Introduction

Here I want to take a moment to reflect on the changes 2020 has brought to our lives and what it means moving forwards.

2020 was a crazy year with some massive ups and downs (mainly downs). We all saw our work locations shift, millions of first-time retail investors rush to the stock market, the beginning of a healthcare revolution, the digitization of entire industries a decade before expected, Crypto (again) and the rise of the streaming services.

This is by no means a deep-dive into all possible upcoming trends, but trends I can see becoming more and more prevalent over the next 1- 2 years. I’ll come back to this piece at the end of the year to see what I got right and where I’m drastically wrong.

In no particular order…

1. Audio

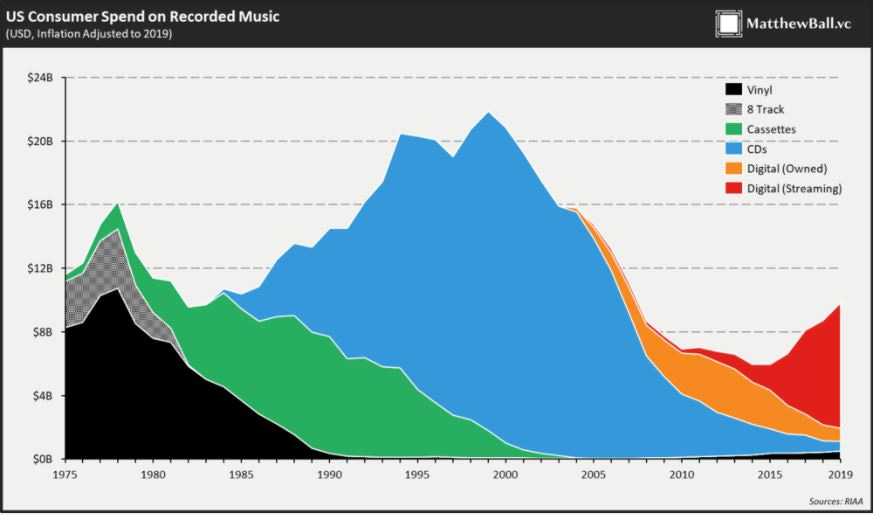

2020 (and the few years before that) has seen the revival of audio. Spotify has been the pioneer in the new way we consume audio, as well as the business model involved. We now have access to the entire world’s catalogue of music for the small cost of £10 per month. Not a bad deal in my opinion.

This change in business model has not only significantly altered our behaviours as consumers, but also as listeners. There is no longer an incremental cost to experimenting with music (or podcasts) - meaning we are free to explore without the risk of ‘wasting’ money. This benefits both the consumer and the smaller artists.

Things started to heat up last year with Spotify and Amazon aggressively acquiring various podcasting talent, with the goal to retain high-quality exclusives on the respective platforms. A prediction made in my Spotify overview states that I see Spotify essentially taking over the role of the record label in the industry when they eventually have enough leverage. Not something we’re going to see play out over 2021, but one to watch over the next decade. Keep a close eye on $SPOT.

2. Gaming

I think the video gaming industry is slowly morphing into something significantly different compared to what the industry has traditionally been over the past 20 years.

Games are beginning to turn into a sort-of SaaS model compared to past business models. It’s no longer the case you just buy a game and that’s the end of your purchasing within that game. Models pioneered by companies like EPIC now see free base games with multiple season-long subscriptions. There is in-game content and a whole host of more ways to monetise the experience once you are hooked to the core game. So a single game can become a recurring revenue mechanism – which was never possible in the past.

Games are the future of social networking. This is something we’re beginning to see with games like fortnite who are putting on in-game ‘concerts’ where people can view a performance live with their friends within a game. Given time, it’s not hard to imagine the next social networking platform looking more interactive and ‘game-like’, rather than scrolling and liking pictures.

This is why I think Unity ($U) will be one to watch moving forwards, as they are the platform most games are built on. Also keep an eye on Roblox, who will be IPOing at some point this year.

There are plenty of other possible picks here, but that’s for another time.

3. AR/VR

This leads me nicely into the next topic which is more-or-less related. VR and AR (or a mixture of the two – known as XR) have seen steep developments in 2020 – not only in the capabilities of the hardware, but also the accessibility to consumers.

There is no case more prevalent than Facebook. In the latter half of 2020, Facebook introduced to consumers the upgrade in their ‘oculus’ VR line – the ‘Quest 2’. Coming in lighter, more powerful and (most importantly) significantly cheaper than its predecessor, the Quest 2 is opening up VR to the masses. Before, you would be paying silly money for a high-end gaming PC AND a headset needing to be plugged into the PC at all times.

As more people adopt this technology and get used to it, we will see a whole host of new use-cases outside of gaming. To name just a few include Healthcare, meditation, Architecture, training, live events, design and many more.

In terms of AR, we are possibly a little while off seeing anything mind-blowing. However, Facebook are teasing us with Rayban AR glasses which we might see a demo of sometime this year (pure speculation).

I’d say the main plays at this point are $FB and $U, but with many others including $NVDA $AAPL $MSFT just to name a few.

4. Gig Economy

Check out my article on Fiverr which dives deeper into this topic.

The gig economy is something that has been around for a while now, but has arguably been boosted by COVID. As people were forced back into their homes for work, we found an extra couple of hours in the day to focus on whatever we wanted. The clever ones among us decided to use this extra time and energy to start a side-hustle or work on an alternative revenue stream using the skills they already have.

I believe now that more people are becoming au fait with the idea of the ‘gig economy’ through sites like $FVRR and $UPWK, we will continue to see this trend gain in popularity.

36% of America’s total workdorce are freelance (+2 million since 2019)

22% increase in total freelance earnings since 2019 ($1.2 trillion in 2020 compared to $1 trillion in 2019)

Percentage of fulltime freelancers increased 8% to 36%

Over half (58%) of traditional workers now working from home are considering freelance since Covid-19

$FVRR $UPWK

5. Healthcare

Healthcare has been somewhat of a stagnant industry over the past decade or two, with not much in the way of significant innovation. It is still the case that in America, not everyone has access to the same base-level of healthcare due to affordability.

The pandemic has kick-started the move towards more of a ‘virtual’ approach to healthcare, with more and more people becoming comfortable with the idea of having a virtual visit – saving time and money.

We are likely to see more and more companies in this space over the next year or so, challenging the likes of Teladoc ($TDOC) who have seen exceptional growth in 2020.

I dive deeper into telehealth with my article on $TDOC.

6. Social + E-commerce

Again, this is an area we have seen gain more and more traction over the past two years. The need for brick and mortar shops has been slowly dwindling over the past decade which has ushered in the idea of the online store. Combine this trend with the overall improvement in global logistics (a movement spearheaded by Amazon) then you can begin to see how this industry is destined for big things. I believe $SHOP are in the best position to lead the way.

Following a similar upward trend has been the rise in social media platforms and the amount of ‘influencers’ or creators we see on these platforms. This continued rise in traffic has meant influencers can make a hefty living simply by selling products to their followers. Big corporations are aware of the effectiveness of this advertising model, and are actively implementing e-commerce functionality on their sites.

An effective implementation (led by $FB $PINS $SNAP) could be key to unlocking untapped potential within the e-commerce sector and significantly decrease the level of friction in the purchase of an item over social media.

7. Streaming

This one of those trends that makes sense, right? We’re stuck at home due to this pandemic and, well, what else is there to do other than switch on Netflix (or whatever you use)? Even without the pandemic, we were slowly starting to see consumer behavior moving toward the direction of ‘streaming’ rather than watching normal ‘linear’ TV.

In my opinion, this trend is here to stay. And with that shift comes a great deal of opportunity for retail investors. One way to get an idea for the potential consumer demand for a trend is to look at the quality of the competition and the amount being invested. For example, 2020 saw the launch of Disney’s ‘Disney+’ service, which is looking to compete (more or less) directly with Netflix.

I want to note here that a good sign of your moat is to see if it withstands attacks from high quality competitors. Disney launched a well thought through, expertly executed strategic attack on Netflix earlier this year and it doesn’t seems to have dented their moat one bit.

Players to look out for in this industry: $NFLX $DIS $ROKU $CURI

8. Pent-up travel demand

This is one I want on a very personal level - I’m craving a beer sat on a beach in Spain more than you know.

As we are all painfully aware, it’s impossible to travel at the moment – and if we can travel it’s very much frowned upon, along with the fact it’s not much fun right now. Therefore, whenever we get out of this mess (hopefully by summer) the demand to travel will likely be huge.

Conversely, we could see the opposite happen within the business-travel sector. It’s entirely possible this whole experience has changed our opinion on travel – the impact it has on the environment, the monetary cost and the fact we can do almost everything over zoom. As a result, I can envisage business travel volume being significantly reduced for the next 5 years or so. Not looking great for the airlines.

But over the next year (if everything goes smoothly), stocks like $ABNB will likely see huge growth as people flock back to popular tourist destinations.

9. Veganism

Slowly but surely we are starting to wake up to the idea that we have some serious choices to make about the future health of our planet. Companies like Beyond Meat are giving us the power to positively impact the future health of our planet by making purchasing decisions - an important step in the right direction.

The trend towards plant-based diets is growing, and with that the market demand for plant-based foods is exploding. I don’t think we’ll see a mass adoption of a vegan diet for maybe 10 to 20 years (could be wrong), but a good start will be substituting meat with an alternative that tastes identical and has a significantly reduced environmental footprint.

The obvious plays here are $BYND and $TTCF.

I do a deep-dive on $BYND here.

10. Decentralization

This is maybe a slightly longer-term one, but decentralised technology will likely become mainstream over the next several years. We are starting to see the beginning of this with $BTC and $ETH reaching all-time highs in early January, which at one point put Bitcoin in the top 10 assets in terms of market cap in the world. Along with this, more and more big players in industry and finance are looking to utilize blockchain technology. This demand, off the back of the introduction of institutional investors, will almost certainly spur innovation within this sector – hopefully uncovering more viable use-cases for the technology.

There’s lots to be said on this topic – and most of which I don’t have the technical experience to write about. However, it’s worth doing your own due diligence with this one as it’s a very volatile asset.

Conclusion

Other honorable mentions include XaaS (something as a service), AI, decreasing attention spans and low/no code products.

Trends are interesting things, and not something you can predict with ease. Some trends come as quickly as they go, whilst others stick around for the long haul.

2020 was a weird one as it has forced peoples habits to change, which is a powerful thing. If we had come out of this pandemic and gone back to normal after 3 or 4 months then a lot of these habits we developed as a consequence would most likely not stick. For example, remote work and remote meetings. I see this as something that has been deeply ingrained as a habit in most of us now, so will be hard to change back.

I’ll keep an eye on these trends as the year progresses, but this is a fun exercise to do once a year as it forces you to think critically about what the future holds - and not just for your investments.

Cheers,

Innovestor