Welcome to the 38 new readers who have joined us since the last article! If you aren’t already subscribed, join the community of 1,234 investors by subscribing here:

Quarterly Highlights

Business Overview

Innovation

Market Opportunity

Bull Case

Bear Case

Financial/Valuation

Concluding remarks

1. Quarterly highlights

Revenue increased 66% y/y to $770 million

Market Cap of $92B

ARPU (Average Revenue Per User) increased 36% YoY to $2.74

Still making losses ($(287)M compared to $(306)M for the prior year), though margins improved from (68%) to (39%).

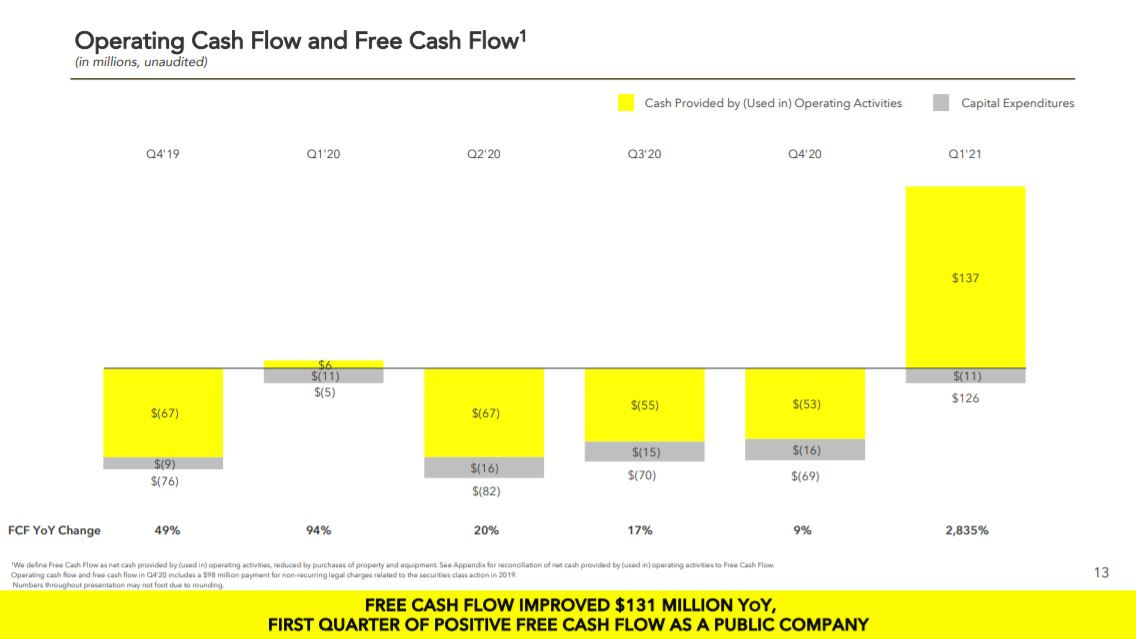

First ever quarter of positive Free-Cash-Flow, having improved $131M y/y.

DAUs (Daily Active Users) were 280 million in Q1 2021, an increase of 51 million, or 22% y/y.

For the first time, the majority of the DAUs for the quarter were on Android.

Outlook:

Revenue is estimated to be between $820 million and $840 million , compared to $454 million in Q2 2020 (80%-85% y/y).

Adjusted EBITDA is estimated to be between $(20) million and breakeven, compared to $(96) million in Q2 2020.

Summary

To summarize, not a bad quarter for Snap Inc as the company has achieved their first ever positive free cash flow - something investors have been looking to see for a while now.

2. Business overview

2.1. Company

Snap Inc class themselves as a ‘camera company’ - distinguishing themselves from social media counterparts such as Facebook, Twitter and Instagram. Apart from this distinction, I would say their main differentiation is the focus on the younger demographic.

2.2. Mission

Taken straight from the Investor Relations page...

“Snapchat is an app that empowers people to express themselves, live in the moment, learn about the world, and have fun together. It's the easiest and fastest way to communicate the full range of human emotions with your friends without pressure to be popular, pretty, or perfect.

Snap’s camera supports real friendships through visual communication, self expression and storytelling. Moving forward, our camera will play a transformative role in how people experience the world around them, combining what they see in the real world, with all that’s available to them in the digital world.”

2.3. Product

Many of you reading this will have either used, or know kids who use Snapchat on a daily basis. The core product is a simple idea - a picture-based chat platform, allowing you to connect with friends mainly through the medium of images. The distinguishing feature here would be the fact that images disappear after being viewed.

Although completely unique when the company first started, the easily replicable nature of the Snapchat platform has lead to other social media companies mimiking aspects of the product.

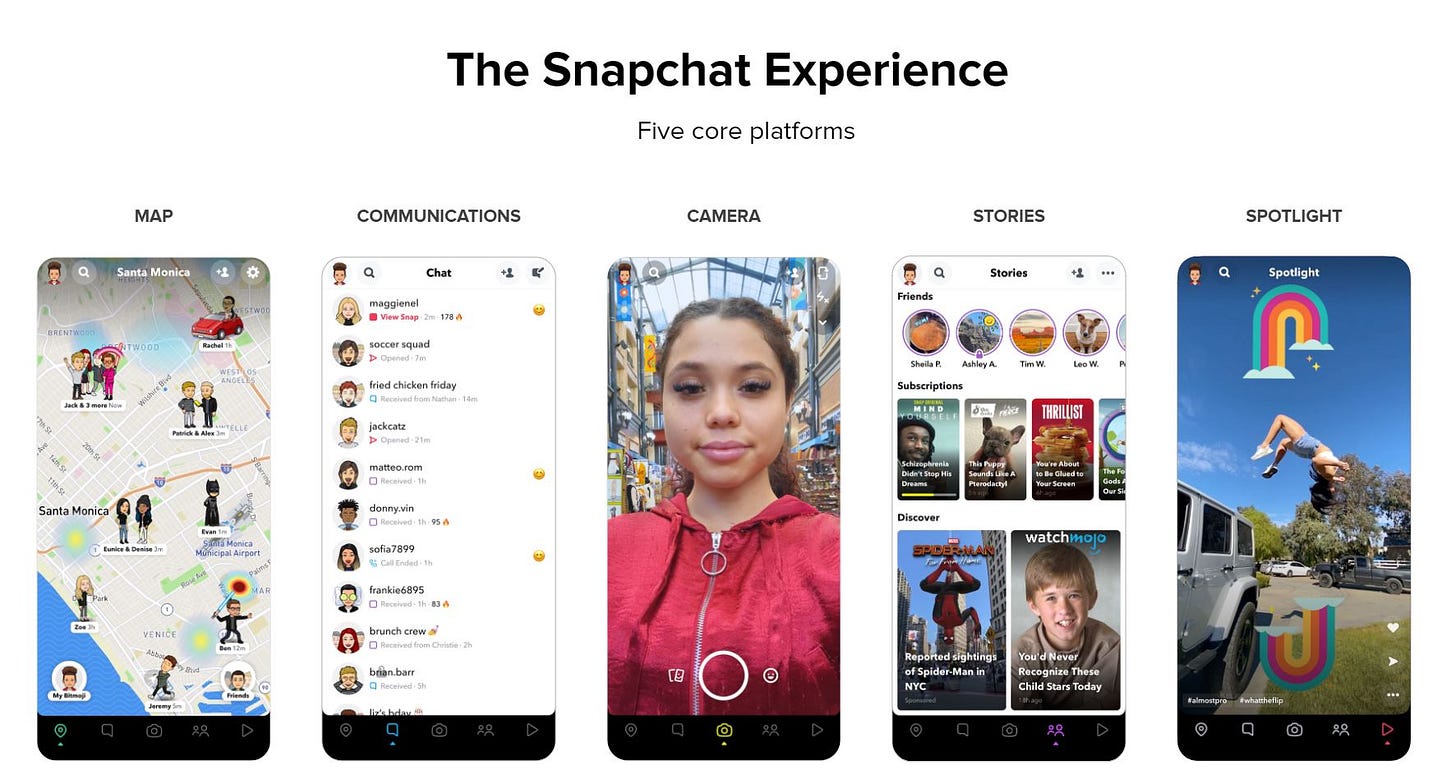

The core product is relatively simple, however contains several different aspects…

1. Camera: The Camera funtcion is at the core of the product. When a user opens the app, they will be greeted with a selfie view - the idea here is to encourage instant use of the app via sending pictures to friends.

The camera also includes a powerful Augmented Reality function (which we will talk about later) that is able to understand, interpret, edit and augment a scene in real-time - enabling the next generation of computing.

Although the AR function is core to the product, I believe it is somewhat underrated in terms of potential added value.

Over 5 Billion Snaps are created every day on average

Over 200 Million users engage with AR every day on average

2. Communications: Another vital aspect to the core platform is the ability for the user to chat with friends. Similar to other social-media chat platforms, the user can send text and images along with the ability to play games among other things.

A typical user opens the app over 30 times per day

Over 30 million users play ‘in-chat’ mini-games each month

3. Stories: The story function allows the user to upload pictures to their 24 hour reel in chronological order, essentially allowing everyone to see what the person has been up to over the past 24 hours.

Originally, this was a unique feature to Snapchat - however due to the relative simplicity of the product, almost every other Social Media platform has implemented some form of stories. In my opinion, this fact shows how powerful of a product idea stories really are.

70% increase in time spent watching stories in 2020

4. Snap Map: Snap Map is essentially a ‘find my friends’ feature - allowing the user to see exactly where their friends are, updated in real-time.

I’m personally not a fan of having a bunch of people know exactly where I am all the time, however I can see it’s value and the fact that it is a good way to encourage people to open the app.

That being said, a cool feature of Snap Map is the ability to see where exactly there is a large gathering of people (possibly a concert) shown by a heat-map. Then, when you click on the heat-map you are able to view other people’s public stories - therefore getting to experience the event in an authentic way without having to be there.

Over 250 Million users use Snap Map every month

Over 35 Million businesses are viewable on snap-map

5. Spotlight: This isn’t exactly comparable, but is most similar to Tik-Tok or Instagram Reels, where Snapchat feeds the user popular Snaps created by the community. It provides a destination to share user-generated content.

Over 125 Million Monthly Active Users on Spotlight

Distributing over $1 Million per day to the top performing videos

2.4. Revenue streams

Unfortunately, the company doesn’t really break the revenue out by segment in their financial statements - however the majority of Snap.Inc’s revenues (99% as of 31 Dec 2020) come from advertising. The other 1% of revenues is generated from the sale of ‘spectacles’ however they do not class this as material.

Effectively, seeing as Snap.Inc’s platform is free to use, the company focuses on monetizing this user-base through ads.

2.4.1. Self-service

Snap.Inc are in a good position with their advertising platform after having transitioned to a self-service advertising model in 2017. This move increased the efficiency with which advertisers are able to purchase advertising space on the platform, along with increasing the the ability to interrogate campaigns better. This has set the company up with a good base to push off from over the coming years.

“Snap Ads allows advertisers a way to tell stories similar to the way Snap's users do, while also providing additional features such as long-form video, and the ability for users to visit an advertiser's website or install an advertiser's app. AR Ads includes Sponsored Lenses or Sponsored Filters. The former provides users with branded augmented reality experiences. The latter provides entertaining, artistic overlays that allow users to interact with an advertiser's brand.”

2.4.2. User-base

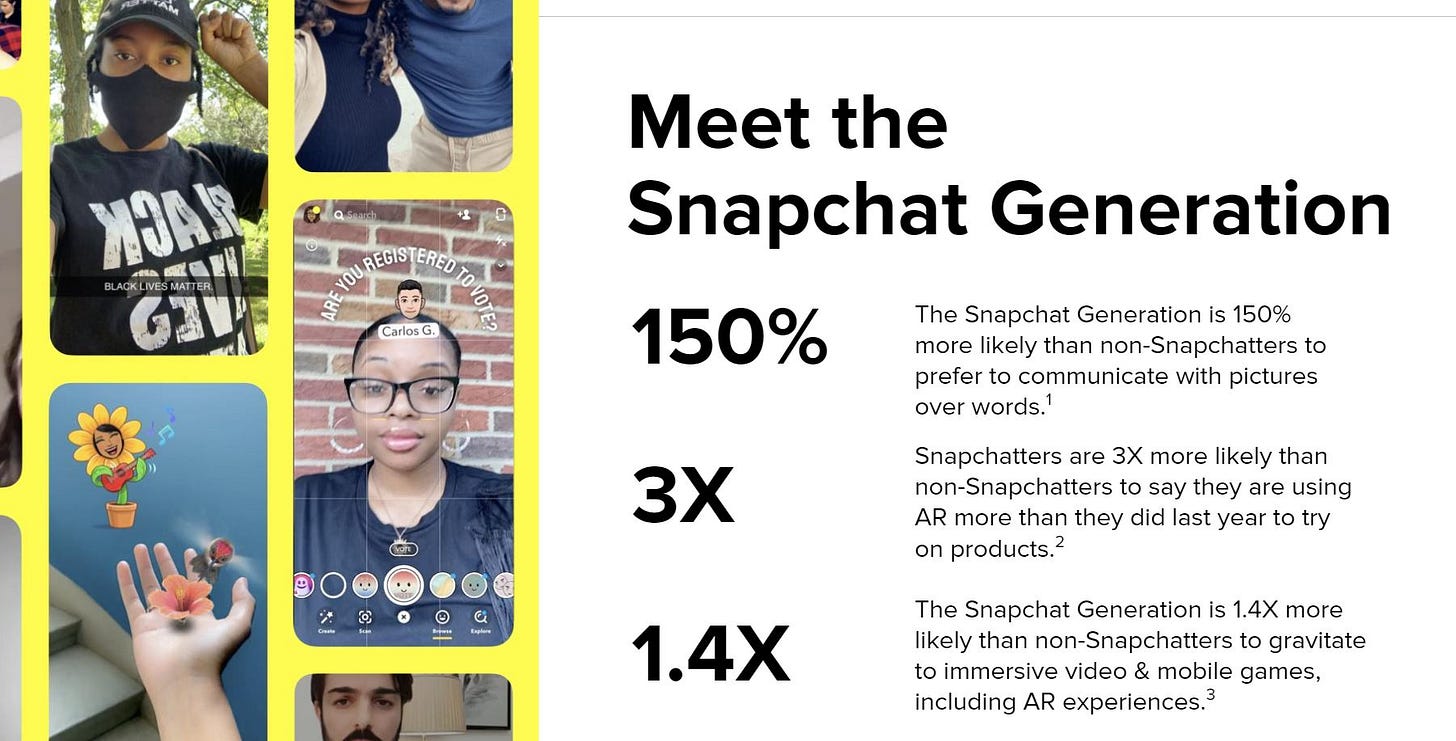

The user-base for the Snapchat platform is young and comes with an impressive level of penetration:

In the US: 75% of the 13-34-year-old population and 90% of the 13 to 24-year-old population.

Outside of the US: 60% of the 13-34 year-old population and 80% of the 13 to 24-year-old population.

2.4.3. Monetizing their audience

The company are focused on three main points in order to drive the continued demand for advertisement.

Improve ranking, optimization, and measurement in order to drive ROI

Build out sales and marketing functions to support needs of ad partners.

Deliver innovative ad experiences

These three focuses allows Snap.Inc to drive ad performance at scale for businesses around the world.

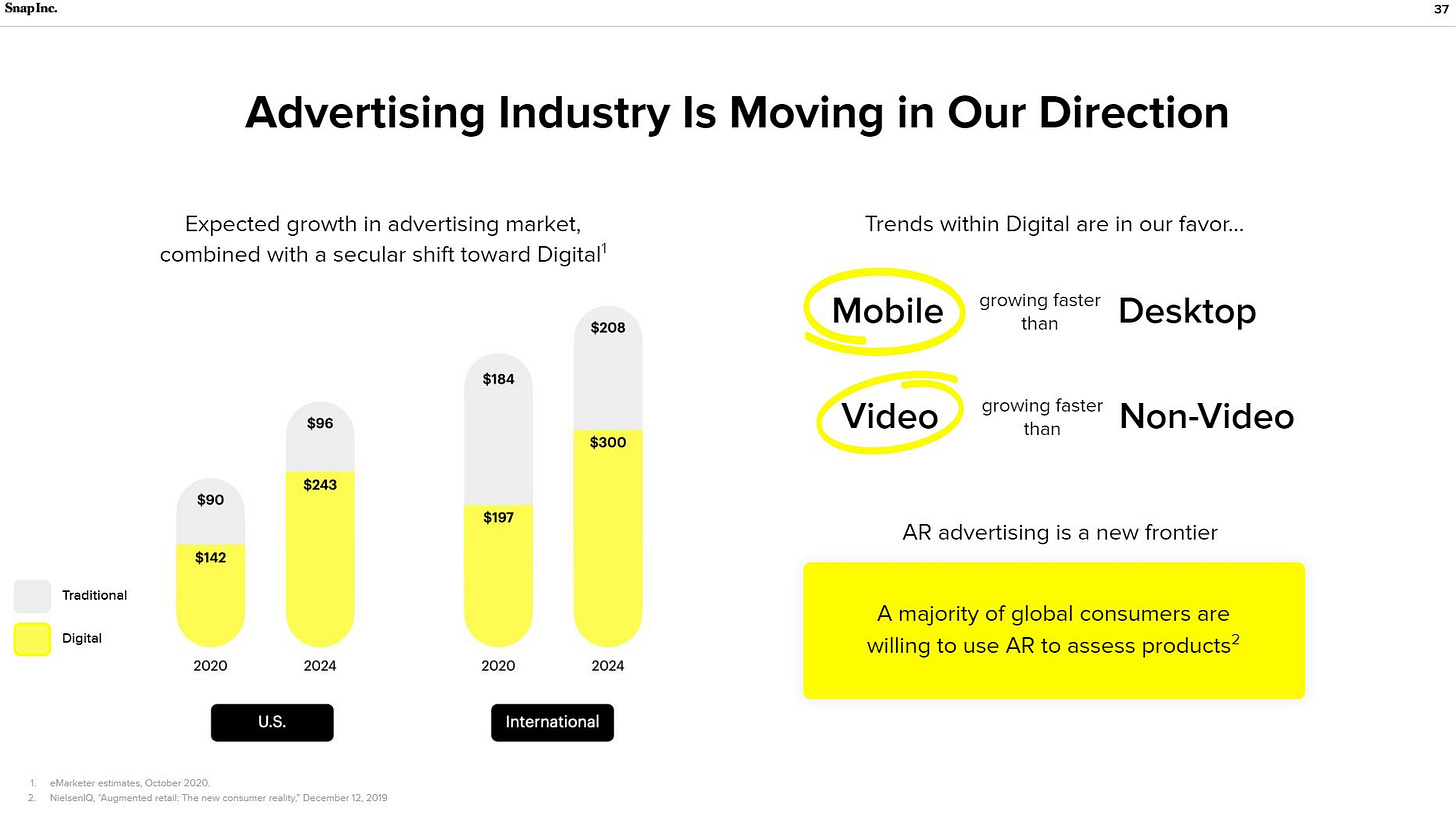

In addition, it seems like this is the correct focus moving forward due to the increase in demand for advertisement that Snap.Inc specializes in. E.g. mobile ads are set to grow faster than desktop, and video is set to grow faster than non-video. The relatively unexplored area with regards to advertising is the AR space, which we will see unfold over the coming months/years.

2.4.4. Other

I think long-term we may see revenue streams from e-commerce sales or other AR hardware (similar to spectacles) as these markets continue to develop. However this is purely speculative as it stands.

3. Innovation

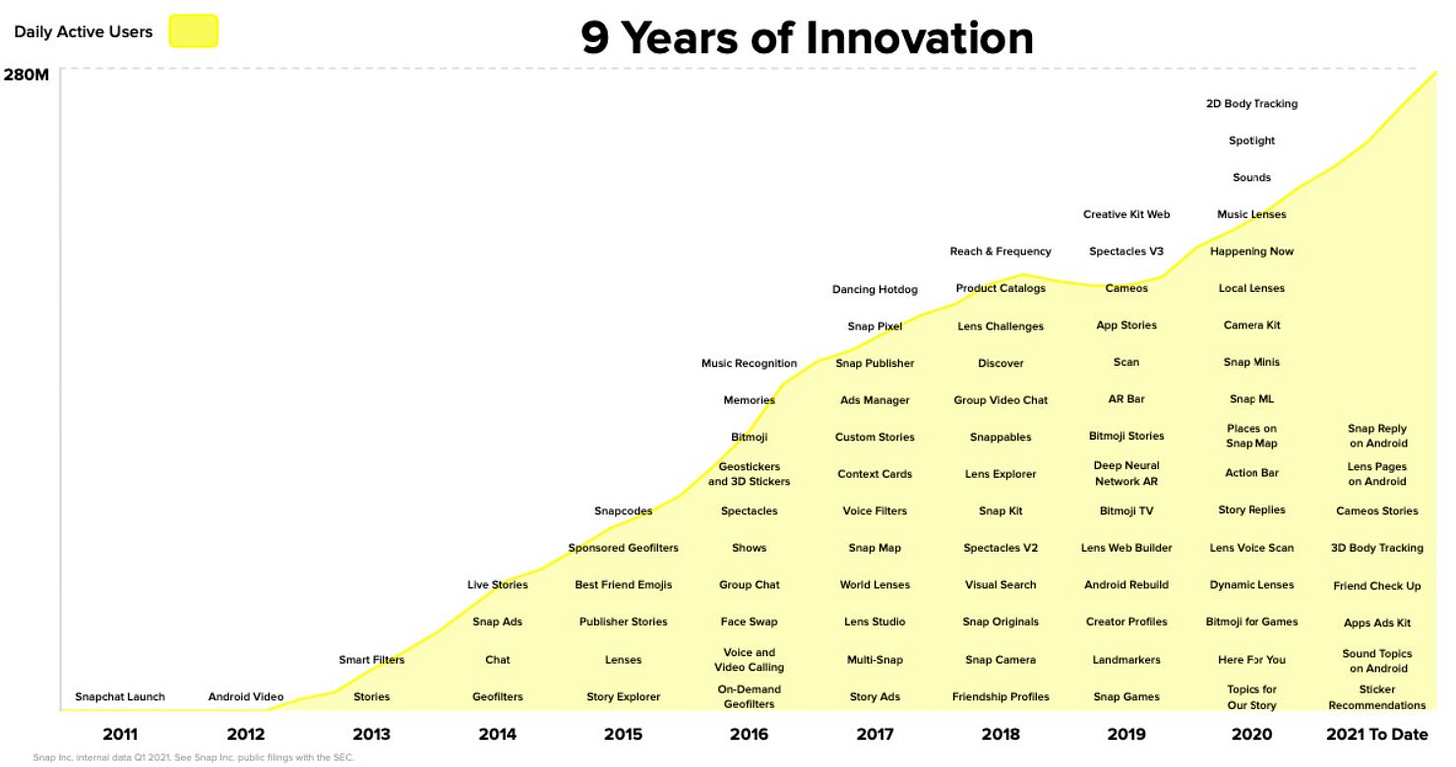

Snap.Inc are particularly interesting when it comes to innovation. This chart below is a good indication of the level of innovation output over the past decade.

I think it’s safe to say that most of the ‘innovations’ listed in the above chart wouldn’t exactly be considered ‘cutting-edge’ in terms of the technology being used, however the sheer volume is the impressive part here.

Due to the younger demographic and quick nature of a user on the Snapchat platform, the level of innovation demand is greater on Snapchat compared to their social media counterparts. This point is expanded in greater detail by KnowHowCapital in their weekly newsletter…

Before I go on to talk about AR, I want to point out several of the company’s recent additions which are likely to be pivotal in their future strategy.

Camera Kit: “Camera Kit is a complete end-to-end solution to include Snap’s AR platform into your own applications. Access a turnkey suite of tools and services, from Lenses AR experiences creation to Lens carousel management and analytics, to enable AR technology for your community.”

Mini’s: “Snap Minis are lightweight, simplified versions of apps that live within Snap’s Chat section. These apps — built with HTML — are designed to improve engagement among users by enabling them to perform a range of additional tasks without leaving the Snap app.”

“Though a relatively new concept in the U.S. and U.K., the mini apps model is quite popular in Asian markets. Tencent’s WeChat has attracted over a million miniature apps that allow users to perform a range of tasks.”

Local Lenses: “Local Lenses essentially enable users to interact with an AR overlay of a real-world location. You can virtually paint whatever you like over the shops and streets, and your contribution will then be visible to any other Snapchat user who visits the site.”

3.1. Augmented Reality

Snapchat are one of the few companies with a major focus on innovating within the AR space. This decision to focus heavily on the AR ecosystem could be a healthy long-term play.

I always come back to this slide because I think it’s super interesting. In Ark’s 2021 big ideas report, they predict Augmented reality has the potential to grow from a $1B dollar industry today to a $130B industry by 2030. This is fueled by the increased investment from companies like Snap.Inc, Facebook and Apple - therefore accelerating the widespread adoption of this technology.

I thoroughly believe Snap.Inc have a long-term vision to be one of the world leaders in consumer-level AR. Below, I will outline Snapchat’s AR operations and why I think this puts the company in a good place moving forwards.

3.1.1. Lens Studio

In 2017 Snapchat introduced Lens Studio, which allows the creator community to use the same tools as internal Snap.Inc employees to be able to develop Augmented Reality lenses.

Lens studio

Today, over 75% of Snapchat’s users (200M+) engage with AR on a daily basis.

3.1.2. Creator Community

The AR creator community currently makes about 30% of the Snapchat AR lenses that are available. The community is made up of over 150,000 creators from nearly 200 countries and territories who create a wide variety of AR experiences across different geographies and cultures.

3.1.3. Future Potential

The future value of this technology on the business is hard to visualize at the current time due to AR only just getting started - however Snap.Inc seem to be signalling their intent to enter into the AR e-commerce space with some of their recent acquisitions.

Examples include:

Screenshop: an app which scans your photos to identify style choices - then provides clothing recommendations based on those findings.

Bitmoji fashon products - Now, with Snapchat's full-body tracking tools, users can create life-sized versions of their Bitmoji characters, which they can overlay onto real-world scenes.

FitAnalytics - Sizing technology company that powers solutions for retailers and brands.

2D & 3D full body tracking to be used in trying on clothes

Developing new AR enabled spectacles.

Partnered with the fitness company ‘Sweat’ to launch a full body Lens to track body movement while exercising in order to recommend optimal form to Snapchatters.

Partnered with Gucci to launch the first sponsored LiDAR Lens which projected a 3D camping site around the user to promote the The North Face x Gucci collaboration.

All of these developments point towards Snap.Inc targeting the e-commerce market.

“We believe that AR can really help retailers on the top and bottom line and also provide a really compelling shopping experience for consumers as well. We're experimenting in many other areas though. I can highlight Minis as an example or native checkout where we're really trying to remove friction from the checkout process overall, so that brands who want to host their own store on Snap can make it really easy for folks who want to buy their products to essentially tap and buy in one click with safe credit card data and things like that.”

3.1.4. AR statistics

The number of Snapchatters engaging daily with our augmented reality Lenses grew more than 40% yearover-year in Q1 2021

Over 260 million Snapchatters engaged with Valentine’s Day Lenses over a two-week period

Lunar New Year Lenses reached over 125 million users.

We released Lens Studio 3.4 with improved capabilities around hand tracking, 3D multi-body tracking, and full body segmentation and a new asset library of 3D models, materials, scripts, and presets to help creators build Lenses.

On average, Lenses created by our community via Lens Studio accounted for more than 50% of daily Lens views.

4. Market Opportunity

In terms of market opportunity, this is a hard one to quantify.

4.1. AR

As hinted to in the Ark graph above, the Augmented Reality portion of the business looks to be one of the key drivers of future growth over the next decade. What is currently a $1B market has the potential to reach $130B by 2030.

4.2. Advertising

Snapchat is an advertisers dream. High engagement combined with a user-base growing in purchasing power will see the demand for Snapchats Ad business only increase over the coming years. The company transitioned to a self-serving ad platform (similar to what Pinterest are currently implementing) which will provide the company with a good base for advertising revenue growth.

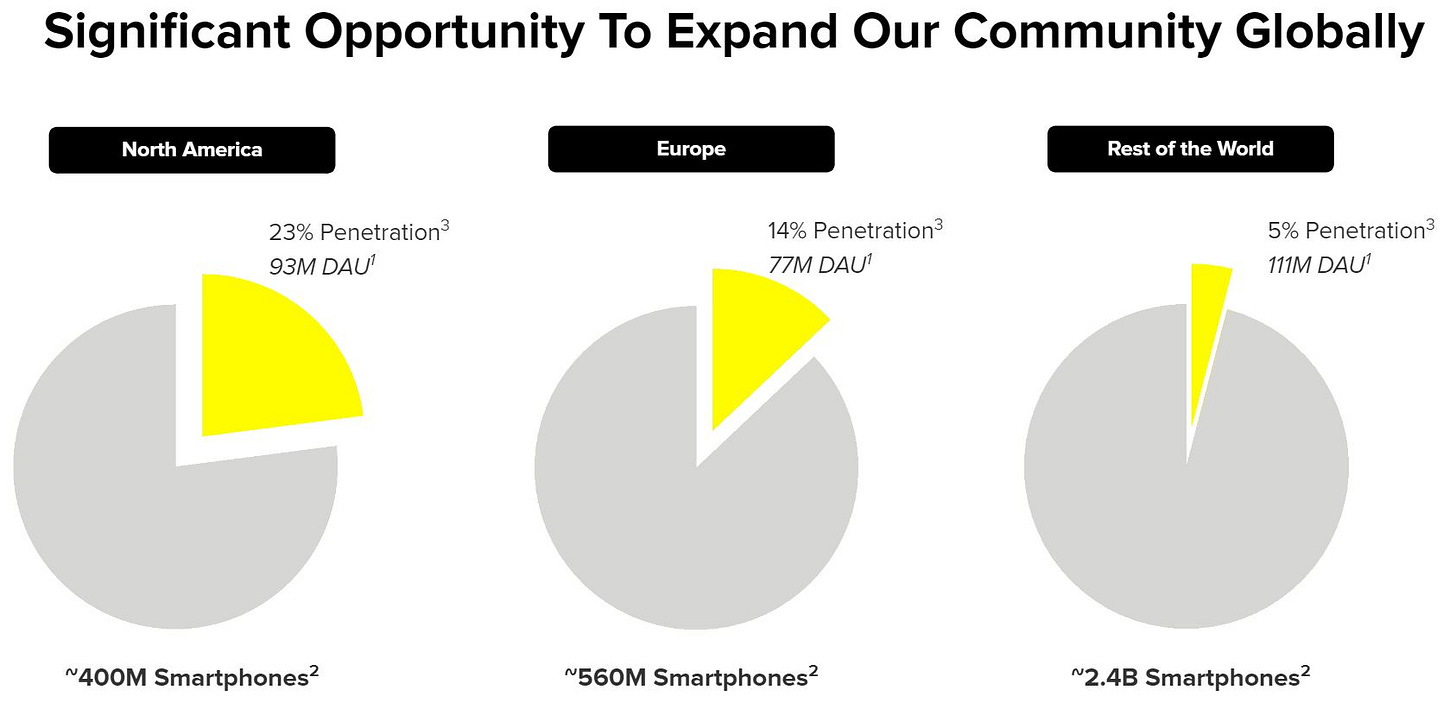

4.3. International

International expansion is potentially a large market opportunity. Monetization internationally is at a much earlier stage when you take into account the ARPU, however plans are in place to capture this high level of current penetration.

“We do have so much room to grow in some of the world's most established advertising markets outside of North America, where we have really strong smartphone penetration. In countries that comprise over half the world's digital ad spend, Snapchat reaches 70% of 13 to 34-year-olds. So we're already there with deep penetration of critical demographics that our advertising partners are eager to reach. So, in 2021, to answer your question, we're going to be making these investments in sales and sales support teams to capture the opportunity, the way that we have in North America in the coming quarters and going to grow those teams to grow top-line growth in the years ahead.”

4.4. Purchasing power

Snapchat’s user-base is young. The company reaches over “70% of 13-34 year-old’s in countries comprising of over half the world’s digital ad-spend”. This stat has several benefits, however the overarching benefit relates to the indirect purchasing power Snapchat are building.

One factor derived from the current user-base being young is the relatively low purchasing power. The younger the user, the less likely they are to have any sort of significant disposable income. Therefore even if these users are willing to spend on the platform, the likely overall spend is going to be low.

However, if we zoom out to take the longer-term view - as these users pass through the various stages of their life-cycle, we will see the purchasing power of these groups becoming increasingly stronger.

If Snapchat are able to acquire customers at this early stage at very little cost and have the ability to keep them engaged throughout their development stages, then by the time the person has reasonable levels of disposable income the theory is that this person is far more likely to stay within the Snapchat ‘ecosystem’ - thereby increasing the overall customer lifetime value (LTV).

5. Bull Case

Strong built-in network effects

SnapChat increases in value to the user as more people sign up to use the platform. This creates more of an incentive to frequently use the app - a virtuous cycle.

Confidence in revenue growth over the coming year.

Expected revenue growth for the second quarter (y/y) is predicted to be between 80-85%, which is made to look slightly better than reality due to a slow Q2 2020 due to the beginning of the pandemic.

During its investor day in February, it predicted it would generate more than 50% revenue growth over the next few years.

Snap believes the expansion of its ecosystem and its gradual evolution into a social commerce platform for online shopping will drive that consistent growth.

User-base is growing at a steady rate

Daily active users grew 22% year over year to 280 million during Q1, which matched the growth rate in the fourth quarter. The company predicts DAU growth at 22% y/y to 290 million in Q2.”

Effective and growing ad platform

Snapchat’s ad platform has been growing substantially in terms of effectiveness over the past 5 years or so as the company has added new features designed to capture the users attention for longer and increase engagement.

Penetration into the younger demographic is strong. Within the US, Snapchat reaches 75% of the 13-34-year-old population and 90% of the 13 to 24-year-old population. Outside of the US (UK, France, Canada & Australia) Snapchat reaches 60% of the 13-34 year-old population and 80% of the 13 to 24-year-old population.

Decreasing infrastructure costs

“As Snapchat's DAU and ARPU has grown, the infrastructure cost per DAU declined 13% year over year to $0.62, marking its lowest infrastructure costs per DAU since its public debut. It attributed those lower costs to better negotiated rates for several of its cloud services.

Lower infrastructure costs can also free up more cash for Snap to increase innovation, strategically acquire companies and to boost headcount.”

History of successful innovation

As discussed in the section on innovation above, Snapchat have been aggressively adding to their list of innovations at a rapid pace - providing significant value to the end users.

The Augmented Reality market has the potential to be huge, and Snapchat could be a leader in the space.

Discussed in detail above, the market for AR is potentially huge within the next decade. Snapchat are positioning themselves well to be able to capture a sizable chunk of this growing pie.

Capturing large audience with long term purchasing power

Due to the high penetration in the young user base, as this demographic’s purchasing power increases over the coming years, Snapchat will benefit from higher levels of spend - especially if they can successfully integrate e-commerce into the platform.

A possible re-opening play

Evan Spiegel (CEO):

“During the pandemic, a lot of folks sort of shrunk their social graph. They started talking more to their family members or really close friends. And what we're seeing now in the United States, which is really exciting is that people are going out more. And they're seeing more friends or they're returning to school or work. And so, their social graph and the people they're interacting with on a regular basis is starting to expand. And that sort of communication with that wider social graph drives a lot of the frequency of use of Snapchat. And then, of course, the conversion then to our other platforms and products that we offer.”

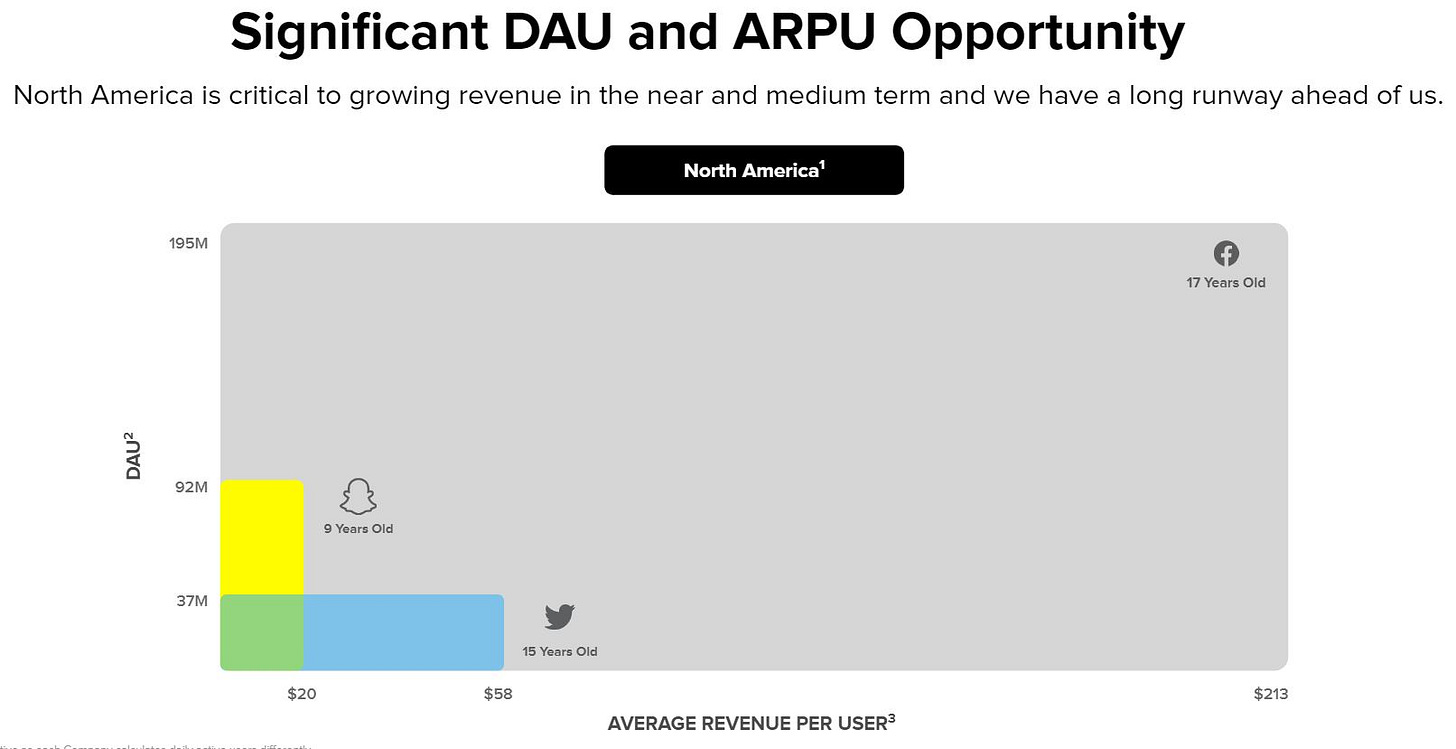

Opportunity to increase ARPU & DAUs

The company’s average revenue per user (ARPU) increased 36% year over year to $2.74, which accelerated from previous quarters. Its ARPU increased 66% in North America and 36% in Europe, though it dipped 7% in the rest of the world due to the impact of its overseas investments.

6. Bear Case

Competition. As we have seen over the past several years, the competition within the social media space is heating up. Companies like Instagram, Twitter and Facebook have all been able to replicate some of Snapchat’s key (unique) features. Can Snapchat continue to compete within this market?

The company never reaches profitabilitiy. Due to the fact there is no clear path to profitability for Snapchat, it is possible the company never makes any profits - however this is unlikely. The company are working hard to make the most of the potential AR opportunity up ahead.

Negative press. Due to the nature of the platform, there have been many reports of misconduct by adults targeting underage teens. Unless Snapchat can figure out a way to control this issue, it may bring unwanted negative attention to the brand.

7. Financials

7.1. Overview

Q1 Revenue increased 66% y/y to $770M for Q1.

2021 FY TTM (trailing twelve months) revenue stands at $2.81B, representing a 52% increase following on from the previous year’s 46% increase.

Gross margin for the quarter stands at $366M (46.39% of the $770M in revenues) and 52% for the TTM value.

Operating losses of $303M for the quarter are fairly consistent with the past several years of operating loss.

Looking at this as a snapshot, it’s not the best looking set of finances. On the positive, revenues are growing at an attractive rate, and are predicted to continue to increase at (or above) these levels moving forward, which is impressive. However, the fact that the company are yet to produce any positive income with advertising as their main (and basically only) source of revenue is fairly concerning.

The path to profitability for Snapchat is slowly becoming clearer with the implementation of e-commerce onto the platform being one route to successfully monetizing their huge DAUs. However, ‘clearer’ is still not clear in this case, which causes some concerns.

All this being said, I find that it’s less useful to forensically examine the finances of these growth companies like this. Mainly due to the fact that these guys are taking a massive leap of faith on cutting edge technology which may or may-not pay off in the long-term.

7.2. Profitability

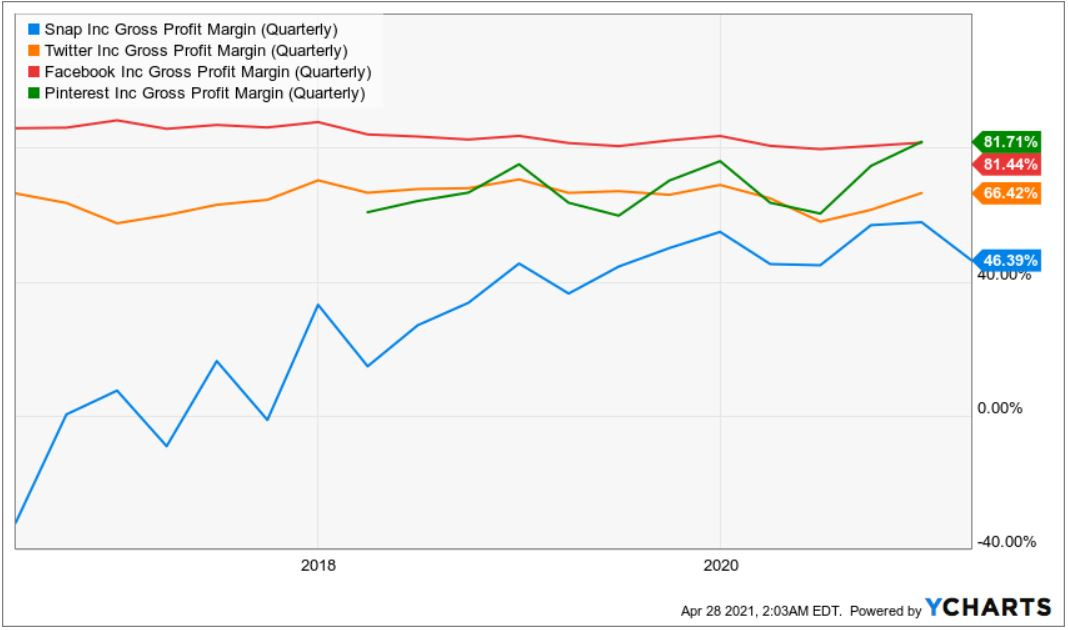

I think gross margins are a fairly important comparison to be able to make in this case, as it’s hard to increase your operating income without improvement in the gross margins.

The below graph shows how Snap.Inc’s gross margin stacks up against their competitors. Snap.Inc have consistently fallen behind their direct ‘social media’ competitors.

Again, I’m going to refer back to KnowHowCapital’s graphs on their Substack regarding Snapchat and Pinterest’s margin compared to ‘R&D’ and ‘Selling & Marketing’ as a percentage of sales, as I think they make an incredibly insightful point. *Please do check these guys out.*

Essentially, the point made is that for social media platforms like Snapchat and Pinterest - as the user-base matures, we want to see gross margin stabalise whilst ‘R&D’ and ‘Selling & Marketing’ expenses (as a percentage of total sales) fall. This is the path to profitability.

When looking at Snapchat (above) we can see gross margins steadily improving, however these other costs are staying at elevated levels. Part of the reason for this is that the company’s strategy involves innovating heavily to retain users and expanding internationally to gain new users - two vital factors for future profitability.

If we then compare to Pinterest (below) we can see a more stable gross profit for a longer duration, combined with falling ‘R&D’ and ‘Selling and marketing’. Exactly what we’re looking for!

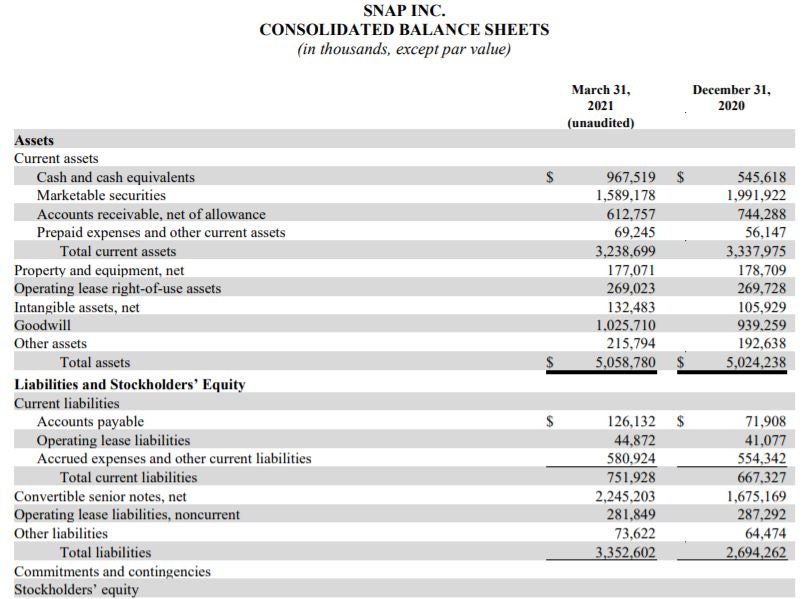

7.3. Balance sheet

Firstly, lets take a look at the company’s ability to pay off current (short-term) and non-current(long-term) liabilities. To be conservative, I will take the ‘cash and cash equivalents’ along with ‘marketable securities’ into account regarding current assets. This adds up to $2.6B. And if we compare this to the current liabilities of $581M, we can see that the company has the ability to pay off any short-term debt 4.4X over.

This $2.6B doesn’t quite cover the total liabilities on the balance sheet of $3.3B. However, the total current assets come close - and the total assets far exceed this figure, at $5B.

Overall this is a relatively healthy balance sheet. However, the bottom line is that Snap.Inc are still losing money y/y. So the issuance of debt to be able to finance the various innovations present in the sections above can only go on for so long. At some point soon, the company need to start generating positive cash flows which, luckily, they have finally started doing.

7.4. Cash Flows

The company finally reported their very first Free Cash Flow positive quarter. The company did $126M of Free Cash Flow from a base of $770M revenues, which equates to roughly a 17% FCF margin.

Historically, the company’s past Free Cash Flow position hasn’t been great. The graph below shows how this story is beginning to change as of more recently. As you can see, the company reported a positive free cash flow in Q1 2020, however due to $11M of Capital Expenditures the final figure ended up at $(5)M.

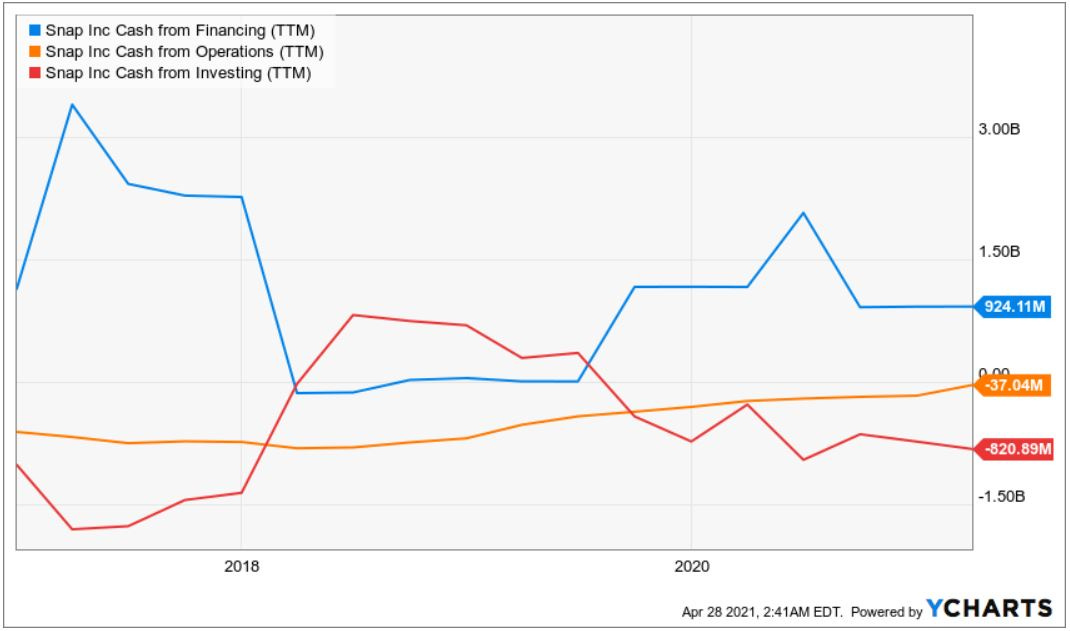

If we look at the breakdown of cash flows over the years for Snap.Inc, we can see that the business has been fairly consistently fueled by cash flows from financing, with cash flows from operations beginning to slowly grow. This is a good sign. Hopefully they can keep increasing CF from operations over the coming year.

If we caompare this to Pinterest’s Cash Flows (below), we can see that over the past couple of years the company has been predominantly financed via inflows from financing (such as debt issuance), though this trend has subsided recently - with Cash from Operations now being the main driver (just).

Typically, these results are expected for companies in the relatively early stage of growth. However, we do want to see increased inflows from operations as the company establishes themselves. It’s good to see the beginning of this trend with Snapchat.

There is still a long way to go due to the difficulty of earning solid operating income with their advertising business model, however I can see this improving over time as more revenue sources mature and the Augmented Reality market develops.

Realistically, we want to see the ARPU increase, as this is an area of huge opportunity and something Snap.Inc are falling behind on slightly.

7.5. Valuation

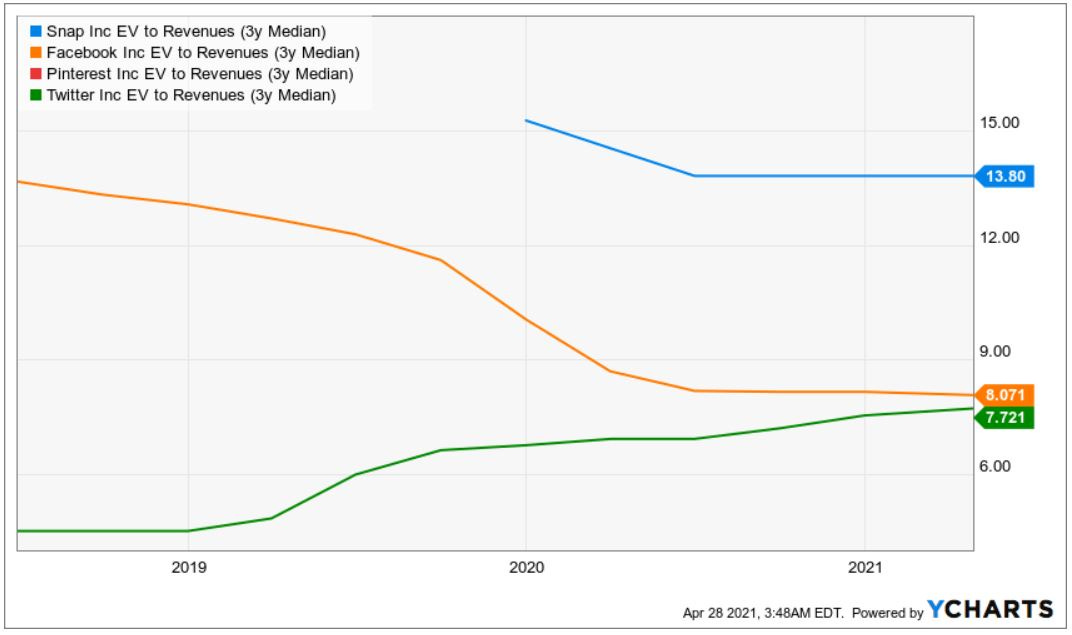

I’ll briefly look at some relative valuation in order to get an idea of where Snapchat are in relation to their social media counterparts. To do this I will look at the Enterprise Value to Revenues ratio.

We can see that Snap.Inc are the most richly valued out of this bunch, with Pinterest - in a similar position from a growth standpoint - with an equally high multiple. You could argue the justification being future growth rates are likely to be significant over the coming years which may justify the premium.

And if we look at these taking into account the 3 year trailing median, we can see Snap are currently trading at 13.8X. Meaning they are currently trading at a significant premium to the 3 year average.

Note: Thanks to everyone who made it this far. If you enjoyed, please subscribe or share the article as it really helps me out!

8. Final Thoughts

Snap.Inc is an interesting company. They combine a mixture of messaging, content, advertising, software, and hardware in a way that challenges the idea of what it means to be a typical ‘social media’ company.

They were once a business I dismissed due to an unclear path to profitability alongside not seeing how the company could stand out in a competitive field - up against the likes of Facebook, Twitter, Pinterest, Apple and Microsoft.

However my tune has changed somewhat recently, as I am beginning to understand the company’s vision for 5-10 years down the line. This vision, as I see it, centers around bridging the divide between physical and digital worlds in a way that was once not possible. The major tool being utilised to achieve this will be Augmented Reality.

If the company can continue to gain new users, maximise the ARPU opportunity and sustain positive cash flows moving forwards (as has been the case in recent updates), then I can see big future upside for this stock.

Proceed with caution.

Cheers,

Innovestor