Welcome to the 71 new readers who have joined us since the last article! If you aren’t already subscribed, join the community of 1,395 investors by subscribing below.

My aim with these deep-dives is to make the research process of investing in individual stocks more accessible. Enjoy!

Thesis

Key takeaways

Streaming terms

Business overview

Advertising

Bull Case

Bear Case

Financials

Conclusion

1. Thesis

The cable-cutting revolution is well underway - and with that, paid TV is taking a back-seat. Time spent watching traditional TV has, and continues to, fall off a cliff. This chart from a Matthew Ball article perfectly demonstrates the shift currently taking place within the industry. The value proposition of streaming is simply too great.

The basis of my thesis is this - as the older generations continue to leak from the sinking ship that is linear television and younger generations begin to mature - OTT and CTV services will continue to grow. With this, advertising dollars will need to be re-directed towards CTV. If Roku can establish themselves as the new ‘go-to’ TV operating system, then they will be able to attract the lions-share of traditional TV advertising dollars.

Since 2019, 1 in every 3 Smart TV’s sold in the US were Roku operating systems, making Roku the No.1 OS for smart TV’s in the US. Alongside this, Roku logged over 18.3 billion streaming hours last quarter - an increase of 1.4 billion since the previous quarter.

Due to the leading position with regards to both ad-tech and market share, I believe Roku are perfectly poised to take advantage of the opportunity.

2. Key takeaways

Roku are an advertising play on the cord-cutting trend.

Industry-leading ARPU at $32.14

Active account growth slowing slightly with 2.4M (totaling 53.6M) in Q1 showing possible slowdown in streaming momentum

Streaming hours increased 49% y/y to 18.3B

The Roku Channel reaches roughly 70M (more than double Q12020)

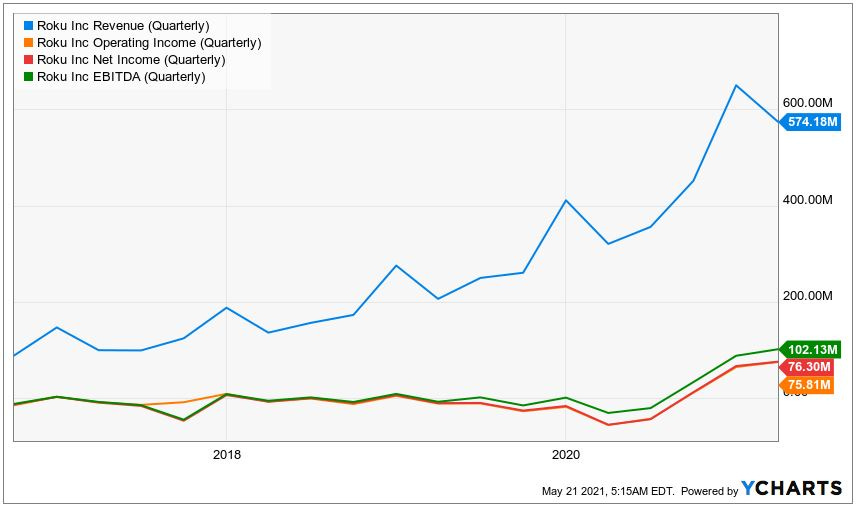

3 consecutive quarters of net profits ($76.3M)

Revenue up 79% y/y to $574M

Platform segment revenue (Ad-based) more than doubled y/y to $466.5M

In the first three months of 2021, more than 85% of adults 18-49 who watched The Roku Channel were unduplicated with traditional TV

Embarking on a strategy of acquiring, licencing and producing original content.

3. Streaming terms

I will be abbreviating Connected TV (CTV) and Over the top media (OTT) at various points throughout the article. But in essence, CTV is the device/operating system used to stream OTT services like Netflix.

What is Linear TV?

Linear TV is a traditional system in which a viewer watches a scheduled TV program at the time it’s broadcast and on its original channel. It also can be recorded via DVR and watched later. Linear TV still boasts the largest market, however, reach is fragmenting due to the increasingly competitive streaming landscape.

4. Business overview

Roku originally rose to popularity as a connected television device - helping pioneer the ability to stream apps like Netflix and HULU on your ‘not-so-smart’ TV.

As the years have gone by and as technology has developed, Roku have transitioned towards more of an advertising model as opposed to selling individual pieces of hardware (which they still do).

The Roku devices are sold mainly in the US & Canada, although have been expanding internationally over the past several years - reaching new territories such as Brazil.

The company are big believers in ad-supported tv, which they see as an under-served part of the market from a consumers point of view. Everyone knows people come over to streaming primarily to be able to watch what they want when they want. However what most don’t realize is the second most common reason for the switch - which is to save money from over-inflated cable bills. Roku recognized a large chunk of consumers would be willing to watch ad-supported TV as long as the ad experience isn't too painful and the content is good. The fundamental business model is built on this assumption.

4.1. Strategy

The strategy here can be simplified into several simple aspects.

Gain high market penetration by selling connected TV hardware at a low margin.

Develop a high quality advertising platform using big-data.

Attract advertising dollars from the fall-off from linear TV.

Maximize Advertising efficiency.

Profit

Lets break that down…

The overarching goal here is to create a platform where Roku are the number one Connected TV operating system in the world - enabling the connection between the entire TV ecosystem. It will be a one-stop-shop for all your TV needs. This serves as a win win for both ROKU and the SVOD channels like Netflix and Hulu etc. as Roku provides these services with a large audience whilst these services increase the volume and quality of data Roku use to serve ads, thereby increasing the quality of ads.

For this to happen, Roku’s hardware needs to be simple, effective and bug-free. As someone without a Roku TV, this isn’t something I can speak to directly - however after trawling through the reviews & comments it seems like this statements holds true for the most part.

1) Gain higher market penetration:

In order to capture a greater market share Roku need to keep increasing the number of active accounts.

To achieve this, the company sells hardware such streaming players, accessories and TV’s with Roku built-in. Alongside this, Roku work with hardware brands who licence the operating system in order to manufacture and sell Roku-based TV models.

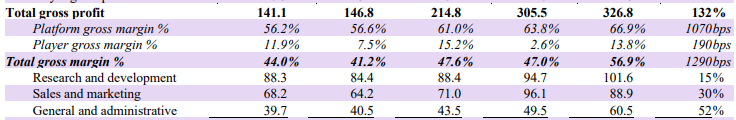

The important aspect here is being able to get these connected TV devices and software to as many people as possible - therefore the margin on this aspect of the business is low in comparison to the platform aspect (13.8% compared to 66.9% in the most recent quarter). These margins have remained relatively stable, with a slight decrease in platform growth revenue over the course of several years.

2) Develop a high quality advertising platform:

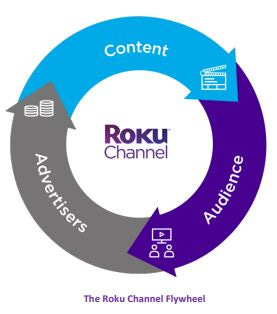

One of the ways to achieve this is to fuel the Roku fly-wheel. If Roku focus on improving the user experience and engagement aspect of the platform, the rest will follow.

More content in the Roku channel drives engagement - that engagement drives (as it is predominantly an ad-supported model) more ad inventory. As a result of this, the increasing demand coming over on the advertising side diverts more money back into spending on content, which results in higher quality ads (due to more data)... And the flywheel repeats.

3) Attract advertising dollars from the cord cutting trend:

There is strong evidence to indicate that traditional TV ad revenue is shifting towards connected TV.

A quote from a recent article from Beth Kindig…

“About $10 billion has been spent on Connected TV ads compared to $70 billion on pay television ads in the United States alone. Pay-TV ad spend is now expected to decline by 15% to $60 billion this year due to the postponement of live sports and also due to an increase in cord-cutting from covid.”

As the Roku operating system is currently the number 1 operating system in the US - I believe the company are best placed to capitalize on this opportunity.

4) Maximize advertising efficiency:

ARPU (average revenue per user) is a good metric for the efficiency with which Roku are able to monetize their audience. As you can see from the image below, ARPU has been increasing rapidly over the past year, with a 32% y/y increase from Q1 2020.

The steady increase in active hours, Streaming hours & ARPU is good evidence that the fly-wheel effect is indeed working. With more users on board, more data can be collected about user habits - therefore increasing advertising efficiency over time.

4.2. Revenue streams

The core of Roku’s revenue is centered around three main pillars - Advertising, The Roku Channel and Premium Features - all of which come under ‘platform revenues’.

Advertising: Advertising is the core of the business. Advertisers pay to have their content displayed on the Roku channel, which they are seeing as a way to engage customers more efficiently. Roku’s growing user base of over 53.6 million users has been a catalyst with this. In addition, Rokus average revenue per user (ARPU) is around $32.14 (up 32% y/y).

The Roku Channel: This is a specific channel Roku owns/curates and one of the only places where the company are able to show ads. The Roku channel helps with content discovery, which feeds into advertising dollars and keeps customers coming back to the platform. Roku help you discover new content, similar to YouTube or Spotify.

Premium features: This includes movie rentals and subscription based services. Roku Pay is integrated into the system in order to make the purchasing experience much more streamlined - reducing friction.

Roku is also a hardware company. In the financials, revenue is broken down into two main categories - Platform Revenue and Player Revenue (hardware).

As you can see from the below chart, the platform revenues overtook player revenues in 2018 and have been pulling away ever since.

Platform revenue consists of advertising, content distribution, subscription and transaction revenue shares, premium subscriptions, billing services, branded channel buttons and licensing arrangements.

Player revenue consists of hardware, embedded software and unspecified upgrades on a ‘when and if-available’ basis. This section makes up roughly 26% of TTM (trailing-twelve-month) total revenues - and has been steadily falling in each of the past 4 quarters, from 45% of total rev in Q2 2020 to 23% of total rev in Q1 2021. This decrease in revenue share signals at Roku’s core intentions to be a dominant player in the ad space. Other factors such as logistical issues (suez canal/chip shortages) and the fact that Roku are going for high-penetration of devices so selling at low margins are also key drivers of the increasing gap.

4.3. Hardware

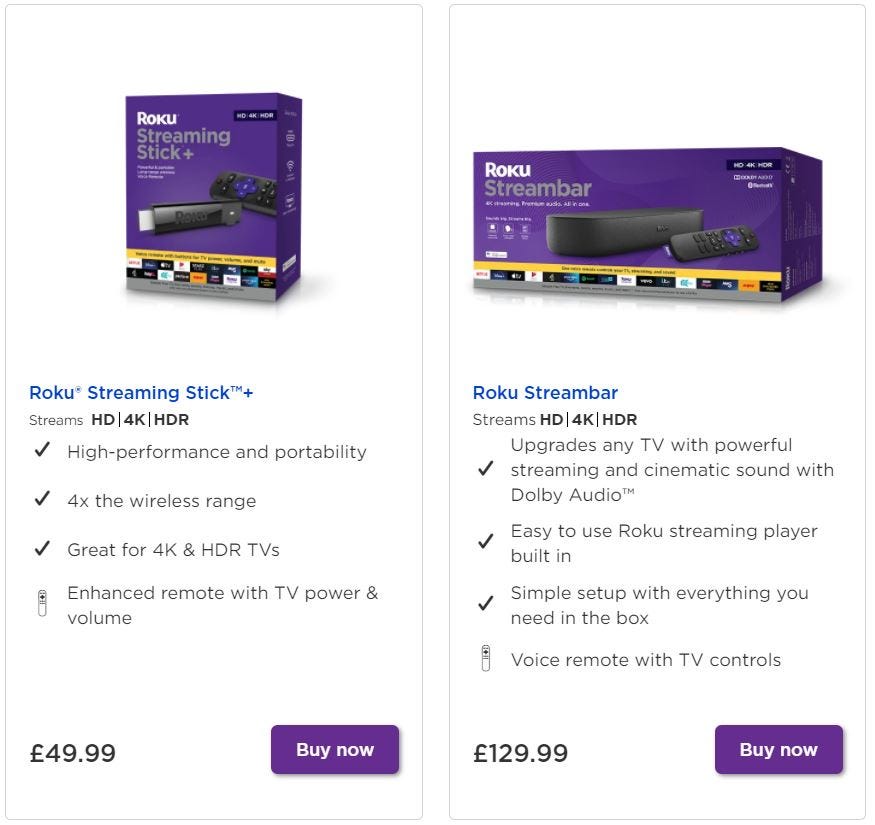

I won’t spend much time on the hardware available, as it’s all easily accessible on their site.

As mentioned above, Roku originally started by selling devices you can plug into your TV in order to access SVOD services like Netflix/HULU/Amazon Prime etc.

They have a stream bar as well as the Roku boxes that they are known for. These are plug and play devices that allow anyone to bring streaming into their homes. Even when comparing the Roku OS to integrated solutions like the ones found on newer televisions, Roku seems to have an edge in that the experience is more fluid, and the channel options are constantly expanding. They’ve placed technology at the forefront of their design and have built a base of loyal users who generally enjoy using their platform. They sell their devices at every big box retailer (including Walmart, Target and others) which makes their platform accessible to all consumers (even ones with limited technical ability)

In addition to these, Roku creates their own Smart TV’s alongside integrating their operating system into a variety of third-part smart TV brands. This strategy makes the Roku operating system hard to avoid - thereby gaining long-term penetration into the Smart TV OS market.

One thing to point out here is that I am UK based. And because of that, my exposure to Roku products is limited. As you can see above, the company have only just released their first integrated television into the UK market. I expect to see much more of Roku over the coming years.

5. Advertising

In March, linear TV ratings for adults 18 to 24 was down 22%. Q1 TV ad spending was down 11%, according to MediaRadar. Meanwhile, Roku doubled monetized video ad impressions on the platform.

Ad spending by major agency holding companies with Roku more than doubled.

Americans on an average day will spend more time on TV streaming than all major social media platforms combined: 3x Facebook, 2x YouTube, and roughly 2.5x Instagram, TikTok, and Snapchat combined.

Advertising in general has taken some heat over the recent years with companies like Facebook and Google testing the limits with respect to personal data and using that data to sell ad-space. Many folks are looking for alternatives.

Other social media outlets such as Snapchat and Pinterest have majorly benefitted from the rotation away from the big boys of tech. I believe as advertisers continue to rotate ad dollars, testing different mediums, Roku will benefit.

The direct nature of Roku’s relationship with advertisers along with the targeting accuracy of Roku’s ad platform results in a satisfied client. The ability to measure the effectiveness of the ads along with the ROI is another key plus point. In addition to this, it is safe to say that as traditional TV advertisers see the benefits from a more efficient ad model, Roku’s services will be in greater demand.

As I have mentioned several times above, advertising is a core aspect to the business-model for Roku. It’s safe to say the ad side of the business has gone somewhat under-the-radar over the past few years. However, it has simultaneously been the fastest growing aspect as of late.

User account growth has been accelerating, and with that, hours of streaming has been increasing at a similar rate. Billions of hours watched every quarter results in more engagement, which results in more ads served.

5.1. Acquisition of DataXu

The deal thesis when Roku acquired DataXu in late 2019 was that there was a significant advantage to roku & advertisers in combining capabilities from a winning DSP platform (reach & self service programming capabilities) with Roku's broad-scale reach, first party relationship with largest streaming audience out there, and all proprietary data that comes from that.

DSP - A demand-side platform is a piece of software used to purchase advertising in an automated fashion. DSPs are most often used by advertisers and agencies to help them buy display, video, mobile and search ads.

5.2. OneView

Roku’s OneView is the self-serve option for marketers who would like to purchase ads on Roku and integrate all of Roku’s data available for marketers in order to use at their disposal. Previously Roku acquired Dataxu DSP (demand side platform) and integrated it into OneView, allowing OneView to be even more efficient at obtaining and filtering the data marketers want.

The Oneview ad platform side of things is basically tripling whilst the overall ad business is growing very fast.

Roku monetizable video ad impressions more than doubled y/y.

You can reach an estimated four in five persons in the US using Roku’s OneView platform.

Consumers now spend more time streaming than they do those other three touch points combined.

As consumers move to streaming and all TV advertising is streamed, advertisers are looking for a tool-set to scale their OTT advertising. They want self serve capabilities to optimize and to measure performance. Roku provides this.

5.3. Nielsen

“In April, we completed the acquisition of Nielsen’s video automatic content recognition (ACR) and dynamic ad insertion (DAI) team and technologies, which will accelerate our launch of an end-to-end linear ad replacement solution in partnership with programmers.”

This will be huge for ROKU as they will be able to integrate the Nielsen "always on" digital ad ratings into the OneView platform for marketers.

6. Bull Case

Roku is an advertising play rather than streaming play.

As an advertising play on the CTV/OTT market, Roku are unique.

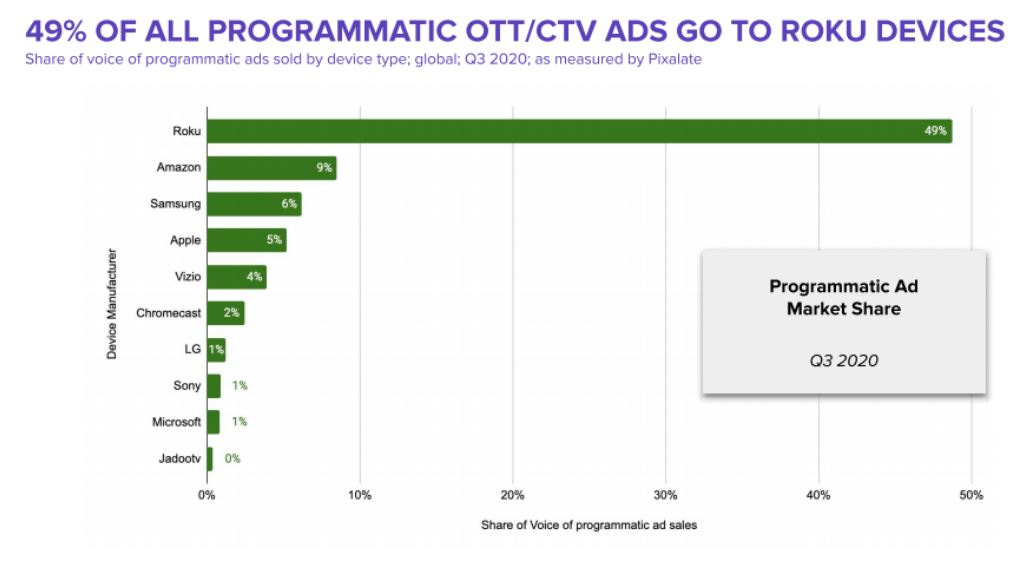

As of Q3 2020, 49% of all programmatic OTT/CTV ads went to Roku. Amazon is second with 9%.

The future of TV will be app driven.

Streaming has been steadily gaining traction over the past decade. We have seen entrants from giants such as Netflix, Disney and Hulu. The ease of accessibility for streaming apps will be part of the main driver to have access to the Roku operating system. Roku is currently the number 1 operating system because they have managed to create a high-quality reliable product that people like to use.

Roku's moat is that they power the operating system of most TV's.

At a high-level, this might not seem like the most convincing moat, however we need to think about how difficult it will be for a newcomer to enter into the space and displace Roku - almost impossible. Nearly 1/3 smart TV's have the Roku operating system.

Superior economics of being a ‘neutral’ middle-man.

The agnostic nature of Roku’s business model in regards to the streaming wars enables them to benefit from the overall increase in eyeballs into streaming. The benefit of being a neutral middle-man enables Roku outplay their competitors as content providers with their own devices like Google, Amazon, and Apple are always going to have difficulty in negotiating with competitors to support their devices.

It would take a huge player to come in as a "neutral" competitor to unseat Roku from this position.

Revenue growth is expected to continue.

Y/Y revenue growth hasn’t dipped below 48% over the past 3 years and in some ways looks to be ramping up from here.

Some proportion of the growth in Active Accounts, Streaming Hours, and ARPU is down to the Covid working from home situation. However this isn’t a trend that is going away. The direction of travel is clear - over the next decade, streaming will command the majority of advertising dollars.

Roku’s ARPU is insane compared to other tech companies.

Although Netflix has access to a user-base that far outweighs Roku’s, they don’t have the capabilities to monetize the audience as effectively. If we compare ARPU between the two companies, Roku is steaming ahead with $32.14 compared to Netflix’s Average Revenue per Membership of $10.73. Roku achieves this through a mix of advertising options that maintain a non-invasive experience for the customer while providing significant value to the advertiser.

Reed Hastings hinted at this in January when he mentioned that Netflix will not monetize its users any further by offering advertising options because it would be too difficult to compete with the big players in advertisement (Google/Amazon/Facebook/Roku).

Planning to add more content to the Roku Channel.

Roku is constantly adding new content to the Roku channel. One example of this is the recent acquisition of Quibi’s entire library. This, along with the rampant on-boarding of content to The Roku Channel (as evident on the balance sheet) indicates the intention moving forward - providing a more robust option for cord-cutters than simply a consolidated streaming app location.

The Roku Channel and scaling into more content. 175+ licensing partnerships are already in place and growing fast.

Expansion opportunity

The US is way ahead in the cord-cutting phenomenon, and this trend is global (unlike Roku’s current customer base). As technology continues to develop and become more affordable, we will see Roku expand into new territories.

7. Bear case

Question-mark over whether international expansion will work due to differing geographical economics.

Coming straight off the last bull-point… The US have an interesting relationship with the cord-cutting revolution in terms of economics. Historically high cable penetration rates and extremely high monthly ATV costs makes the decision to move to CTV fairly straightforward. Roku saves consumers a lot of money.

Whereas if you compare to the UK - the cost to watch television is generally inexpensive due to affordable and high-quality public broadcasters. Therefore the ‘need’ for something like Roku is reduced.

That being said, Roku's playbook of driving scale, driving engagement, then working on monetization once you've got enough scale is porting nicely to international markets.

Only 1 year ago Roku entered their first integrated TV into the UK. Ramping up ad monetization. Free ad supported TV is going to be a core experience.

How can they deliver more ads outside of the Roku Channel?

Roku are unique in that they are the closest thing to being a neutral content-provider within a competitive playing field, however - as they attempt to increase the level with which they monetize that channel, the more likely it is that content providers move to alternative streams of revenue.

The underlying concept of serving ads in a non-invasive way is certainly there, however Roku need to figure out a way to deliver more advertising whilst using the 3rd party apps like Netflix etc.

First mover advantage here is strong, but diversified revenue streams are relatively weak.

Connected TV is a commodity business, therefore has no significant competitive advantage.

Roku is much more than a connected TV device hardware company - they are an advertising platform. The whole point is you will be able to reach a wide audience and monetize those audiences through ADs. It doesn’t matter if it’s you TV, laptop, phone, set top box - Roku is aiming to become the operating system of streaming.

Big tech will be able to enter their devices into the market for a lesser price and compete directly with ROKU. This will drive down margins, making Roku obsolete.

Roku are already selling hardware at next to nothing and letting it impact their margins and they're doing that in order to become as ubiquitous as possible while the window is open.

Ad Video on Demand is a very new and emerging market. We can see this by the portion of traditional TV advertising dollars that are yet to move over.

So yes, the big tech companies like Google and Amazon are competing with Roku at the moment - in a very ‘head-to-head’ full on way. The fact that Roku have managed to remain in their number one position shows the strength of the business/brand.

What is Roku? (UK)

I live in the UK, and part of the reason I was skeptical coming into this is the lack of Roku brand visibility over here. I think this one somewhat comes down to the difference in existing television infrastructure within the UK compared to the US. Within the UK, we have free public broadcasters with a relatively inexpensive (or free) charge.

The US has much more of a need for Roku products, so it makes sense for the US to be the initial market.

Good product but no moat.

As mentioned before, the real moat here is the fact that Roku will be the No.1 operating system for connected TV. It may not sound like the strongest moat, and arguably it’s not actually a moat, however Roku are in the best position to be able to make this happen.

Competition

Even though Roku doesn’t have a large, or particularly threatening, group of competitors right now - it is extremely likely new players will enter the market as SVOD becomes mainstream. Attempts have been made with the Amazon Firestick (although relatively unsuccessfully), however as the market continues to develop we will almost certainly see more competitors attempt to grab a slice of the pie.

My prediction is that TV manufacturers will eventually settle on a standard operating system across the range of different TV’s. It’s entirely possible there will be 2 or 3 major operating systems - akin to Apple vs Android.

One recent development that highlighted the increased competition in the market was the Youtube distribution fight.

This was perceived as different than standard content dispute. Usually you would have a content publisher and a distributor, which results in different economic terms with a different viewpoint. Mutually agreeable economic terms is usually do-able.

This was not the case here. Roku were allegedly not asking for any different economics in relation to ad supported TV. Google was asking for unreasonable actions (e.g. to provide data that Roku don't provide others - biased and unbiased search results - looking to create requirements which would greatly increase the cost of the Roku players). These conditions were argues to be anti-competitive.

YouTube TV are actually still on the platform, however they have been made 'private', meaning people who had existing YouTube TV subs could still use it, but you can’t sign up to a new subscription.

8. Financials

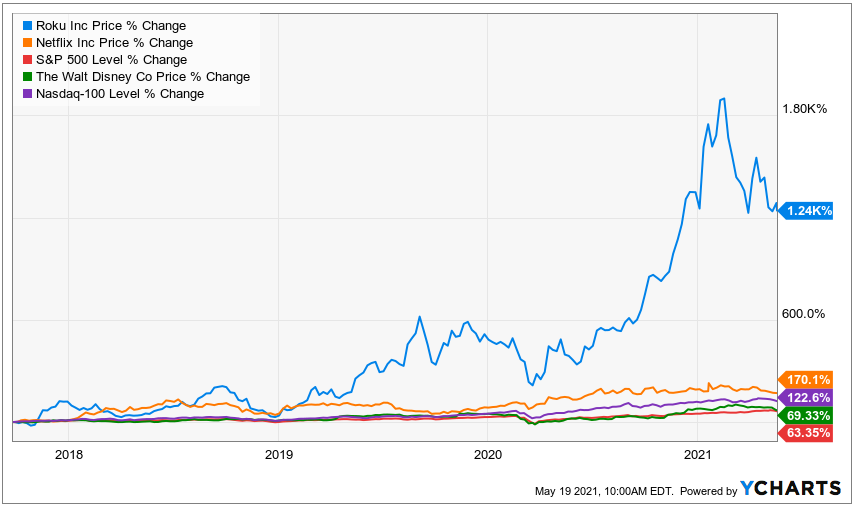

Lets first zoom out to look at Roku’s journey since IPO in 2017 where we can see the price % change has been substantial compared to various benchmarks such as the S&P 500, Nasdaq, Netflix & Disney. Thoroughly outperforming each.

8.1. Profitability

*The revenue split has already been covered in section 4.2*

Roku has historically been an unprofitable company, with 2020 as no exception. This is mainly due to the company’s strategy of investing heavily in expansion. However, 2020 was close to being a profitable year, with $17M in losses and two profitable quarters in Q3 & Q4.

I can see Roku posting a profitable year in 2021. And it’s off to a good start, with $76.3M in net income - far and above the -$54.6M loss from Q1 2019. Historically the first two quarters are the poorest performing quarters, with sales picking up in the latter half of the year. For the second quarter, Roku issued guidance of net revenue between $610 million and $620 million and net income of $10 million-$20 million, indicating a positive year ahead for the Connected TV giant.

Steve Louden (CFO) “We anticipate revenue growth rates in the second half of 2021 will be robust, but at a slower rate than the first half. For the full year, we expect overall gross margins to be in the high 40% range. We anticipate that Platform gross margin will be similar to 2020 levels, as we expect the outperformance of content distribution to normalize in Q2 and in the back half of the year. Looking ahead at the Player business, as a reminder, we do not optimize for Player gross profit, but rather account growth”.

Covid has definitely been a factor in the past year’s positive operating results, resulting in more demand towards Roku - leading to higher margins.

As we mentioned earlier (3.2.), the revenue is split into two sub-categories - platform revenue and player revenue. Platform revenue commands the majority of the focus for Roku as this is where the higher-margin business lies. The graph below starts from Q1 2018 which is when platform revenue began to overtake player revenues. Since this point, the gap has been widening, and will continue to do so in my opinion. The split is currently 71% platform to 29% player.

So, taking into account that the platform revenues are increasing as an overall percentage of revenues, combined with the fact that platform revenues are the higher margin revenue stream (66.9% compared to 13.8%), we can expect the overall gross margin to increase over the coming years.

That being said, player margins are relatively unpredictable due to changing short-term factors, and platform margins have been reducing over the past couple of years which is a potential concern (~75% in 2017 to ~62% in the past 12 months).

Initially, platform revenues took a hit from the coronavirus pandemic as businesses all over the world were struggling with operating expenses. Therefore cutting marketing budgets to spend on advertising was inevitable. This situation has been steadily improving over the past year, with the platform margin increasing from 56% to 67%.

Steve Louden (CFO) said “Platform gross margins were more than expected due to a favorable mix of higher-margin activities as a result of new direct-to-consumer launches with investments in audience development and positive 606 accounting impacts from increases in the estimated lifetime deal values of our content distribution agreement”.

8.2. Operating costs

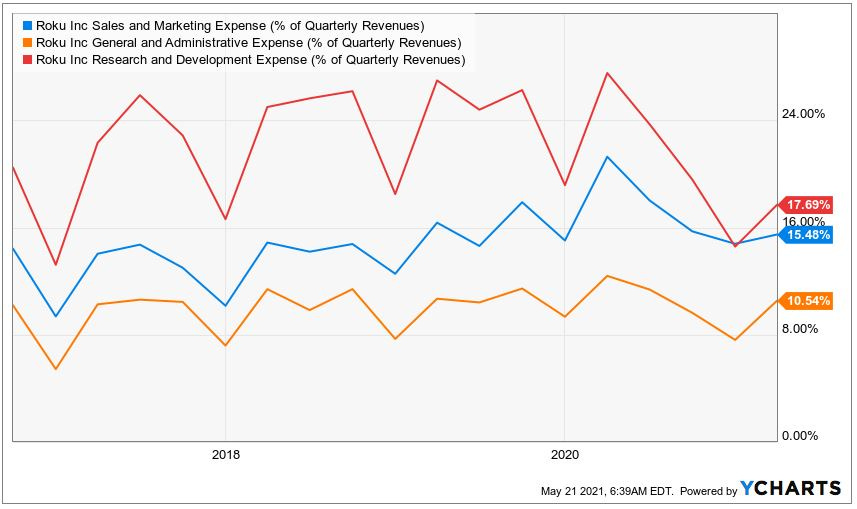

Typically Roku has encountered operating losses over the company’s time being public. 2020 changed this, with the last three quarters producing positive operating income of 13.20%, 10.02% & 2.65% respectively. This is compared to the typical operating loss of between -5% and -17%.

It’s also important to remember that with the recent acquisition of DataXu, Roku has acquired the respective operating expenses - which can be an interesting wrinkle.

This isn’t the most interesting chart, but shows that Roku’s have managed to maintain fairly consistent operating costs over the past 5 years, indicating strong management.

8.3. Balance Sheet

Current assets = 2.75B

Total Asssets = 3.49B

Current liabilities = 682.12M

Total liabilities = 1.05B

Roku’s balance sheet looks healthy as it stands, with total ‘current’ assets being able to fully pay off total liabilities by 2.62X - so Roku is safely able to continue operating without a problem for the near future.

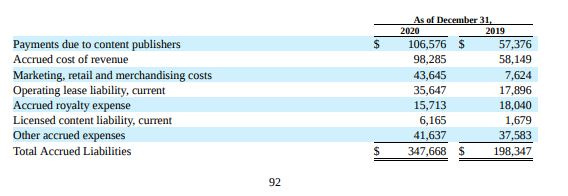

Looking in a bit more detail, Roku’s largest liability is the accrued liabilities (currently sitting at $477M), which is essentially Roku acquiring the right to stream content for free on The Roku Channel. Arguably, this is a good sign as it indicates the company’s commitment to improving the product and thereby a focus on continued growth. This number has been increasing rapidly over the past year, with 2020 seeing 75% increase from 2019, and Q1 2021 seeing a 37% increase from Q4 2020.

Additionally, their marketing accrued liabilities increased by over 6 times between 2019 and 2020, showing the intent to expand and grow the user-base is of top priority.

Another large increase is the lease payments - driven mainly by the current expansion and the need for new facilities.

Overall, their balance sheet looks healthy.

8.4. Cash Flow

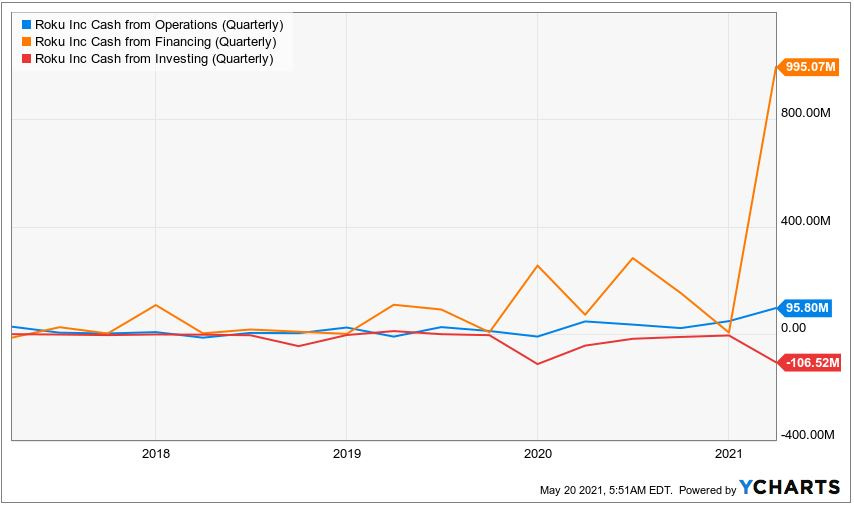

Roku has 2.1B in cash as of Q1 2021, a 1B increase from the end of 2020. However the net cash from operating activities decreased from $143M in Q4 2020 to $95M in Q1 2021. The overarching majority of the company’s cash is raised via financing activities, with the last quarter seeing a huge uptick in the cash available via financing (below).

The above chart shows that, historically, Roku’s main source of cash has been from financing activities, with a huge uptick in the past quarter. Ideally, we would want to see cash flows from operations overtake cash flow from financing at some point - as this indicates a healthy business which is financed organically.

The risk with this spike in cash flows from financing activities is that Roku either take on more debt, or end up diluting the shares. In this case, it’s a dilution of shares as the majority of this increase comes from “Proceeds from equity issued under at-the-market offerings, net of offering costs”.

8.5. Valuation

It’s hard to compare Roku with their main competitors such as Google, Amazon, Apple, Netflix and maybe Disney. as most of these competitor’s streaming elements are only a fraction of the overall business - whereas Roku is a pure-play. The closest comparison is arguably Netflix.

As you can see from the above chart, even though Netflix are carrying substantially higher levels of debt, Netflix are still valued at a more reasonable rate. It’s a fair comment to make that Roku are still overvalued at the current point in time, which poses relative risk.

Alternatively, simply looking at price, Roku recently touched the 200 day moving average, which presents a tempting opportunity to buy.

I strongly believe, Roku is set up for a good buying opportunity at the moment, and if they care able to execute over the next 5 years, I can see the company growing into a $80B-90B market cap.

*Thanks for making it this far. If you would like to help support my writing, feel free to buy me a coffee via the link below.*

9. Conclusion

To conclude, as the cord cutting trend continues to gather momentum, more and more TV ad dollars are leaking from linear TV to Connected TV. Roku are a tremendous ‘pure-play’ in connected TV ads space - with a large share of the market, growing user-base, growing hours watched and an industry-leading ARPU of $32.14 (with room to grow).

Roku sits firmly in the middle of the competition for eyeballs within the streaming sector, while the other SVOD services such as Netflix, Amazon and Disney jostle for market share via new content.

Roku’s upside is agnostic to the ongoing ‘streaming wars’ - benefitting from the overall upward trend of streaming. In other words, as long as the overall streaming industry continues to grow and Roku maintain their position within the industry, then the company will do very well. Roku is an advertising play. If you have faith in the cord-cutting trend playing out, Roku will likely be a good investment.

Lastly, as a company whose share price has been rocketing over the past several years, finding an entry point has been difficult (to say the least). These recent lows in the stock market have resulted in Roku hitting their 200 day moving average - and I believe this may be a good opportunity to buy a great company at a reasonable price.

Cheers,

Innovestor

I am an employee of Roku working in data engineering team. We have clear guidance from the VP of Programming and Engagement on The Roku Channel data manipulation. We add streaming numbers and have exaggerated reach by 90%.

Roku's The Roku Channel is currently streamed by avg 4.2M active accounts every quarter.

Roku is first to market but it doesn't make them best in-class. Competition is doing so well. See Fire TV and Google TV. Both are killing it in international market. Roku is successful because of Chinese parternships nothing else.

A friend of mine who works there mentioned Roku manipulates The Roku Channel data a lot to mislead advertisers. Their VP of Programming and Engagement Mr. Rob Holmes leads the data manipulation illegal activities. The Roku Channel is barely any viewership and it's a failed business. Anthony Wood wants to run it because they have invested so much in it.

Someone should ask Roku executives to post viewership & streaming numbers for the Roku Channel. You will probably be surprised to see how badly they are doing.