Summary

In this piece on Spotify I will be sharing my opinion on the company’s performance to date, the market opportunity for audio moving forwards, some of the risks they face and some interesting points of innovation.

In addition, in order to give some context to the audio industry I have outlined a brief ‘history of music technology’ section.

Spotify, who launched their first product in 2008 and are now the ‘audio-as-a-streaming-service’ leader are continuing to expand their reach in order to beat Apple, Amazon and Youtube Music in the race to dominate audio. Some key stats:

144 Million premium subscribers (up 27% y/y)

320 Million monthly active users (up 29% y/y)

Latin America and Rest of world showing the fastest growth, growing 30% and 51% respectively – with Rest of World buoyed by recent launches in India, Russia, CIS and the Balkans, with Russia being the largest driver.

Available in 92 Markets

The year so far has been good for Spotify, with big initial steps towards taking over the podcast industry by acquiring the rights to certain podcasts such as the Joe Rogan Experience and the Michelle Obama podcast. This trend will continue in over the coming years which will likely draw millions more to the service from all over the world – increasing Spotify’s reach and leverage as the ‘go to’ place for audio.

Financially Spotify are in a strange position. They have yet to generate sustained positive operating income, with this year being the same. It is an interesting nuance of Spotify’s business model and long term strategy, which requires them to aggressively expand and market in order to reach as many people as possible, which somewhat explains the loss.

Overall I am more bullish than I was going into this analysis piece, as I really do believe Spotify have the long-term strategy in place along with a stellar management team in order to achieve the goal of being the world’s ‘go to’ place for music and podcasts.

Company + Business model

The Spotify music streaming business model is fairly easy to understand. They make their money in two main ways – Premium accounts and advertising. Users who don’t have a premium account are forced to listen to adverts in between songs.

The beauty here is in the simplicity. Everyone likes and listens to music (with increased usage over the past couple of years of podcasts and audiobooks). The ubiquitous nature of audio means Spotify’s TAM is essentially the entire human population with access to a computer or a phone.

Part of this business model relies of Spotify paying out billions every quarter in royalties to the artists and record labels which allow Spotify to host the music on their platform. This number (cost of good sold) is particularly high for Spotify at about 75% of revenue.

Some context - a short history of music and it’s various technologies

Pre 1850’s

Music has been around for as long as man, and has had a great deal of interesting changes throughout the years.

Before we had the ability to record music, it always had to be live. I.e. in order to hear a musician’s work, you would have had to physically travel to the nearest village. In addition – the duration of a song was not capped. This led to the ‘not-so-surprising’ fact that classical music tends to last a much longer time than your standard modern song. Over time, however, this changed…

1850’s

In the mid 1800’s when the flat record came about, it standardised around the 78 (78 rotations p/minute). This came in two sizes – a 10 inch version, limited to approximately 3 minutes, and a 12 inch version which was limited to 4 minutes. For the first time in human history, music had a standardised duration.

This was later solidified in 1948 with the 45 RMP Vinyl single, which had about 3 minutes duration.

1927 to 1950

The launch of the radio broadcast in 1927 allowed people from across the country to listen to audio at very minimal cost.

Following this, the 1950’s resulted in the transistor radio – making this a portable experience too.

1950’s onwards

The increase in distribution and access to music allowed for different kinds of artists to rise to prominence – like the Beatles/Elvis etc. Of course these artists were hugely talented and innovative, however the technology aspect of being able to reach a global audience definitely played its part in their success.

1982

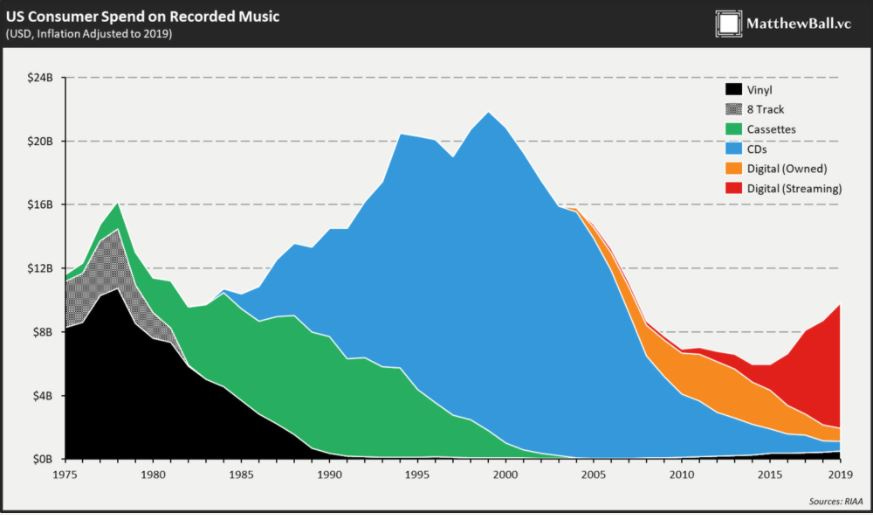

The year 1982 saw the introduction of the CD, with ABBA being the first popular release. As you can see from the above graph, the CD encouraged personal consumer spend on music, which rocketed from $10 billion to $22 billion – with the peak in the year 2000.

2003

Fast-forward to 2003 and we have the launch of iTunes, which totally revolutionised how we consumed music and the business models behind it.

Apple were the first to de-construct an album into its respective tracks to be bought individually. In doing this, Apple were penalising artists for bundling multi-part songs into one track – e.g. Pink Floyd’s Dark side of the Moon.

Though this was fairly disruptive, I wouldn’t argue the business model was all that innovative. Consumers had owned personal tracks for a while at this point.

This model did, however, almost force the introduction of pirate sites such as Napster and Pirate Bay, which were a necessary pre-courser to the current streaming services we have now.

Along came streaming…

2008 onwards

Somewhere around 2008/2009 Spotify launched its streaming service, bringing with them an all new way of listening and arguably an all new business model – consumers had ongoing access to all music ever created, whenever they wanted. This was never before possible.

This also allowed for a different model to pay artists. It enabled Spotify (and similar services) to pay artists relative to the amount people listened to their work. This seems like an obvious thing to do, but was never before possible with physically bought music.

A consequence of this new way of consuming music brought with it new incentives for artists. Getting paid per-stream (anything over 30 seconds) resulted in the incentive to create short and catchy music. Why create a 10 minute song when you could create 5 two minute songs and 5X the revenue? Not sure this is a good thing particularly.

Market opportunity for audio

The total monthly active users by region is a good indication of where Spotify have scope for growth over the next 5-10 years. With 320 million of the monthly active users spanning mainly Europe, North America and Latin America – it leaves a huge amount of room for growth in other countries around the globe. For example, India has about 1.3 billion people which is roughly the same as Europe and North America combined, presenting a huge opportunity for potential growth.

My prediction is that Spotify will win in the audio space – and in doing so create enough leverage to become its own record label. This would finally allow them to remove the middle man in order to become profitable.

Already they are looking at ways to increase gross margin which is currently low due to the current model of paying licences to the major record labels.

Logically it would make sense to distance themselves from these record labels. However, as their business so tightly relies on the licencing from these labels, it will be hard to break away. To do this, Spotify need to gain leverage over these labels, which is currently growing.

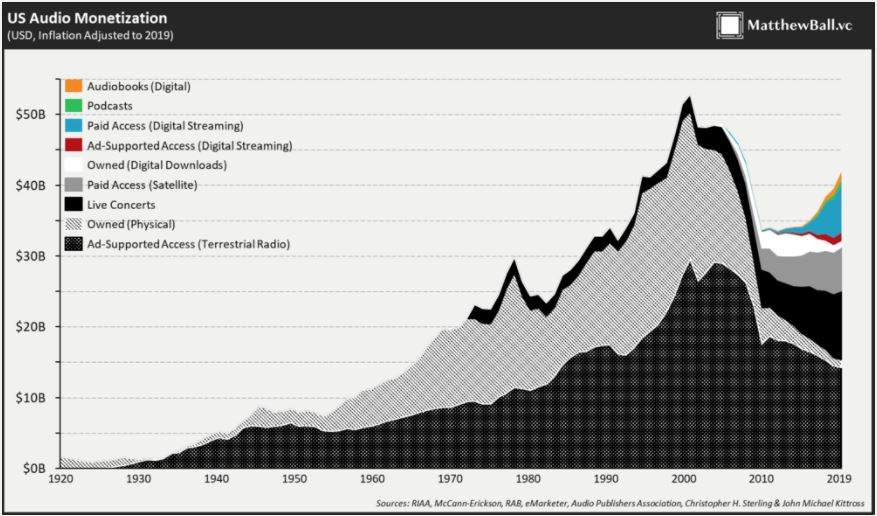

Just like Spotify needs the labels for licencing, the labels will soon come to rely on Spotify for the vast majority of revenues as the majority of industry revenues are coming from streaming (graph below).

This is an exciting potential new shift in the music industry as it will essentially see Spotify become one of the world’s leading record labels. Once this shift takes place, it will be hard to stop them.

Also it will allow Spotify to invest in original content – which will add to an increase in their gross margin.

We are actually seeing the very beginnings of this with Spotify buying out podcasts to exclusively stream on their platform. For example Joe Rogan + Michelle Obama.

As of Q3 2020:

Number of new podcasts increased over 20%

Music releases up 13% over previous quarter

Originals and exclusives now account for over 19% of all podcast listening on the platform

CEO (Daniel Ek) states in the Q3 2020 earnings call that Spotify has considerable scope to grow users in the future. And whilst this is the main focus moving forwards (user growth), based on maturity and the value provided to subscribers, Spotify has seen engagement and value per hour grow substantially over the past few years. And this metric is an important lever to decide when the correct time to increase the price of the service is, which Spotify are willing to do.

This comes with the caveat of not getting ahead of the market in Covid times. They will only increase the price when the time is right.

Financials

Short note here. I am planning to look at this in more depth when the annual report comes out in early Feb.

Key stats

TTM Revenue of €6.9 Billion, up from €5.88 in 2019 (+15%)

Gross margin remains at around the 25% mark

Profitability still negative on a year by year basis, with the loss for the year so far at -€224M (significantly down from a positive operating income of +€4M in 2019)

Profitability as of Q3 2020 significantly lower than the final 12 month value for 2020. I would put this mainly down to the increased spend on R+D, Sales and G&A in comparison to 2019. E.g. Q3 2020 saw a 14.1% revenue increase with an average cost increase of 24.8% over R+D, Sales and G&A – therefore contributing to the reduced revenue.

Free Cash Flow was €103 million in Q3, a €55 million increase y/y.

Strong liquidity/cash position with €2 billion in cash and cash equivalents at the end of Q3.

To summarise, there is nothing new here for Spotify. Operating income continues to be a loss – though I will wait for the annual report in order to get a better picture of the current state of play.

It is encouraging to see the investment this year in R+D expenses as a contributing factor towards the goal of increasing their customer base. Sales + marketing seems to be something they could look to trim over the next several years in order to take those steps towards being a reliably profitable company, as they are definitely not quite there yet.

Liquidity looks strong at a glance with current assets being able to cover 92% of current liabilities. And total assets covering 175% of total liabilities.

Risks

Alongside the extensive list of fairly standard risks (e.g. retaining users, dependence on third party licences, ability to comply with license agreements, changes in legislation, COVID etc.) Spotify face some unique risks which will likely need to focus a higher level of resource in order to mitigate. These include…

Lack of control over the providers of our content and their effect on our access to music and other content;

Spotify don’t own the vast majority of their content which makes it difficult to use the content in the exact way they would like. This is likely to change in coming years with the increased investment in original content.

Risks associated with our international expansion, including difficulties obtaining rights to stream content on favourable terms;

Part of the long-term strategy for Spotify is to expand into global markets which we are currently seeing in countries like Russia and India. This will bring with it new risks which need to be taken into account.

our ability to generate sufficient revenue to be profitable or to generate positive cash flow on a sustained basis;

This is one of the factors investors will be keeping an eye on over the coming years. Spotify can’t go on losing money year on year. From my understanding, the plan for the foreseeable future is to expand and become the ‘go to’ service for audio. I’m not sure how close we are to seeing sustained profitability – however with all the investments this year in original content alongside the planned expansion oversees, I believe we will start to see this reflected on the bottom line relatively soon.

our ability to expand operations to deliver content beyond music, including podcasts;

Making sure podcasts and video are properly implemented on the platform will be an important factor moving forwards as we are seeing an increased demand.

Innovation

Consumer behavior

The change in business model from ownership of physical copies to streaming meant for consumers there was no longer an additional 99p marginal cost to consuming more music – therefore making their choice of music more adventurous. Which, in turn, should encourage more diversified (niche) artists to emerge and make a living from music.

E.g. A large amount of people listen to music as they sleep, which they probably wouldn’t do (or do less frequently) if there was a real marginal £ cost behind it.

Business models change your behaviour. Which is interesting.

Piracy

Piracy is very prominent in the software space, as somehow it is seen as ‘wrong’ in some way to charge for pixels on a screen (one’s and zero’s).

I remember a time where I was pirating almost everything. Thinking back, this was mainly due to the fact I was a kid with almost no money, which made me feel like I wasn’t able to access the vast array of music/movies/TV shows available on the internet.

The subscription model of Spotify (and now other software companies such as Adobe) means all the content was now so much more accessible and as a consequence has almost completely eliminated the need for piracy, as these products are so much more convenient.

Use of AI and Machine Learning to drive song predictions

One of the most undervalued parts of Spotify’s new service is the rich level of data provided by the users - not only in the ‘user data’ on songs and podcasts (when people pause or skip, how long they listen etc.), but also in the playlists people have created.

This quantity and quality of data allows Spotify to do really clever things with individualised predictions. Which is part of the reason why the ‘discover weekly’ service is so good.

Spotify are not only allowing us to listen to all the music we would ever want to listen to, they are also enabling us to explore and discover new music in an extremely efficient way.

Marketing

Spotify have had some of the most successful marketing campaigns and strategies over the last several years. For example the partnership with Google nest mini and Spotify’s own ‘end of year review’ stand out as particularly creative.

These campaigns have two main uses – to drive more people towards becoming a paid subscriber, and to get people to share on social media (creating essentially ‘free’ or very low cost advertising).

Valuation

Valuation, as always, it tricky. Especially for a company like Spotify where I can’t easily compare their share price to another similar company. The closest competitors we have are Apple Music, Amazon music and Youtube Music, who are only relatively smaller parts of larger organisations – therefore it would not be a direct comparison.

I will address the valuation aspect in more detail when Spotify release their annual report. Though I would say there is plenty of value within Spotify in order to justify their current price - even with the ~100% increase since March.

Conclusion

All in all I am confident in Spotify’s long-term vision combined with its driven and passionate management team to be able to deliver sustained profitability in the future. This does rely on the success of the current expansion efforts – and their ability to remain on top of their main competitor (Apple Music).

I am also interested to see how they continue to utilise emerging technology such as AI and Machine learning in order to gain further leverage on it’s competitors.

I will be adding to my current weighting to make the total weighting about 6% of my portfolio.

Cheers,

Innovestor