Welcome to the 102 new readers who have joined since the last article! If you aren’t already subscribed, join the community of 1,990 investors by subscribing below.

My aim with these deep-dives is to make the research process of investing in individual stocks more accessible. Enjoy!

Contents:

Thesis

Key takeaways

Business model

Market opportunity

Growth plan

Acquisitions/partnerships

Bull & Bear

Management

Financials

Conclusion

1. Thesis

Enthusiast Gaming is an opportunity to capitalize on a combination of a rapidly growing market (esports/gaming) with a ‘direction agnostic’ position within that market. I.e. not reliant on taking a bet on any particular game/trend/franchise to play out (e.g. Roblox/Fortnite/CoD).

The thesis here is to bet on the gaming industry in general, and the immense untapped value that a highly engaged group of 300M GenZ’s and Millenials will have in the near future. As advertisers and marketing managers come to recognise the potential for community, the average revenue per user will grow substantially (prediction of $3 but possibly way higher).

Along with this, gaming is the next social hangout space for young people, and 70% of GenZ’s attribute gaming as a large expression of their personality.

Gaming will continue to evolve rapidly over the coming years - EGLX are in the best position to monetise the community of gamers around the globe.

2. Key Takeaways

Platform with global reach of over 300m gamers every month

Building social network (platform) for gamers, capitalizing on social revolution and changes in how Gen Z and millennials consume content

Q1 2021 Revenue was $30.0 million, a 321% increase vs Q1 2020 revenue of $7.1 million.

Gross profit was $5.9 million, an increase of 80% vs Q1 2020 gross profit of $3.3 million.

Net loss was $13.6 million.

Robust first-person data-set of highly lucrative demographic (GenZ/Millenials/GenA). Engaged, loyal communities of gamers.

Undervalued compared to industry peers.

Great exposure to the huge and fast-growing video game market through Esports, entertainment and media.

Insider ownership of 30%.

The company is beginning the monetization phase of its business strategy.

3. Business Model Overview

Enthusiast gaming is a business model that, on the surface, isn’t the most straightforward. They are neither a games developer, distributor, or anything directly related to the titles themselves. Those roles within the industry are competed by companies like Activision (ATVI), Electronic Arts (EA), Roblox (RBLX), Unity (U) and Take-Two (TTWO) amongst others, who are all extremely good at what they do.

Enthusiast Gaming’s area of competence is around the community. They have spent time and money building a community of engaged gamers with the option to tap into directly at any time. I’ll go onto explain why this is valuable later on in the article, however for the time being here’s their mission statement.

Mission – “building a world of communities where video gamers connect and engage”.

In essence, Enthusiast Gaming is building the world’s largest platform of communities for gamers and eSports fans. The company owns a platform with over 100 websites over 20M youtube subscribers, 7 pro E-Sports teams, over 550 influencers, subscription sites, events and more. Part of this includes the ownership of Luminosity Gaming, which is one of the bigger E-Sports organizations in the world. Also, they have close to 30 events (b2b & b2c) around the world – including the largest mobile gaming event in Europe and the largest gaming expo in Canada.

The sheer size of the user-base of 300M monthly active users worldwide is arguably the company’s most compelling competitive advantage. This alone gives them the ability to communicate with over 300M game enthusiasts each and every month, which makes EGLX the largest gaming network in both North America and the UK.

“We feel no-one is as obsessively focused on the fan experience as we are. The thing that makes us so different to anyone else in the space is that we are not trying to dominate a vertical; we are not trying to just be an eSports organization, a collection of websites, or a tournament organizer - we want to build value right across the fan experience. If you are a super-keen EPIC Games’ Fortnite player who has logged-off, the beauty of this gaming phenomenon is that you are not then ‘done’ – you go to Twitch where – obviously! - we want you watching our Fortnite streamers Muselk and Fresh, when you go to YouTube, we want you to go to the biggest Fortnite YouTube channel in the world – our channel, BCC Gaming, if you want to see what EPIC Gaming is up to next, we want you to then come to one of our events and see their booth up-close. It is all highly integrated – and hopefully a lot of fun also!” - Adrian Montgomery (CEO)

3.1. So, how do they make money?

As with many business models, the answer is advertising.

Enthusiast Gaming don’t own any large games like CoD or streaming platforms like twitch. However, they do have a base of over 300M engaged monthly active users with which they can present adverts to. Combine this with the possibility for influencer marketing and you have a powerful route directly to these lucrative age groups.

Companies like Facebook and Google are already dominating the advertising space with their ad platforms, however advertising is evolving. Influencer marketing is becoming one of the most effective forms of advertisements - and Enthusiast are in a great position to capitalise.

The level of content and reach within the gaming industry gives Enthusiast Gaming the opportunity to partner with large companies like Samsung who will be able to more effectively target ads.

3.2. Understanding the model

The idea of gaming is a different experience for different people… Some might complete the story-mode, maybe play online - but then once you turn it off, you forget about it. The other type of gamer would be playing in a similar way, with the big difference being the involvement and consumption of content around the game. For example, youtube videos, forums, podcasts, attending events etc.

In order to understand the business model, lets try to put ourselves in the shoes of a typical gamer. I’ll use myself as an example. Once I’m done playing I might…

Try to find news about future games/updates to games that are coming up.

Join a forum to discuss the game with other fans.

Subscribe to a youtube channel to watch live-streams or to find tips/tricks/engage in comments.

Look at twitch or youtube to follow a particular e-sports team

Attend virtual event (previously live events) – and connect with other fans at these events.

The fact Enthusiast Gaming has curated an eco-system creates a flywheel effect where the more people involved in every aspect of the ecosystem (websites, YouTube channels, e-sports team, influencers, experiences), the more value is created for users – therefore attracting more users and fueling the flywheel. This eco-system around the game itself the the portion of the gaming experience EGLX are aiming to control.

3.3. The core pillars of Enthusiast

If we zoom out slightly to try and distinguish some core pillars of the business model, it breaks down into three main sections - Media, Events and E-Sports.

3.3.1. Media (95% of rev for most recent quarter)

The media aspect, which makes up roughly 95% of the most recent revenue stream, is a crucial part of Enthusiast Gaming’s business. As shown in the image above, this consists of over 100 active sites, over 1000 youtube channels with over 3.2B views every month and a bunch of high-profile influencers within the industry.

The company sees their assets (luminosity gaming, influencers etc.) as “content factories” - keeping fans engaged.

The crucial point here is the fact that EGLX owns this entire audience. This means they have direct access - a trait which brands value immensely. Subsequently allowing Enthusiast to charge a premium for advertising real-estate.

Interestingly, the amount of focus EGLX has put on the media aspect to date has been relatively low compared to the anticipated focus moving forwards. The plan is to move focus towards direct advertising rather than programmatic advertising (difference explained here), which will require a big boost in the number of sales team-members. We are already starting to see this.

3.3.2. Events

Secondly, events within the gaming sector are crucial to building the community. It’s a chance to bring together a community of like-minded individuals.

Pre-covid, EGLX have been doing a good job at putting on large events for the gaming community. Their flagship event is the EGLX event (above), however they do other events/conferences such as ‘pocket gamer connects’.

3.3.3. E-Sports

As I have discussed in previous articles, the rise of E-Sports is a phenomenon in-and-of-itself. It is essentially a subset of the overall gaming industry (as demonstrated below), where elite gamers are able to compete against the best in the world.

E-Sports has been growing at ludicrous rates over the past several years. The industry is now at a point where viewership figures are beginning to overtake traditional sports.

(Below source: business insider)

“A 2020 report by Limelight Networks found that gamers ages 18 to 25 spend significantly more time each week watching other people play video games online (4 hours, 7 minutes) than they spend watching traditional sports on TV (2 hours, 36 minutes) or online (2 hours, 34 minutes).”

“As competitive video games continue to integrate into popular culture, global investors, brands, media outlets, and consumers are all paying attention. Total esports viewership is expected to grow at a 9% compound annual growth rate (CAGR) between 2019 and 2023, up from 454 million in 2019 to 646 million in 2023, per Insider Intelligence estimates. That puts the esports audience on pace to nearly double over a six-year period, as the 2017 audience stood at 335 million.”

With regards to Enthusiast Gaming, the company own one of the bigger e-sports organisations in the world called Luminosity gaming which they acquired in 2019 for $1.5M in cash, 7.5M shares of GameCo and a promissory note worth $2M.

The franchise has over 50 content creators and key influencers, over 100M fans and 6 pro e-sports teams. Tyler “Ninja” Blevins, one of the most famous gamers in the world, was a member of Luminosity Gaming earlier in his career (and I believe is still under contract with the franchise).

E-Sports thriving during the pandemic.

Luminosity currently ranks 42nd in terms of revenue generation. Lots of room to improve here.

E-sports makes up 6.5% of total revenue.

3.4 Revenue streams

The CEO, Adrian Montgomery recently said in an interview when asked about the strategy behind revenue generation at EGLX - “We aggregate the largest fanbase possible, and turn that fanbase into a customer base.”

Simple.

Now if we delve slightly deeper into this statement, we can begin to see why this strategy (within the context of the gaming industry) will be so lucrative in the future.

“They” (Gen Z & Millenials) “are the world’s most lucrative demographic because they have a lot of purchasing power. They don’t have their money sucked away by these things called children and mortgages. If you are a company, you are no doubt trying to get them into your world at a very early point in their buying lifecycle. What people don’t really understand is that any traditional sports would kill for the demographics of an eSports fan - they are a little bit older than you think – typically being in their 20’s; they have more disposable income than other traditional sports fan but then, they are elusive - they just don’t consume content the way I did in 20 years ago!” Adrian Montgomery - CEO

“Gen Z are the most lucrative demographic, but also the most elusive.” Some statistics to illustrate this point…

Almost none watch linear TV.

Gen Z spend almost 4.5 hours a day on social media, while Millennials estimate they spend an average of around 3.8 hours.

Gen Z are more likely to have watched social media videos in the last week than TV series. 70% of Gen Zs say they consume social media videos. That’s an increase from 66% who reported watching social media videos in the last week back in June 2020. This means that for this group, social media video viewing now eclipses TV series viewing, with 66% reporting that they watched TV series in the last week.

Instagram, TikTok, and Snapchat are in their top 10 sources for video content - but cable isn’t. Just 15% report watching cable weekly or more.

The majority are using social media while they’re watching TV. Over half (57%) of Gen Z use social media while they’re watching TV. The fragmented attention is real. That’s compared to 51% of Millennials who say the same, so in case you were wondering if older consumers were more engaged viewers, they are but barely.

Gen Z makes more mobile purchases. Compared to millennials, Gen Z is twice as likely to purchase something on their mobile device.

Taking all this into account, Gen Z are fickle, hard to reach, elusive, but also a goldmine for advertisers. Being able to communicate through gaming is the key to unlock this demographic. Therefore creating an incredible opportunity to monetize through ad-sense, and you can command significant advertising rates because of this. It’s all made possible due to the fact that the platform is wholly owned by EGLX.

So, if we then look at how this breaks down in reality - there are 4 main methods of generating revenue, and more to come.

Ad sales: Strong base to sell ads and to monetize. Viewers come back 25ish times per month – compared to IGN/Gamestop = 5/6 times per month. Twich = 5/6 times per month.

Subscription: Opportunity to sell subscriptions to a percentage of these 300M base. E.g. sims resource subscription service – 137,000 people pay $4 per month for VIP content. Recurring high margin rev stream.

Sponsorship of E-Sports teams: All the big brands want to get into gaming at the moment.

Appreciation in value of e-sports teams: One way trend for all sports.

*Future - marketplace/platform for gamers.*

The beauty with this business model is the fact it’s agnostic to specific games or directions of travel within the industry. It’s not like Activision who’s future performance directly relates to the success of their handful of franchises. If gaming wins - EGLX wins. Therefore it’s great overall exposure to the e-sports sector.

There are no other companies/products with this array of assets. The aim is to own all communities, and have as many touchpoints as possible with GenZs.

4. Market Opportunity

According to YouTube, viewers watched an approximately 50 billion hours of Gaming Video Content on its platform in 2018, doubling to approximately 100 billion in 2020.

The number of gaming-related tweets increased from approximately 218 million in 2017 to over 2 billion in 2020, according to Twitter.

I won’t talk for too long about the gaming industry, as I have been over it several times in the past - mainly in my Activision Blizzard deep-dive. I would also recommend reading a collection of essays by the 10th man, who has gone into great detail on the industry.

“I had just read an article about eSports, and one of my guys phoned me and said “You know how you were interested in eSports? Well, these guys are coming in – do you want to come on the site tour?”. Well, it turned out we had this opportunity to host the biggest eSports event in the world – the DOTA 2 International run by Valve – that was coming out of Seattle for the first time. I came down and met these three guys, who were acting as if they were in charge of FIFA or the SuperBowl or something! “Take that down, move that, block that off, our crew needs this...”. I was getting a little frustrated and keen to try to put them in their place, saying ‘Hey, so what exactly is the prize purse for this little rinky-dink tournament right? “$33 million dollars (USD)”. Oh my god! So, I went back at the end of the site tour and said, alright, there is clearly something here!” Adrian Montgomery - CEO

Gaming, as you are probably aware, is one of the fastest growing industries at the current time and is expected to continue its spectacular growth trajectory over the coming years.

Gaming is the most powerful form of entertainment – twice as big as the movie industry and the music industry combined. Online viewership has far more views than any traditional sports.

Growth at 35% p.a.

Prior to COVID, studies were already showed that over 90% of all children in America were gaming in some capacity.

Hollywood $40B industry, gaming $150B and growing

Layer on the 25% of the audience which are GenZ’s. 75% of which think gaming is a core personal expression.

“According to Newzoo, the industry is expected to grow to USD$218 billion by 2023. The proliferation of high speed internet, accessible technology, and publishers using enhanced live operations and other tools have further accelerated the gaming market. Gaming has amassed a diverse audience who rely on the industry as a form of entertainment and social connection. Increasingly, younger generations are immersing themselves in gaming ecosystems and now choose gaming as their primary form of entertainment. Today, there are 2.7 billion global gamers, who engage with interactive entertainment using three platforms: console, PC and mobile, according to Newzoo.5 It is expected that gamers will surpass 3 billion by 2023 as smartphone penetration increases globally.”

The idea of gamers as kids in their parents basements, barely affording rent is a thing of the past. The average age of an esports fan is 22. The purchasing power of this audience is therefore rapidly increasing - and will continue to do so over the coming years.

4.1. Positioning within the gaming market

You have the $200B gaming industry consisting of large publishers like Activision Blizzard, Take-Two and RIOT that make the games. Facebook, Amazon and Google are competing to become the broadcaster for the content. That leaves Enthusiast Gaming with a lot of freedom to consolidate the fan experience.

There are 2.5B Gen Z’s in the world – 70% of whom say that gaming is a core part of their identity as human beings. They are consuming content and playing video games at record levels. In addition, you could argue gaming is also the new social network. Gaming is how people interact with eachother and, one day, might be the most common method of interaction.

(Ardian Montgomery) - “Gaming to them is what music was to the rest of us. It’s the way they express themselves to the outside world, which is extremely powerful. So to be able to speak to billions of Gen Z’s through a shared love (gaming) is a powerful engaged relationship. With this highly engaged relationship comes more data and better understanding of their wants/needs.”

“When you have that large community to draw upon – when you give that young person who loves video games an extra hour in the day, they’ll spend that in some way somehow in the video games ecosystem.”

4.2. Stats & vision

On the influencer side, No.1 on twitch in terms of viewership. Nearly double anyone else. (March 2021 40M hours watched compared to No.2 with ~25M hours).

On the Youtube side, EGLX currently reach about 25% of all Youtube gaming (over 3M views per month).

On the website side, the company has spent 4-5 years acquiring all of these websites – leaving not much left for competition to replicate the model. Therefore going to be hard for a fortune 500 company to replicate from scratch.

Big companies like Microsoft and Facebook are obsessing over video gaming and content communities. The power of communities, the sharing of content, the creating of content and the fact people aren’t passively sitting in front of traditional media. People are flocking to communities and that’s why Microsoft and Facebook are focused on this area. The CEO of Microsoft said something very impactful - “we’re going to transition from being about media consumption to content creation – and building communities around that creation of content”. EGLX are onto something big here.

4.3. COVID

Covid spiked traffic to EGLX’s various touchpoints. Over 25% across the board and over 40% on some sites.

Content views gone up by around 25%

Page views up.

Time on site up.

The challenge is that advertising rates were down at the beginning of Covid but have since picked up.

5. Growth plan

The majority of past growth has stemmed from a strategy primarily based on strategic mergers and acquisitions. This will continue to be a growth lever moving forwards.

In addition to strategic M&As, Enthusiast Gaming believes they have a clear path towards increasing monetisation within the gaming ecosystem. These strategies include…

Optimising CPM

Increasing direct sales

growing the subscriber base

and licencing content

The company has a 4 stage plan to increase ARPU from $0.40 to $3.00 by 2023.

Stage 1 involves building scale by acquiring assets within gaming/content creation.

Stage 2 involves concentrating on increasing the ARPU number by focusing on direct advertising. This will involve the company increasing their sales team.

Stage 3 involves working on other forms of revenue generation within the company by focusing on increasing subscription revenues and licencing deals.

Stage 4 involves leveraging first party data (eg. acquisition of tabwire) to enhance gamer experience. EGLX are looking towards e-commerce and the creation of a social platform.

‘Platform’ is the key word here and is arguably the end goal for the company - i.e. to create a platform for gaming entertainment worldwide… To be the no.1 source of gaming content/entertainment.

“What is next is for us to sell our content using elements such as subscriptions. We believe we can take a userbase and turn it into a marketplace. Why can’t we have an App Store? Can we connect these communities and people together and make a social media network of our own even – that is all ahead of us. I always tell my team, while we are building a company called Enthusiast Gaming, we are also helping to build an industry – and the rules are being written as we speak. Adrian Montgomery - CEO

Ideas are to…

Become a subscription content platform similar to Roku – offering advertisers direct access to a highly engaged audience.

Could become a marketplace for gamers – making use of the 300M ‘walled garden’.

5.1. Advertising

“According to eMarketer, consumers in the U.S. spent an average of 181 minutes accessing digital media in 2010. In 2020, this figure increased to 470 minutes a day, representing 160% growth. Due to, among other things, the shift in media consumption from traditional to digital and increased time consumers are spending online, advertisers have adjusted the way in which they allocate their advertising budgets. According to eMarketer, USD$90 billion was spent globally on digital advertising in 2012. This spend increased to USD$378 billion in 2020, representing growth of 319%. Digital advertising is expected to grow to USD$646 billion by 2024.” - Management Discussion

Until recently, Chief Marketing Officers tended to ‘age discriminate’. This manifested itself in dismissive behaviour towards e-sports as a vehicle for advertising - mainly due to the demographic being seen as too ‘young’ or ‘niche’. Now, all brands want/need to be involved in e-sports. We are beginning to see all the big brands clamoring to get their name involved within the industry.

"Enthusiast Gaming is already partnering with the likes of Gillette, Proctor and Gamble, GoDaddy, and Pizza Hut. However, Adrian was clear that other brands need to realize that gaming is not a hobby for many millions – billions of people.

“eSports is more than a hobby for gamers - it’s a way of life. It’s their identity, it’s their social network, and it’s their method of expression. eSports and gaming is going to continue to skyrocket, and people are realizing how pervasive it is in people’s lives. What I’ve seen change this year - and I can tell you which is one of the most exciting things for our industry today - is that most marketing directors now know if you need to communicate with young people, you simply must have a video game strategy. eSports has made quantum leaps during the recent pandemic.” - Excerpt from interview with Adrian Montgomery.

The industry as a whole is estimated to be growing at roughly 35% per year. This presents massive opportunity for brands looking to get in early and cement themselves within the community.

Take Red Bull for example. With an early vision of esports marketing, the company is now synonymous with various top players - Ninja for example.

5.2. ARPU

Relating directly to advertising, ARPU (average Revenue Per User) is the low hanging fruit the company can currently focus on in order to really grow top-line revenue in the short-term. ARPU currently currently sits at $0.4 but with some minor changes of emphasis, it is predicted to jump to $3 by 2023 - however I can see it going much higher.

ARPU is higher in the US than anywhere else because the sheer value of the Youtube and Web eyeballs in America is significantly higher than anywhere else.

5.3. Advertising/Sales team

Another aspect of the growth and increasing ARPU is the increase in the sales team to better penetrate the direct advertising market.

They have the potential to quickly unlock some of the ARPU through direct ads. These direct ads are more likely to be exclusive/targeted and much better value for the brand/advertiser as EGLX know exactly their target audience (70% Gen Z & Millenials). These brand partners are willing to pay a premium for this added precision with the advertising model.

The brands want access to Enthusiast’s youtube audience, web audience, but most importantly the influencers. This combination of youtube, web and influencers is something that no-one in the market is delivering at the moment and really moves the needle on sales for brands.

Once they have the advertising, sales and subscription sales sorted, they can then evolve to a marketplace for gamers – leveraging their 300M walled garden of engaged gamers. (Stage 4)

“So now that we have an opportunity and so for the present time despite all the success that we've had recently with direct sales we're probably only selling two percent of our inventory directly to the customer, but when you sell directly to the customer you're almost at a minimum 10x in your cpms. So every incremental two percent three percent shift of inventory from programmatic to direct has an outsized impact on margin. And so when we look at all of the things in front of us we think we can dramatically increase our gross margin like we did before with enthusiasts.

How complex and expensive is it to switch from programmatic to direct is it just a matter of hiring the sales people.”

Programmatic advertising on it’s own was probably at around $0.5c per user, and this was fairly bottom-of-the-barrel, low effort, easy to scale stuff – whereas if you layer in the data and the sales team and the subscriptions and the e-commerce, that’s when you could potentially go $5-$10 per user. So that’s where the focus is at the moment – building and scaling up the sales team in order to be able to implement this change from programmatic advertising to direct.

For an indication of this, in Jan 2020 the company had about 2 salespeople – now they have over 40. The intention is clear.

Much of the $120M in revenue from the previous years was due to programmatic ads. This change is the tip of the Iceberg.

5.4. CAC - Customer Acquisition Cost

One relatively hidden benefit of Enthusiast Gaming’s business model is the very low (allegedly $0) CAC. This is also arguably their deepest moat.

“The thing that blows people away – and is routed in our content and approach – is when I tell them we don’t spend a single cent in acquiring or keeping that traffic coming back. They won’t believe it. Building a world-class business routed in user-generated content is definitely a very hard thing to do – and when you succeed it is a very hard thing to explain! There is a lot of art as to how it’s curated, how its presented, but when you can do it well, the sky is the limit for you in terms of possibilities.” - Adrian Montgomery

Silicon Valley tend to ask the question “is your CAC lower than your LTV?”

All this growth in ARPU with $0 CAC (due to owning both the traffic and data) will lead to outsized margin increases over time. The moat is that there isn’t anyone else in the industry with an audience as large and highly-engaged as EGLX. The company don’t spend money to drive traffic to their sites – the traffic comes organically. Therefore it is virtually impossible to replicate an audience as large and as loyal. Those 300M people consume over 4.5B views per month.

5.5. Content licencing (Roku/Samsung)

The play for the longer-term is to begin to licence some of the content and sell to companies like Samsung and Roku, which will have an immediate effect on the bottom line. (Stage 3)

“The Company is pursuing opportunities to license its library of content and owned & operated brands to distributors. Enthusiast Gaming already has established partnerships with TikTok, Samsung, and Snapchat.”

5.6. Downsides of growth

In terms of profitability, EGLX are still several years off – they are actively investing in growth as they see this as a huge potential opportunity. Everything is being ploughed back into the ability for the company to grow.

“The alchemy of running a ‘user generated content’ business is that it’s very hard to do and it's almost harder to explain, and the moment you lose that authentic and genuine edge the whole thing falls apart. Activision as an example – people wouldn't flock to Activision fan communities if they knew big brother was owning them and moderating them right and selling selling the data. We are focused on growth and uh but we could be profitable tomorrow if we so choose.” - Adrian Montgomery CEO

Growing and scaling as a business is hard. Short term profitability usually needs to be overlooked in favour of long-term gains.

6. Acquisitions/partnerships

Acquisitions and partnerships are a key aspect of the growth strategy. In this section I will very briefly touch on some of the acquisitions/partnerships Enthusiast gaming have made over the recent past.

So far, we’re looking at 16 acquisitions in the past 4 years.

In addition to the various acquisitions over the past several years (above), the company owns 6 e-sports teams including (Vancouver Titans - Overwatch, Seattle Surge - CoD, Luminosity - Fortnite, and Luminosity - Valorant)

Some of the most notable recent acquisitions include…

Omnia Media - “Omnia owns content brands that matter to fans who love gaming and pop culture including BBC Gaming, Arcade Cloud and Wisecrack.”

Enthusiast Gaming has announced the launch of BCC Gaming, its first free, ad-supported streaming channel, which is available on Samsung TV Plus, Samsung’s free Smart TV video service, in the US.

This licensing and distribution activity is the latest result of Enthusiast Gaming’s recent acquisition of Omnia Media, which extends the company from one that was previously focused on online esports and gaming communities to one that produces and distributes premium, original content.

Icy Veins - acquisition of Vedatis, which owns Icy Veins — a platform dedicated to guides for Activision Blizzard games including Hearthstone, World of Warcraft, and Overwatch — for €7M EUR ($8.51M USD).

Enthusiast Gaming expects the acquisition “to be accretive to Enthusiast Gaming’s revenue and margins and demonstrates opportunity for increased monetization through the company’s proprietary flywheel, which includes YouTube channels, subscriptions, content licensing, and e-commerce.”

Tabstats - A step in the direction of increased social interaction on the platform. “GenZ and Millennial audiences have been moving away from traditional social networks and turning to gaming as an alternative,” commented Adrian Montgomery, CEO of Enthusiast Gaming. “Project GG addresses these trends and will allow gamers to register their unique gaming profiles, compare stats, develop meaningful connections, and share content and ideas.” He continued, “Tabwire marks an important milestone for Enthusiast Gaming to be able to bring Project GG to market later this year. It will provide us with essential data capabilities to deliver our customers a complete social offering with a more targeted, integrated and personalized experience for today’s gamer. This is a meaningful next step towards becoming a technology-powered, media, esports and entertainment company.”

6.1. Collab with Coldplay

Coldplay are a historically innovative music act. One of the, if not the, first bands to licence their music to iTunes. That deal was done directly with Steve Jobs by licencing ‘viva la vida’ for an iTunes commercial and ended up winning a grammy.

EGLX have a content creator in Luminosity called ZHU, who is one of the leading EDM DJ’s. The idea is for ZHU to remix ‘Higher Power’ by Coldplay.

EGLX created an event showcasing the remix, along with a performance from Coldplay. Really interesting cultural crossover between mainstream music and gaming.

“Coldplay are timeless, cross-generational musicians, and we look forward to serving as a bridge between them and our global gaming audience. While this is the first collaboration of its kind for us and in the gaming space, our platform provides immense opportunity for similar experiences in the future.”

EGLX are taking over the world – and it’s not just in video gaming. The interesting thing here is the intersection between music & gaming, fashion & gaming, lifestyle & gaming etc.

Adrian Montgomery goes on to make some really interesting points about attracting the entrenched investors who may not be keeping up with pop-culture. This collab with Coldplay is something that may spark their attention. EGLX will be doing more with Coldplay and other mediums of entertainment outside gaming.

6.2. Torstar JV

More recently EGLX form a Joint Venture with Torstar to launch an online news channel - creating an original news platform and community named AFK.

"AFK is a new brand that brings insight and community to issues that matter to gamers in a tone and format that feels familiar to them, such as short-form video content and message boards on digital-first platforms."

Gen-Z focus: short vids + digital first approach

Content creation seems a big focus here

This one is particularly interesting to me as EGLX seems to really be putting together the beginnings of a ‘platform-like’ experience.

7. Bull & Bear Case

7.1. Bull

Global Reach of engaged audience members (300M)

Capitalizing on revolution in how GenZ and Millenials spend social time. Creating the beginnings of a gaming-orientated social network.

Strong monetisation strategy with strong present and future revenue streams.

Multiple growth opportunities with significant upside potential.

Optionality. Direct and varied touchpoints with young people (Media, esports, gaming, music).

Sports betting market will be a big industry that EGLX are looking to get in on.

Social network primarily for gamers.

Content licencing with Roku/Samsung – licencing some of the content and selling it, which will have an immediate effect on the bottom line. Basically just live broadcast directly to ROKU which will increase viewership.

EGLX owns their audience, and therefore (and arguably more importantly) owns the data.

Monetising data is key. Enthusiast owns all of their users data along with the direct traffic which will be extremely valuable moving forwards. This puts them in a good position to sell user data and use it as a freemium model – i.e. people can access content for free with the assumption of being able to use their data. This will be valuable because it’s a very niche and very targeted audience meaning they can sell the advertising space/data at a significant premium.

Undervalued compared to industry peers.

Great overall exposure to gaming sector - game/trend agnostic.

7.2. Bear

Overly reliant on one source of revenue.

Competition

There is potential for large companies to come in and buy up a large portion of the gaming real-estate. However, EGLX currently one of the only companies doing what they are doing

I would argue there are very few companies who will be able to generate the same level of reach in an organic way.

Profitability still a long way off.

Definitely one of the most concerning aspects of the company is the profitability. At current levels it’s not sustainable. That being said, in my opinion there is a clear plan to achieve profitability over the next few years. It will be really important as an investor to keep an eye on key metrics in order to ascertain whether the company are on track to achieve their goals.

Short interest.

As shown by the chart below, short interest for Enthusiast Gaming over the past several months (and well before that) has fluctuated wildly - ranging from 5% to over 50%.

Share dilution

In order to grow, Enthusiast Gaming need cash. Therefore it’s entirely likely the company will continue to issue shares in order to raise capital in the short term. That being said, they have ample working capital to meet the expected need for cash over the next 12 months.

Definitely something to keep an eye on moving forwards.

8. Management

One of the key factors when analyzing a company - especially a ‘growth company’ - is the competency of management. There are several different things I would like to see when assessing the management team.

Transparency

Inside ownership

Long-term orientated

Experienced within the industry

Passionate

Strategic acquisitions

General impression from interviews

Before outlining some of the key executives at EGLX, it’s worth noting the glassdoor score of 41% score for management. This isn’t great - I would ideally like to see a much, much higher score.

From looking at some of the comments it’s clear to see employees leaving poor reviews are generally referring to ‘growing pains’ due to the company growing so fast.

Management consist of a healthy mixture of gaming enthusiasts and industry veterans, for example Menashe Kestenbaum (founder) alongside individuals who have previously worked in sports entertainment and media - an industry sharing similarities with Enthusiast Gaming’s goals.

Additionally there is a significant portion of insider ownership, currently sitting at 30%.

ADRIAN MONTGOMERY

CHIEF EXECUTIVE OFFICER

“Vast experience in media, sports and entertainment, finance and industrial services. Most recently, he served as President and CEO of Aquilini Sports and Entertainment (Vancouver Canucks), one of Canada’s premier sports and entertainment organizations. He is the former president of Tuckamore Capital Management, a conglomerate with over $700 million of annual revenue, and was also the former CEO of QM Environmental, one of Canada’s largest contracting companies.”

This crossover from traditional sports to e-sports is a large positive for me.

Additionally, he comes across extremely well in all interviews and talks I’ve seen online.

MENASHE KESTENBAUM

PRESIDENT

“Menashe began his career in video games when he was 13, writing for IGN where he eventually became a community leader. After studying and lecturing in the Institute of Advanced Talmudic Law in Jerusalem for eight years, he returned to his passion for the video game industry and launched his first gaming blog, “Nintendo Enthusiast”, in 2011. In 2014, he returned to Toronto and incorporated Enthusiast. He has personally owned and operated gaming websites to a readership of over 2 million gamers, and has led Enthusiast and grown a writing and community staff team of over 84 people.”

ALEX MACDONALD

CHIEF FINANCIAL OFFICER

Was the CFO of Aquilini GameCo Inc., and led the 2019 mergers and acquisitions between Aquilini GameCo, Enthusiast Gaming Properties, Luminosity Gaming, and J55 Capital.

Prior to this he was the CFO of TSXV listed Peeks Social Ltd. (previously Keek Inc.) from 2014-2018.

9. Financials

9.1. Q1 2021 highlights

We’re almost at the announcement of Q2 earnings, so I won’t go into too much depth on the Q1 performance, although there are some interesting stats.

Revenue was $30.0 million, a 321% increase vs Q1 2020 revenue of $7.1 million.

Gross profit was $5.9 million, an increase of 80% vs Q1 2020 gross profit of $3.3 million.

Net loss and comprehensive loss was $13.6 million, resulting in a net loss and comprehensive loss per share, basic and diluted, of $0.12.

Direct advertising sales of $2.2 million, compared to $60 thousand in the same period last year.

Paid subscribers grew 49% over the past 12 months to 137,000 paid subscribers as of March 31, 2021.

9.9 billion total views across written and video content.

Strengthened balance sheet by approximately $50 million with the combination of a bought deal financing for gross proceeds of $42.5 million and the reduction of indebtedness through the conversion of outstanding debentures of approximately $9 million.

9.2. Revenue/profitability

Revenue for Enthusiast Gaming has grown considerably over the past several years. Mainly driven by the pandemic bringing more attention to gaming, and more specifically e-sports.

We don’t have years and years of financial data to look back on, however if we look at some y/y comparisons the growth of these numbers speak for themselves.

Q1 2021 Revenue was $30.0 million, a 321% increase vs Q1 2020 revenue of $7.1 million.

Gross profit was $5.9 million, an increase of 80% vs Q1 2020 gross profit of $3.3 million.

Net loss was $13.6 million.

These gains in top-line growth were mainly driven by Covid and the uptake in gaming/esports. This led to direct advertising sales of $2.2 million, compared to $60 thousand in the same period last year, an increase in paid subscribers by 49% over the year to 137,000 paid subscribers as of March 31 2021, and finally an impressive total viewership number of 9.9 billion across all content.

Above we can see how Covid has impacted the revenue generation of Enthusiast Gaming and the gaming industry in general. However, it’s important to note the surprisingly low levels of profitability (or even losses) which are being sustained.

A gross margin on a TTM basis (Trailing Twelve Months) of 27.38% along with an operating margin and net profit margin of -34.39% and -46.01% respectively is less than ideal. However, management have long-term profitability planned for further down the line. As stated in several interviews with the CEO, if the company wanted to become profitable in the next quarter, they could. However growth is the key factor which is currently overriding the need to take profits.

“I think that we can similarly vault the gross margin up going forward and the reason is because as menasha had alluded to, historically we'd only ever sold our ads programmatically and we didn't have a direct sales function and we were selling for the most commoditized cost per thousands that we could that are out there because we were building the audience first.

I would say there isn’t really much use is comparing gross profit, operating profit and net profit with gaming industry counterparts due to the fact EGLX are purposefully operating at a loss for the time being as part of the long-term strategy.

I like this long-term thinking from management.

9.3. Revenue mix

As discussed earlier, the revenue is split between 3 main pillars - Media/content, E-sports & entertainment, and Subscriptions.

Media and content - mainly consists of advertising revenue on web and video platforms, and content licensing revenue. Video platform relates to the newly acquired Omnia. The increase in media and content revenue in Q1 2021 is mainly due to the acquisition of Omnia. Q1 2021 media and content revenue attributable to Omnia is $20.7 million. Q1 2021 media and content revenue excluding Omnia is $6.3 million, which increased $2.9 million compared to $3.4 million in Q1 2020, which is still an increase of 85%.

Esports and entertainment - Esports revenue relates to management services of other esports entities, sponsorships, prize money, merchandise sales, and other esports related sources. Entertainment revenue mainly relates to Pocket Gamer Connects mobile gaming events which occur throughout each year and the EGLX event which occurs in Q4 of each year. The decrease in esports and entertainment revenue was a direct result of Covid 19 and the inability to host an in-person event.

Subscriptions - revenue generated from paid subscribers to various offerings within the ecosystem. The increase between 2020 and 2021 is mainly due to to an increase in paid subscribers on ‘The Sims Resource’. EGLX had approximately 92,000 paid subscribers as at March 31 2020, increasing to 137,000 paid subscribers as at March 31 2021.

9.4. Balance Sheet

Current assets = $43.7M

Total Asssets = $236.2M

Current liabilities = $22M

Total liabilities = $53.5M

The balance sheet looks relatively strong here. The company’s total assets easily cover the current & total liabilities which allows the company to pursue the strategy of growth via acquisitions. The one negative is the fact that current assets does not cover the total liabilities. This ratio of 0.81 has improved since March 2020 where the current assets/total liability ratio sat at 0.35. Ideally I would like to see an increase to above 1.0.

As of 31st March 2021, the company’s cash position is relatively strong, although not entirely positive. The company have working capital of $21,642,243, which will be used to finance operations, growth, and mergers and acquisitions over the next 12 months.

$5 million of cash is expected to be required in the next 12 months, for which management believes that the existing working capital is sufficient. If more working capital is needed, the Company has revolving credit facilities of $14 million available to draw upon.

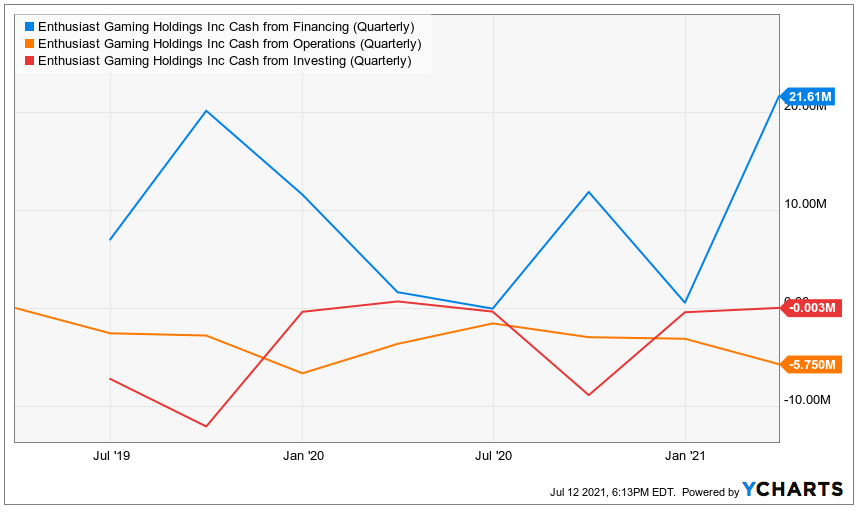

9.5. Cash flow

“During the three months ended March 31, 2021, the Company incurred a net loss and comprehensive loss of $13,565,128 (March 31, 2020 – $5,364,312) and, as of that date, the Company had accumulated a deficit of $111,802,958 (December 31, 2020 – $98,285,532) and negative cash flows from operations of $7,287,680 (March 31, 2020 – $4,930,645).”

It is uncertain as to when or whether the company can maintain positive cash flows from operation. The Company has not yet realized profitable operations and has mainly relied on non-operational sources of financing to fund operations.

It is entirely likely the company will continue to finance the company’s operations, growth and M&A through financing activities for the near future.

The below chart outlines the split of cash inflows/outflows. At some point down the line I would like to see this change to positive cash flows from operations and lower cash flows from financing.

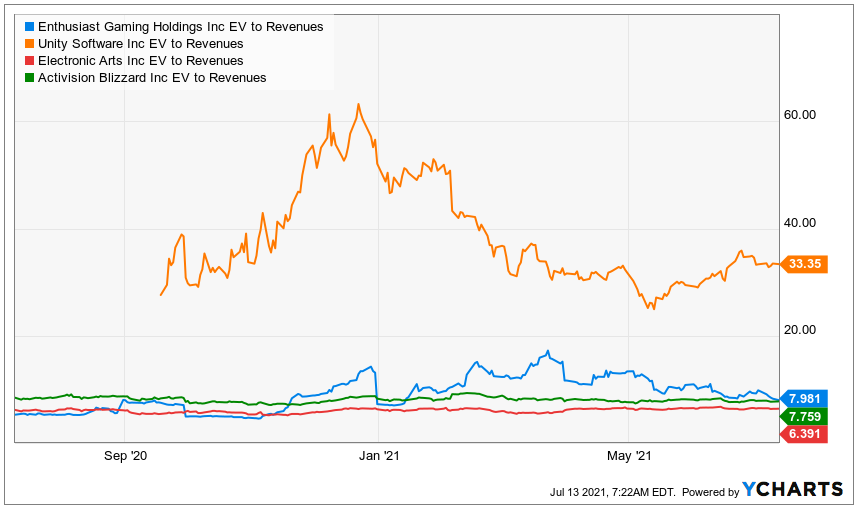

9.6. Valuation

Valuation in this context is difficult - mainly due to the fact Enthusiast Gaming is growing at such rapid rates. However to inform the relative valuation of EGLX, investors should pay attention to key metrics such as user growth and ARPU.

EGLX is currently trading at a $594M market cap and a $587M Enterprise value. With TTM annual revenue at $73.6m, it puts the company at an EV/Sales ratio of 7.981. For a growth stock within the gaming industry - this seems reasonable.

And if we look in comparison to some other companies operating in the gaming industry, even though these companies are not ‘like-for-like’ they all can be classed as ‘entertainment companies operating within the gaming sector’.

One company I would have liked to compare it to is Skillz, who’s EV/Rev did not show up on Y-Charts. Theirs stands at roughly 20X.

In addition, if we look at where the company is planning on heading in the near future and beyond (an increase in ARPU to $3 by 2023), they are set to significantly increase revenue (750%). And then taking into account the potential increase in MAU’s, the ARPU figure of $3 could in-fact be fairly conservative.

*Firstly, Thanks for making it this far. If you would like to help support my writing, feel free to buy me a coffee by clicking on the link below.*

10. Conclusion

Enthusiast Gaming are a fascinating company operating in a rapidly evolving industry.

If the company are able to execute in their goal of creating an engaged community of over 300M monthly active users, then there will be significant scope to increase monetization and become a very profitable company.

There are still major obstacles to overcome with regards to growth - i.e. executing on the four-step plan they have in place. However, if EG can successfully cultivate a community of lucrative gamers, then the sky is the limit.

If you wan’t to get exposure to the gaming industry, EGLX are one of the only publicly traded options in the gaming space.

The company interact with over 300M gaming enthusiasts/fans every month.

43% of every American male visits one of EGLX’s properties every month.

Gaming communities are going to become increasingly more valuable.

EGLX are possibly the only vertically integrated gaming company in the world right now.

When investing, we are more-or-less looking for monopolies. So then we have to ask ourselves the question - “Can Enthusiast Gaming’s core business be easily replicated at a similar scale?” - and I think the answer is no, at least not easily and not without compromising the authenticity required for success.

To conclude, I believe Enthusiast Gaming is a great way to gain exposure to the evolving Gaming/Esports industy. Valuation is hard at these early stages of development, although I believe there will be significant upside if they can meet/beat ARPU and user-growth expectations.

The opportunity is not without risks (mainly financials). However, my confidence in the gaming sector combined with the vision of EGLX so far has led me to begin a speculative position.

I will be keeping a close eye on this one for the upcoming quarters.

Cheers,

Innovestor.

nice job! have you done any updates? now that the price is much lower I am very interested in getting in. I'd be very happy to hear your takes on what took this one down and what are tobe expected next. Thanks,

Great deep dive as always!