you will from the slide below showing 2020 market position. But to me it looks like Shopify are clearly signalling their intention to eat up some of Amazon’s dominance in the e-commerce market. Obviously a huge ask - but they’re gaining momentum and closing that gap.

Absolutely still a buy. Shopify are about as quality a company as you will find.

Cheers,

Innovestor