Key Stats

Tam $121 Billion

Market Cap 33.6 Billion

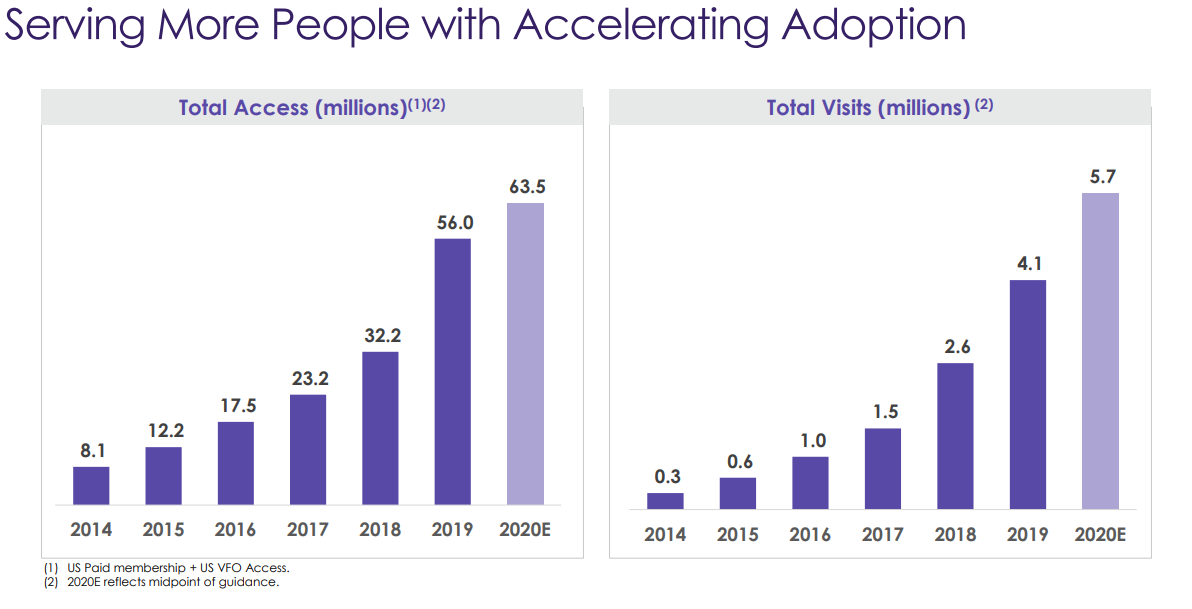

Membership growth +29% for 9 months up to Q3 2020

Q/Q revenue growth over the past 5 years averaging 15% per quarter

Y/Y revenue growth for Q3 +109.3% ($288.8 million)

Continued operating loss (but improved margins)

Summary of thesis

Telehealth is a relatively new industry set to disrupt the old entrenched Health industry. With an aggressive M&A strategy, Teledoc are set to create substantial network effects allowing them to capture a large amount of value as the market expands.

Business/society are slowly moving towards a ‘digital-first’ approach, reflecting the younger generation. This trend will only accelerate over the coming years, for which Teledoc are in a great position to capture a large portion of the market.

Business Model

In essence, Teladoc’s business model is relatively straightforward on the surface – you digitally meet a doctor/physician to for routine check-ups, mental health issues, and a host of other on-the-go problems. This is all done through their platform, offering access to certified doctors through the web, phone or the mobile app – all with the promise of no longer than 10 minutes waiting time.

This is a huge shift in a currently stagnating health sector, that enables people who have busy lives or who are always on-the-go (truck drivers, travelling executives etc.) to have access to their basic health needs. The lower cost model also removes the previously high barrier-to-entry, meaning more of the population can have access to healthcare.

Teladoc have the goal of becoming the leading digital platform within the healthcare ecosystem.

How do Teladoc Generate Revenue?

Primarily, the company generates revenues from subscriptions with various ‘clients’ (employers) who then grant their employees/members access to the Teledoc Health suite of products. This would be classed as B2B2C.

In addition to this model, they also have certain contracts generating revenue based on a ‘per-healthcare-visit’ basis for general medical and other specialty visits. This is more of a ‘pay-as-you-go’ solution and focused around direct B2C which has seen huge growth y/y.

Teladoc’s aggressive M&A strategy

Teladoc continue to aggressively acquire a host of companies within the Telehealth space with the idea to add more substance to the Teladoc product offering. Their current portfolio includes Teladoc, Advanced Medical, Best Doctors, BetterHelp, HealthiestYou, InTouch, and Livongo.

Livongo – enables the Teladoc brand to expand into continuous monitoring and data collection. This does two things, to help patients have a better understanding of their unique health profile whilst also allowing Teladoc to further refine the product offering in order to meet patient’s needs. Livongo's data analytics and patient-coaching platform will be put to use across other Teladoc services and could be a key competitive advantage against its peers.

InTouch – InTouch's technologies, tailored for "complex medical environments" of all shapes and sizes, will help Teladoc offer wider service and improved patient experience in acute care, ambulatory care and home care settings.

MedicinDirect – Will allow Teladoc to expand into France.

Market opportunity

The US healthcare system is just one example of a system completely out-of-touch with this century. Not only in terms of cost, but of quality and of access to simple care. Teledoc aims to disrupt an otherwise stagnant market by dragging it kicking and screaming into the 21st century.

There are a host of points to address on market opportunity, but here I cover:

The potential size of the international market

The trend towards virtual care

The Network effects

The benefit of scale

Size of potential market

There is a huge international market still to penetrate for Teladoc. I believe we are currently at the beginning of a digital revolution in which COVID has propelled us forwards possibly a decade quicker than we otherwise would have – which leaves Teladoc in a brilliant position to be able to capitalise on this strong tailwind of demand for digital products.

The graphic below gives one indication of this demand (at least internationally) as it shows that worldwide, there is huge untapped potential to reach at least a significant chunk of the 1.1billion people currently not using Telehealth solutions.

Trend towards virtual care

The trend towards larger organisations looking to see the benefit of implementing virtual care solutions is set to only increase moving forwards. The image below shows that a significant number of large employers believe virtual care has a very significant impact to the overall care strategy.

Not only with virtual care, but the underlying digitization of all markets is rapidly evolving. For example, we are seeing digital products pop up in all sorts of industries where previously we would not see them – one example is Lemonade ($LMND) in the insurance sector.

Network effects

Like many other good businesses, Teladoc’s business model creates a sort-of ‘fly-wheel’ effect where with each additional customer added to the ecosystem, the eco-system as a whole becomes more valuable to its users, which then attracts more potential users to the ecosystem (which snowballs from there onward).

Another of the network effects relates to something I mentioned earlier – the ability of Teladoc to access data on a user in order to tailor the experience towards the individual user, which leads to increased customer satisfaction and retention rates.

Benefit of scale

Lastly, Teladoc is set to benefit from their vast scale which allows them to achieve round-the-clock care and quick waiting times.

Financials

The financials are strong here for Teladoc. Revenue in 2013 sat around the $20million mark and has increased over the years to around $900 million (hoping to break the $1 billion mark this year).

Quarter on quarter growth is equally impressive, averaging 15% QoQ growth over the past 5 years. For example, revenue growth for Q3 2020 is up 109% to $288 million from Q3 2019. We are seeing the effects of the ‘fly-wheel’ take place, where the more users Teladoc have, the more outsiders are willing to join.

However it’s important to note (and it’s something Teladoc pointed out in their quarterly filings) that the steep growth we see in the year 2020 is largely down to the Covid-19 pandemic – forcing people to use their service.

Profitability-wise, the business isn’t profitable and continues to operate at a loss. However we are starting to see a steadily decreasing operating margin – trending towards profitability. As I see it, we should see profitability within the next year or two if the Telehealth market continues to grow at these rates. Although this relies on Teladoc’s ability to keep gross margins high whilst continuing to improve the bottom-line.

The gross margin decrease over recent quarters is mainly due to overloaded visitor capacity but is starting to improve – leading to improved operating efficiency.

Lastly, let’s take a look at the valuation.

As it is fairly common with most of these rapidly growing companies, it may at first glance seem like they are trading at relatively steep multiples (19x sales), however it is important to note the estimated CAGR is around 37% organic growth for the coming years. And if you combine this fact with the multiple acquisitions (providing significant value moving forwards), this price seems fair.

Conclusion

Overall, I’m excited about this one. The more I’ve delved into the analysis the more bullish I’ve become.

Healthcare is an industry desperately in need of large scale disruption – especially in the states, where large numbers of people are completely unable to afford even basic healthcare.

Teladoc are aggressively winning in this industry amongst currently very few direct competitors (which I do see changing in the coming years). However, they are in a fantastic position to become the long-term winners in this space. Give it 5 to 10 years, but healthcare is changing. And with that change comes huge potential opportunity, especially considering the market size being basically every human being in the developed world.

Teledoc’s continued success depends on their ability to:

Keep their product frictionless

Improve the range of products and procedures offered

Continue to expand at scale

If they can continue to achieve all of these aspects whilst improving the margins achieving organic growth, then I can absolutely see $TDOC winning in a big way.