Intro

Thesis

Key highlights for the quarter

RentPath Acquisition for $608 million

Competition

Key risks for iBuying

Financials overview

Valuation

Conclusion

1. Introduction

As you will likely be aware, I have recently covered Redfin in a company overview which is still very much relevant. You can find it here. That version goes over most of the ‘big picture’ stuff like the business model, market opportunity, Management and more.

In this write-up I’ll be directing my focus on several different aspects, such as any key highlights for the quarter, the recent RentPath acquisition and a slightly more in-depth look at competition within the space.

Let’s begin…

2. Thesis

Driven by the frictionless experience, low fees and a convenient online business model – Redfin are rapidly gaining market share in an industry poised for disruption.

Capitalizing on the opportunities presented throughout the pandemic and the secular shift towards digital, Redfin will continue to see strong growth throughout the coming years as consumers adopt this new business model.

Redfin represents a bet on the effective implementation of digital technology within a stagnant market (innovation-wise), the continued growth of US real-estate market and Redfin’s ability to convert a significant share of this industry into paying customers.

3. Key Highlights

Market Cap: $9.38 billion

Revenue growth of +14% for 2020 to $886.1 million

Real Estate services gross profit up +56% to $234.1 million

Monthly Average Visitors: 42.8 million for the year (+28% from 2019)

Over 21,000 video tours in Q4 2020 (showing a 137 x increase for video tours and 7x increase in monthly views of 3D walkthroughs.

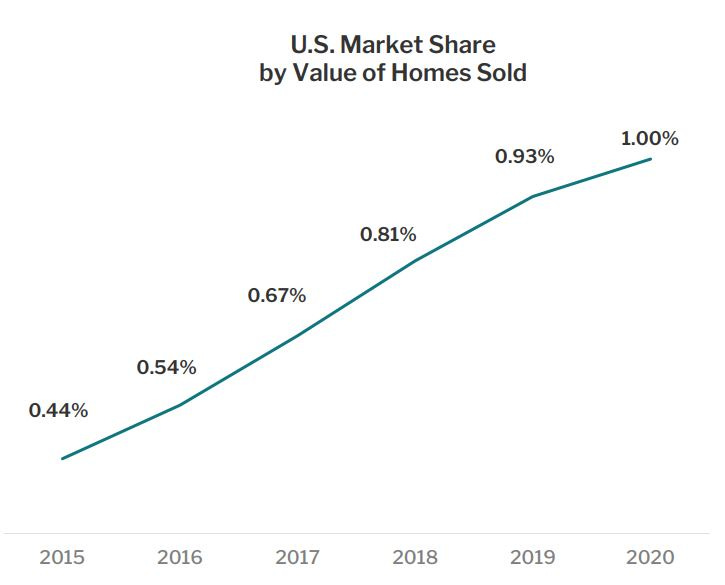

Market share remains roughly at 1.04 %

Notable updates for the quarter

Reached market share of 1.04% of U.S. existing home sales by value in the fourth quarter of 2020, an increase of .10 percentage points from the fourth quarter of 2019.

Saved buyers/sellers over $54 million in Q4 and over $185 million in 2020. This includes the savings Redfin offers buyers through the Redfin Refund and sellers through Redfin's lower listing fee when compared to a 2.5% listing commission typically charged by traditional agents.

Redfin's mobile apps and website reached a record of 44 million average monthly users in the fourth quarter. For the year, Redfin reached a record of more than 42 million average monthly users, an increase of 28% compared to 2019.

Continued expansion of RedfinNow by launching in Sacramento, San Francisco and Seattle in the fourth quarter of 2020.

Conducted over 21,000 video tours in the fourth quarter. Since the start of the pandemic in March, Redfin has seen a 137-fold increase in monthly requests for video tours and a nearly 7-fold increase in monthly views of 3D walkthroughs on Redfin.com.

Upgraded its software for customers, agents, partners, home services and mortgage teams, including:

Adding flood risk data to home listing pages to give customers more information about individual properties and their risk factors.

Adding Direct Access touring information to the Owner Dashboard, giving sellers and agents the ability to track self-tours and see buyers' feedback about the home.

Improving the functionality, speed and stability of Redfin Builder Tools and Redfin Lender Tools, software used by Redfin's home services and mortgage organizations.

Rolling out a new communication platform for Redfin partner agents to help them easily connect with customers, driving faster response times and better customer experiences.

Launched Redfin Rise, an employee-funded initiative to support charitable organizations that are building paths to homeownership for working-class families.

4. RentPath acquisition

Redfin are to acquire the Atlanta-based owner of ApartmentGuide, Rent.com and Rentals.com for $608 million in cash. The aim is to bring together the leading site for buying a home with the leading site for renting a home, enabling the user to have a complete picture of the market from one source.

This acquisition is massive news for Redfin. RentPath add a product dimension to the overall business which just makes sense in terms of long-term strategy.

For example, 1/3 of American adults rent properties rather than own properties. Within this demographic, the majority of young people entering the housing market will be looking to rent to begin with rather than buy. This will therefore allow Redfin to get people using their platform in the early stages of their housing journey where they will likely remain for the future.

"RentPath has more than 20,000 apartment buildings on its rental websites, and grew its traffic more than 25% last year," said Redfin CEO Glenn Kelman

RentPath will bolster Redfin’s traffic by drawing a younger audience to Redfin whilst also increasing stature as a premium real-estate site. (Vice versa by drawing more traffic to Rentpath – e.g 10 mill of Redfins user base may also be interested in renting a home)

Redfin aiming to compete with the largest portals on every front for every visitor.

How they work together immediately:

More apartment buildings on RentPath.

Work together on a sales strategy – consisting of piloting a program for property managers to pay only for signed lease. No other sites should match Redfin’s reach and value.

Hiring real estate agents to help with renting. Not looking likely that Redfin will have rental properties on their site in 2021. The goal for the platform is not just to get bigger but to get better for people buying, selling AND renting.

Having to serve consumers on one side of the marketplace and businesses on the other will be new for Redfin. The local multiple listing services used by real estate brokers just to share listings have been the main source of listings on redfin.com, so they haven't had to ask brokerages for their listings. To get monthly rental listings Redfin will need RentPath's 250-person sales team to sign up thousands of new apartment buildings, one building at a time.

Redefine real estate in consumers' favor. Over time, the companies will work together to figure out how they can make the entire process of buying/selling/renting a home better, not just the initial search.

Conference call points:

The deal is not yet 100% complete, but they should be able to get FTC approval where CoStar (who operate apartments.com) failed. “We're new to the rentals business, and we think we represent a new alternative for property management companies to get better value. So we would expect the government to welcome that.”

Rentpath struggling – what will it take to get back to growth trajectory? Rentpath growing at a steady rate in 2020 but had uncertainty about its future so struggled to sign up new customers. With the Redfin brand behind the company, RentPath should be able to attract more properties to the platform.

How does this fit into the strategy of ‘one’ platform? “The reason that Redfin has such a competitive advantage in building our brokerage and delivering value to consumers because the [world is being passed] to our door through redfin.com. And so any investment we can make to drive traffic to redfin.com, is going to let us serve consumers better. It lowers our customer acquisition cost, but it also helps to sell properties.

And what we found is that adding rentals to our website will actually not only increase the audience of renters on our site but also increase the audience of homebuyers on our site. We rank very highly for individual properties on redfin.com when you search Google for an address. When you search Google for Phoenix real estate, we don't rank this highly because we well recognize the limits of our expertise. We are narrow in our expertise not a broad real estate destination. So if we are going to take on realtor.com, zillow.com, other big real estate websites, we need to offer rentals and for sale listings, both of those sites do and we don't.

So I think we're going to build relationships with consumers earlier in their lives because you start out in life looking for an apartment before you look for a house. And we're going to rank higher in searches on broad real estate terms just because we're going to answer more real estate questions.”

How will the two companies integrate? “So it will take us until 2022 to get the RentPath listings on redfin.com, but that will benefit both businesses. The industrial logic is really strong. For RentPath's property management customers, it nearly doubles the audience because we already know that about 1 in 5 redfin.com visitors is interested in rentals and is looking at rentals on other websites. But we also recognize that when we add rentals to redfin.com, it will just increase our stature as a broad real estate destination.”

5. Competition

One of the criticisms from my previous write-up was the shallow look at the competitors within the space of ibuying. There are, in fact, a bunch of really high-quality looking companies operating within this space who will be competing in roughly the same territory as Redfin.

Here I will be looking at Zillow and Opendoor. Though obviously we have others to add in the future.

Redfin

As mentioned in my previous overview, they are a tech enabled brokerage with a growing market share in the US. One of the differing factors here are regarding the staff who are full time, salaried employees – unlike other real-estate models.

Pros:

Increasing profit margins whilst others decreasing

Lowest rate option to sell your home: 1% commission when buying and selling with Redfin within 12 months (normally 6%)

Gross margins increase to 39% up from 22% prior

Cons:

Staff on a salary model so may not be highly incentivised to get you the best deal on a sale as it’s not tied to their salary.

Agents often overworked.

Zillow

Zillow are comparatively large with revenue models far more diverse in nature. Part of their revenue (IMT – internet, media and technology) involves selling ad space to realtors and property management companies and is performing relatively well – whilst iBuying is a relatively new avenue which is low margin, and not performing well in the current market. $3.3 billion sales in 2020.

Beginning to move towards more of a real-estate brokerage model (similar to Redfin) and using Zillow Offers to branch into iBuying (competing with opendoor). Could they be late to the party?

Pros:

Established within the industry

Likely have large amounts of data/insights from years of experience in the industry

Strong brand + trusted reputation

Cons:

ibuying is an inherently lower margin business. First foiree into ibuying resulted in a loss.

May have to significantly shift business model from current avenues to the brokerage model. This could lead to a contradiction in desire for two (competing) aspects of the business.

Opendoor

Check out my thread here.

$10B in homes sold. Fully digital play. Collecting and using vast array of data.

Pros:

Data is key here for Opendoor and will be one of the main strategic benefits moving forwards. Continuing to iterate on the data aspect of this part of the business could prove to be their MOAT. If executed correctly, could result in a high quality, low friction product for users.

Leading the move to iBuying – responsible for 50% of homes bought and sold online in 2020.

Cons:

Generally need to implement higher fees than traditional agents, mainly due to the additional carrying costs.

Low margin.

Sensitive to house price fluctuations.

iBuyers account for just 0.2% of all US home purchases in Q3 2020

Rising competition

To conclude this section, the whole real-estate sector is being forcefully transitioned towards ‘digital’ as new buyers enter the market. Over time, the purchasing power of these younger demographics will grow. Part of the opportunity lies in the fact that a large proportion of value seemingly disappears to the seller during a transaction – eliminating inefficiencies within this process are where opportunities lie.

Regarding who wins? I don’t think there’s going to be just one winner in this space. The market is big enough and diverse enough to cater for all.

6. Key risks for ibuying

Thanks to @CapPatman for pointing out several fundamental risks within the iBuying space.

May struggle to break even when price inflation takes place. If the pricing gains slow or turn negative, the highly leveraged house of cards collapses.

Capital intensive business model with low propensity to scale

Business relies upon

o Asset price appreciation in order to gleam profit from flipping.

o Somewhat taking advantage of the seller by offering below market prices (although I would argue here 1, costs are saved elsewhere and 2, much of the hassle of the process is eliminated – which will be worth a slightly lower price in some peoples eyes)

For consumers, “fees” are technically lower, although this is mainly due to the lower value for which you are selling your property. This is where these companies make money.

ibuying numbers not looking good at the moment because all stopped acquiring homes due to covid.

iBuying models lose money when fully burdened with OpEx. The brokerage and lead gen segments are the profitable aspects.

7. Financial Highlights

Here we’ll be taking a look at Redfin’s finances over the past year.

Market Cap

YTD return

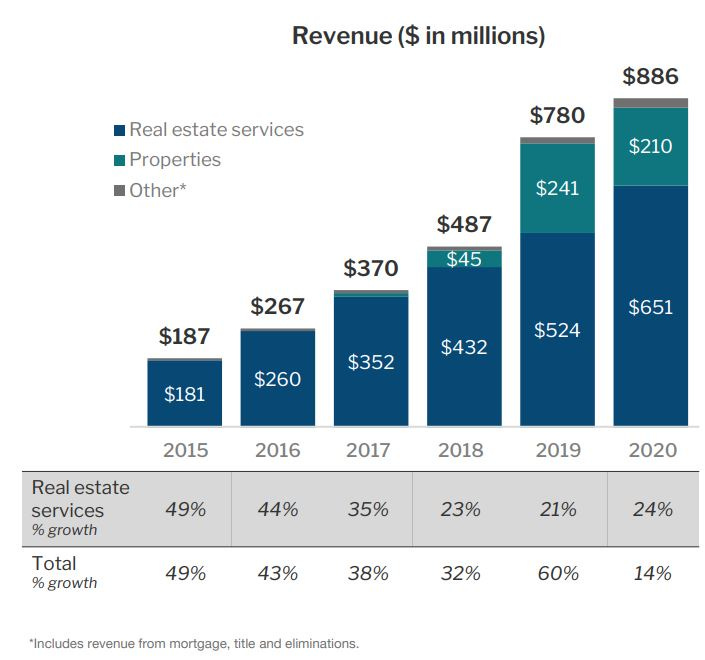

Revenue FY growth of 14% to $886.1M, Q4 growth of 5% from 2019

Gross Margin of 26.2% for 2020 up 770bps from 18.5%

Net Loss for the FY of $18.5 million, down from $80.8 million in 2019

Revenues

Redfin generate the majority of their revenues from the commissions and fees charged on each real-estate services transaction closed by lead agents/partner agents and from the sale of homes. This is broken down into three main categories – Real Estate Services Revenue (Brokerage revenue + Partner Revenue), Properties Revenue, and Other.

Revenues in the core business of brokering home sales increased 51% in Q4, with gross margins again exceeding 40%.

The mortgage aspect of the business looks strong at the current time, with 210% revenue growth over the prior year.

From the below table, we can see the revenue growth trajectory for Redfin over the previous 5 years – shooting up from $187 million in 2015 to $886 million in 2020. It does seem like revenue growth is beginning to slow down over the past year however initial guidance indicates this should pick up again over 2021.

Key quote from Glenn Kelman (CEO) - "Revenues in our core business of brokering home sales increased 51% in the fourth quarter, with gross margins again exceeding 40%. Our mortgage business had even stronger results, with 210% revenue growth. We were the fastest-growing major real estate website, as home-buyers moving to a new part of the country have increasingly turned to the Internet to find a real estate agent. Since more than half of all homes now sell in a bidding war, our on-demand home-touring has become a crucial competitive advantage for our customers, who want to see a listing either in-person or virtually before other buyers even know it's for sale."

Margins

Margin-wise, things are looking healthy for Redfin who have experienced a total gross margin increase of 770 basis points to 26.2%. This was mainly driven by relative growth within the real-estate services section combined with the ‘properties’ business relative lesser contribution as a proportion of revenue.

Real Estate services gross margin increased from 28.7% in 2019 to 35.9% in 2020. This was mainly attributable to the decrease in personnel costs & transaction bonuses, a decrease in home-touring & fixed expenses, a decrease in listing expenses and finally a decrease in travel and entertainment expenses.

The properties gross margin decrease from -1.9% (2019) to -2.2% (2020) was mainly attributable to increase in personel costs, home selling expenses – offset by a decrease in home purchase costs & related capitalized improvements.

Overall, I’m pleased with the outcome of the margins for this financial year as it’s always good to see a continuous push towards healthy operating leverage.

Balance Sheet

Taking a look at the balance sheet, Redfin’s liquidity situation seems healthy – with a strong growth in current and non-current assets y/y. The total current assets covers the total liabilities by almost 2X which is always a good indication of how strong a position a company is to continue financing growth.

For example, the addition of RentPath for $660,000,000 will leave the current assets being able to pay off total liabilities by over 1x still. This is good.

8. Valuation

The trouble with most of my relative evaluation work comes down to the issue of comparability. I can often find similar-ish companies, however no company is exactly the same – which makes this a hard task to complete. For example, within the real-estate industry alone (Opendoor, Zillow, PurpleBricks, Expi, Redfin etc.) each company operate distinct business models, focusing on different aspect of the wider market. So take these valuation comments with a pinch of salt.

Looking at Price to Sales, we can see it’s a relatively lofty valuation – however all within the 6x – 11x range, with Redfin sitting bang in the middle. As with most other stocks in the market, these valuations may seem high, however the market as a whole has been trending upwards at a drastic rate since march 2020 which leads to these frothy valuations.

I would argue the valuation for Redfin, in this particular case, seems fair. The growth potential is huge and with that comes a premium.

In addition to all of this, I would add that revenues are possibly not the best way to measure the value here as the quality of revenues (gross margin) between each of the three companies are significantly different (as seen below). Note here the improvement in both $Z and $RDFN.

9. Conclusion

Having only recently captured about 1% of the US housing-sale market, there is plenty of room for Redfin to grow over the coming decade thanks to the frictionless online business model combined with lower fees and a smoother overall customer experience – much needed in the current real-estate market.

Alongside this, the deeper-seeded secular shift towards digital, and the entrance of GenZ/Millenial buyers/sellers to the market will greatly complement the Redfin business model.

Overall, I’m bullish on the outlook for this segment of the real-estate market as the current inefficiencies are clear and have simply not been addressed for decades.

However, my concerns mainly lie with the company’s ability to remain competitive within a highly contested market. We should also be aware of some crucial risks to the business and keep an eye on how these are tackled over 2021/22. These include:

Remaining profitable during a downturn in the housing market where Redfin’s fixed costs could be a hindrance.

Integrating with RentPath will likely be a multi-year process – will this implementation be successful in increasing reach?

Can they make the iBuying segment profitable?

New business model may not pan out long-term.

If Redfin can continue to grow with the same strategic direction and intent as they are now then I’m confident we could be looking at a strong stock for the next decade.

Cheers

Innovestor

🔥🔥