Intro

Thesis

How Tencent got here

What they do and how they make money (inc. investment portfolio)

The crackdown - what’s happening?

The opportunity

Tencent and the Metaverse

Bull and bear case

Financials/valuation

Conclusion

1. Intro

Tencent are one of the worlds most recognisable brands, yet most of the world have no idea what Tencent even is - such is the insularity of the Chinese market.

China (along with Tencent) are at the center of the news at the moment - and not in a good way. We’re seeing more and more frequently how decisions made at the very peak of the Chinese government are impacting the share-price of these tech-focused conglomerates.

In this lengthly deep-dive, I aim to answer the question of whether Tencent makes a good investment over the next 5-10 years. I touch on the various and interwoven business models at play and try to understand the context within the current market.

In addition, I will attempt to walk you through a simple valuation model to try to value the company over the next 5 years.

2. Thesis

I’ll keep the thesis short and snappy.

Tencent, although facing significant short-term instability alongside a myriad of longer-term risks, are a company whose fundamental businesses (along with the investment portfolio) are undervalued by the market.

These facts will solidify the company’s future success:

A proven track record of growth.

A resilient and well diversified business model.

Evidence of strong cash-flow generation.

The scale of WeChat is a nearly impenetrable moat.

Recurring revenue streams in each of their business segments.

Strong management and culture.

World-class investment portfolio.

3. How Tencent got here...

I’ll keep the background as short as possible. But it’s important to understand how the company managed to get to where they are today, and the context surrounding their rise to power.

Tencent was founded by ‘Pony’ Ma who’s first success was QQ - a social network which took off in early-internet China.

In many ways, the building blocks of Tencent (QQ and WeChat) were a case of ‘right time, right place’. However two aspects of the company’s early business model distinguished them from the pack.

3.1 The initial success of QQ

Firstly, rather than relying on advertising for the majority of the revenue, QQ helped to pioneer “Value added services”.

Users could purchase virtual goods like customisable avatars and gifts as status symbols. The success of this model was thought to be directly related to the fact that under communism, Chinese people had been ‘dull and collective’ in their personal representation. QQ therefore enabled a representation of one’s self in a way that was never before possible.

Secondly, with the addition of each new product, Tencent have never truly been starting from scratch - the company would carry its enormous and growing user-base from one venture to the next until it had near monopoly-level control over the world’s largest market.

Then in 2011 the company launched what would be their most successful ever product - an application known in English as WeChat (Weixin in China), which integrated with QQ.

WeChat continued to grow dramatically with the, now commonplace, WeChat Pay and Mini programs - which allows users to install other apps within the app.

In 2021, you can think of WeChat to be about as close to a ‘super-app’ as it gets. This is down to the fact that Chinese life is essentially entirely operated from inside the app. You have the ability to shop, pay, rent, run a business, game, consume media, make doctors appointments and much, much more.

This useful info-graphic from Vinyard Holding’s article on Tencent, nicely outlines just how all-encompassing the app actually is.

“Texting has always been quite pricey in China, so unlike in the US – where large telecoms bundled texting with other phone services – WeChat was able to quickly fill the instant messaging gap and hit critical mass. Many Chinese adopters skipped immediately to smartphones, leapfrogging personal computers entirely.”

3.2 Mobile Stats

Roughly 50% of all online purchases in China are made via mobile, as opposed to the 30% in the US.

Before COVID-19, China was already a digital leader in consumer-facing areas, accounting for 45 percent of global e-commerce transactions while mobile payments penetration was three times higher than that of the US.

Over 1.2B users spend over 4 hours a day (on average) on the WeChat app in china. That’s more than US users spend on all social media combined.

4. What they do and how they make money

So, now we have the background out of the way, I want to answer the next question - “What does Tencent actually do, and how do they make money?”...

This question is not a simple one to answer, mainly due to the fact that Tencent is a vast and sprawling business, covering a plethora of different industries and countries - with their fingers in almost every pie you could possibly think of.

But let's start from the center and work outwards.

In the context of China, Tencent are one of three Chinese internet giants, along with Bidu and Alibaba.

Operating in Shenzhen (HongKong) the company operates as a sort-of mirror to silicon valley, which is famous for intense work hours, a deep-rooted culture of competition, and a reputation for thinking outside the box.

The core of Tencent’s business model, as outlined in the background section, relies on their Super-App - ‘WeChat’. Stemming from this are (give or take) 6 core business divisions which, on their own, easily compete with industry leaders in their respective fields (as we can see from the image below).

Communication and Social

Online games

Digital Content

Online Advertising

Fintech

Cloud and other business services

Here are several examples of the sheer scale of Tencent’s individual divisions:

Tencent’s Digital payments division is almost on par with PayPal.

The subscription revenue is close to that of Netflix.

They make more from games than Sony or Nintendo.

WeGame is significantly larger than Steam.

Also they own 100% of Riot Games (creators of Leauge of Legends), 5% of Activision Blizzard, 40% of Epic games - just to name a few.

4.1 Why is Tencent so dominant?

The Chinese economy is inherently different from the US, though the differences may seem counter-intuitive. For example, if we look at the US, the technology ecosystem is filled with competition - we have multiple leading companies for almost every industry.

Whereas in China, it seems to be the case that Tencent are one of only several dominant companies, with competition being more concentrated to less than a handful across all industries.

This goes against our intuition due to the fact that China have a much larger population with a far greater diversification of languages, cultures, regions and not to forget the sheer size. You would therefore think these differences would result in a far greater diversity of options for consumers.

The distinction lies in the fact that the Chinese government is willing to give Chinese companies the freedom to operate as they see fit as long as the result is beneficial for the Chinese government. This has led to the existence of near-monopolies/duopolies with the clear examples being Tencent, Bidu, and Alibaba.

The elevation by the CCP (Chinese Communist Party) of these domestic Chinese companies serves 3 main purposes for the state…

Brand - Putting these companies on a pedestal serves to elevate the image of Chinese entrepreneurship, and therefore the Chinese ‘brand’ as a whole. This is thought to make China look like a more prosperous society from the outside.

Ensuring domestic success - the success of domestic companies comes at the expense of foreign ones. To the very limited extent that Western companies succeed in China, they do so with the express approval and financial benefit of a Chinese counterpart. It is even a legal requirement that foreign firms must parter with a local one.

Territorial Power - The fact that these Chinese companies have become so overbearingly large with stakes in multiple global companies serves a slightly more malicious purpose - global dominance. With some level of power outside of mainland China, these Chinese companies will have the ability to impose their rules and regulations. One possible example of this would be the ability to collect data from EU/US citizens in companies Tencent has minority/majority stakes in - i.e. Snapchat, Riot, Reddit, Epic Games etc.

In the following sub-sections I will try to give my insight into each of the core divisions Tencent operates within. Focusing on:

WeChat

Gaming

Media

Fintech

Cloud

Investment Portfolio

4.2. WeChat & Social Networks

As discussed before, WeChat serves as the core of tencent’s business and is arguably the company’s most substantial moat.

From leveraging the original userbase on QQ in the realms of social and gaming (and then WeChat), Tencent have created a platform where Chinese people rely on the app to carry out the majority of their every-day tasks. In other words, if Tencent were to vanish tomorrow - Chinese life fall apart.

WeChat is essentially the super app for china. It’s genuinely hard to operate in modern China without using the WeChat platform. This is the real kicker in my opinion. It is what will enable Tencent to weather almost any storm.

As a gatekeeper to the market, WeChat is able to set prices, copy & kill competitors, and be selective in what they show. An example of this is the fact that when companies outside of China attempt to enter the Chinese market, they end up either partnering with Tencent or dying a death.

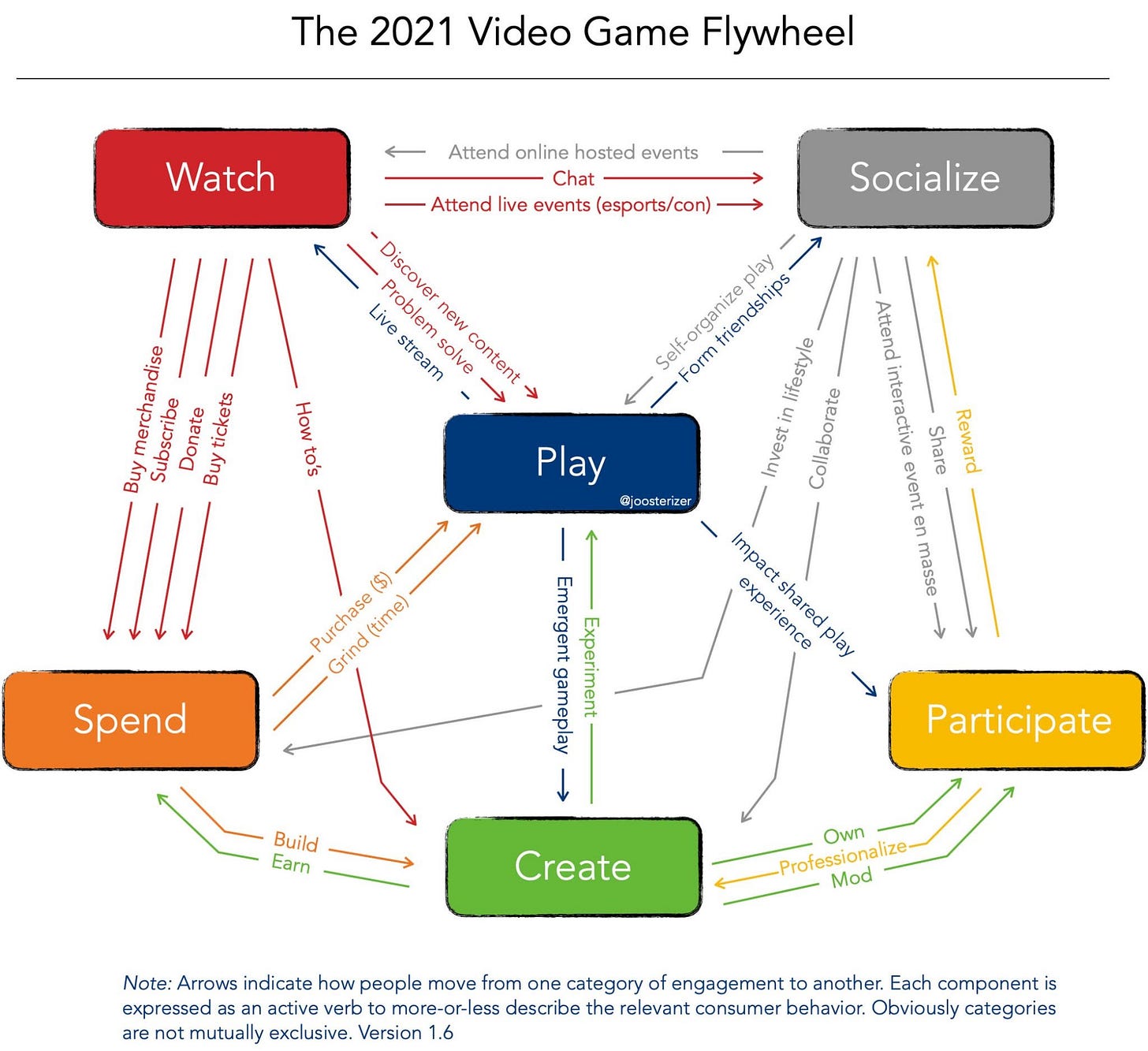

Outside of the main functionality of the app, WeChat acts as sort of an enabler for Tencent to enter into each of their other industry segments - for example, payments and gaming. This type of thing has been mentioned many times before, but the flywheel effect here is significant. I.e. when merchants join the platform to access the customer base, it adds more reasons for new users to join - all while WeChat/Tencent take a small slice of the transaction value. Once the flywheel momentum starts, it’s hard to stop.

And yet, this app is only a relatively small aspect of the wider business model.

4.2.1. WeChat Mini-Programs

A vital aspect to understand about WeChat is the mini-programs, as this is where a large amount of the value really lies.

Mini-programs are essentially mini-apps inside of Wechat, which have several distinct properties:

Can be developed rapidly due to lower coding requirements.

They are accessible because of not needing to download or install.

Most every-day tasks can be carried out using these mini-programs.

Here are some statistics to outline the impact mini-programs have on the Tencent business model:

There are 3.2M mini chat programs

410M Daily Active Users (DAUs)

1.2B Monthly Active Users (MAUs)

Almost all users are between 25 and 35, so good pricing power.

88% of American companies use ‘WeCom’ to communicate with employees in china

87% of consumers in China use ‘WeChat Pay’ for online payments

“36.2% of all time spent on apps in China are spent on Tencent apps, and 11% of all online advertising revenue is spent on Tencent adverts. This suggests not only does Tencent have the market dominance on both the advertiser and the consumer sides, but that there is also decent room for monetisation.”

More than just being a useful tool for supply-side merchants to connect with their customer-base, these mini-programs offer easy, flexible, direct avenues, which users can share within the app.

The product locks merchants and customers into the WeChat platform, lowering the long-term customer acquisition cost for merchants and improves experience for customers - a win win.

In China, WeChat is dominant. It’s possibly the most overpowered acquisition funnel to get people to use their other businesses.

Three of the four largest holdings - Meituan Dianping, JD.com, and Pinduoduo - are Chinese ecommerce businesses that run on top of WeChat. Tencent uses data from WeChat to source investments, and then provides preferential placement to its investees’ Official Accounts and Mini Programs within WeChat.

No one else has the transaction data or the ability to boost a company’s distribution the way that Tencent does with WeChat. This will continue to be an advantage - in just three years, there are over 1 million WeChat Mini Programs. Tencent can cherry pick the best, invest, and practically guarantee their success.

Here is a super valuable thread from JoshuaTai who nicely outlines each of the uses of WeChat

4.3. Gaming

As mentioned earlier, although not considered a gaming company per se, Tencent’s online gaming segment did $6.65B in Q2 revenue (increase of 12%), which is bigger than any other gaming company on the planet. It owns Riot Games, which makes League of Legends, the most popular esports title in the world by over 4x (as judged by Twitch streams) and 40% of Epic Games, which makes Fortnite (350 million players).

The below graphic by Granite Bay Capital serves to highlight the sheer reach of Tencent’s gaming dominance. They are connected throughout most of the gaming industry in some way or another.

4.3.1. Gaming Strategy

In the push for global gaming dominance, Tencent’s approach seems to be multi-pronged:

Increase mergers & acquisitions in overseas developers, like Riot Games and SuperCell.

Develop games internally (like Honour of Kings) to be published overseas. And also licence these games to key distribution partners (such as SEA Ltd).

License other IP assets at their disposal to develop new games for global mobile market (Call of Duty Mobile, PUBG Mobile)

Gaming has always been a big deal in China with, one could argue, more brand loyalty attached than in the west. Gaming is also far more embedded in the culture, partially due to the type of games played.

In the west, early gaming was more along the lines of plug and play shoot-em-ups etc, whereas the far east were playing more Massive Multiplayer Online Role Playing Games (MMORPGs) - the most popular of which probably being World of Warcraft. These types of games lent themselves to Chinese culture as it enabled a sense of individuality via customization. These games tended not to have an end, therefore building up very sticky customers over a long period of time.

In addition to gaming being an integral part of the Chinese culture, the gaming business is great for flywheel effects. As shown by the image below, the on-ramp of gaming leads to many other avenues where monetisation is possible.

Therefore, owning the games is key to owning the flywheel.

All that being said, gaming is a hard business. On the positive side of the spectrum - franchise games have brilliant unit economics, loyal customers, low capital expenditure requirements, regular streams of income, and strong pricing power. However, the downside is that successful games are almost impossible to produce on a reliable basis. This makes it hard to re-invest capital. It is also why gaming Intellectual Property is becoming so valuable.

In the context of Tencent’s overall gaming strategy, their past actions in terms of investments and choice of partners has lead to a dominant position within the gaming market. They are the largest shareholders in Riot Games, Bluehole, Supercell, Activision Blizzard and Epic Games.

Epic Game’s Unreal Engine is one of the two major competing games engines that underpin the development of almost every major game and 3d/graphic-based application worldwide. Their 40% stake in Epic games was possibly one of the best investments the company has ever made in this sense.

4.3.2. Competition

It’s clear gaming competition within China is beginning to heat up. Competitors like Alibaba, NetEase & Bytedance are all heavily allocating capital towards their own gaming efforts. Each has released well received games in 2021.

Smaller gaming studios are popping up all over the place, too. And although this may not seem like a massive threat on the surface, it only takes one viral game to knock the current no.1 off the top spot. We have seen this with titles like Rocket League, who have come from humble beginnings to being one of the most played games worldwide.

This article goes into detail on Tencent’s increased investment in gaming.

4.3.3. Investments

A running theme throughout this deep-dive will be the high praise I give towards the capital allocation of management. Some of the investments made over the past decade have been nothing short of inspired.

With regards to the gaming portfolio, Tencent has made some impactful investments into gaming studios. They are the largest shareholders in Riot Games, Bluehole, Supercell, Activision Blizzard and Epic Games. As mentioned earlier, Epic Games is probably the most noteworthy investment here, however there is a large amount of strong IP and valuable assets within each company.

4.3.4. E-Sports

As talked about in great depth in my Enthusiast Gaming deep-dive, I see e-Sports as a huge growth opportunity within the gaming landscape. In this particular instance, Tencent’s dominant position within the wider Chinese E-Sports industry shows just how big of an opportunity this is.

To boil it down, the whole industry uses Tencent’s platforms, investments, and infrastructure (livestreaming/distribution/marketing etc). The Chinese E-sports ecosystem is nuanced but also nearly impossible for eSports professionals to opt out of participating in Tencent eSports.

They essentially have a monopoly in this department.

4.3.5. Potential risk

As I mentioned earlier, a large risk within the gaming realm is the possibility of another gaming studio producing a massively popular game that reaches new heights. As gaming is the one of the main on-ramps to Tencent’s overall platform (and it is a large source of revenue) the company will see any competitors as a threat.

“Recently, Genshin Impact (GI) – a AAA, free-to-play mobile game – launched, hitting roughly $400 million revenue in two months (on a budget of ~$100 million) and winning Best Game 2020 awards from both Apple and Google.”

The biggest takeaway from this development was the fact that these smaller gaming studios no longer NEED Tencent to be able to pull-off a big revenue generating game.

Circumventing the Tencent ecosystem, GI-creators miHoYo marketed via a range of other channels (Twitch, YouTube, Reddit, Discord, etc). They also set the first well-received example of a truly open-world, console-like experience on mobile.

The implications of miHoYo’s game are – in summary – that mobile-first gaming is huge and can compete with console in quality; that the Chinese studio competition is fierce and impending for East and West developers alike; and that the free-to-play model is likely the future.

4.3.6. Looking forwards

If we are to predict what is next for Tencent within the gaming industry, they will firstly need to strengthen their gaming ecosystem over time. This could materialise in partnering with companies like Nintendo, maintaining the dominance of WeChat, or investing in companies like VSPN (the leading esports solutions provider in Asia) where these markets are set to grow over the next decade.

This raises the question of international expansion, which has never been an easy task for Chinese companies. However, Tencent are in a good position with their globally diversified investment portfolio.

4.4. Media

Leaving gaming out of the equation for one second, one could make an argument that Tencent is one of the most influential media companies in the world at the moment. That being said, competition is rife in this sector and has been heating up over the past two years with the rise of Bytedance and TikTok.

Because our customer attention is zero-sum (i.e. there is only so much time in the day someone can look at their phone), all of these companies are fighting tooth-and-nail for the most attention possible - and this is true for all forms of entertainment.

In online TV, Tencent (394 million monthly active users) competes with Alibaba’s Youku (394 million) and Baidu’s iQiyi (348 million).

In short form videos, Bytedance owns the market with Douyin/TikTok, but Kuaishou is a close second. This is an incredibly important battleground.

The purchasing power of these users will likely grow over time.

4.4.1. Livestream

In July 2019, Tencent won a lawsuit giving them game copyrights in third-party live broadcast. This gave them major control over the game broadcast market. Currently, this “Twitch-for-Asia” market is dominated by Douyu and Huya (in which Tencent is the largest shareholder), who together have an 80% share of the market. Kuaishou has 18.5% and Bilibili has 17.1%, both are partially owned by Tencent, too.

For this reason, both Douyin and Kuaishou are moving heavily into livestream, longer form video and eCommerce. Kuaishou has 300 million daily active users, of which 170 million watch livestream and 100 users engage in livestream e-commerce each day.

4.4.2. Music

Lastly, music is another industry in which Tencent dominates. Tencent Music Entertainment (TME) is the largest music platform in China with a market cap of $30B.

The competitive advantage here is similar to that of Spotify - where they have spent vast sums acquiring music licenses and exclusive rights. Netease Music is their only real serious competitor.

They are now looking to expand into livestreaming, online karaoke, podcasting, and offline performances.

They have developed an advertising arm of the business, which is growing at 100% y/y.

They expect podcasting users to double by 2021 end.

Paid subscriber growth within music leaves plenty of room for improvement. Currently only 9% of users are paid subscribers, whereas Spotify boasts around 45%.

4.5. Fintech

Fintech is a real potential area for growth. It has been one of the fastest growing industries over the past 50 years - and with the recent tech revolution, this industry can be expected to continue its fast-paced growth.

At it’s core, the Chinese payment system is majority app-driven - mainly due to the fact that cheap mobile devices came about in a relatively short period of time. This enabled leapfrogging of the western technology development road-map.

One obvious thing is the difference between Revenue for both companies. The business models are fundamentally different and speak to the regulatory oversight of the CCP. Fin-techs in China are there (in the eyes of the government) to serve the Chinese people. Hence, they have less room to monetize than their Western counterparts. This principle carries over into WeChat advertising relative to Facebook’s, Alibaba’s GMV relative to Amazon’s, and more. (less opportunity to generate rev, but much larger base).

Both Alibaba and Tencent are investing aggressively in these thematic industries. Given their size and complexity, it is impossible to say who has the advantage here. Both Tencent and Alibaba have incredibly holistic views of the consumer through their myriad offerings and products. This data allows them to track consumer lending, offering variable loan rates and product prices to different buyers.

4.6. Cloud

Early stages to say the least.

Cloud adoption in China (let alone the rest of Greater Asia), is still in the bottom left of its S-curve. It is conservatively predicted to grow around 28% annually to 2023, with historical growth rates shown in Figure 29.

Hurdles for cloud mainly fall into 3 categories:

distrust of cloud due to historical leaked data scandals

a mentality that is used to cheap labour and software piracy subsidising costs

yet-unmet expectations around customisation of cloud offerings

The trends are there to get businesses in China to begin to use the cloud: A younger workforce, COVID-19, big tech’s push to cloud, a 5G roll-out, geopolitical sovereignty, and the CCP-mandated 5-Year-Plan.

So where does Tencent fit into this? Roughly speaking, Alibaba has 40% market share in China, and Tencent and Huawei vie for second with both hovering around the 16% mark. Tencent doesn’t disclose their cloud growth beyond lumping it with the rest of “FinTech and Business Services” which grew ~26% year-on-year through 2020. Qualitatively, EqualOcean’s comparison below highlights some of the differences between AliCloud and Tencent Cloud.

4.7. Oh, and how they make the rest of their money…

Possibly the most exciting aspect of the business, and why I believe the company is still somewhat undervalued from an investment standpoint, is the scale and depth of the investment portfolio.

PackyM has done a fantastic service by compiling a super-list of the main Tencent investment portfolio holdings, which we can assume is more-or-less accurate. Even if just to give us a ball-park figure, it’s an incredibly useful tool.

Taking a quick glance down the list of businesses - most are household names. Here are just a few you may have heard of, split by sectors.

E-commerce

JD (18%)

Afterpay (5%)

Pinduoduo (17%)

Finance

WeBank (30%)

Futu (30%)

Nubank (10%)

Gaming

Riot Games (100%)

Supercell (81%)

Epic Games (40%)

Activision Blizzard (5%)

Ubisoft (5%)

Roblox 1.3%

Other

Discord (2%)

Universal Music Group (10%)

Spotify (6.8%)

Tencent Music (58%)

SEA (26%)

SNAP (12%)

Reddit (5%)

Tesla (5%)

Nio (15%)

In my opinion, the skill within the management team to deploy cash is second-to-none. Two of Pony Ma’s top executives are ex-Goldman Sachs bankers, which makes sense.

“Our M&A strategy has always been trying to invest in up and coming companies which have a great management, who have innovative products, and at the same time, they have synergies with our existing platforms. We now have more than 700 companies.”

The investment portfolio in context

To give some context - if we were to try to calculate the intrinsic value of Tencent’s operational divisions (which I will do in the valuation section below), the value comes out somewhere between $500Billion-$700Billion depending on your level of optimism. Let’s be on the safe side and say $550Billion, which is already 91% of their $600B market cap.

Importantly, this is NOT including the additional investment portfolio.

When adding the value of the investment portfolio to the estimated value of the operating business, we come to a value roughly 33% above the the current market cap.

Over and above the obvious value in being vastly diversified within some of the most exciting up-and-coming businesses in the world, the investment portfolio serves as a sort-of risk management tool in order to pursue the goal of increasing international dominance.

In China, some of Tencent’s largest and most important investments are in E-Commerce, with the plan of increasing the amount of investment going into smart retail due to the success of the WeChat Mini-Programs.

The international portfolio is more diversified. With gaming by far the largest slice of the pie (with some big names mentioned earlier in the article).

Outside of typical foreign territories such as Singapore and Indonesia, Tencent are beginning to invest in companies building similar super-apps to WeChat - such as SEA and Gojek.

To summarise their investment portfolio - it’s complicated, wide-reaching, large and risky. Tencent invest in almost every up-and-coming company out there, which results in heaps of potential future opportunity, alongside some short term volatility.

I believe the investment portfolio is one of the many gems within Tencent’s overall business and should not be overlooked.

4.8. To summarize

The ‘what they do’ section here is understandably massive. Tencent are a vast and sprawling company with their fingers in many different pies. But the main takeaway is this. Tencent are dominant in almost every industry they operate within. If they can continue to hold off competition within each of these industries, there is no reason why they can’t remain number 1.

5. The crackdown - what’s happening and why?

Now that we understand what they do (as well as is humanly possible), let's figure out what is happening with Tencent within the context of China right now - and try to figure out whether the recent pullback is justified and will be sustained

Quick summary before jumping into the detail:

China announced a 6 month rectification plan for big tech and internet companies, including turning education businesses into non profits. These education businesses were big ad spenders for Tencent, so will have some material impact on the revenue figures.

Tencent uses some questionable tactics such as link-blocking competitors on their platforms. This has been called into question by the regulators.

Regulatory pressure on WeChat Pay. Tencent's WeChat Pay holds a near-duopoly in China's online payments market with Ant Group's Alipay. However, the Chinese government wants to regulate both platforms more tightly as financial institutions -- which could cripple their ability to disrupt traditional state-run banks.

Banning the merger of Huya and DouYu (provide videogame live-streaming services akin to Twitch in the U.S.). The merger would have created a great promotional platform for its top games and expanded its streaming video presence beyond Tencent Video. Unfortunately, the market regulators blocked the deal, claiming the deal would monopolize the esports streaming market - which it would.

No more exclusive music for Tencent Music. On July 24, the market regulators forced Tencent Music, which controls over 80% of China's streaming music market, to give up all of its exclusive music licensing rights. Tencent spun off Tencent Music in an IPO in late 2018, but it remains the company's biggest stakeholder.

The gaming business is coming under fire, with the government looking to restrict the amount of playing time minors can have on a daily basis. Could definitely impact revenue.

As most will be aware, the current state of Chinese stocks is a concerning matter for anyone with any amount of capital invested. I won’t spend too much time on this section, however I will try to outline the main point of what is causing the ‘nose-dive’ in the price of Chinese stocks and, more importantly, why.

5.1. The what...

China’s goals over the past several decades are clear - to become the largest global economic force. An interesting distinction about China, compared to most of the rest of the world, is that they are not a fully capitalist society. At least not as far as we understand it in the west.

Slowly, over time, the Chinese Communist Party has been trying to introduce different aspects of capitalism into the economy. One example of this was the establishment of the Chinese stock exchange. This re-opened in the 1990s and since then, the government has been slowly adding more capitalism-type investment vehicles to be utilized by chinese companies.

That being said, China would also be considered to be ruled by an authoritarian government/political-body. This can be a real problem for any capitalist-type business operating within China, as the ruling body (in this case the CCP) don’t like giving up their power.

As an example, the government has made a habit of making ambitious economic/political plans to allow more private investment and freedom to Chinese companies, only to backtrack shortly afterwards when they try to take back the power they have given up due to problems arising.

This has manifested in a recent backslides, in which they have dramatically increased the oversight applied to prominent Chinese technology companies who are currently listed on the stock exchange and plan to be listed on the stock exchange in the near future.

5.2. The why

So why does this matter? And what does this have to do with Chinese stocks in general tanking?

The first thing to take into consideration is the fact that the Chinese stock exchange was considered by the world at large to be only on a provisional basis. It can be treated as somewhat of an experiment by the Chinese government - dipping their toes into new waters. There were, and still are, big question marks around whether the CCP will really allow for these capitalist-style financial vehicles to operate in the way they were intended.

The market opportunity in China is massive, with the world’s largest middle class, littered with huge monetisation opportunities - but none of that matters if the Chinese government will continue to interfere/ban certain businesses to operate.

The general consensus with investors in Chinese companies is that as long as the government remains relatively hands-off, they are willing to invest. However, with this recent backtrack and outright interference in some of the major Chinese players, the Chinese government has scared many foreign investors out of the country - tanking the share price.

Adding to this - it’s important to note that the motivation behind these anti-capitalist policies and regulations isn’t simply to break up the monopolistic companies like Tencent and Alibaba for the greater good of the economy. It seems more like a knee-jerk reaction to the idea that power is being taken away from the CCP. When it’s boiled down, the CCP want to remain the most powerful entity in China, and are therefore willing to do whatever they can to achieve that goal.

All this being said, I have estimated the current damage to Tencent on these crackdowns on their core revenue to be somewhere between $3B - $6B (or between 4% and 6% of annual revenues). I would therefore argue that the recent pullback of +20% seems somewhat overdramatic. However, it’s difficult to know to what extent this crackdown will continue and for how long.

6. The opportunity

The chinese middle class is huge. Over the past several decades, the growth of the Chinese middle-class has been nothing short of exceptional. Over the next ten years, the middle class in China and the rest of Asia (areas which Tencent are targeting in particular) are projected to continue growing rapidly. For example by 2035 China will have a larger middle class than USA + Europe combined. They are targeting 35k USD per capita.

China hasn't had a recession in 40 years. The regulators do their jobs and regulate. For example, the recent crackdown on the ANT IPO, where they were lending ~10k to students through a quick 2 minute form and charging 20% interest. China is good at shutting these type of things down, whereas in the US there seems to be much more leniency for this kind of activity. This proactive behavior creates short term pain but long term stability.

6.1. Where do I see the future growth?

Much of Tencent’s future growth relies on the continued flywheel that is WeChat and the various ancillary services surrounding that. The more Tencent are able to focus on expected growth industries, such as cloud and gaming - the better chance of continuing their substantial growth trajectory.

Some tailwinds for growth include…

Industry specific tailwinds

High base rates case for gaming-industry growth. Roughly 15% per year is the base estimate which, given Tencent’s position in the market, they will likely smash.

5G being rolled out worldwide would provide tailwinds with many of their indirect investments.

Rising chinese consumer spending as the economy continues to develop.

Several areas of Tencent’s focus - e.g. cloud & SaaS are severely undervalued in terms of use-cases. This is a significant area to increase monetisation.

Country-specific

Between 2010 and 2018, the Chinese GDP per capital has grown at roughly a 7% CAGR (compound annual growth rate). The forecast between 2019 and 2026 comes in at roughly 7.5%. Very few other markets are growing at these rates.

Lastly, with the ever-increasing push into

overseas markets, and into a more investment-centric model, I expect markets in India and Southeast Asia to underpin a chunk of growth going forward. These two countries are somewhat similar to China a couple of decades ago, and while Tencent focuses on the move to B2B within China, they will look to repeat much of their B2C growth within these markets.

7. Tencent and the Metaverse

I talk about the metaverse a lot - so here’s a brief thread I did a while back outlining my thoughts on what the metaverse is and how it might shape-out over the next 10 - 20 years.

Of all the super-apps out there, WeChat, one could argue, is the closest thing we have to a metaverse-like platform - even if this platform mainly exists in the 2D realm. Users can shop, pay, play games, send gifts, personalise products amongst many other things - all without leaving the app.

This opportunity to be a metaverse-like platform is likely to represent an incomprehensible about of wealth-creation over the next 10-20 years as technology develops. And Tencent, who have strategically invested in many metaverse areas of focus (e.g. Epic Games), are in a leading position to capitalise on this opportunity.

7.1. The building blocks

We don’t really know what kind of ‘platform’ the metaverse will end up being built on eventually. It could be Epic’s Unreal Engine, Nvidia’s Omniverse platform, or both, or neither. Most likely, and this is actually one of the core definitions of the metaverse, is that the platforms will be interchangeable and connected. In other words, there will be no singular platform.

Tencent’s 40% investment in Epic Games is the best opportunity (in my opinion) the company has to be able to capitalise on the potential metaverse adoption. More than likely, most applications (games, AR, VR etc) will use either Unity or Unreal Engine to build the metaverse. The Unreal Engine is the platform, Fortnite is Content. It owns 1.5% of Roblox, which has 164 million users and is played by half of people under age 16 in the United States.

Here’s a detailed thread on EPIC.

Another important piece to the puzzle is Snapchat. As Tencent are Snapchat’s largest shareholder at ~12%. I think snap are an important piece in the metaverse jigsaw puzzle - bridging the gap between the physical and the digital worlds.

7.2. Audio

Audio is beginning to make a resurgence with podcasts beginning to become the norm and daily listening times increasing. Therefore I see audio becoming a more integral part of our everyday lives.

Tencent has a 9% stake in spotify, who are best placed to capitalize on the audio opportunity. The company currently has

Spotify, of which Tencent owns 9%, is best positioned to capture that earshare. Spotify currently has 365 million monthly active users and are rapidly experimenting with different types of long-form spoken-word content. Sleepwell Capital is a great resource for all things spotify.

I believe audio will nicely fill the gap in the metaverse where people are not able to fully immerse in the digital world - offering an extra on-ramp. Additionally, audio really enhances the immersive experience that the metaverse is looking to achieve.

There is much more to be said on the relationship Tencent has with the metaverse - check out Packy McCormick’s essay on this subject.

8. The Bull & Bear Case

8.1. Bull

#1 - WeChat which is a nearly impenetrable moat that Tencent will enjoy for at least another decade or two. WeChat users spent $115 billionthrough mini programs in 2019 and exact figures weren’t disclosed in Tencent’s 2020 annual report but I did find that in their report that annual transaction volume from Mini programs doubled in 2020.

All of this is important because while WeChat is a dominant force, user growth has been slowing given that it already penetrates nearly all of China and so it’ll be important for Tencent to continue monetizing on its users to propel further growth.

In order to not be too repetitive, I won’t touch upon gaming and Tencent’s investment portfolio. 2nd most valuable brand in china and the 7th most valuable in the world.

#2 - Resilient with strong Moat. The abnormally large scale allows Tencent to leverage scale benefits across all verticles. Integral to the Chinese consumer. Integral to most businesses in china as a point of sale, distribution channel, advertising medium and providing cloud and data infrastructure. Also integral to the asian gaming market.

Not dependent on any one supplier. Multiple successful business arms. Low marginal cost. Low to no Customer Acquisition Cost. The more they grow, the better the unit economics become. Low debt and low capital requirements. All of these factors contribute to the company’s overall resilience.

#3 - Strong Management & Culture. Tencent is still led by the core team who founded it. Great working environment with a 4.3 star rating on glassdoor. Of Tencent’s founding five, two are still executives (Pony Ma, CEO and Xu Chenye, CIO). The other three are on the advisory board. Most of the rest of the executive body have been with the company since around 2005.

#4 - Live Streaming. Tencent owns a dominant 37% and 38% stake in China’s largest gaming streaming sites named Huya and Douyu and has been pushing for the two companies to merge. Unfortunately for tencent, this did not pass due to monopolistic concerns, however this segment remains a huge growth opportunity which serves as a nice compliment to their gaming segment.

#5 - Fintech and business services. This is the fastest growing segment of Tencent’s business (40% for Q2 y/y). Tencent has been able to take considerable share away from Alipay through Tenpay (equivalent of Paypal or Venmo) which currently accounts for about 39% of transactions - up from about 10% in 2014.

Regarding the cloud, Tencent holds the 3rd place spot in terms of market share and given that the overall industry grew by 62% in Q4 2020, I’m sure Tencent will be putting a lot of effort into this business segment.

#5 - The investment portfolio. This is possibly one of the best aspects of owning Tencent, and is a smart move on the company's behalf. Creating and developing their own products would be very inefficient. The company’s best minds should be focusing on building a company that is set up to catch the next big growth wave.

Investment in some of their best bets vs ownership is smart (especially within the context of the metaverse). It will likely be wide-reaching, and we don’t know who the various winners will be. But it most likely wont be one sigle entity.

To avoid repetition - I will simply list the rest.

#6 Reasonable valuation

#7 Strong fundamentals

#8 Multiple industry tailwinds

#9 Leader in almost all areas of operations

8.2. Bear

#1 - Regulatory risk. Unlike Jack Ma who notoriously spoke out against the party and caused many issues for Alibaba, Tencent is known to have a very strong relationship with the government. That being said, the CCP can at any time change its policies that can hurt Tencent’s business (and have done so over the past several months).

This is an ongoing risk and probably one of the largest short-term drivers of the stock price. We simply don’t know how long this will last, or how much damage will be done.

#2 - International political unrest. It’s a real risk that China grows way too powerful that countries will work to limit its power, such as making Tencent sell off its US holdings if an anti-China US president came to power. What should be noted though is that Tencent’s business mostly resides in China (97%), so there would be notable but minimal impact

#3 - WeChat growth is slowing and competition is heating up. As WeChat have grown to be the single largest messaging/social/business platform in all of China, user growth has inevitably began to slow. And the new kid on the block looking to eat up some of this market share is ByteDance which is the company behind Douyin / Tiktok.

TikTok has over 689 million monthly active users while Douyin has over 600 million, and as we’ve seen with WeChat, once you have the users, your opportunities to create additional businesses are endless

#4 - Tencent trades in the US as a Level 1 ADR. Level 1 ADRs trade on OTC markets and don’t need to abide by GAAP accounting which result in less reliability and transparency when it comes to reporting the numbers.

I find it unlikely that Tencent would commit serious fraud with their accounting, but it;s something to be aware of. There was also some talk about the US delisting Chinese ADRs so again, this is another risk.

Alternative options, as discussed in the financial section below, are to invest in Naspers or Prosus.

#5 - Lacking in one single vision/goal/focus. One could argue Tencent has lost focus and drive - the company is too far-reaching and therefore lacks the direction needed to succeed long-term. It could be compared to an investment fund - not to say this is necessarily a bad thing.

# 6 - Competition in all areas. As mentioned earlier, competition is heating up in many of the areas they operate within. They face a behemoth of a general competitor in Alibaba, an investment competitor in Softbank, an emerging wave of entertainment competitors such as Bilibili, NetEase and Bytedance, and increasing anti monopoly regulation.

#7 - Culture of Short-termism. There are several accounts knocking about that due to the sheer scale and desire to grow year on year, some members of management have been known to focus more on the short-term goals than is healthy.

In a nutshell, and this is something that happens to companies when they get too big, is that they lose the ability to innovate effectively - so they just copy ideas and acquire (look at Facebook).

9. Financials

I’m going to briefly go over the headline financial figures for Tencent before doing a much more thorough job at a discounted cash flow valuation in the next section as I believe that is far more important.

Tencent have a good financial history, with little debt and strong historical revenue growth. The company are highly profitable with an adjusted EBITDA of around 40%. They have roughly as much cash as they do debt.

No marginal cost for most products. Similar to the US technology gians, the more Tencent grows, the better their unit economics become. They have the leeway to be able to invest in companies/projects with poor unit economics which can be subsidesed through cash from the company’s core operations.

You may want to see a larger cash position, but Tencent is generating so much in free cash flow that it really doesn’t matter over the short-to-medium term.

9.1. Cash Flow

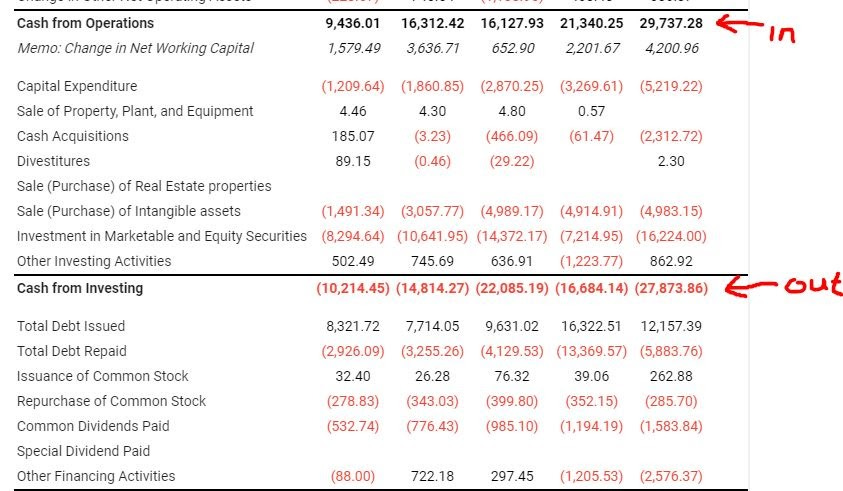

The cash flow statement is extremely strong. But what is really impressive is the way in which Tencent re-invest back into its businesses using cash generated from the core operating businesses. This is what’s leading to its fast, sustained, compounding growth.

If we run a quick eye over the cash flow statement, we can see the substantial cash from operations coming into the business. At the same time, we can also see a significant, and almost precise, outflow of cash towards investing activities. This is cash coming straight in and heading straight out the door. In other words, they are utilising every bit of cash-flow they make in order to invest and compound at a greater rate. Exactly what we want to see to indicate longevity.

9.2. Summary of financial position

Highly profitable, adjusted EBITDA around 40%

Roughly as much cash as debt.

Generating large amounts of free cash flow.

Not necessarily cheap, but could now be a good time to purchase?

The way in which they reinvest capital back into its business from its core operating businesses is what’s leading to it’s long lasting growth and compounding.

Cash generated from operations was 29B, and 28B reinvested back into the business.

9.3. Valuation

I’m going to try to keep this aspect as simple and as easy to follow as possible.

Generally speaking I find complex valuation models make things less clear rather than more clear. I’ll take you through my thought process step-by-step and provide the spreadsheet so you can play with the numbers and follow along.

Step 1 - get the numbers

Step 1 is to gather the historical financial data for the company over the past 5 years. I realise we’re half way through 2021, however I’m going to use the annual figures from 2015 to 2020, as it keeps the process simple (ish).

This step is actually harder than it sounds as Tencent doesn’t report in USD - therefore I will have to use a third party provider (y-charts or TIKR) to grab the numbers.

Step 2 - Make basic assumptions

We’re going to make some minor assumptions based on the historical figures in order to forecast growth over the next 5 years (2021 - 2025). Assumptions made here include:

Conservative estimate of revenue growth @ 15% per year (even though average revenue growth over past 5 years is ~37%).

Using historical average EBIT margin of 31%.

Using historical FCF as a % of EBIT in order to calculate the future Free Cash Flow (see formulas in spreadsheet if confusing)

For example, if we know that historically (on average) the Free Cash Flow figure is 1.25x the EBIT number, we can multiply any future EBIT number by 1.25x to get the estimated cash flow.

Step 3 - Which method of earnings do we use?

Now that we have all of the numbers and forecasts, the next thing we need to decide is which method of earnings to use to calculate a fair value for Tencent - the options being ‘Net Income’ or EBIT.

In this case we’re going to use EBIT due to the fact that Net Income includes some investment gains that we want to exclude for the moment.

Even though the investment gains are technically ‘real’ and of material value, it’s simply too volatile to be able to predict moving forwards. Therefore we will bolt-on the equity investments at the end of the valuation.

We will also be using the Free Cash Flow number which has averaged at roughly 125% of EBIT.

Step 4 - Finding the intrinsic value

In order to find the intrinsic value of the operating business, we need to add together the discounted terminal value and the sum of the discounted free cash flows.

In order to get these terminal values, I will need to come up with a terminal value multiple. I have chosen a TV multiple of 20 to be on the safe side. The reason being is that the EV/EBIT multiple has been trending downwards over the past 5 years, so I can see this pattern continuing. Equally a fair value would probably be anywhere between 20 to 30.

Once we have calculated the terminal value (formula in spreadsheet) we then discount this terminal value figure by the discount rate of 15% (formula in spreadsheet), which gives us the discounted terminal value.

We then sum the discounted FCF values and add them to the discounted terminal value to get to the intrinsic value of the operating business. Which equals to roughly $536 Billion.

Step 5 - Adding the investment portfolio

Next, we want to find the total estimated fair value of Tencent, including their investment portfolio arm - which is the intrinsic value (which we just calculated) + the estimated value of the investment portfolio.

PackyM’s spreadsheet shows the current portfolio to be worth roughly $320B, but I’ve discounted it by 20% to account for some volatility.

Therefore, the total estimated value of Tencent in 5 years is $785B, which (dividing by the outstanding shares) makes a share price of $81. The margin of safety is roughly 22% from the current price, as well as an IRR of roughly 22%.

On the basis of some fairly conservative estimates, the current price looks extremely attractive to me. I have also added a bull and a bear case in the spreadsheet.

9.4. Relative valuation

On a relative basis, Tencent are coming back to a level that looks more appealing. Especially considering the underlying business hasn’t changed much, regardless of the Chinese crackdown.

The below graph compares the EV/Sales ratio between some of the major Chinese companies. It’s a good way of showing the general market trend. Though appearing attractive at the moment, it’s difficult to say how long or how deep this shakeout of Chinese stocks will/can continue.

This valuation matrix below, from factset, gives a great indication of the relative underlying fundamental performance of Tencent compared to both their Chinese and Western counterparts.

Amongst the chinese group, Tencent lead the way in terms of profitability numbers. They lead the pack in net margin, EBITDA margin and FCF yield. However their revenue growth numbers look decidedly average.

I would argue that the below table, which shows solid fundamentals, justifies the relative premium in comparison to their Chinese counterparts in the chart above.

9.5. Buy Tencent at a discount?

While researching, I kept coming across Naspers and Prosus as potential alternatives to investing in Tencent at a ‘discount’. Lets find out what all this means…

What is Naspers?

Naspers took the decision to buy a 46.5% stake of Tencent in 2001. The ownership stake was diluted when Tencent decided to ipo. The total cost basis of that Tencent investment was 32 million dollars back then, which has turned into over $200B today as Tencent has become one of the most dominant internet giants not only in china but globally.

That is a CAGR of approximately 55%, which is insane. As a result of this Investment, Naspers market cap has grown to the point of dominating the South African stock exchange. Even today, Naspers accounts for 22% of the South African index.

However, this poses a problem. since many institutional investors in South Africa are forced to sell out of the Naspers investment in order to reduce the concentration risk in their portfolio. The sustained selling of the stock along with the limited float resulted in a reduction in the price of Naspers shares.

In order to address this discount, Naspers management decided to organize a spin-off in the form of ‘Prosus’.

Prosus

September 2019 saw Naspers list Prosus on the Amsterdam Stock Exchange. With the idea that the formation of Prosus would give the company more liquidity from a new diverse base of investors.

The new listing would reduce the problem that Naspers had where they were dominating the entire South African index. This spin-off would be allocated the entire Tencent stake and other investments that Naspers previously controlled.

The listing was a massive success - with the initial listing price prediction of 58.7 euros Prosus exceed this, shooting up to a range of around 76 euros.

So, If you’re looking at Prosus or Naspers, you’re not really looking at an investment in Tencent, but more the capability of the management team to manage the capital. Most likely, Naspers and Prosus will never sell their stake in Tencent.

My opinion is that if you are looking to invest in Tencent, don’t over-complicate it. Unless you are truly knowledgeable about the management of either Naspers or Prosus, don’t in what is essentially a derivative of a derivative. There are plenty of risks to already consider with owning Tencent without adding an extra layer of complexity.

10. Conclusion

I’ll keep this conclusion short, mainly because the article ended up being so long. However, I think the opportunity present here is great.

I believe Tencent has pretty-much everything we’re looking for in a good investment opportunity - resilient business, strong investment portfolio with an eye towards the future, huge growth tailwinds in multiple industries, dominant in almost every area of operation, impenetrable moat and ‘metaverse-ready’ (amongst other things).

All risks considered, the company is trading at a relatively reasonable valuation level. I strongly believe the potential upside here far outweighs the risk.

For full disclosure, I have already initiated a 3% portfolio position in Tencent at an initial cost basis of ~$59, with the aim of gradually adding over the coming years. This is a good practice for any investment in order to manage risk, but in this case I wan’t to manage the downside as much as possible.

Cheers,

Innovestor

Some thanks:

Special thanks to both of Pacy McCormick’s Tencent articles (One, and two) where he goes into great depth on the history aspect and has done some amazing ground-work on the investment portfolio analysis.

Special thanks to Vineyard Holdings article who goes into vast detail on Tencent, and moreso within the context of China.