All information here is from the most recent investor analyst day (Dec 2020)

Thesis

Tattooed Chef are one of the main disruptors in the fast-growing ‘plant-based’ food industry. The company have a unique production model with a wide (and quickly expanding) range of high-quality products. In addition to all of this, they have encountered strong growth over the past couple of years, with robust plans to rapidly evolve into a billion dollar company by 2026, or a $500 million company by 2023 (lofty goals, but achievable).

Similar to Beyond Meat, they are capitalizing on the huge trend towards a plant-based diet which is fueled by concerns over global pollution and protecting the environment. It’s not a certainty, but over the next 5-10 years I can see veganism becoming more and more popular, to a point where it may even be the norm in 20 years from now.

Betting on these big trends is a long, potentially risky play, but one that can pay off in a big way.

Business Model

Tattooed Chef are a plant based food company based in California and Italy. They have evolved a fair amount over the last decade – starting out as ‘Stonegate’ Foods in 2009 with a turnover of $2.1 million, all the way to their current level in 2020 with revenues of $148 million, that’s a 5 year Compound Annual Growth Rate of 63%.

They have 38 products in their portfolio, which includes some high-quality looking meals that they are aiming to expand to 62 different products by 2021 (+63%).

Recently, Tattooed Chef completed a merger with ‘Forum Merger II Corp’ enabling them to become a public company, and changing the name to Tattooed Chef. The main reason behind doing this was to “build brand awareness, expand distribution, launch innovative products, and invest in its infrastructure to capitalize on the global plant-powered food market.”

Ultimate control. Good or bad?

In terms of production, Tattooed Chef control the production cycle from beginning to end, with locations in Italy and California.

The vertically integrated model allows TTCF to easily pivot and prioritise their production which is potentially a key factor in their growth. It also allows them to stay with trends as to get from an idea to a product on shelf takes an estimated 3 months – much better than any competitors.

Controlling every factor going into the production of the product has the benefit of allowing the company to stick to their core objectives and ethos, however it comes with the drawback (or at least the question mark) of scale. Will TTCF production be able to keep up with demand as the company inevitably grows? Time will tell.

Growth machine or unrealistic expectations?

As with most speculative growth companies, it is hard to accurately predict the medium-to-long-term trajectory as there are so many contributing factors driving both success and failure. The simple fact is, anything can happen in the future, which is an important reminder when investing.

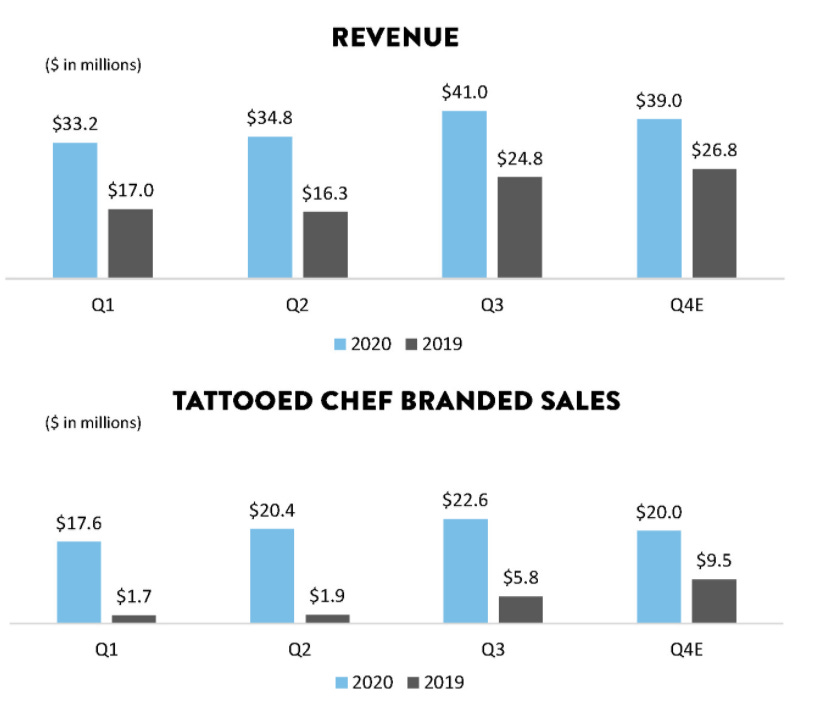

The journey over the last couple of years has been rapid due to the significant tailwind of mass adoption of a ‘plant-based’ diet. For example, year to date revenue has increased 87% to $108.9 million, with expected total year revenues of $148 million. This is all with no real marketing push (relying on the current brand awareness).

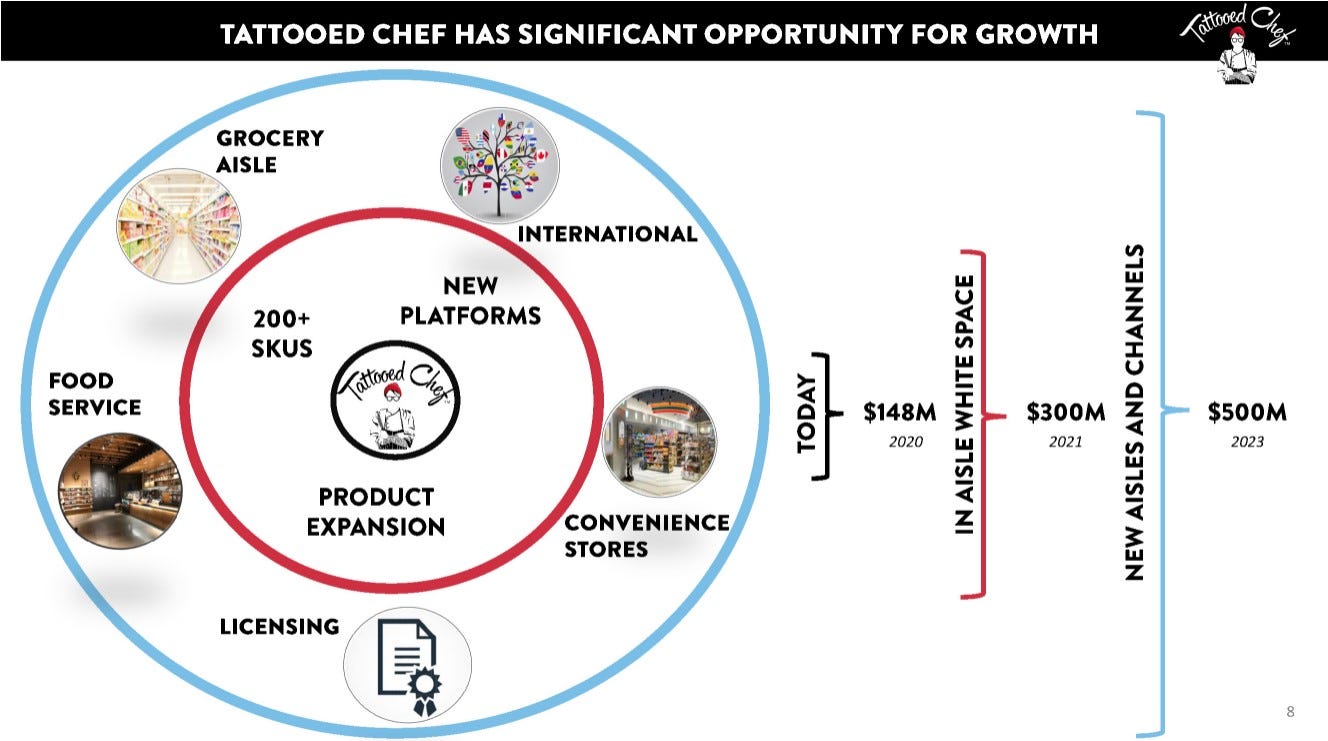

Looking forwards, the company believe they have a growth plan to reach $300 million by 2023. In order to achieve this target they will need to…

Continue to increase product offering to +200

Continue to expand retail outlets offering products in new and existing retailers

Target new market segments/opportunities like deserts (which represents about $12.6 billion)

And in order to reach the target of $500m by $2026 the company need to…

Expand beyond the frozen section and into the grocery aisle

Expand to ‘food service’ (grab-and-go) and convenience stores along with looking to potential licencing opportunities

Expand internationally, starting with current locations in Italy

Interestingly, they are diversifying not only the product offering but also the potential sales outlets – therefore maximising potential revenue sources.

Another important aspect of the growth strategy is to focus on the number stores offering Tattooed Chef products. Currently the company reach a total 4,272 stores across the US, which equates to a +155% distribution vs 2019. Alongside this, the total number of ‘points of distribution’ totals 23,000. The goal, looking to 2021, is to reach 10,000 stores (+134%) and 65,000 points of distribution (+182%) by the end of 2021.

Additional points:

Continuing to expand at a CAGR of 63% y/y would see TTCF expand to a half billion dollar company somewhere around 2022/23. Fairly unlikely.

Plans for creative acquisitions in the future in order to help expand the brand, however not expected to happen until possibly 2022 due to the timeframe on a deal from start to finish.

Strong growth in branded product sales without any current advertising.

What is the market opportunity?

Looking at some of the market size estimates:

UnivDtos market insights estimates a $38.4 billion plant-based food market by 2025, with a CAGR of 8.94%

Meticulous Market research estimates $74.2 billion market by 2027 growing at a CAGR of 11.9%

Allied Market Research estimates $31.4 billion by 2026 with a CAGR of 10.5%

Plant based alternatives to meat has seen a massive spike in growth over the past two years, with more and more people adopting a vegan/vegetarian lifestyle. Tattooed Chef have already made solid efforts to quickly grow their brand with huge exposure over the majority of the US.

Millennials and Gen Z’s are the main driver of this growth which is an expanding segment with an increased purchasing power over the next 10 or so years.

Prepared plant based meals operate within a $33.9 billion sub-category of the overall US Frozen retail sector

Plan to enter into the $12.6 billion Desserts category, however from listening to the latest conference call, this won’t happen for a little while yet – maybe 2022.

The base in Italy will allow TTCF to expand internationally and compete within the $380 billion global food market.

Financials/valuation

$148 million 2020 revenue

Estimated $222 million in 2021

q/q growth double the value compared to 2019

Revenue increased 87% y/y for the 9 months ending sept 30th, with gross profit increasing 70%

Margin-wise, gross margins have declined mainly due to:

First time promotional campaigns

Inefficiencies during merger process

Larger push for more diversified product mix

Adjusted EBITDA growth of 126% to 10.6 million, and as a percentage of sales increased 1.6% to 9.7%.

Balance Sheet

From taking a quick look at the balance sheet – their cash position is relatively healthy, although not amazing – with almost $67 million in total assets, $52 million in current assets and $58 million in total liabilities. This means, if it came to it, they could pay off the majority of liabilities with the current assets, but not all.

Valuation

If we compare the Price to Sales (P/S) ratio of Tattooed Chef to that of Beyond Meat (one of the other few public plant-based food companies), we can see TTCF trades at a PS ratio of 11.62 whilst Beyond Meat trade at almost 21x sales. At a glance, this indicates to me that Tattooed Chef is the better value pick. However, there are a long list of caveats. To name just one, we’re not comparing apples to apples here – Beyond Meat operate in a slightly different segment of the plant-based market. Beyond are much further developed in their growth cycle and are focused on creating a meat-like alternative using advanced techniques within biology and chemistry, whilst Tattooed Chef are simply making accessible, good tasting, Vegan food for the everyday consumer. Very different business models.

The problem with looking at these sorts of valuation metrics for growth stocks is that it takes a snapshot of the past, not accounting for any future cash flows within the current valuation of the stock. Therefore, as this is a growth company looking to expand rapidly in the coming years – we need to be looking forwards.

I’m going to start experimenting with some different valuation models moving forward as it will hopefully give a more rounded snapshot.

Risks

Can their internal production processes keep up with their aggressive growth

For a company whose goal is to scale long-term in an industry where there is likely to be a huge demand increase over the next decade, we will have to see whether the company can efficiently scale their productions.

TTCF are a high-growth company in a market where we will likely see very strong competition – can they keep pace?

We are already seeing a whole host of competitors jump into the plant-based food market which raises the question of TTCF’s ability to fend off these competitors with a strong brand, large product portfolio and strong company ethos.

Can they maintain growth with increased advertising spend?

Growth over the past couple of years has been incredibly strong, however keeping this pace up for the next several years will be a challenge. The plan is to increase spend on advertising to contribute towards this growth – time will tell if this strategy works out.

Conclusion

Overall, I’m optimistic about the future of Tattooed Chef as a growth company over the next 5 years.

In my opinion, the plant-based food industry is set to explode over the next 5-10 years, fueled by several different macro factors – including the increased focus on the environment, animal well-being and personal health. These huge tailwinds will result in steadily growing demand for which TTCF are in a good position to capitalize.

They have already somewhat established themselves within an extremely competitive market (currently just in the US), produced a wide range of high-quality products and have established fairly diverse revenue streams compared to competitors. In addition to these points, the company have paved a clear path to future success with the lofty goal of becoming a $500 million company within 5 years.

Taking this all into account, at the current price I believe Tattooed Chef to be a strong buy. That being said, I will continue to keep an eye on the performance over the coming years. I will be looking to see if they are able to scale at the rate projected whilst maintaining a healthy balance sheet. I will also look to see if they are investing more in advertising and what effect this is having on sales.

Big potential upside here.

Cheers,

Innovestor

They are in the uk as well.

Thanks for doing this. I am in!