Thesis

Alongside being one of the most dominant publishers on earth with a rich library of intellectual property at their disposal, Activision Blizzard have positioned themselves in a way to be able to effectively capitalise on the upcoming tailwinds within the industry.

Gaming is slowly but steadily creeping its way towards being the new ‘third place’ - with millions of users playing games simply to meet with friends. In addition to this, the upcoming boom of e-sports will take competitive gaming to another level - pumping billions of dollars into the industry.

With a management team and CEO proving their willingness to innovate and change along with the industry over the past 3 decades, I am confident the next 10 years will be just as fruitful as the last 10. This will only be the case if they can position themselves effectively over the next 1-2 years.

In this deep-dive I will be taking a look at Activision Blizzard’s business, the gaming industry and how the company has managed to adapt and change with the agility of a company a fraction of their size.

Short history

Activision Blizzard is an interesting company with a fascinating origin story which you can read here for a detailed background and here for a more personal look at the CEO. In summary, Bobby Kotick (CEO of Activision) has been at the helm for over 30 years having joined the company in 1990 and becoming the CEO the year after.

Activision struggled after the 1983 video game crash, where it changed its name to Mediagenic in an attempt to move into business software for the Mac. That failed, spurring Bobby to round up a bunch of investors to buy the ‘Activision’ name and its assets out of bankruptcy for $500k.

By 1995, Kotick had achieved the promise he made to the investors: that he would give them four years of 50% growth in revenues while remaining break-even. After reaching this initial goal, Kotick then set course on achieving the second promise he made to the investors: to develop high-demand games and make the company profitable.

Shortly after this, Bobby spearheaded various successful strategic acquisitions - leading the company to major success over the following 3 decades. Three of the main developments over recent years include:

Infinity Ward Purchase in 2003 for $5M. The global gaming franchise is now worth billions in revenue on an annual basis.

The merger with Blizzard in 2008. Blizzard owns some of the most valuable and popular gaming IP on the planet - inluding Diablo, Starcraft, and Overwatch.

Acquisition of London-based ‘King’ in 2016 for $5.9B (The $5.9 billion price Activision is paying, at $18/share, is well below the 2014 IPO price of $22.50 a share). King make mobile gaming titles such as Candy Crush.

The business

The composition of ATVI’s business has changed over the years with several large acquisitions. The company is made up of three primary aspects - ‘Activision Puiblishing Inc.’, ‘Blizzard Entertainment Inc.’ and ‘King Digital Entertainment’. Activision produces titles like Call of Duty, Blizzard Entertainment produces titles such as Diablo, Starcraft, World of Warcraft and Overwatch. And ‘King Digital Entertainment’ is a mobile development/publishing team with the most famous title being Candy Crush.

In terms of revenues, we don’t know the exact details of the splits - however the estimate is that a large chunk (~70%) comes from just a handful of the titles.

Activition

Activision’s main goal is releasing annual Call of Duty titles on various consoles and PC to achieve what is essentially recurring revenue.

Currently the 3rd best selling video game franchise of all time with roughly 400M copies sold - behind Mario (805M) and Tetris (495M).

Call of Duty is almost certainly the company’s most valuable piece of Intellectual Property.

In late 2019 Activision made the decision to bring the Call of Duty franchise over to mobile - which increased the MAU (monthly active users) by 93M almost overnight.

The introduction of the free-to-play Battle Royale element to Call of Duty (Warzone) was released on March 10th 2020 just before the pandemic and has been a roaring succcess.

“Because of it, during the second quarter of 2020, the hours played increased eight fold year on year. On PC, the hours played were double Black Ops 4, showing Activision that free to play is the right direction for a battle royale game, especially when plenty of great free to play BRs exist, such as Fortnite and Apex Legends. Revenue also hit a new record, increasing by five from last year due to the game’s battle passes, Call Of Duty points, premium store purchases etc.”

Recently launched Call of Duty League (E-Sports) showing the value of owning your own IP. Comparing this to the termination of the destiny contract with Bungie in 2019 which negatively impacted the MAU - showing the opposite side of IP ownership.

‘Free to play’ models and E-sports will likely be a go-to business model moving forwards.

Blizzard

Blizzard has a handful of very successful IP’s for which they create new content - though not on a yearly basis like Call of Duty - these include Diablo, Overwatch, StarCraft, and World of Warcraft (possibly the most popular PC title worldwide).

The majority of revenue here comes from the monthly/yearly subscriptions from WoW for which Blizzard produce regular updates.

As mentioned above, the major difference between Activision and Blizzard titles is the frequency of releases - Blizzard being the less frequent, with bigger spikes in revenue.

The margins on subscriptions for WoW are significantly higher than other areas of the business - making WoW one of the most profitable divisions.

Overwatch was a relatively new addition which has since subdued in terms of revenues and viewing figures - however with the introduction of the Overwatch e-sports leagues and the upcoming release of Overwatch 2, this could change.

King

The acquisition of King Entertainment in 2016 was a huge deal for ATVI as it allowed the company to add ‘mobile gaming’ to their armory.

Bobby Kotick - “We see great opportunities to create new ways for audiences to experience their favorite franchises, from Candy Crush to World of Warcraft to Call of Duty and more, across mobile devices, consoles and personal computers”

One of King’s main titles, Candy Crush, is responsible for the lions share of the company’s revenue. Monthly Active Users fell by almost 40% in the first three years after the acquisition whilst revenue increased. This suggests the on-boarding of the Activision Blizzard strategy - to increase focus on the top performing franchises.

Strategy

ATVI’s strategy is to increase reach and engagement by reinvesting into existing franchises and adding new ones where appropriate. We have seen this recently with the renewed focus on Call of Duty - focusing on the free to play aspect along with e-sports.

Taking notes from Disney, the strategy of monetising across all mediums of entertainment is a proven strategy - and one that keeps users engaged.

Free-to-play

The free-to-play format has been around for several years now, with EPIC leading the way in the implementation of their immensely popular titles such as Fortnite and Rocket League. These titles have pioneered a whole new norm in the gaming industry.

In 2018, Fortnite made $2.4 Billion in revenue — the most annual revenue for any game in the history of the gaming industry, a record which is yet to be broken. Despite this fact, Fortnite accounted only for 2.2% of the gaming industry’s 2018 annual global revenue, which stood at $109 Billion.

In March 2020, ATVI entered the ‘free-to-play’ chat with Call of Duty: ‘Warzone’ - a Battle-Royale style model with revenue solely coming from in-game purchases.

“While ATVI does not breakdown in-game bookings revenue by segment, they noted in Q2 2020 that Call of Duty in-game net bookings more than doubled quarter over quarter and were around five times higher than a year ago. In Q3 2020, they noted that in-game bookings revenue was four times higher than a year earlier.”

Typically, game development teams work on a seasonal basis - with games being worked on throughout the year to be released before Christmas, therefore seeing big spikes in revenue in Q4 depending on how many copies have been sold. With this new model, ATVI were able to show quarterly revenues of over $1.9B for the first time in the company’s history outside of a seasonally strong Q4. There were some obvious tailwinds in the form of the global pandemic, however this increase in revenue was not driven by title sales, but rather in-game purchases - which is significant.

E-Sports

Among other initiatives such as TV/Entertainment and consumer products, Activision has been keeping a close eye on the e-sports industry which has been going from strength-to-strength over the past couple of years.

The company focus on two main opportunities within the esports realm - Overwatch League and Call of Duty League.

Overwatch League was launched in 2018 and was the first city-based esports league. The general structure is similar to that of a standard sports league - with city-based teams competing against each-other. Activision Blizzard have allowed entrepreneurs to run these teams as businesses, allowing the owners to share profits as the league grows. Another important distinction compared to other e-sports leagues is the fact that Blizzard operates and organises the whole thing - taking full control of their IP.

The Call of Duty league is more recent having kicked-off at the beginning of 2020. The reason CoD is being preferred as an investment over other IP like World of Warcraft is due to the fact that first person shooters are a much more widely played gaming genre and is therefore more marketable/profitable when selling to a mass audience.

With regards to revenue and growth, it is tricky to ascertain the exact level coming from these e-sports leagues as the company classifies this revenue as ‘other’. However, we can see the growth has been somewhat modest from 2019 to 2020 at only 6% - representing roughly 8.5% of total revenues. Realistically we would have liked to see a larger increase in revenue from 2019 to 2020 with a completely new league in CoD being introduced.

From this article, it is clear that the Call of Duty League is the growth driver whilst Overwatch is seemingly heading in the opposite direction.

As the overall e-sports industry continues to expand, ATVI are placing a bet on cementing a leading position within the industry. There is still a long way to go before we see this thesis play out, however the foresight to solidify themselves as part of the infrastructure within the industry seems like a winning strategy.

Gaming market

The gaming market is a complex beast It would take far too long for me to go into the granular details within this report, however I’ll attempt to outline the wider landscape for context.

Many among us will not realize the scale of this sector, but the gaming industry has grown to become the largest subset of the entertainment industry. Even bigger than the movie & music industry, both of which combined made $60.8 Billion globally in 2018. Around 80% of the total gaming industry revenue in 2018 and 2019 was attributed to the free-to-play business model.

Video games have developed significantly over the past 20 years. Anything pre the year 2000 we were playing offline - it involved you on your own or with a friend sitting next to you.

With the widespread adoption of the internet in the early 2000’s came ‘social gaming’ - where you could be in your lounge playing against a player on the other side of the world. This phenomenon kick-started the growth in the gaming industry as gaming was no longer an anti-social activity and enabled a competitive element.

Roughly 10 years ago, the industry was more heavily concentrated towards console gaming (50%) with PC gaming making up about 33% and mobile only about 5%. This has changed dramatically over recent years, with mobile gaming growing to 33%, PC gaming dropping to 26% and console gaming dropping to 30%.

This article outlines the huge potential growth happening currently in mobile gaming industry. To summarise:

Covid drove demand for mobile gaming. This demand doesn’t seem to be reducing as Covid is slowly going away.

Users worldwide downloaded 30% more games in the first quarter of 2021 than in the fourth quarter of 2019

Spent a record-breaking $1.7 billion per week in mobile games in Q1 2021. That figure is up 40% from pre-pandemic levels.

Activision Blizzard have done a good job of changing their product mix over this period of time to represent the changes happening within the industry - most notably with the acquisition of King (mobile games) in 2016.

Growth

Even though 2020 was an abnormally good year for the gaming industry (and ATVI in general) it doesn’t look like growth is slowing.

“Call of Duty mobile reached 500 million total downloads during the first quarter, helping the company as a whole generate $2.9 billion in trailing 12-month free cash flow -- 103% more than the same period a year ago.”

Moving with the times in order to target a whole new player-base has enabled Activision to dramatically increase their user-base

By adapting a long-loved franchise to new systems, Call of Duty was able to dramatically expand its potential player pool. The CEO Bobby Kotick has expressed his desire to carry forward this formula to other games - "Call of Duty is the template we're applying to our proven franchises."

It’s hard to predict the growth within the gaming industry as it’s constantly evolving and adapting to various technologies. For example, we have completely new gaming mediums coming into play over the next decade such as Virtual and Augmented reality - we have no idea how these will play out over the long-term.

We can, however, draw some generic insights (Grand View Research):

Free2Play (F2P), Massively Multiplayer Online (MMO), and multiplayer games have progressively gained popularity, a trend which is anticipated to continue over the next eight years.

The rising disposable income level is leading to an increased consumer spending on gaming products.

Large-scale adoption of more advanced gaming consoles equipped with sophisticated features such as record and share and cross-platform gameplay.

The trend of social media gaming is expected to have a positive impact on shaping up the market growth. For instance, a substantial percentage of the global population use social networking sites such as Facebook and Reddit for gaming.

Growing popularity of eSports tournaments and the increasing number of professional gamers are anticipated to increase sales of video games and accessories along with gaming hardware and software.

The video game market is experiencing high demand in various avenues such as educational institutes and corporate enterprises. The adoption of gaming as an educational tool provides opportunities for deeper and cognitive learning. The concept of ‘gaming to learn’ has been around for quite some time. However, the actual potential for gamification possibilities in the academia vertical is being exploited only recently.

Some independent growth projections include:

Grand View Research predict the U.S. gaming market to increase from $151B in 2019 to $450B in 2028 at a CAGR of 12.9%

Research and Markets predict the global gaming market to reach a value of US$ 287.1 Billion by 2026, exhibiting a CAGR of 9.24%.

Metaverse

As mentioned above, one of the most interesting aspects of the gaming industry is the increase in social inter-connectivity. A more and more widely held belief is that video games are beginning to act as not simply a place to play games, but a place to hang out with friends.

This brings us onto the subject of the Metaverse, which is a complex and relatively undefined area in its own right - but is likely to be crucial for the future of gaming and the way we connect. I posted a thread not long ago giving a brief overview of the metaverse (below), which goes over most of what you will need to know.

The ‘modern’ ideas of the metaverse - pioneered somewhat by Matthew Ball and his fantastic essays - isn’t visible in any form just yet. In fact, nothing even comes close. That being said, there are some examples of metaverse-like ‘ideas’ present within modern gaming and more specifically the Battle-Royale games such as CoD and Fortnite.

Cross platform play.

Increasing number of concurrent players (CoD experimenting with 150 players in a lobby).

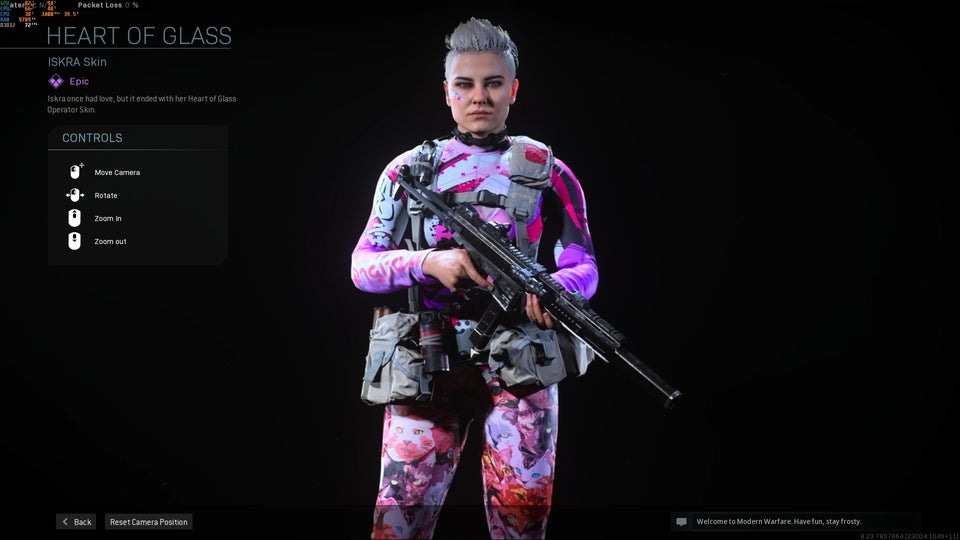

Custom avatars more common. There are even secondary markets selling in-game items.

Areas available just to ‘hang out’ and chat with friends.

User generated content is available.

This ability to add a layer of autonomy to the game, to make it feel personal to you, the player, is crucial to the continued stickiness. You are much less likely to leave the game (and therefore the virtual marketplace) if you have a bunch of psychological reasons to keep you there.

Humans love autonomy and identity. So the games best serving this to the masses will likely finish on top.

Social gaming

Within the context of gaming it looks increasing likely that Call of Duty and other Activision Blizzard franchises (but most likely Cod) will look similar to a social network. Not necessarily anything to do with a ‘metaverse’ - but it will likely share some of the social aspects.

Activision will benefit from this in the sense that once we learn how to play the game and our friends learn how to play the game - we have purchased our in-game items, upgraded our weapons etc. it will be a much harder mental task to switch to another game.

In addition, the positive social re-enforcements we get from playing the game with friends that connects winning a game (for example) to CoD is another strength for the IP. The gamer is far more likely to go out and purchase something Call of Duty branded because they have that positive experience.

I remember making a similar argument for Disney in a previous article, where strong IP mixed with positive experiences and the optionallity to purchase that IP via a different medium is a powerful thing.

Overall, the increases in social experiences within gaming can only be good for ATVI as more players use the games as a place to meet.

Management

Bobby Kotick - CEO

As mentioned earlier in the article, Bobby Kotick is an interesting character with a rich history. Interestingly, he has also proven himself to be an astute CEO with an incredible eye for detail and a healthy obsession with capital allocation (similar to Warren Buffett) - indicating in past shareholder letters that he looks up to the famous investor.

Bobby is young for a CEO at 57 years old, yet has over 30 years experience of successfully growing and operating Activision.

He is passionate about the business and has over 2.5million shares in the company - so a large personal stake.

“I think that you can’t do what I’ve done for 30 years without that relentless focus on doing better. I come to work each day wanting to improve. And so I think that commitment to excellence, and wanting to improve can come across sometimes as dissatisfaction or unreasonableness.”

Dennis Durkin/Armin Zerza - CFO#

Dennis Durkin worked at Microsoft for 12 years and as the CFO/COO of Xbox, before joining ATVI in 2012 as the CFO. The insights Dennis was able to bring from Microsoft (semi-competitor) I’m sure will have been invaluable over the years.

“Dennis has been a key contributor in some of the most value-creating moments of our history, including the buyback of control from Vivendi in 2013 and our expansion into mobile through the acquisition of King.”

In the most recent earnings call the company announced the appointment of the new CFO - Armin Zezra.

"“Also in the service of our shareholders, I'm pleased to introduce Armin Zerza as our new chief financial officer. Armin's deep experience as a global finance and operations executive and his contributions as chief operating officer of Blizzard and chief commercial officer of the company, make him especially well suited to serve as our next CFO.

In his six years with the company, Armin has been a central figure in the company's continued growth and record financial results. He has the commitment to profitable growth and operational excellence that our shareholders have always recognized us for. And Armin comes to the role with an incredible team assembled by Dennis and Thomas over the last decade.”

Bull Case

1. Strong IP:

Activision Blizzad are in a strong position with their intellectual property - a position they have built up over the past 3 decades by creating and acquiring new innovative content. Arguably, however, the Call of Duty franchise is the the most valuable aspect in the ATVI ecosystem, although WoW, Diablo, StarCraft, Candy Crush and Overwatch all have potential to be strong brands.

The first CoD title was created and released in 2003 by a games development studio called Infinity Ward which was purchased by ATVI. The first release garnered a Metacritic score of 91 - making it rank within the top 3% of all time games. Since then, the company have released a new version every year.

The CoD franchise has sold more than 400 million units to-date, cementing is as the number 3 all-time highest selling franchise behind Mario (~805M) and Tetris (~495M). The brand loyalty Call of Duty has built up over the past 20ish years is unmatched.

2. Huge opportunity with E-Sports:

The E-Sports industry is just getting started.

In 2021 alone, E-Sports is predicted to have more viewers than any sports league (apart from the NFL). This growth is predicted to continue over the next 5-10 years - posing a fantastic opportunity for ATVI to capitalize on a growing market.

3. Gaming, and more-so ‘social gaming’, is set to explode:

With the rise of titles like Fortnite and Roblox over the past 5 years, we have seen a massive move towards gaming for the sake of meeting up and talking with friends.

Fortnite offers features allowing players to join a game chat without having to actually be playing the game. And from personal experience, a large reason why I game at all is to connect with friends who I would not otherwise speak to.

Social gaming has come a long way over the past 2 decades, but still has a long runway in my view.

4. Adopting free-to-play business model:

Similar to the point above, the adoption of the ‘free-to-play’ business model has given the company a new lease of life - stimulating overall engagement as well as in-game sales.

5. Optionality from IP:

The benefit for ATVI of having a large user-base emotionally invested in your IP is that they have the ability to create revenue generating content/products outside of gaming alone.

6. Benefit of scale:

Most large gaming franchises like CoD also receive some scale benefits.

If we take marketing as an example, Activision most likely spends over $200 million on marketing alone for a single Call of Duty game release. Then when you compare this to other game franchises that would struggle to make $200 million in revenue, you can begin to see the benefit of scale.

Additionally, due to the sheer popularity of the game with streamers, (currently number 2 behind Fortnite) the CoD title will reach much larger audiences - and engaged audiences at that. This fact alone will more than likely lower the unit cost of marketing via these channels.

Lastly, the strategy of using the current large user-base to market other titles ‘in-game’ is proving to be a useful too. For example, the free-to-play Warzone game held an in-game event to release the trailer of the new 2020 Cold War game. Over 1 million people turned up to participate in this event.

7. tailwinds from the pandemic:

ATVI were clearly one of the major beneficiaries of the global pandemic. With millions of people out of work and having more free time, video-games became a standard past-time. Revenue rose 24.6% to $8.1 billion, while net income rose 46.2% to $2.2 billion.

8. Experienced management

Management have a history of good decision-making with acquisitions, pay cuts and over 30 years of experience within the gaming business.

Bear Case

1. Increased competition:

As with any expanding industry, the level of competition increases as the potential opportunity becomes more clear. Alongside this, the barrier to entry for becoming a game developer is reducing significantly.

2. Too concentrated on one franchise:

The trouble with focusing too heavily on only a handful of franchises/IP’s is the risk that players and developers essentially get bored. Also, the over-reliance on one source of revenue is a huge risk.

IP fatigue is real risk (for both players and developers). In order to tackle this issue the company had to innovate. The CEO stated in a recent interview about giving control to the dev team - “They’re the ones that make the decisions about what the product is going to be or what content they’re going to create,” “And the business is way too large for me to be able to get involved in those kinds of decisions. I don’t have the skills that our heads of studios and heads of franchises have.”

The company’s ability to create high-quality content consistently is a massive factor in the continued success.

3. Are they really innovating enough?

The question has to be asked whether ATVI are innovating as much as they could be considering the lack of presence in the AR/VR industry (as one example).

My opinion on this one is that yes, the company are doing enough. They are experimenting with mobile, free-to-play and e-sports already. Bobby Kotick stated recently that “Activision Blizzard will not roll out VR products until we feel like we are pushing the art form forward."

4. Questions over management:

On one hand it could be argued management have shown some level of insensitivity. For example, in 2019 the company laid off 800 employees after a very successful 2019. Also the company has been accused of underpaying staff whilst taking home large checks.

Alongside this, there are genuine questions about overall employee happiness - as seen in glassdoor ratings that have been declining over the years (above).

On the other hand, it seems management are aware of negative public opinion and are making steps to correct this. Taking recommendations from shareholder groups, Bobby Kotick reduced his compensation, cutting his base salary in half to $875,000. He will still get bonuses based on how the company performs over multiple years, and his contract has been extended through March 31, 2023.

Financials

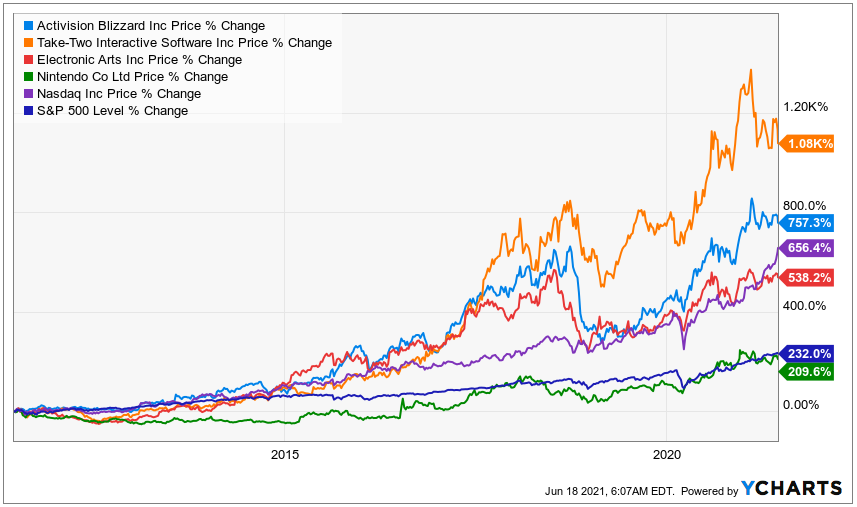

If we start by taking a broad look at the price movement of ATVI over the past decade, we can see the company have generally outperformed the majority of the gaming industry alongside various benchmarks including the NASDAQ and S&P 500.

This is a good indication that, over the longer term, Acvitision Blizzard are capable of thinking ahead of the competition and making significant changes where necessary.

Q1 2021 performance

Bobby Kotick - “Everything was up, year over year. Call of Duty was up. Candy Crush was up considerably. Blizzard was up. Across the board, the business is going well. The pattern is strong. Free-to-play introduces people to the franchise.”

27% revenue growth to $2.28 billion for the first quarter ended March 31

Activision Blizzard (including King) had 435 million MAU’s, compared to 397 million MAU’s in the previous quarter. Kotick said in the earnings call that the goal is to hit a billion users, and he noted Call of Duty gained more than 100 million players in the past year

Activision

Activision’s Call of Duty franchise continued to outperform last year’s results as people continued to play a lot more games during the pandemic

MAU’s tripled over the past couple of years, with the current number sitting at around 150M (up 40% from Q1 2020).

GAAP revenues for the first quarter ended March 31 were $2.28 billion, up 27% from $1.79 billion a year ago. GAAP EPS were 79 cents, compared to 65 cents a share a year earlier.

Call of Duty: Mobile’s debut in China in December generated tens of millions of new players, said Daniel Alegre (the chief operating officer of Activision Blizzard) in the analyst call.

Blizzard

Revenue growth +7% from 1 year ago, led by strong growth in the Warcraft franchise. World of Warcraft’s Shadowlands expansion has grown, and Blizzard had 27 million MAUs in the first quarter.

Overwatch expected to arrive in 2022.

King

Revenue growth of 22% in the quarter

258 million MAU’s in the quarter (down from 273 million a year ago).

One driver of growth was Crash Bandicoot: On the Run, which launched March 25 and has seen more than 30 million downloads to date. That likely helped with MAUs.

70% growth in advertising net bookings in the first quarter, with significant increases across both direct brand advertisers and partner networks. Bookings have stayed strong in the second quarter

Mobile is continuing to benefit.

Rev vs EPS

From first glance, over the past decade, EPS (earning per share) has been growing at an impressive average of 20% per year compared to revenues which have been averaging around 7% comparatively.

The explanation for the disparity between EPS and revenue growth is down to several factors. One is the move from physical to digital (higher margins) for which the whole of the gaming industry is experiencing. Two, Activision Blizzard repurchased 1/3 of their outstanding shares from Vivendi in 2013 at roughly $13.60 per share. That investment alone has returned an average of 28% per year against the cost of debt which was 5%. And three, the purchase of King in 2016 for a reasonable price which enabled the company to get into the mobile gaming industry.

Monthly Average Users

Another important metric to consider is the MAUs (Monthly Active Users) as this is a good general proxy for the overall health of the business. From the graph below, we can see there has been a steady decrease in overall MAUs since late 2016 (roughly since the acquisition of King).

In late 2019/early 2020 we can see a spike in total MAUs which looks to be mainly driven by the pandemic, however a substantial amount of the growth within this period could be attributed to the introduction of CoD Warzone, CoD Mobile and CoD E-Sports league. This indicates the strategy of concentrating investments towards the most successful IP is clearly working.

Learning from companies like Disney & Nintendo - maximising the potential of your best IP can be a winning strategy. And I think Activision Blizzard will be closely following this road-map.

Revenue/profitability

As a direct result of the increase in MAU’s, profitability has also been increasing for Activision. As the game has continued to mature, providing map updates, map alterations, gun additions, new characters and more ‘in-game’ purchasing options - ATVI’s profitibility has began to noticeably increase. This is because the ‘in-game’ section of revenue is by far the higher margin portion of the revenue.

The above chart illustrates the increase in profitability over the period of time from 2018 to now (Q1 2021). And we can see that since the inception of CoD warzone in early 2020 (period 9 on the chart below) total net bookings has climbed significantly - leading to an overall increase in revenues in the periods where, traditionally, net bookings are lower.

These results stem from the additional options for in-game purchases, as evidenced by the 4 consecutive periods of in-game bookings above all-time highs.

Gross Margin

The margin makeup of Activision Blizzard over the past few years has changed significantly due to several reasons, but the main one being the change from physical sales to digital. As this change within the gaming industry continues, we are likely to see the gross margin element of ATVI increase over the next 5-10 years as the focus shifts to mobile and digital sales which are inherently higher margin areas.

In addition to this, another driving factor for the potential increase in overall gross margins will be the reduction in platform fees (hosting) due to improvements in technology efficiencies.

Currently the gross margin sits at around 72% with the operating margin at 35% and net income at 27%. With the tailwinds mentioned above, it’s within the realms of possibility for gross margin to continue to increase over the coming decade to around 78% within the next 10 years.

Operating Margin

Next, comparing operating margin to that of competitors within the industry shows that ATVI is significantly above the industry average of around 18.5%, and has been consistently operating above the competition for quite some time now. This dominance in operating margins is good to see.

I would expect that as Activision Blizzard continue to grow and invest over the next decade, we will see somewhat of a reduction in R&D expenses as a percentage of sales as the company move focus to their most valuable IP. Secondly, the move to the free-to-play model will encourage an increase in in-game sales which have an inherently higher margin makeup. Lastly, as the e-sports industry continues to grow, we should expect to see increasing margins here too.

Balance sheet

Current assets = $10.92B

Total Asssets = $23.42B

Current liabilities = $3.18B

Total liabilities = $8.09B

ATVI currently have, and have historically had, an extremely strong cash position (as we can see from the most recent balance sheet snapshot). This can be seen as a good and a bad thing. Good in the sense that current/Total assets easily cover the current/total liabilities, and the fact it allows the company to be in a good buying position should the right opportunity present itself. On the other hand, the opportunity cost of holding so much excess cash is a reality if there are other, better, opportunities to invest in the market/projects at any given time.

Bobby kotick (CEO) has a reputation for prudent capital allocation as many of his philosophies regarding investing and capital management relates closely to those of Warren Buffett.

Adding to the above, and re-enforcing the point about waiting for the best opportunities to present themselves, the purchase of King in 2016 was a great opportunity at a reasonable cost.

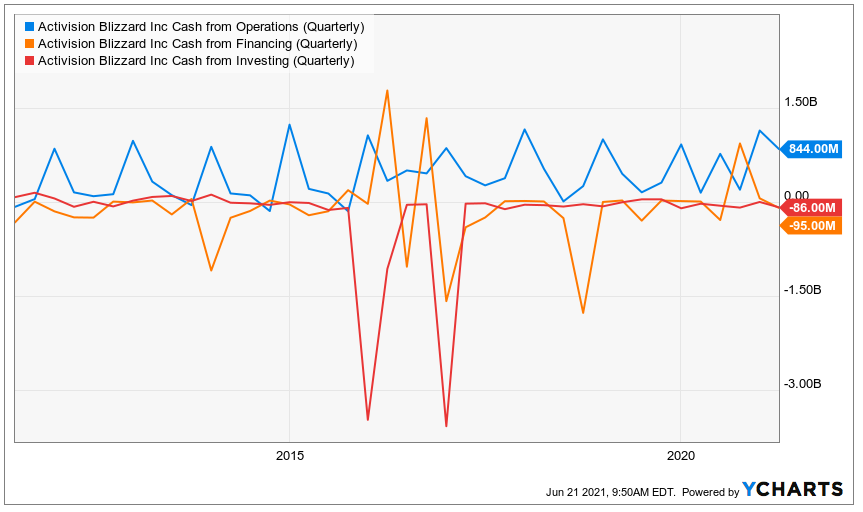

Cash Flow

Taking a quick look at the cash flow situation - we can see ATVI operate a strong cash position, with the majority of the cash flow coming through their operations. Historically, as seen below, the Cash Flows have been somewhat predictable, following a seasonal nature, with the majority of sales (and therefore cash) coming at the end of the year (near christmas). The change in strategy towards ‘free-to-play’ and ongoing e-sports leagues should result in more of a consistent cash stream - relying less on the success of the yearly titles.

The Valuation

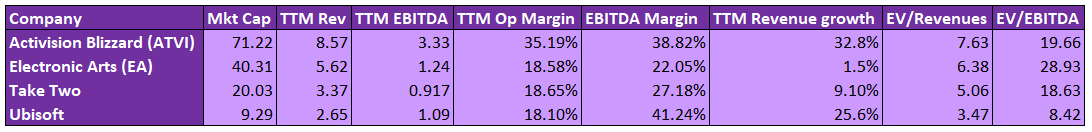

When we begin to compare some of the key metrics with other companies in the gaming industry, we start to get an idea of how well ATVI compare.

Firstly, looking at the operating margin between the 4 companies, ATVI’s sits at 35.19% for the past 12 months - more than double that of every other competitor. This operating efficiency dominance is within the context of significant revenue growth - 32.8% compared to the next closest which is Ubisoft at 25.6%.

Importantly, we can see that ATVI are not just leading in one of these metrics, but in many.

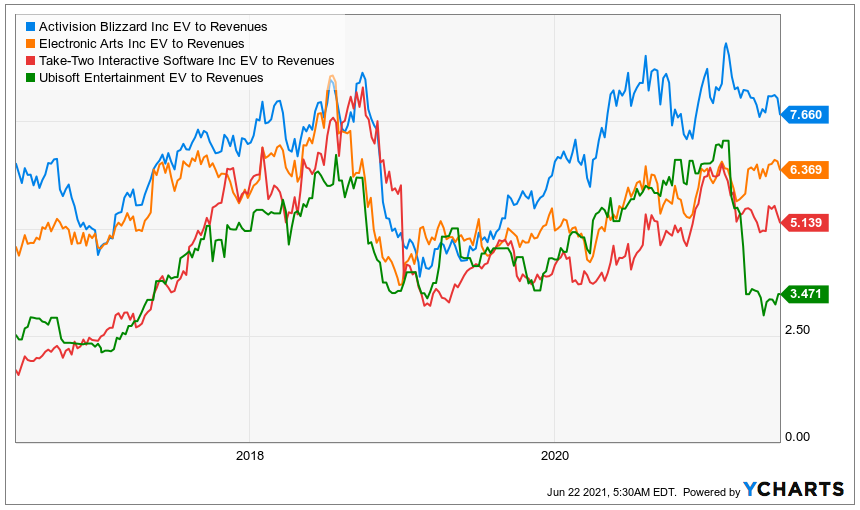

Multiples

Looking at the multiples we can immediately see ATVI are trading at the richest EV/Revenues valuation of 7.6X.

However, if we then look at the EV/EBITDA ratio (purple table above), we can see ATVI trading at somewhat of a discount to (or at least on par with) their nearest rivals. This is with the context of much better top-line revenue growth, better operating margin and a less cyclical business model.

If we were to say ATVI were trading at a similar EV/EBITDA ratio to TakeTwo (28.93X) then the company would have a market cap of $94.46B and therefore a share-price of (94.46/0.77702 *777M shares outstanding*) = $121.57 which represents a potential upside of 32%.

I would guess most of the current pricing assumes that Activision Blizzard will struggle to keep up with the uptick in business from the pandemic, and therefore the relative success seen throughout 2020 will revert back to pre-pandemic norms. However, in my opinion the business has fundamentally changed - a new strategy is in place in order to focus on the popular IP and reduce the cyclical nature which will benefit them for the long-run. Adding to this, CoD Warzone is still the second most streamed game over 1 year on from its release and CoD (the overall franchise) is number 3 in most titles sold ever with 400M copied - coming in behind Tetris and Mario.

Conclusion

To conclude, as Activision Blizzard continue to cement their position within the gaming industry with their valuable IP, capable management and a robust yet evolving business model. I am confident they can continue to lean into the tremendous opportunity that is ‘gaming’ over the coming decade.

The past several years has seen the industry evolve rapidly - adopting new features and hardware (such as social gaming, e-sports and VR/AR) which has completely altered the gaming landscape. ATVI has adapted quickly to these changes, bringing in new business models for existing IP (free-to-play) and dipping their toes in completely new areas (e-sports). Both of these moves are encouraging, as it signals managements intent to bring ATVI into a new generation of gaming.

That being said, there remains several very real risks…

The management become far too reliant on one IP (CoD)

Management too cautious with investing cash

The gaming segment doesn’t take-off like we predict

Much of the current upside over the next decade is already factored in

However, I believe the overall future for ATVI is a bright one. The recent changes to the company have come at a perfect time - stimulating engagement and overall sales throughout the pandemic, leading to increased profitability and greater long term potential.

ATVI is a strong play on the future of gaming.

Cheers,

Innovestor

Great writeup! Why is Ubisoft at the lowest valuation? given its growth and value, why wouldnt you consider Ubisoft to be the best investment of the bunch?

This was great.

The biggest risk I see is management being too prudent on an industry that is evolving so quickly. I think in the gaming industry and having a strong cash position you are better off trying an failing than waiting.

Thanks again for the hard work