Today is a different style of article than the usual Innovestor deep-dive. I’m hoping to produce more of these short-form ‘stock take’ articles which will cover various topics related to stocks and investing. Ideas of future articles include:

The power of good Intellectual Property

Basics of valuation

Various industry segment overviews (Gaming, 5G, immersive technology etc…)

Feedback is always appreciated. Enjoy!

Which would you rather?…

A pilot flying a plane whilst sitting in the cockpit? Or a pilot flying the plane remotely, sitting in an office?

An engineer designing an aircraft without ever having to use it? Or an engineer designing an aircraft which he/she is forced to use at least twice a year?

Recommendations on a project from consultants who don’t have any intention of implementing the changes? Or advice from consultants with a responsibility to implement?

Giving your money to a fund manager with a large personal stake in the fund? Or giving your money to a fund manager with no personal exposure?

These are all practical examples of real-life situations where having some sort of ‘skin in the game’ is likely to be beneficial to the outcome of a situation/task. The reason being is that there is an obvious alignment of incentives.

What do we mean by ‘skin in the game’?

The origins of the phrase is mainly unknown, however one theory relates to William Shakespeare’s ‘The Merchant of Venice’ where the antagonist ‘Shylock’, demands collateral of a pound of flesh on a debt from the protagonist ‘Antonio’.

Skin in the game is one solution to the ‘principal-agent problem’, where a person making decisions on the behalf of others has little-to-no incentives to act in their best interests.

“Skin in the game is an individual who assumes risk related to their decisions, strategies, advice, designs and activities. Generally speaking, individuals who are responsible for risks are more likely to make good decisions and put in a reasonable effort.”

Put simply, it is the idea of having a personal stake in the outcome of an event/situation.

In this short piece, I’ll be taking a look at how the concept of ‘skin in the game’ can help with your investing strategy.

Skin in the Game on a personal level

Have you ever placed a bet on a sporting event - maybe horse racing, football, or basketball?

Next time you do, think about how you feel before and after placing the bet. Chances are you will find yourself way more invested in the horse or team for which winning benefits your bank balance.

In sports, many people use betting to make the game more enjoyable due to the higher personal stakes involved. Therefore if we apply the same principle to investing, we can use it to our advantage by playing on our innate human biases.

The feeling of wanting your team/horse to win when betting is a very similar feeling to when you invest in a stock. You will do everything in your power to help your team to win (shouting at the TV). Similarly when investing a small amount in a stock, your immediate impulse is the desire for that stock to increase in value as much as possible. The result of which is an increased desire to delve deep into the company accounts - finding any source of information which could give you an edge over other investors.

In reality, it’s not always a good idea to start a small position in a company for the sole reason of making you more personally invested in the company. But if it’s a company for which you have carried out a good portion of your DD, it’s often a good idea to initiate a small position to see if you feel comfortable with the decision/volatility.

“What matters isn’t what a person has or doesn’t have; it is what he or she is afraid of losing.”

The above quote comes from a book I recently finished called ‘Skin in the Game’ by Nassim Taleb. An interesting book filled with thought-provoking examples. I found myself disagreeing with about as many ideas as I agreed with. Take of that what you will. A thought-provoking nonetheless.

The underlying message in this book is about the asymmetry of information and how having skin in the game is the desired option for most scenarios.

“The curse of modernity is that we are increasingly populated by a class of people who are better at explaining than understanding, or better at explaining than doing.”

How can I make sure I apply ‘skin in the game’ to my investing process?

When we look at ‘skin in the game’ with regards to the companies we choose to invest in, we are basically asking the question… “does company X have the correct incentives in place in order to enable the best chance of future success?”

I have three main ways of distinguishing companies with skin in the game from those without. There are nuances with each of the below, however they serve as a good rule of thumb.

1. Insider ownership

One of the best ‘tells’ as to the incentives of a company’s management team is the level of stock ownership present. For example, the CEO at company A might own 20% of the company’s shares, whilst CEO of company B only owns 0.5% of Company B’s shares.

Which do you think has the better incentives to ensure the future success of the company?

2. Founder led

Founders being involved in the company when looking to invest (even in a small capacity) is usually a big positive. The reason being is that it represents one of the main principles of skin in the game - that the long-term vision for the company is directed by someone who (at their core) cares about the success of the business. And not just success in terms of making money, but more-so ‘legacy’ for the founder.

A good example of this is Amazon. Jeff Bezos, the founder of Amazon, built the company up from scratch in order to be the behemoth it is today. That being said, just because the original founder is no longer involved in the project, it does not mean the company cannot thrive.

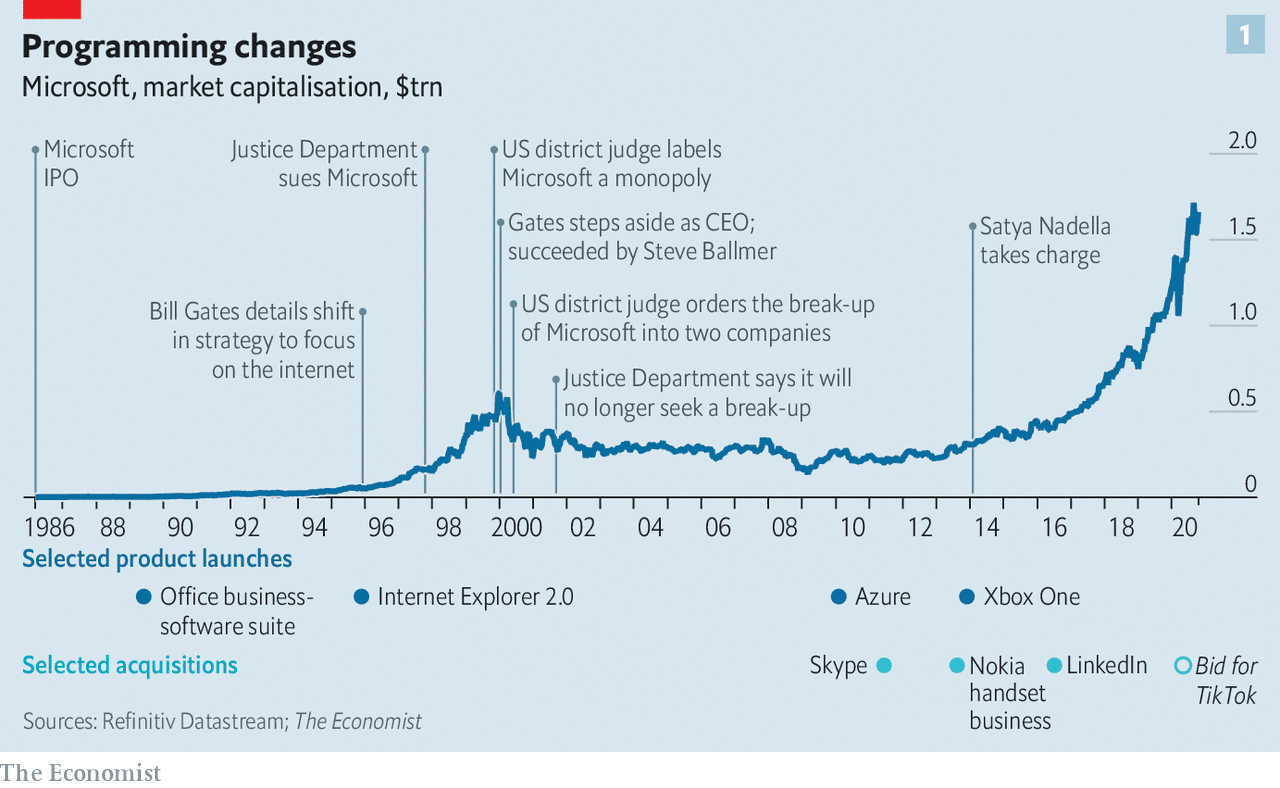

Take the below chart as an example, showing Microsoft’s success over the past several years since the on-boarding of a new CEO.

We can clearly see that Steve Ballmer didn’t have the best spell as CEO of Microsoft. This all changed when the company recruited Satya Nadella as the new CEO in 2014.

3. CEO satisfaction

This is an added bonus if I can find the data. Here I’m looking to see if I can find any reviews from staff members (past or present) to indicate the culture and approval rating of the CEO.

As an example, I’ve used the widely-praised Redfin CEO Glenn Kelman who, as we can see, is a popular CEO. This leads me to believe the company culture is good and the employees are empowered in working towards a common goal.

Each of these ‘rules’ should not be taken as absolutes when used in your due-diligence, but rather pieces of information used to paint the broader picture.

Having skin in the game increases your opportunity to learn

Lastly, I’ll take a quote directly from Steve Jobs. He used the example of working in consultancy as a reason why ‘skin in the game’ is so important and valuable to your growth…

“I think that without owning something over an extended period of time (several years), where one has a chance to take responsibility for one's recommendations. Where one has to see one's recommendations through all action stages and accumulate scar tissue for the mistakes, and pick oneself up off the ground, and dust oneself off… one learns a fraction of what one can.”

“When you're coming in and making recommendations and not owning the results, not owning the implementation… I think (you get) a fraction of the value and a fraction of the opportunity to learn and get better. You do get a broad cut at companies, but it's very thin. It's like a picture of banana – you might get a very accurate picture, but it's only two-dimensional. And without the experience of actually doing it, you never get three-dimensional. So you might have a lot of pictures on your walls. You can show off to your friends like ‘I've worked in bananas, I've worked in peaches, I've worked in grapes…’ etc. but you never really taste it.”

Final thoughts

Skin in the game is, if nothing else, a useful rule of thumb which should be considered in your investment decisions, along with life in general. When looking at companies to invest in, using the heuristics above can help to narrow down your search in finding the best of the best companies to invest in for the long-term. This is, however, no substitute for detailed due-diligence.

Cheers,

Innovestor