I have been getting a good reception from these ‘Stock Take’ articles over the past several months, so I will be looking to continue the series moving forwards. The aim is to give my opinion on various topics related to the stock market and ideally to create discussion between readers. Here are the past two Stock Take articles:

If you enjoy this type of content, let me know by leaving a like, a comment and subscribing using the link below. You can also find me on twitter @innovestor_

Enjoy!

Prelude

Introduction

The art of leveraging IP within entertainment

Is there a correlation between IP and financial success?

IP within Medicine

Examples of companies with valuable IP

Conclusion

1. Prelude

We are, whether we like it or not, entering a brand new era. Where ideas and data are the new oil and gold. This period in history, and business, can be described as the ‘Information Age’.

An idea (or piece of intellectual property) is an interesting thing - we have them all the time. Sometimes completely original, oftentimes not.

So the age old question of whether (or not) your idea is wholly original, and can therefore be used for commercial gain(?), is highly debated.

In this article I will be exploring several examples of how Intellectual property (IP) has been leveraged by businesses, and how we (as investors) can use this information to benefit our investing process. I will also explore the relationship between Intellectual property and the financial performance of businesses, and to try to understand whether a link exists. In addition, I will look at some examples of companies who have surfed the wave of IP over the past several decades and why (or why not) IP might be an important factor moving forwards.

2. Introduction

As we have transitioned from ‘physical to digital’ in many aspects of our lives over the past several decades (see my piece on the technological revolution), the ease and replicability of ideas (mainly in SaaS technology companies) has increased.

It is now relatively easy to create a product mimicking someone else’s concept.

There are many examples of copyright law being misused in order to further ones financial gain. However, there are also plenty of examples outlining why it is an important safety net for creators.

“Intellectual property protection is critical to fostering innovation. Without protection of ideas, businesses and individuals would not reap the full benefits of their inventions and would focus less on research and development. Similarly, artists would not be fully compensated for their creations and cultural vitality would suffer as a result.”

3. The art of leveraging IP within entertainment

Entertainment covers many different industries - TV/Film, Music, Gaming, Theater… the list goes on. So when we think about the exploitation of IP within the entertainment industry, there is almost no better example than Disney.

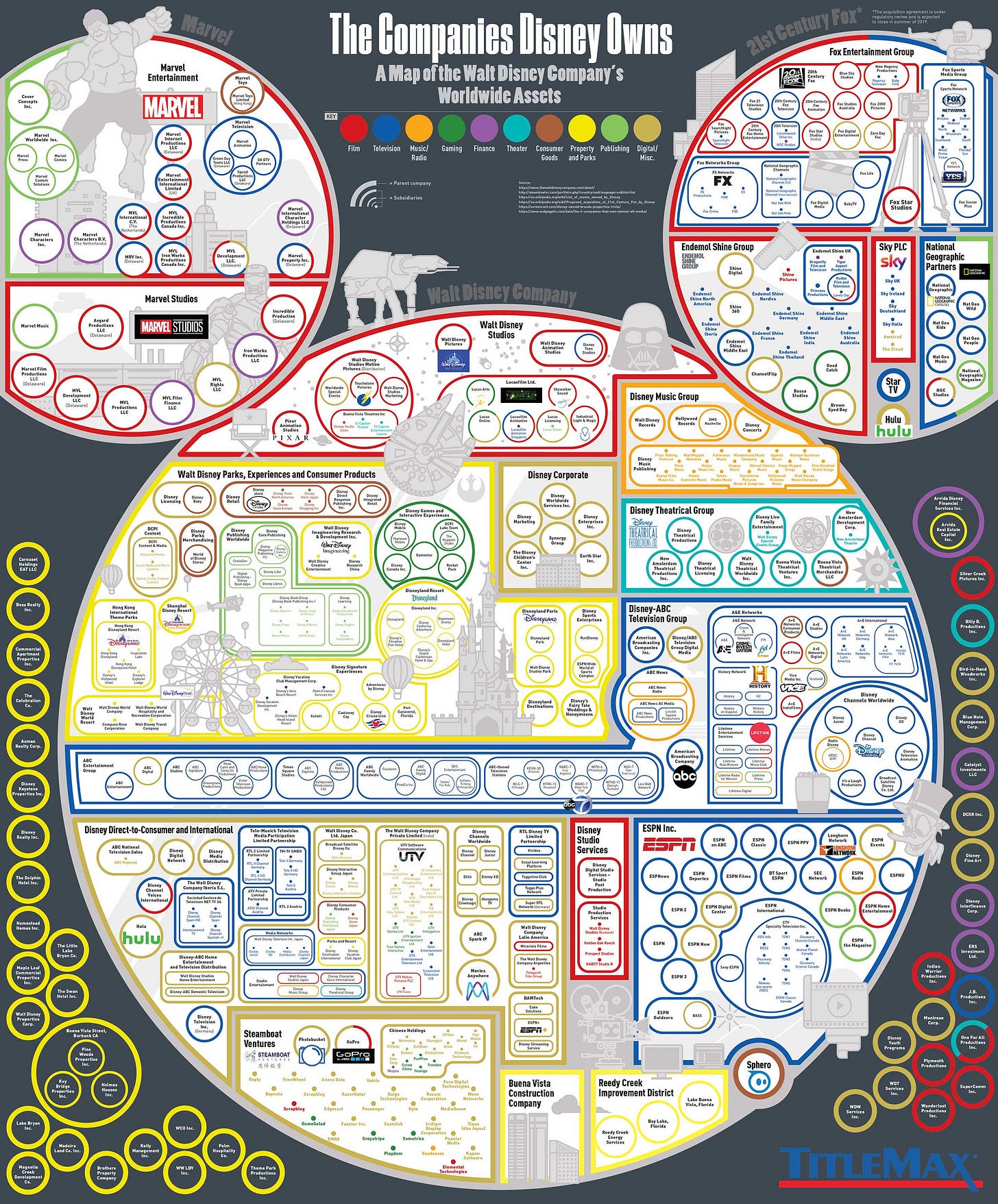

The level of intellectual property Disney has control over is nothing other than staggering. If you want to look for yourself, the list is seemingly endless. Also, the below info-graphic does a good job at highlighting the breadth and depth of the company’s ‘idea bank’.

To better understand how Disney managed to accumulate this empire and what impact it has on the wider IP landscape, lets first take a look at the origins…

Disney’s influence on IP rights runs deep

Part of my interest in Intellectual Property and copyright is due to the inherent conflict it creates. On one side, it protects your creative work from being ripped-off and others profiting from your idea. However, there are plenty of examples where IP laws actively stifle people from using other creative work as inspiration.

In order to understand this conflict, we need look no further than the man (and company) who essentially shaped our current intellectual property landscape - Walt Disney.

In 1928, Walt created the character Oswald the Lucky Rabbit for Universal Studios. Oswald was wildly successful. However when Disney approached Universal about making more Oswald cartoons, he found out that the studio was already working on new Oswald shorts without him. And because they owned the rights, he couldn't do anything about it.

Walt was far from happy. Out of a mixture of rage and jealousy, he decided he would only work for himself and that everything he created from this point forwards would be owned by him.

Walt then developed a new character, making sure it belonged to him - and him alone. As you could probably guess, it was ‘Mickey Mouse’. This is where the real story begins, the story about how Walt managed to change IP landscape in Disney’s favor, forever.

His plan worked well. Walt Disney now owns possibly the largest, and most popular, collection of characters, franchises and studios on the plant.

After Walt bought the rights to Mickey Mouse in 1928 - the laws at the time only allowed copyright to last 28 years (with the option of an extended 28 years) before going back into the ‘public domain’ to be used freely. Therefore, Mickey should have become free for the public to use in 1984.

HOWEVER, in 1978 Disney petitioned congress to increase the life of their revenue generating asset. The Copyright Act of 1976 was ultimately signed by Congress. Under this Act, copyright protection for already-published corporate copyrights (like Mickey Mouse) was extended to to 75 years. Works published after 1922 were entitled to a full 75 years of protection. That extended Mickey’s copyright through to 2003.

HOWEVER (again), in 1998 the copyright extension act (affectionately known as the Mickey Mouse Law) was passed - extending rights for 70 years after the authors death and protecting corporate works for 95 years from the original obligation, or 120 years from the creation (whichever expires first).

Disney spent over $6.3 million on lobbying for this act, which pales in comparison to the revenue the company will be protecting by getting this law enacted.

So, in essence, Disney have taken most of their ideas for characters directly from the public domain in order to milk their IP as long as possible. Mickey becomes free to use in 2024, but it remains to be seen whether this will be extended further.

Why is this good (or bad) for individuals and businesses?

The actions Disney have taken in order to retain their ‘assets’ are debatable on a number of levels. However the main issue revolves around Disney’s hypocritical method of taking IP straight out of the public domain, copyrighting it, and then meticulously suing anyone in breech of the IP. Additionally, these copyright laws will be in play for Disney way after the death of their creator.

Is this fair? Shouldn’t Walt’s work fall into the public domain? Who knows.

For businesses, the answer to the question of whether the generous IP laws are good or bad(?), heavily depends on your point of view.

More often than not, this level of ‘idea protection’ is a useful tool in order to protect the hard graft one puts in to create an idea. If we use the example of James Dyson, a singular inventor working at his workshop for years and years before any success. Eventually releasing his patented new method of suction for hoovers. The idea of IP allowed Mr Dyson to avoid any large corporation simply copying his idea by using their massive resources - the core danger for most inventors.

On a side-note, this podcast involves a great interview with James Dyson which goes into his history, and how he worked hard to create what is now one of the worlds most well known brands.

On the other hand, you could argue that these IP laws benefit mainly large companies like Netflix, Nintendo, ActivisionBlizzard, Qualcomm etc. who, if they can afford to do so, can buy up as much IP as possible and milk it for as long as possible.

Great. But how does this impact innovation?

IP with a long shelf life essentially stifles innovation. Part of the push-back from creators is that most ideas stem, in one way or another, from the works of previous creators.

Disney, and other large ‘IP rich’ corporations, make a point to sue any infringements on their copyright. This leaves creators and businesses in a precarious positions as to whether to even pursue content creation due to the fear of needing to pay up. This is a common argument as to why these IP laws stifle innovation and creativity.

The moral question…

As a creator of content myself, there is a fine line to tread between taking inspiration from other peoples ideas, and ‘stealing’ ideas. Oftentimes, to get around this I will aim to add my spin on an idea, and if I can’t, I will link the source.

But deeper than this, it is my belief that ideas compound over time. I.e. ideas, for the most part, aren’t created in a vacuum - they are the product of building on past ideas and iterating in order to improve.

A good example of this is in modern music. It’s staggering to know how much great music is derived directly from older motifs. Take the below video looking at all of the samples in Kanye West’s ‘Graduation’ album (one of my all-time favorites).

With regards to writing, the problem isn’t so bad, however in TV, film and music, the problem can lead to stifled innovation if IP is ‘locked-up’. I believe it’s a common experience for rap artists where they need to get the approval of the right-holders on various samples, which can delay and even stop the production of the album.

So, you decide, has Disney’s impact on IP law been a net positive or negative?

4. Is there a correlation between IP and financial success?

An interesting question that came up when asking my followers about interesting topics around IP is whether there is any relationship between the level of a company’s IP and their financial success (or profitable IP and financial success).

I’ve done some digging on the subject and have concluded that there is, in fact, some positive correlation between the level of IP and financial success of a business.

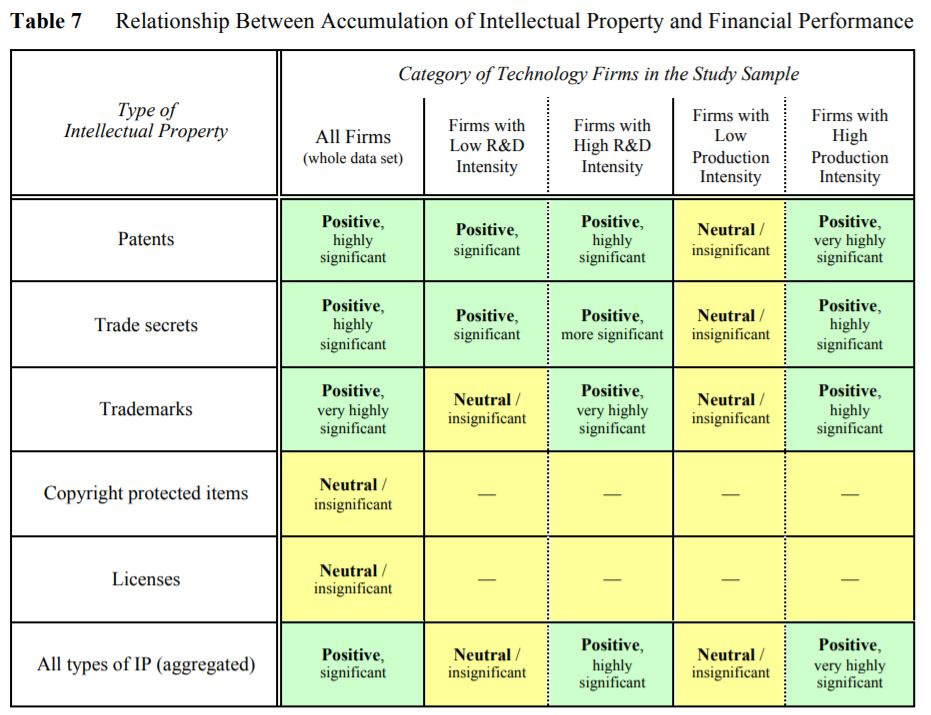

A 2013 study conducted by Kelvin W. Willoughby titled ‘What Impact Does Intellectual Property Have On The Business Performance Of Technology Firms’ looked at the statistical evidence to suggest a link between the level of IP and a firms financial success.

The study had 3 main hypotheses (focusing on No.1):

The accumulation of IP has a positive impact on the firms performance.

Assuming hypothesis 1 is correct, the level of this increase in financial performance is positively related to R&D intensiveness.

Assuming hypothesis 1 is correct, the level of this increase in financial performance is positively related to the firms effort towards the comercial production of goods or services.

There are some important caveats to the points above - noting that the relationship between IP and business performance varies depending on a variety of factors such as geography, industry and environmental conditions.

One example being that copyright is more important than patents for software firms, whereas patents are more important than copyright for manufacturing firms.

Interestingly there seem to be cases where studies concluded that patenting is negatively related to the business performance of pharmaceutical firms - using profitability as a measure of performance, Mahlich (2010).

The below table shows that there is statistically significant support for hypothesis 1 in that the accumulation of intellectual property by technology firms has a positive impact on their financial performance.

“However, the results in Table 7 also reveal that the nature of the relationship is not uniform across the various types of intellectual property. The positive contributions of intellectual property to financial performance arise predominantly from the firms’ investments in patents, trade secrets and trademarks, rather than from their investment in copyright-protected items or from obtaining licenses to use technology from external sources.”

What do we learn from this research?

For investors:

Use this knowledge as a heuristic (rule of thumb). For example, if you come across a company which you notice has a tonne of IP stacked away - generally speaking, this could be a very positive point to consider. However, it all depends on quality, which is hard to judge.

Take into account the importance of R&D. If nothing else, let this be a reminder that R&D is important for growth - so pay attention to that line item in the income statement.

For business owners/management:

Improving business performance will generally involve more than simply investing more heavily in R&D or increasing commercial production. “It appears a business must simultaneously invest in building up an appropriate IP portfolio for it to reap the financial rewards of building up R&D or production.”

Employing the right mix of IP rights is key. “While patents clearly have a central role to play in the business of technology firms, other types of intellectual property such as trade secrets or trademarks are clearly also important.”

“While the cost of obtaining, maintaining and enforcing intellectual property rights can be very high—especially for small, entrepreneurial firms, including start-ups—the research presented here suggests that, on the whole, it is a price worth paying.”

5. IP within medicine

Medicine is possibly the most prolific use-case for intellectual property rights. The core idea is to protect the intellectual property of innovators (in this case, drug companies) in order to incentivise R&D activity.

The problem lies with big pharmaceutical companies attempting to patent features of drugs not representing true innovation. This act stifles competition by discouraging competitors from entering a market due to a large financial barrier to entry.

A legal scholar, Michael Heller, calls this the ‘tragedy of the anticommons’. Heller argues that while privatizing a commons might stop wasteful overuse, it can also cause wasteful under-use.

To expand, if everything is copyrighted and the ‘idea’ landscape becomes so sparse and fragmented, it becomes extremely difficult for businesses and individuals to create something new. Neither the public nor competitive copyright holders are willing/able to collaborate with each other.

A useful analogy I found is to think of the public domain as a warehouse stocked full with ideas. Anyone can dip into this warehouse to use, re-use, sample, alter and incorporate into their work in order to create something new. If the warehouse is depleted, there is less inspiration to create something new.

Michael Heller gives the example of a drug company that found a potential treatment for Alzheimer's disease. In order to develop it, they needed access to dozens of other patents. The owners of those patents demanded ridiculous sums of money, and some even blocked the whole deal.

This resulted in the company never accessing the patents. And the drug, which might have saved millions of lives, sits on a shelf.

From stories like these to artists feeling terrified by huge corporations, its no wonder there has been a rise of groups advocating for change. Ranging from the elimination of bio-patents to the legalization of peer-to-peer file sharing.

Stats (Global Innovation Policy Center)

America’s IP is worth $6.6 trillion, more than the nominal GDP of any other country in the world.

IP-intensive industries account for over 1/3– or 38.2%– of total U.S. GDP.

IP accounts for 52% of all U.S. merchandise exports- which amounts to nearly $842 billion.

The direct and indirect economic impacts of innovation are overwhelming, accounting for more than 40% of U.S. economic growth and employment.

6. Examples of companies with powerful IP

There are many unique and valuable instances of Intellectual property out there. If there’s one thing I want you, the reader, to take away from this article is that having IP (in and of itself) isn’t the most valuable thing. It’s how the company are able to utilize their IP in order to create something great.

Your ability to recognize valuable IP as an investor will be a useful tool in order to help distinguish between a good company and a great company.

Below are several examples of companies with valuable IP and my reasoning behind why I think they will succeed long-term. It goes without saying that there are many more not mentioned below.

Nintendo

Nintendo follow a similar playbook to Disney, but are ultimately a very different company. Nintendo own some of the most valuable IP on the planet which they monetise via multiple avenues - games, theme parks, books, TV, Film.

Fun fact, Nintendo holds 11 of the top 20 (and 6 of the top 10) spots on the list of all-time game sales.

Qualcomm

It’s hard to see how Qualcomm won’t benefit from the shift to 5G, seeing as they will essentially own a large amount of the infrastructure.

“With over 130 5G licensing agreements, Qualcomm’s industry-leading, highly valuable, and fundamental 5G innovations are the most widely licensed in the industry—including multiyear patent license agreements with every major handset OEM. We invented fundamental technologies that make 5G work, enabling 5G’s speed, low latency, reliability, capacity, and expansion to new industries.”

Starbux, Gucci, McDonalds, Playboy, CocaCola

These all fall under the ‘brand’ category - I.e. the name alone is enough to sustain the business model. As we are finding out through platforms like Twitter, Instagram and Youtube - brands can be a powerful thing. People are making successful careers from creating online personas/brands.

Never count out the power of a brand.

Netflix

Netflix is a great example of a company using their IP in exactly the right way. If you want to read more on Netflix and why they should not be underestimated, check out Matthew Ball’s 8-part series titled “Netflix Misunderstandings”.

“Deals are extremely expensive for Netflix. An annual report submitted to the United States Securities and Exchange Commission states that Netflix spent USD 14.7 billion on licensed content alone in 2019. Netflix Originals, a series of tv shows and films originally produced by the streaming service giant, appears to be a remedy to Netflix’s licensing issue. Independently producing content meant that Netflix gained the opportunity to take a step back from licensing deals.”

ActivisionBlizzard, Gamesworkshop, EA, EPIC, RIOT

Lastly, Gaming is an area I could have written an entire article on but have decided to leave to another time.

Games are becoming the place where most young people spend the majority of their time - especially over the pandemic. With the rise in Mega-Games like Fortnite, Roblox, GTA and many others - these gaming companies are starting to realise the potential cash cows they are sitting on. For example, Rockstar released GTA V roughly 8 years ago, and are continuing to make more money than ever due to the recurring revenue they are receiving from the never-ending nature of the game. Similar to Fortnite.

Gaming IP will become some of the most valuable on the planet over the coming years.

7. Conclusion

To conclude, as we move out of the consumer age and into the information age, we need to be aware of the major changes taking place. Data is the new oil, IP is the new gold, and whoever is able to dominate the intellectual landscape in any given industry will likely win, and win big.

That being said, Intellectual Property is only one part of the puzzle of running a business. Use the information here as a tool to help guide your decision making when making investing decisions.

Cheers,

Innovestor