Welcome to the 110 new readers who have joined us since the last article! If you aren’t already subscribed, join the community of 1,196 investors by subscribing here:

Intro

Quarterly Highlights

The Streaming Landscape

History

Competition

Predictions

Bull Case

Bear Case

Finances

Closing thoughts

1. Intro

In this article I will explore the streaming company we all know and love - Netflix.

I will take a look at the history of the streaming industry, dive into the current landscape and think about what the future looks like regarding competition in the industry.

In addition, I will briefly be reviewing some of the fundamentals from this last quarterly earnings report to try to understand current investor sentiment and how we might see 2021 playing out for the company.

2. Quarterly highlights

As the lockdown is beginning to lift in some pockets of the world, we are starting to see the effects this is having on companies who significantly benefited from the global pandemic this time last year.

Netflix stock was down considerably after earnings were released on Tuesday. This sharp decline is mainly due to worse than expected subscriber numbers - which is seemingly the only thing investors care about. The company saw an increase in subscription numbers of 3.98M, missing the 6.29M target. Looking forwards, they are predicting a far more subdued Q2.

Most of these dampened results stem from pulled forward growth into 2020 from 2021, i.e. 2020 was far above expectations, which makes comparing 2021 numbers to expected growth tricky and somewhat misleading.

“In Q1, paid net additions of 4m were below our 6m guidance (and the 16m net additions in the year ago quarter) primarily due to acquisition, as retention in Q1 was in line with our expectations. We don’t believe competitive intensity materially changed in the quarter or was a material factor in the variance as the over-forecast was across all of our regions. We also saw similar percentage year-over-year declines in paid net adds in all regions (see our Regional Breakdown table below), whereas the level of competitive intensity varies by country.”

The takeaway for me here is that Netflix feels these lower-than-expected results weren’t down to increased competition in the industry (with Disney+) but more to do with external factors such as the world beginning to re-open and less people needing the Netflix service.

I’m not too worried about a contraction in subscriber growth, as 1) this was somewhat expected as the world begins to resume, and 2) much of the growth from 2021 was pulled forward to 2020 - with the expectation of improved growth in the second half of the year.

Guidance for Q2 is further subdued to 1M compared to a consensus of 4M.

“We project paid net additions of 1m (vs. 10m in the prior year quarter) with our UCAN and LATAM regions expected to be roughly flattish in memberships. We anticipate paid membership growth will re-accelerate in the second half of 2021 as we ramp into a very strong back half slate with the return of big hits like Sex Education, The Witcher, La Casa de Papel etc.”

Revenue beats expectations by 0.37%

EPS beats expectations by 25%

Operating margin reached all-time highs (27%)

Full year FCF on track to be roughly ‘break-even. FCF for Q1 was $692M for 2021 compared to $162M for 2020 - “very close to being sustainably FCF positive and that we no longer have a need to raise external financing to fund our day-to-day operations”.

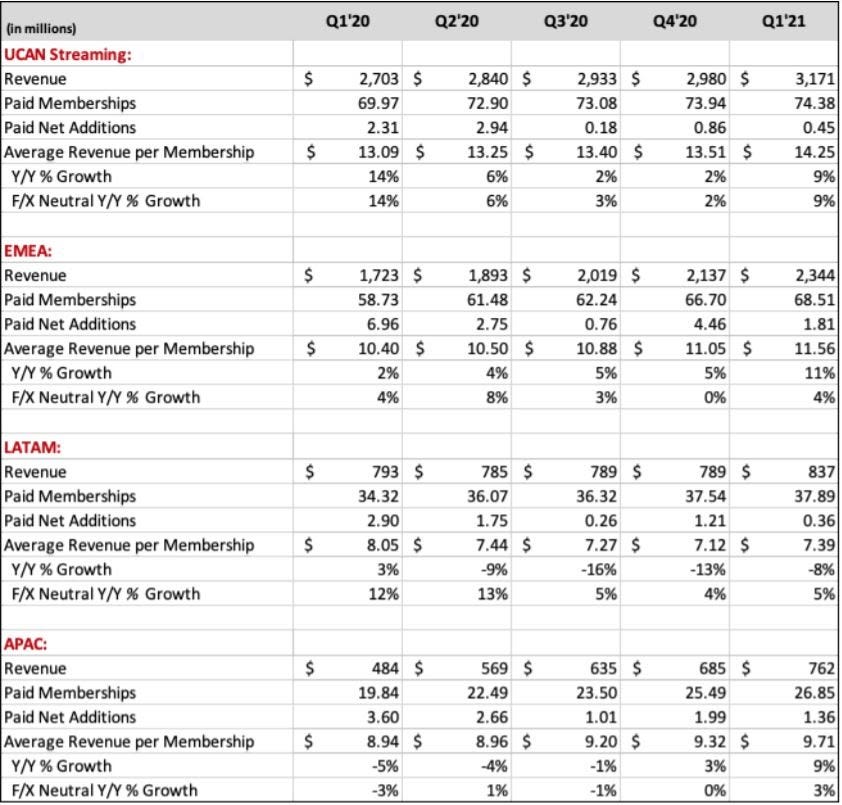

Average Revenue per Membership for all regions comes to $10.73

United States & Canad = $14.25

Europe, Middle-East & Africa = $11.56

Latin America = $7.39

Asia = $9.71

3. The streaming landscape

Streaming is a rapidly evolving/growing industry. Over the past several years we have seen some major entrants into the market that are making a material impact on Netflix - the industry leaders. In this first section I’ll aim to give a bit of background, explore some of the competition present and finally, outline how I see it playing out over the coming decade.

3.1. History

Similar to music streaming, television has been entrenched in a traditional model since its mainstream adoption somewhere around the 1930’s. Most have been using a ‘Pay TV’ model for the majority of the past 50 years – paying for individual linear channels/bundles with Sky/Virgin/many more. And this model made sense…

The introduction of Netflix (and other streaming services) since 2007 has seen a sharp decline in the number of people using the linear model. To show this, the movie rental business in 2006 stood at about $5.5 billion, with blockbuster making up about half of that. Fast forward to 2021 and Netflix alone is a business worth about $25 billion in revenue. With the larger digital streaming market adding up to roughly $70 billion.

Due to the fundamental change in the product being provided to the consumer, the economic landscape of the industry is drastically changing. No longer is there an incremental added cost in order to discover new movies - for the price of £9.99 per month, you have access to a seemingly endless collection of movies/TV shows.

The TV industry has been using this standard model for decades without any complaints from a consumer standpoint. It benefited both parties in that consumers paid a simple fee for scheduled programming, and TV networks made billions in profits from carriage fees whilst allowing advertisers to reliably reach millions of people.

This all changed with the introduction of the internet.

It took a while to fully kick in, but by mid-way through the 2010’s, Netflix had pretty much fully established themselves as the go-to SVOD (Streaming Video On Demand) offering.

This new form of TV - which bypassed the standard TV networks and went directly to consumers - enabled an entirely new business model.

“In 2007, Netflix pivoted from mailing DVDs to streaming video on the internet—ad-free content delivered for (initially) only $7.99 a month.”

The chart below nicely shows the change in consumer behaviour away from traditional linear TV Over the past decade. Almost every age-group have begun to move towards the streaming model.

The fact of the matter is that Streaming’s value proposition to consumers is simply much clearer - more content, greater flexibility, better UI, add-free and a lower price. Pay TV is on it’s way out, and with it’s exit comes new entrants into the SVOD market....

3.2. Competition

As I see it, there are currently a handful of competitors operating within the SVOD industry who are in the contention to win long-term. These include Netflix, Disney+, HULU, Amazon, HBO Max, Apple TV and other niche players.

I find the entire TV industry particularly interesting, mainly due to the impressive ability of these media companies to be able to extract more money from customers than was previously possible. By this, I’m talking about how we, as consumers, have perceived the change to SVOD to be a good one - but is it really that good for our wallets?

Yes, we now have the ability to watch almost anything and subscribe/unsubscribe to any of these subscription services at will. However we have ended up with essentially a set of paid ‘channels’ - just without the standard cable tv infrastructure.

The industry lowdown

Netflix: Netflix are the original streaming model. In the mid 2010’s, Netflix moved from mailing DVD’s to streaming. Today, Netflix has a current reach of 204 million global subscribers and a market cap of $242.92 Billion.

As the industry has developed over the period, of the past 10-15 years, Netflix have had to adapt their own business model. We have seen a move from majority licenced content to a more ‘in-house’ approach with ‘Netflix Originals’. The company can no longer purchase content from suppliers like Disney and NBC, and are therefore forced to create its own content.

“Netflix’s cash content spend is up 5x since 2014, but its movie library has shrunk 40% and its TV library is down 25%.”

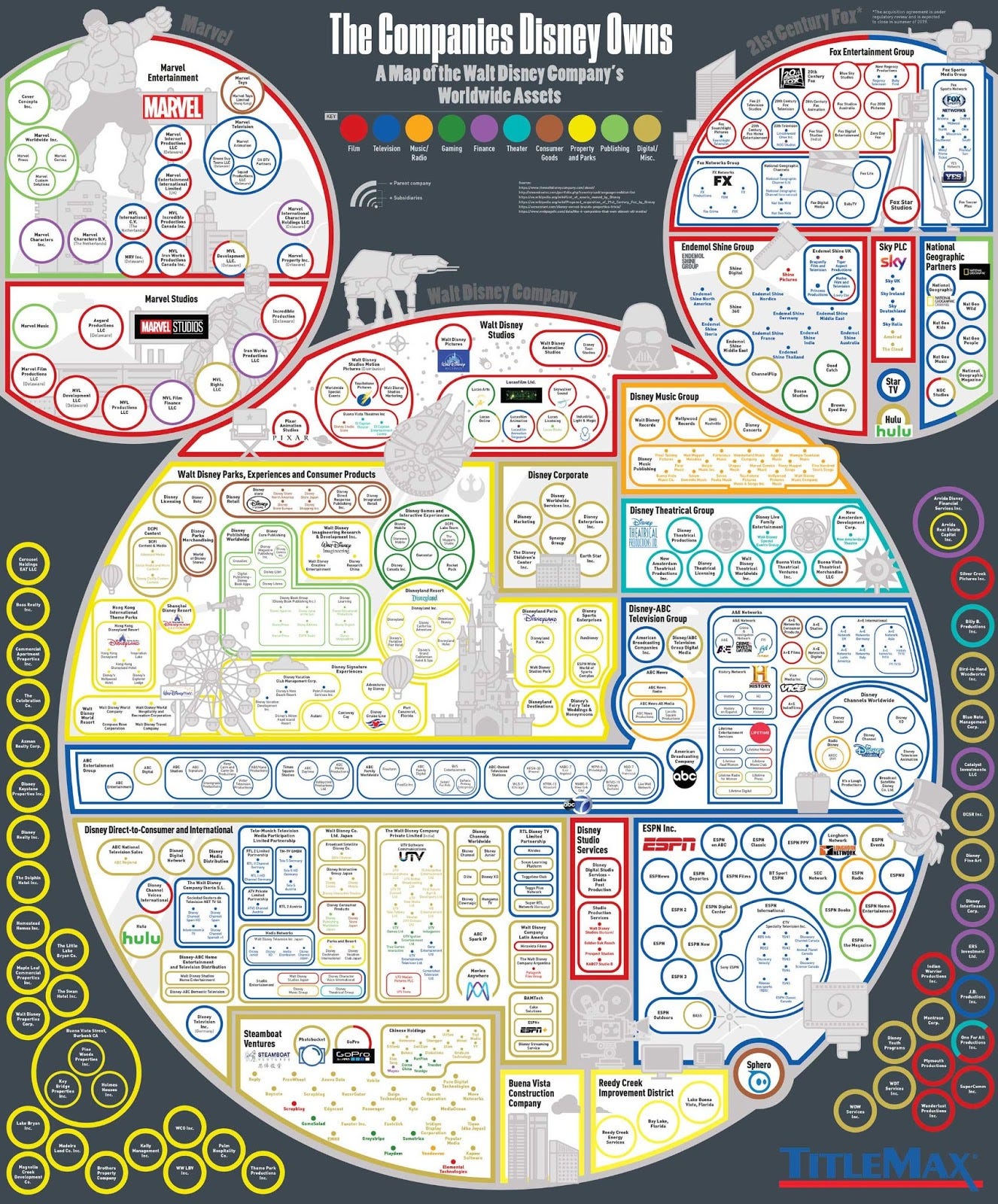

Disney+: For an in-depth look at Disney, see my recent article.

Disney are one of the most dominant (if not THE most dominant) media company in the world with a quite frankly incredible depth of quality IP.

Previous Disney focused on monetising this IP mainly through conventional ways including theme parks, theatres and merchandising. However, since Nov 2019 the company have began to dip their toes into the world of streaming, and as of Jan 2020, the streaming service has amassed over 94M subscribers - the fastest growth out of all providers in such a short period of time.

As this service evolves it will become yet another crucial touch-point in the overall Disney ecosystem.

Hulu: Launching around the same time as Netflix, Hulu struggled with uptake due to less than impressive original content.

With Disney’s recent acquisition of 21st Century Fox, Hulu is to be bundled within the Disney+ package, allowing Disney to reach a broader audience (i.e. not just kids and adults searching for nostalgia).

Prime Video: Prime Video isn’t really in the same league when it comes to streaming. Prime-video is more of an ‘add-on’ to the overall Amazon e-commerce store with the role of drawing more people in to subscribe for a prime membership.

HBO Max: HBO is possibly one of the more established competitors, with a history of high-quality shows. However, it has taken the company way too long to release their competitive product.

Apple TV+: Apple TV+ launched around a similar time to Disney +, however due to almost no original content has struggled to gain a footing.

3.3. My predictions moving forwards

It’s important to note some major differences between each of these. For example - Netflix’s business is solely based on streaming, whilst Disney’s business heavily relies on other aspects such as live theatre + theme-parks. Therefore, a win might look different to each of these companies.

Disney+ (94.9M):

Firstly, lets take a look at Disney+

The past year has been a roaring success for Disney’s DTC offering . The company launched their ‘Direct to Consumer’ product in November 2019 (just in time for a global pandemic), and since then has grown to 94M subscribers paying an average of $4.03 per month. In the first year, this segment represented roughly 10% of the company’s overall revenues - whilst the most recent statistics show the DTC element captures 22% of overall revenues.

As evidenced here, Disney are much different from their streaming counterparts, in that they don’t wholly rely on revenues generated from the streaming segment of their business. Most of Disney’s core business revolves around the ability to monetise the plethora of valuable IP over differing mediums.

I don’t think I will ever get tired of sharing the below image which nicely outlines the sheer scale of the IP at their disposal.

Disney have managed to act with the agility of a growth startup in order to roll-out an entirely new revenue stream within several short years - and they have executed almost flawlessly. Disney will be a winner in this space. But what does this mean for Netflix?

HULU (40M): Disney’s acquisition of 21st Century Fox, completed in March 2019, further added to their offerings - as now HULU will be bundled in with the Disney catalogue, adding a wider variety of shows - targeting a larger audience.

Netflix (204M): Disney’s entrance into the streaming industry had Netflix shareholders worried throughout 2019. However, since the launch of Disney+, the Netflix share price has increased almost 90%. Possibly somewhat to do with the pandemic - however, a great deal of this increase in consumer sentiment derived from the company’s ability to defend itself against a well-executed attack on their moat.

“I want to note here that a good sign of your moat is to see if it withstands attacks from high quality competitors. Disney launched a well thought through, expertly executed strategic attack on Netflix earlier this year and it doesn’t seem to have dented their moat one bit.”

As evidenced from the graph above - Netflix are leading the streaming war race, however competitors are starting to make some serious headway.

Part of the company’s competitive advantage is the fact that the catalogue of possible movies and films to watch is so broad it seems almost never-ending. The result is a low churn as people always feel there is more value to be had.

Prime Video (100M): Amazon is another of the streaming contenders I see winning long-term. However this is not because they excel at producing top-teir content, but because the prime video offering adds enough value to make the benefit of buying into the Amazon Prime eco-system worthwhile.

Winning in the streaming sector for Amazon means improving retention and spend for Prime customers. By this definition, Amazon will win.

Apple TV (35M): I’m not too familiar with Apple TV and its offerings, however my understanding is the service hasn’t decided exactly what it wants to be quite yet. The service launched with a thin offering of original content with the plan to slowly acquire a backlog of shows. I’m not sure how I see Apple TV winning here.

HBO Max (40M): HBO Max will more than likely acquire a large amount of customers due to the reputation of quality broadcasting alone. However, in terms of being a generation-defining part of pop culture, as HBO was, it will lose. HBO's famous tagline is, "It's not TV. It's HBO." Now, it's definitely just TV.

Other niche services such as Curiosity Stream: In my piece on Curiosity Stream, I argue that their “flexible business model along with multiple avenues of content monetization and differentiated content offerings allows CuriosityStream to succeed where other similar ventures have failed. Other similar ventures have had more limited business models, expensive content and narrower go-to market strategies.”

Overall, the previous 10 years has been somewhat of a golden era for television. This ‘golden era’ has resulted a plethora of streaming services jumping into the market - trying to gain a piece of this massive pie.

Over the coming years we are likely to see a large consolidation within these services. The end result will still be beneficial for consumers, with more content, cheaper overall prices and with less ads.

4. Bull case

Netflix puts out so much volume in terms of content compared to the other streaming services. A multi-user family has simply absorbed the bill due to the level of perceived value from always having something new to watch. They do not think about the cancellation decision each month - resulting in a low churn rate.

Long-term, Netflix are likely to be dominant in the global SVOD market. I personally see this market consolidating at some point over the next decade. When this happens, Netflix - as industry leaders - will be best placed to accrue operating leverage

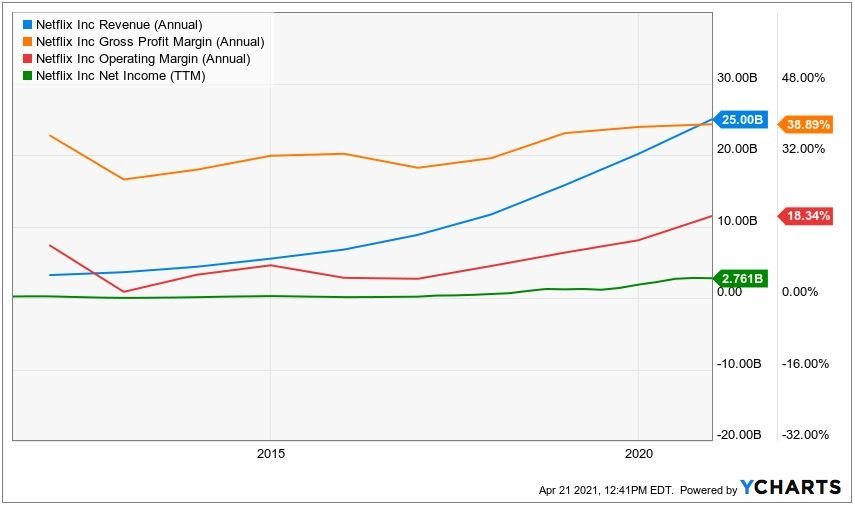

Expanding margins: Recent quarters have seen Netflix’s operating margin rise significantly. This rise may somewhat be due to several of the factors stemming from the pandemic, such as lower content spend and lower marketing spend from a reduced availability of productions.

It is possible we see this margin contract over the coming year as operating costs rise, however Netflix are in a strong position moving forwards.

“We plan to steadily increase operating profit and margin as we balance growth with profitability. With our rapid increase in content spending, and our growing emphasis on owned original productions, cash outlays are initially greater than content amortization, constraining free cash flow relative to profitability.”

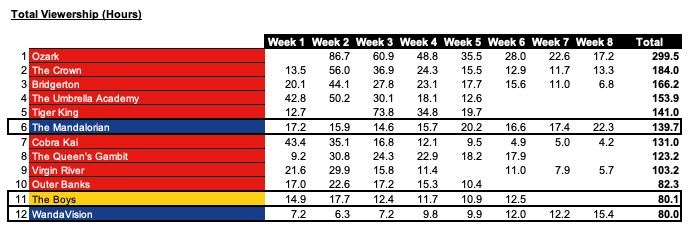

High-quality original content. Ability to churn out ‘hit-shows’ is unparalleled, which further solidifies the company’s value proposition. This chart below, from the Entertainment Strategy Guy’s Substack, further highlights the dominance of Netflix’s TV series dominance.

TAM is huge: “Netflix’s addressable market stands at 50-70% of the developed world and 20% of the developing world based off of 1.6 billion television households worldwide” - Beth Kindig

Statista show a CAGR of 10% to 2025, resulting in a projected market volume of $251B by 2025.

Research & Markets project the Over the Top (OTT) Market was valued at $85.16 Billion in 2019 and it is expected to reach $194.20 Billion by 2025, registering a CAGR of 13.87%.

Allied Market Research estimate the global OTT market size to be valued at $121 billion in 2019, and is projected to reach $1,039 billion by 2027, growing at a CAGR of 29.4%.

Recurring revenue is a powerful tool for any business. Netflix have a strong brand and product offering which results in a low churn and a relatively ‘safe’ source of recurring revenue.

Subscriber growth is still strong, but slowing - international could be the key. Reed Hastings mentioned in the investor call… “So outside of China, I think pay television peaked at about 800 million households. So lots of room -- and that was several years ago that it peaked, lots of room to grow.”

Fended off direct attack from Disney+ - shows strength of brand/product.

Huge distribution network, making producing a show via Netflix extremely attractive.

Relatively price inelastic: strong value proposition so consumers normally understand price increases. Netflix looking to raise prices at some point over the coming year.

5. Bear case

Intensifying competition

Competition within the industry is heating up. And one player coming in late to the game that may cause a serious threat (although not directly within SVOD) is Roku.

“It's easy to compare Roku's roughly 50 million users to Netflix's 200 million and to assume Roku is a much smaller company or lagging the subscription behemoths, such as Disney Plus. This is a mistake as the ad-based video-on-demand (AVOD) market is a newer market than subscription-video on demand (SVOD). The AVOD market is distinguished from SVOD because it's primary driver is pay-TV ad dollars rather than the cord-cutting trend or subscribers.”

The addition of streamers means more people will be looking for ad-based-video-on-demand, which is Roku.

Netflix could be missing-out on a tonne of revenues which are coming into streaming from paid TV. Paid TV ad spend is set to decline whilst connected TV ad spend is set to rise. If Netflix can’t figure out a way to cash in on this revenue stream, then they will be missing out on revenue.

A large amount of ad spending is staying with paid TV for now, due to the fact that it remains effective. However, over time, as more people join the cable cutting revolution - this number will only dwindle.

This comment from Reed Hastings in the conference call nicely outlines Netflix’s opinion on competition at the moment. I.e. they don’t see Disney as a threat, more-so YouTube.

“Our largest competitor for TV viewing time is linear TV. Our second largest is YouTube, which is considerably larger than Netflix in viewing time. And Disney is considerably smaller, but we're sort of in the middle of the pack.”

…adding to that…

“We had those 10 years where we're growing smooth as silk and then just a little wobbly right now. And of course, we're wondering, "Well, wait a second, are we sure it's not competition?" Because obviously, there's a lot of new competition. And we really looked through all the data, looking at different regions where new competitors are launched, are not launched. And we just can't see any difference in our relative growth in those regions, which is what gives us confidence that it's intensely competitive, but it always has been.

I mean, we've been competing with Amazon Prime for 13 years, with Hulu for 14 years. It's always been very competitive with linear TV, too. So there's no real change that we can detect in the competitive environment. It's always been high and remains high.”

Production delays: Self explanatory, but should be less of an issue moving forwards. Lots of upcoming content to look forward to over the coming year.

Content costs: The cost of content to make a Netflix original series is lofty (reportedly $16B in 2020).

Advertising: As mentioned above, as consumers continue to make the switch from linear to SVOD/Connected TV, Netflix could be losing out on substantial revenues if they decide not to implement ads on the platform.

Password sharing: "Yeah, we're probably going to keep trying things, but everyone relax, the streaming police are not going to knock on your door and ask you for your wallet. You know us -- we're not like that."

Liable to lose licenced content: This article (although 2 years old) highlights the risk of over-reliance on licenced content.

Is growth stalling? (counter to the above point on growth potential): This graph shows that Netflix’s worldwide growth numbers may be beginning to stall. Have the company reached a plateau in terms of subscriber growth? Is it a case of all other streaming services catching up from here-on-in?

6. Finances

I’ll take a brief look at the finances here as I think looking at the half year point/full year point is more valuable.

Revenues

Unsurprisingly, TTM revenue growth is incredibly strong at 23% ($21B to $26B). This was mainly driven by external factors surrounding the global pandemic, forcing the population to stay at home and therefore needing entertainment. Netflix filled this gap nicely.

We can see a similar story for the y/y Q1 revenue growth, which stands at 13%.

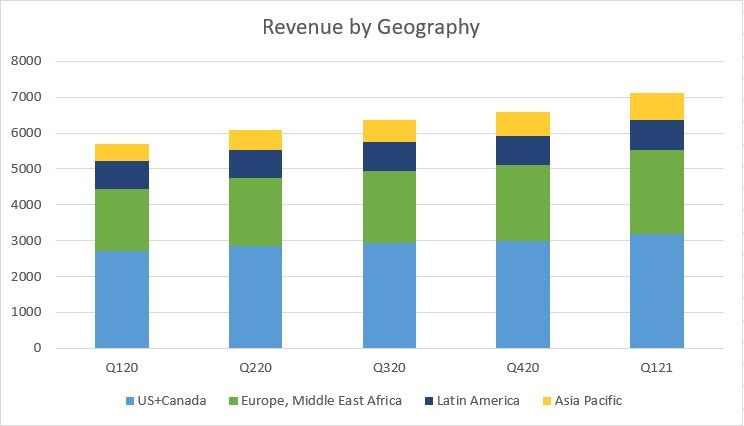

Breakdown by geog?

From the below chart it is clear that the focus on future growth lies internationally in terms of increasing the level of revenue generated within both Latin America & Asia Pacific. Over the past quarter, there have been reports of $500M investment in Korea, 40 new films and series in India, along with more of a focus on Japan. The question still remains around whether this investment will lead to an increased willingness to spend on premium content...

The below chart, provided in Netflix’s shareholder letter, shows the disparity in ‘ARM’ (Average Revenue Per Membership) between the different geographies. If Netflix can improve the product market fit in the relative regions, then they are likely to see this number rise over the coming years.

Cost of Revenues

Costs of Revenues as a percentage of overall revenue has remained relatively stable across all quarters at 61%/62%, leaving a gross margin of 38%/39%

Operating margin reached all-time high’s of 27% in Q1 2021 mainly due to lower content spend and lower marketing spend. Content amortization only grew 9.5% y/y in Q1 2021 vs 17% in Q1 2020. This resulted in a 10% point y/y jump in our operating margin.

Other costs:

Marketing: Marketing costs have generally decreased over the past year as there has been less new content to distribute, and less need for physical marketing campaigns. 2019 = 13.6% 2020 = 8.7% 2021 = 7.2%.

Technology & Development: Technology and development costs has remained stable over the last 2 years, clocking in at around 7 or 8% of revenues.

G&A: G&A has also remained relatively stable at between 4% and 5%.

Profitability

Is the company profitable? Yes, Netflix are a profitable company. Profits increasing fairly steadily over the past 5 years alongside revenue growth. Operating margin has shot up drastically over the past year as Covid has provided the company a nice boost.

Cash Flows

Free cash flow has been up and down over the past 5 years. Management seems to be confident that 2021 will see FCF break-even and continue to grow from there on out.

“We know we've turned the corner on that cash flow story. So we expect to be about cash flow breakeven this year and then sustainably free cash flow positive and growing thereafter”.

Return on Capital Employed

Operating income ROCE = 2.97%

Free Cash Flow ROCE = -0.88%

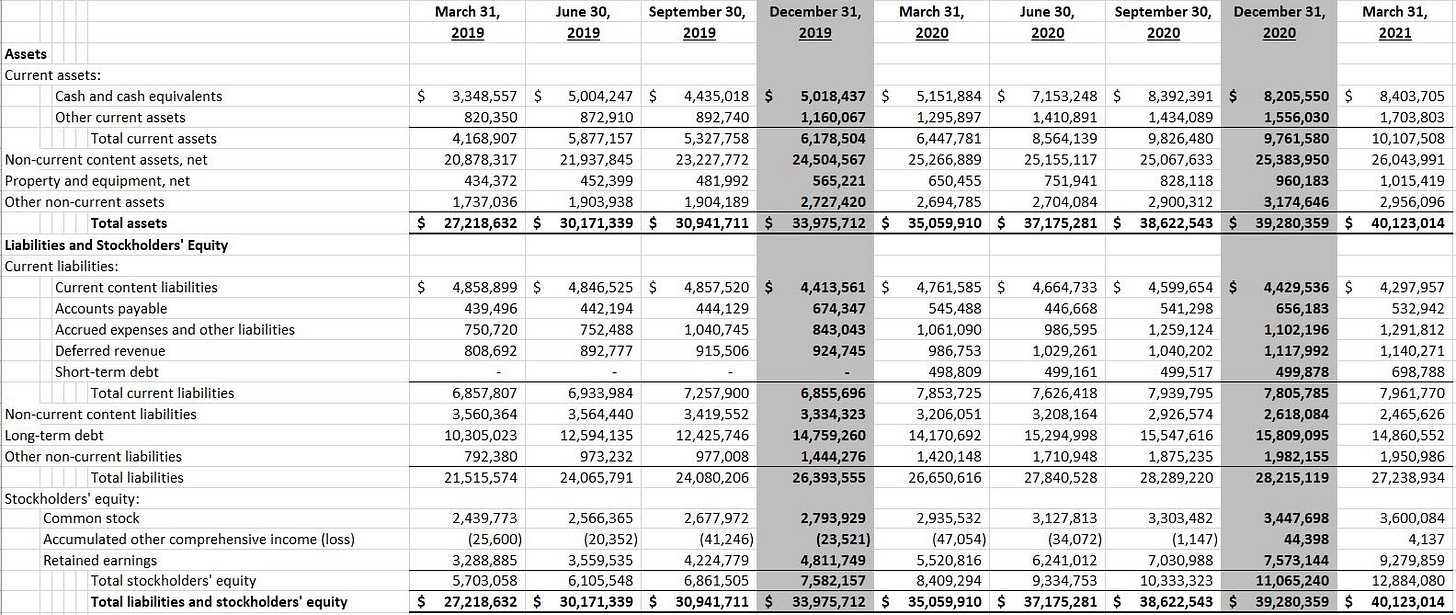

Balance Sheet

Overall, the balance sheet looks relatively strong. Netflix’s total assets have grown from $10B to $40B in the space of 5 years. Short + long-term debt has remained relatively stable, and decreasing as a percentage of total assets over this time period.

That being said, the total assets breaks down as 25% current assets to 75% long-term assets. This isn’t ideal in terms of liquidity.

The total current assets of $10B would fall short of paying off the total liabilities ($27B) if the company were to go into liquidation. The current ratio here stands at 0.37. We want this number to be above 1 as we, as shareholders of common stock, are the last on the list if things go wrong.

7. Closing Thoughts

Overall, the results and subsequent drawback in this quarter should have been somewhat expected. It’s not often a company experiences a year with so much pull-forward in growth along with such an acceleration in share price.

During the first couple of quarters of this year (as we begin to emerge from the pandemic) I will be keeping a close eye on how Netflix and the industry as a whole are dealing with the changing macro circumstances.

Even with quarantine lifting, the cord cutting market is still largely untapped. Over the coming decade, the shift from traditional linear TV to streaming will continue. As infrastructure improves and awareness increases internationally, we will likely see continued growth.

Long-term I’m bullish on Netflix. The brand, content library, industry growth potential, strong business model, dominance in the industry and impressive ability to fend off attacks on their MOAT will continue to see Netflix operate as the number 1 streaming service over the coming years.

It is absolutely true that the market is heating up, with high-quality entrants such as Disney+ which may be stalling growth somewhat.

These are points I will be keeping an eye on, however I don’t see Netflix being knocked off their perch anytime soon.

Cheers,

Innovestor